[ad_1]

Alibaba Holding Group (BABA) has taken a hit, and everyone knows it. The stock is almost 33% from its 52-week high. In this article, I share my reasoning for not increasing my stake on BABA. I am long Alibaba on the idea that China middle class and consumption are secular growth stories. In addition to that, I strongly believe that Alibaba is a leader in Chinese commerce, both brick-and-mortar and e-commerce.

However, I do believe in the current valuation and trading dynamics of the stock market, despite being bullish on fundamentals. Downside exists. Alibaba makes new all-time highs. My article explains why I believe in this belief.

An article from Oleh Kombaiev does a good job at explaining recent stock trading dynamics. In Oleh's article, recent price action of BABA is compared against certain valuation, technical, and macroeconomic factors. The only reason I bring up Oleh's article is because I think it is a good perspective on BABA trading dynamics. In many ways, his perspectives go above and beyond what I explain here. So, I think readers would have taken a look at his article.

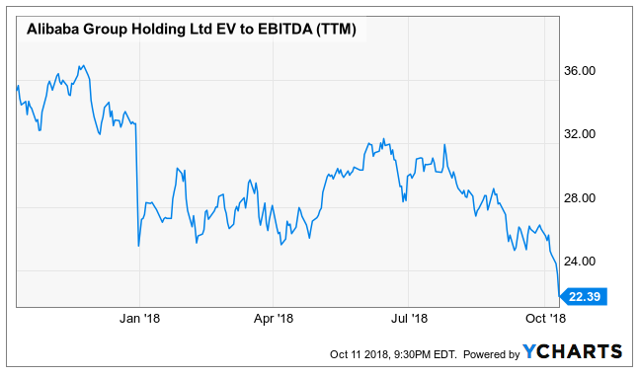

Another reason I bring up Oleh's article is because I disagree with one little portion of it. He argues that EV / EBITDA is not a driver of the stock move. I disagree. I am a believer in EV / EBITDA and I have a yardstick, which I explain in detail later.

EV / EBITDA may, but I believe it will be.

Why EV / EBITDA?

The reason for this measure is that of calculating the value of capital, structure and tax structure. Because of that, I can use multiple EV / EBITDA to value the value of operating business, not just the value of the stock as it would be using P / E metric. I am not saying that I am saying, but rather I'm saying EV / EBITDA is more complete. It allows me to assess investment decisions on the capital stack (whether equity or debt).

Macroeconomic factors should drive BABA in the near future

I believe BABA is trading more on macroeconomic factors than on fundamental factors. It is common for stocks to be more important than macro factors. And I believe that's happening with Baba. This trading will probably continue for two reasons.

First, the US is escalating a trade reform with China, where $ 200B of goods are imported into China. It is likely the US would impose tariffs on another ~ $ 267B of China, which would pretty much cover all China exports into the US. Investors view tariffs as the beginning of a trade war. Thus, investors are (and will probably remain) fearful of investing in companies with Chinese exposure.

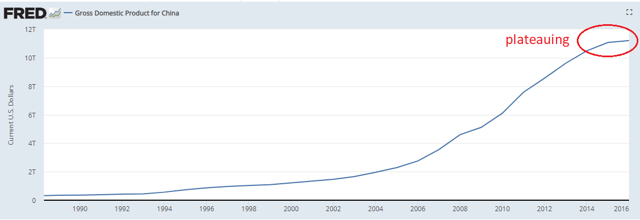

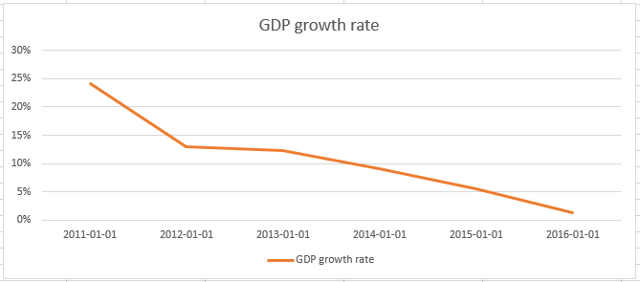

Second, China macroeconomic data has been showing signs of deceleration in the last couple years. Despite being growing at healthy rate, the Chinese economy is no longer growing at double-digit rates. Deceleration in China's growth rate is either maturing, or just undergoing a temporary slowdown. The following graphs show China GDP and its decelerating trend:

Source: FRED

Source: FRED

FRED (Federal Reserve) data only goes until 2016, but it is no secret that China is no longer growing at double-digit rates. China's economy grew at 6.7% in the second quarter of 2018. A healthy rate, but still decelerating from the 10 +% earlier this decade. Additionally, other macroeconomic indicators, like fixed-asset investments, have been lagging and / or disappointing expectations.

High debt levels and a period of deleveraging is also a huge concern for investors' mind. A deleveraging of the Chinese economy would probably cause further deceleration.

A slowing economy, along with the constant headlines about tariffs on China's exports to the US, will increase the fear of investing in BABA. This means that the narrative changes, it is unlikely that BABA will have incremental buyers (in the short term). So, I think it's unlikely to be anytime soon.

Because predicting where the economy is going to come from, I prefer to simply wait until BABA shows signs that business fundamentals are (once again) driving the stock.

Valuation remains somewhat elevated – which means more downside exists

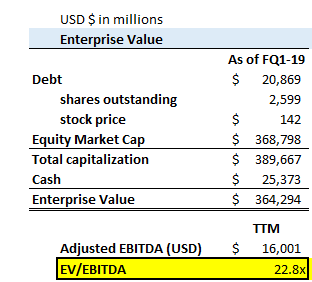

Alibaba's EV / EBITDA continues to be kind of high at ~ 22x EBITDA. Based on my calculations, I do not think BABA is cheap or a bargain stock. Although 22x EBITDA is the lowest valuation investors in the last year, the EV / EBITDA has been as low as 15x over the past three years. Therefore, I do not believe that 22x is the bottom multiple. The following two charts

Multiple Bottom is ~ 22x since January 2018, which is where the stock is right now.

But has been as low as 15x from January to June 2016.

Because Multiple EBITDA Remains Above Its Three-Year Trough, I Believe It Fails to Fear China's Flows.

In a worst-case scenario, the multiple could fall to 10x if the Chinese economy enters a recession (something I believe will happen, but do not know when). Multiple EBITDAs have been reported in the early 2015 and early 2016. You may remember that there were lots of questions about the Chinese economy during that time period too.

Why is valuation high? because EBITDA trends are healthy

As one of the fastest growing-cap growth companies in the world, Alibaba has achieved impressive EBITDA growth trends. From fiscal year 2016 to 2018, EBITDA has grown to ~ 36% CAGR, almost doubling from $ 8.1B to $ 15.5B (amounts in USD). EBITDA is just over $ 16B over TTM (trailing twelve months). I strongly believe EBITDA growth will continue at double-digit rates, even if China and the US intensify their trade war. I also believe EBITDA growth will continue even if China enters a recession, though it may take a temporary slowdown in that scenario.

Nonetheless, I believe EBITDA will continue to increase China growth and growth is a secular growth story.

Wall Street analysts are estimating Alibaba will grow revenue by 40% next year, and 28% the year after. As revenue grows, EBITDA should grow with it at double-digit rates. If EBITDA grows for a couple of years at double-digit rates, the EV / multiple EBITDA will shrink, all else equal. This strength should eventually lead to a decline in the stock market, which is likely to be significant. Alibaba is a good stock to invest.

In the long-run, I believe EBITDA growth will be the driving force of the stock price. The EV / multiple EBITDA would shrink even if the stock is flat for the next few years.

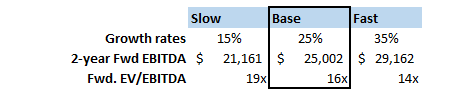

Below are EV and EBITDA calculations. This is the price of this writing:

As mentioned before, Alibaba's multiple would come back as revenue and EBITDA grows. A single scenario analysis is maintained (~ 35% CAGR), then EV / EBITDA multiple will be ~ 14x in two years (late 2020).

Conclusions and investor takeaways

I believe Alibaba stock will keep growing because of solid business fundamentals, but the stock may stay flat (or even keep declining) as people feel fearful about US / China trade and Chinese macroeconomics.

In the short run, investors could easily bid BABA shares by ascribing to lower multiples to its EBITDA. In other words, the stock can (and probably will) keep going lower in the near future. Alibaba's EV / multiple EBITDA was as low as 15x over the past three years, which would equate to ~ $ 95 stock as of today's EBITDA.

However, I am not willing to sell my shares because EBITDA will probably keep growing at double-digit rates. Alibaba Retail, Cloud Computing, and Other Businesses. By not selling, I would not miss the upside if the stock recovers quicker than I anticipate. But because I believe the stock can keep declining, I will wait before I upsize my position.

Disclosure: I am / we are long Baba.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with this article.

[ad_2]

Source link