[ad_1]

Activision Blizzard (NASDAQ:ATVI), a leader in the video game and entertainment business, known for its titles Call of Duty, Overwatch and Candy Crush, has had a tough October, giving up ~17% in the month. The correction was in tandem with the greater tech selloff. Following the earnings release, the stock continued another ~10% lower. Multiples have contracted, and the stock is looking interesting again.

ATVI data by YCharts

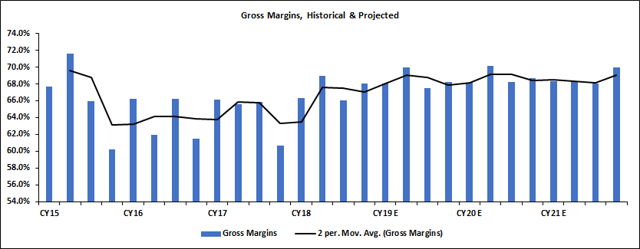

The company is moving toward higher-margin business through new engagement models detailed on the 3Q conference call. The transition to Activision Blizzard being a revenue driver may lead to increasing margin expansion as e-gaming and in-game offerings continue to drive high-margin revenue. The business seems to be moving toward an engagement model driven by in-game content and community-style models, such as the Overwatch leagues and e-gaming teams. The company is optimistic that the shift toward digital engagement will drive value creation through margin expansion and increased community engagement.

Thesis

The recent tech selloff and disappointing earnings numbers have sent the stock to a level where the valuation has become interesting again. If we continue to see strong numbers of margin expansion resulting from the move toward digital engagement, I think the stock is selling at an attractive valuation right now both relative to peers and based on its own historical multiples.

I will show how the margin contraction has change from before earnings to currently. Assuming a 38.82 P/E on 2021 EPS, ATVI is worth about $62 today on a base-case scenario.

3Q18 Earnings Release

The company reported earnings after the bell on Thursday with net revenues of $1.51 billion (-6.6% Y/Y) and GAAP EPS of $0.34 (+37.4% Y/Y).

Engagement & Reach Metrics and Outlook

The company had 345 million monthly active users (MAUs) in the quarter.

Of this, Activision had 46 million MAUs. The release of Call of Duty Black Ops 4 has seen increased engagement and hours played than the previous franchise release, Black Ops 3, with Bo4 total active users and hours played up 16% and 20%, respectively. The game has seen great traction on PC and is expected to see continued growth going into Q4 and the holiday season.

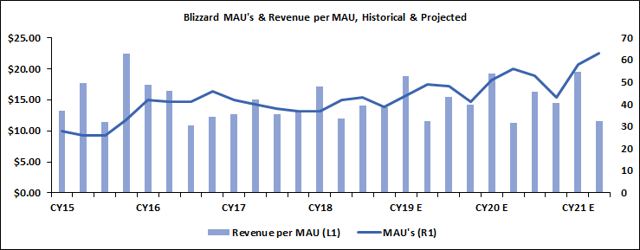

Blizzard had 37 million MAUs, driven by World of Warcraft’s Battle of Azeroth, which has drawn record sales. Blizzard is expected to benefit from margin expansion through e-gaming in Overwatch leagues and the shift toward digital engagement.

King had 262 million MAUs, driven by Candy Crush Saga strength year over year. The company is optimistic in the mobile gaming market and plans to continue creating engagement through its loyal user base.

Guidance

The company issued guidance of net revenues of $2.236 billion and EPS of $0.43. Blizzard is taking a key role in the transition to a new engagement model. The move toward digital community and in-game content models such as the Overwatch and e-gaming leagues which have seen great traction is expected to drive user engagement and margin expansion moving forward. The company’s BlizzCon saw over 40,000 fans, with millions of fans streaming online. The loyal fanbase is expected to grow over the long term and will be a key driver to revenues moving forward.

Model Updates and Price Targets

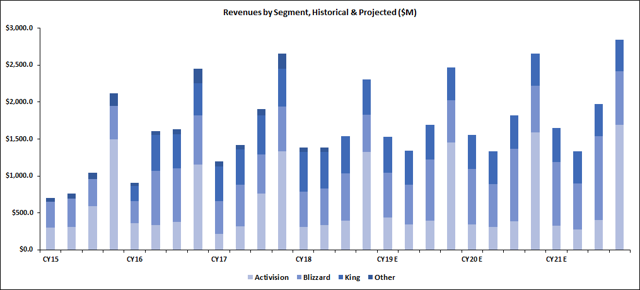

Revenues

The shift toward digital will lead to Blizzard being a huge catalyst for the long term. The secular shift toward community engagement models and e-gaming will be here to stay, and ATVI is in a great spot to reap outsized benefits from its positioning right now.

(Source: Company Data, Bloomberg, internal estimates)

The Overwatch leagues which have continue to gain traction are expected to expand to other franchises, such as Call of Duty. This shift will increase engagement, and in-game content will continue to drive high-margin revenue going forward. The loyal following is expected to grow by way of the increased focus on community content and digital communications.

(Source: Company Data, Bloomberg, internal estimates)

Margin Expansion

A shift toward more digital models will increase margins across the industry. In the model, base case assumes a margin expansion of 66.1% in the most recent quarter to ~70% in 2021 as economies of scale and full cost efficiencies are reached. The increased margins will help to continue to pay down debt invested in product development.

(Source: Company Data, Bloomberg, internal estimates)

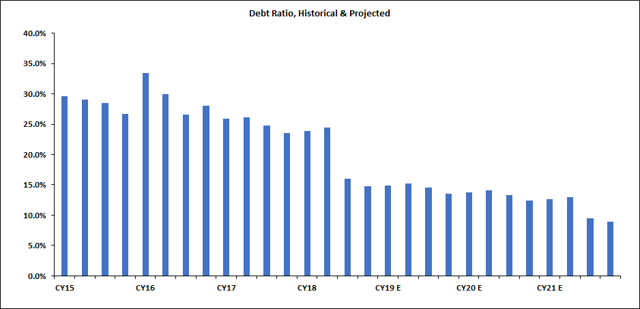

Deleveraging the Balance Sheet

ATVI has been able to pay down large amounts of debt, bringing its debt ratio to ~17% in 3Q18. The company has been dedicated to paying down debt early. Its credit facility has also increased to $1.5 billion now, making liquidity robust. The company’s balance sheet is strong, and its pipeline is promising and looks to remain that way.

(Source: Company Data, Bloomberg, internal estimates)

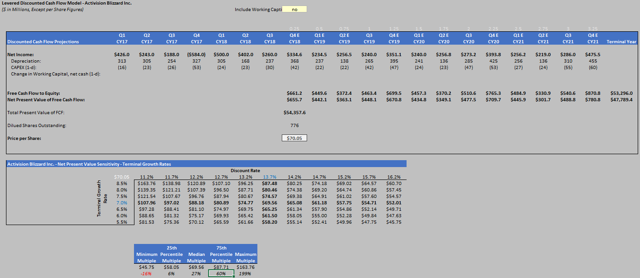

Discounted Cash Flow Model

ATVI is worth ~$70 per share in a base-case scenario. Under alternate assumptions, a bear-case scenario would lead to further multiple contraction and settlement around $46. In a bull case, margin expansion drives multiple expansion to that of peers nearing $164.

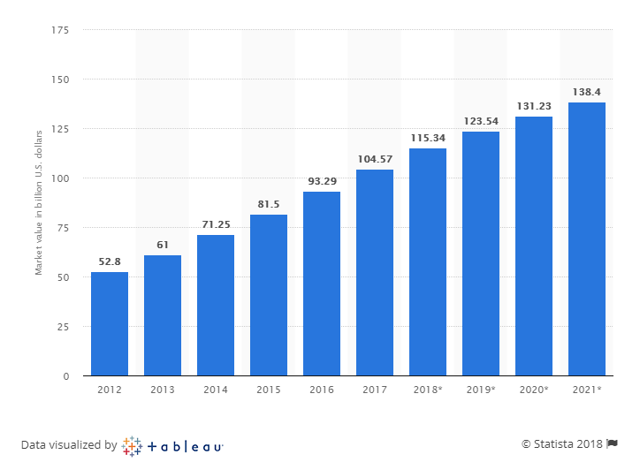

Base case assumes a 7% growth rate consistent with an industry report from Statista projecting the growth of the video game market to upwards of $138.4 billion, at a CAGR of 10.1% from 2012 through 2021.

(Source: Statista)

(Source: Company Data, Bloomberg, internal estimates)

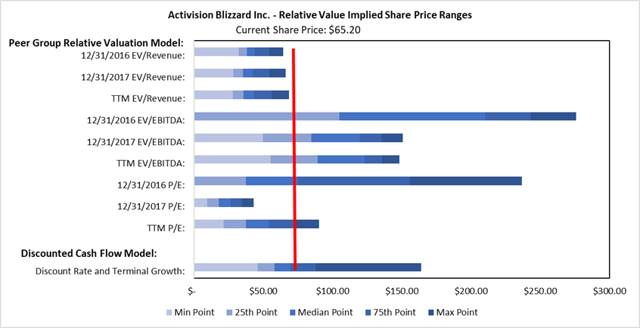

Multiple Contraction Following Earnings

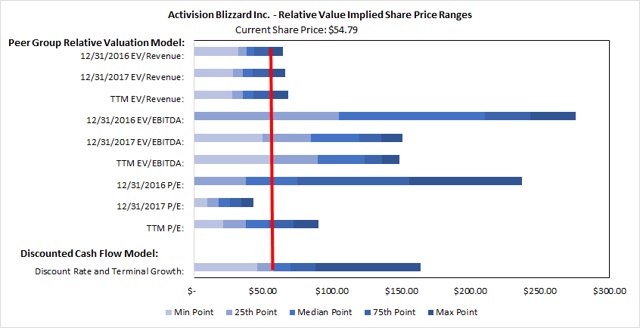

Prior to the earnings release, the multiple was not attractive and this article would have been of a different nature. Following the contraction from the deep selloff following earnings, ATVI is attractive relative to peers again, making this a far more interesting name in the current market environment.

Prior to the release, ATVI was trading toward the higher end of its peer group multiples, which made the upside of the DCF target unattractive given the valuation.

(Source: Company data, Bloomberg, internal estimates)

Following the earnings release, the contraction brought the stock toward the 25th percentile – median multiples against peers, which is more attractive given where we are in the cycle. Exposure to the holiday season and the release of Call of Duty Bo4 and the continued expansion in e-gaming do make up for buying given the current median peer multiple.

(Source: Company Data, Bloomberg, internal estimates)

Price Targets

Based upon a discounted cash flow analysis, given the assumptions mentioned above, ATVI is worth ~$70 per share. Given the relative value model, using a range of 25th to 75th percentile multiples, the fair value should be ~$58.05-87.71.

Risks to these price targets would include:

- Continued disappointing MAU figures

- Lower-than-expected holiday sales

- Lower-than-expected sales on new releases

Conclusion

ATVI has been discounted lately as a result of a broader selloff in tech and a poor 3Q earnings release. Multiples have contracted, while the fundamentals have not changed. The company continues to deleverage with cash on hand from continued margin expansion. Blizzard is expected to continue to drive long-term organic growth through the shift to a new community and digital engagement model. In the long term, ATVI will continue to grow margins through cost savings associated with the shift to digital engagement. A strong balance sheet will allow the company to continue to create content to continue driving growth in total active users.

In the short term, economic growth has been stable and retail sales numbers as gauged by the Redbook economic data, retail looks strong going into the holiday season, and Activision should reap the rewards of a strong holiday season following the release of Bo4.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ATVI over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link