[ad_1]

(Source: imgflip)

We have just celebrated the tenth anniversary of the Great Financial Crisis, the worst financial market crisis since the Great Depression. Given that the Great Recession saw the US stock market lose $ 7.9 trillion (the world market lost $ 34.4 trillion) and cost the American economy $ 22 billion, it is understandable that Americans and investors are worried today that this disaster will not happen again.

This is especially true when financial media, always eager to attract attention to increase advertising revenue, often engage in catastrophic predictions like The next crash will be "worse than the Great Depression": experts.

Such hyperbolic and alarmist articles cite extremely optimistic experts like Peter Schiff, CEO and chief strategist of Euro Pacific Capital, who recently said:

"We will not be able to talk about a recession, it will be worse than the Great Depression … The US economy is in a situation so much worse than it was ten years ago .. We expect that central banks will be passionate about "saving the world" in 2008, he was vilified to be helpless in the next deflationary crash. "- Peter Schiff

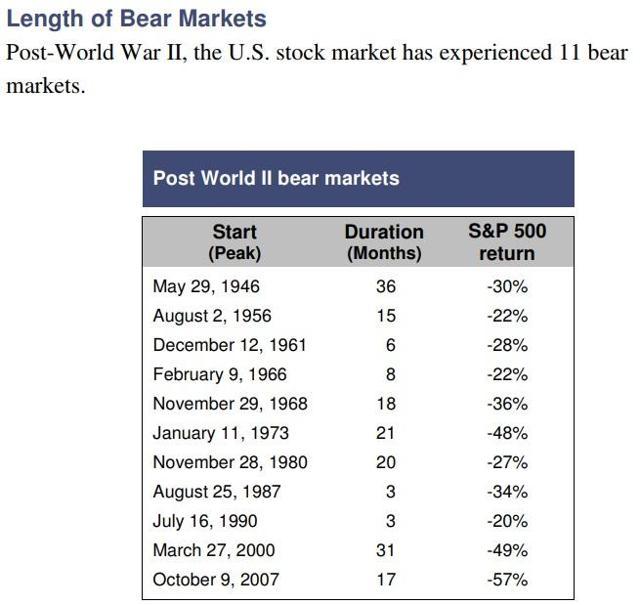

The main reason why people like Schiff are so pessimistic about the next economic downturn is the belief that extremely high levels of indebtedness (domestic and international) at all levels (consumers, businesses, governments) will lead to a financial downpour. . An example that will make the financial crisis of 2008-2009 appear as a simple drip in comparison. If such apocalyptic prophecies were true, the stocks (SPY) (QQQ) (DIA) could fall much more than the 57% decline observed ten years ago. This would potentially be double the average maximum decline of 34% observed in the 11 bear markets since the Second World War.

(Source: Moon Capital Management)

With so many millions of retirement accounts decimated, with so many baby boomers retiring or already experiencing their golden age, many investors are rightly sweating such sensational forecasts.

Now, I will not blow and tell you that high debt levels in the US and around the world are not a risk, as they certainly are. But in order to restore mental health in this discussion and deter readers from committing a potentially costly mistake (for example, staying totally out of the equation), I decided to make a series in several parties on the risks of another financial crisis. In the coming weeks, we will examine the different levels of consumer, business and government debt to see how much they are likely to trigger another financial catastrophe. Finally, we will conclude the series by examining how investors (including retirees) can protect their wealth in the event of a new strike of the Great Recession.

So let's start by looking at the consumer debt of the United States, which triggered the financial crisis. Specifically, let's see why this is not the fuse that lights up the next powder barrel.

US consumer debt has now reached unprecedented highs BUT …

(Source: imbecile)

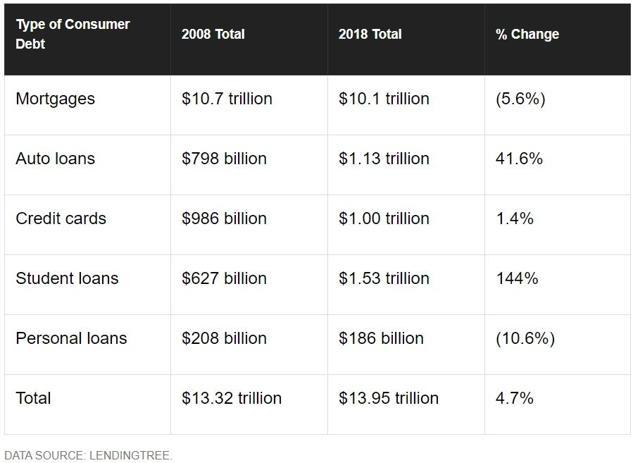

Many catastrophic economic forecasts indicate that US consumer debt has reached new heights. And it is true that consumer debt has risen by about 5% or more than $ 600 billion over the past decade.

But note that mortgage debt, the underlying trigger of the 2008-2009 crisis, has actually declined. This is because the mortgages have tightened considerably and that NINJA days (no income, no jobs or assets) have disappeared. What small amounts of at-risk mortgages are created do not support trillions of derivatives or are held by systemically important financial institutions (too big to go bankrupt).

Credit card debt and personal loans also declined or remained virtually unchanged, with US households spending most of their deleveraging over the last decade.

What about the sharp rise in auto loans and US students? Well, that can be explained by a few key factors. On the one hand, the average price of new vehicles has increased by 27%, from $ 28,350 in 2008 to $ 36,113 by the end of 2017. This is partly explained by the growing popularity of cross-country vehicles. -over and trucks.

In addition, the average term of a car loan has increased to 69.5 months, or nearly six years. The longest loans are 96 months or eight years. This is partly explained by the fact that 25% of auto loans are now subprime (FICO score below 620) and that buyers want to minimize their monthly payments. Longer term loans with higher interest rates mean that US car debt has increased significantly.

What kind of threat does this pose to the financial system?

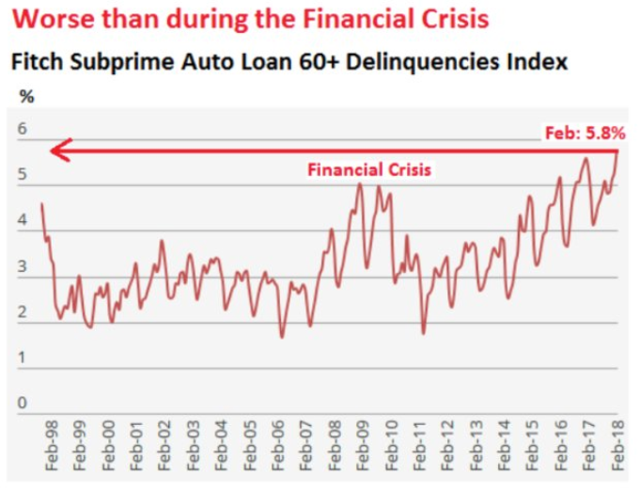

(Source: Business Insider)

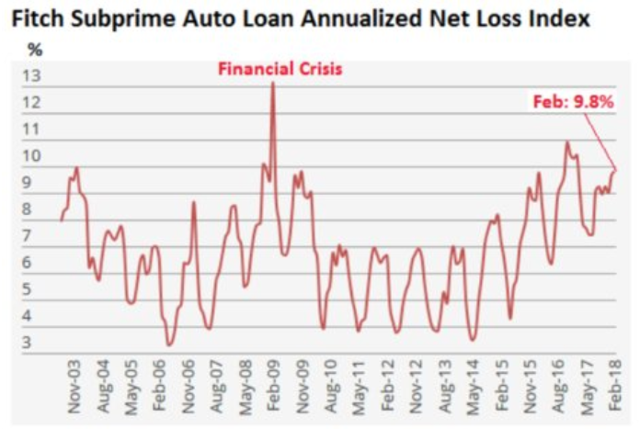

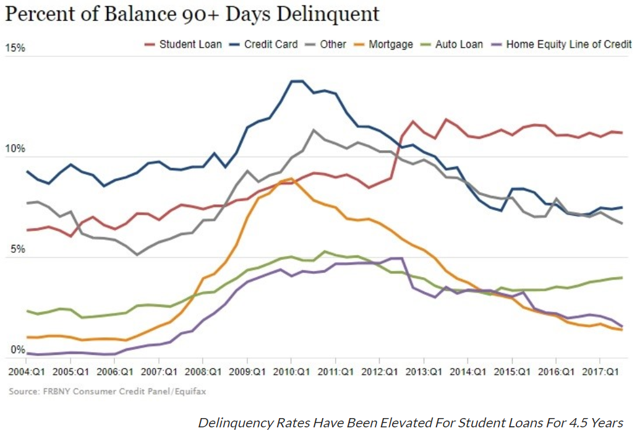

Well, at first glance, this seems important. Today, delinquency rates for subprime mortgages have exceeded the levels of the financial crisis and are at their highest level since October 1996. Likewise, high-risk loan losses are reaching double-digit levels. .

(Source: Business Insider)

But there are two important things to report. First, delinquency rates were higher in 1996 and did not result in a recession at that time. Loan losses also did not reach the same high levels at the end of 2003. In fact, in 2003, we were at the end of a recession, which is why the losses on subprime lending have even reached this high level. Why do not I sweat more and more subprime car loan losses now? This is mainly because of who makes subprime auto loans.

It's not auto makers or big banks, but mostly small, privately-financed companies like Summit Financial Corp., Spring Tree Lending and Pelican Auto Finance, all of which have recently gone bankrupt. These companies borrow from large banks to finance their loans, which are then sold as asset-backed securities, or ABS. These are high-yield, high-risk investments that other investors buy, allowing them to recycle their capital and continue to make new loans.

While the economic model is similar to that of the subprime housing catastrophe, keep in mind that subprime mortgage lenders have gone bankrupt in large numbers over the past two years. This has hardly caused a loss of consciousness of major financial markets or profits of banks. The reason why the high-risk automobile is not likely to sink major financial institutions is that subprime mortgages have been turned into dangerously indebted bets by big banks (leverage up to ############################################################################### 39 to 30 times).

Although these losses would increase during a recession, the fact is that the high-risk auto loan itself is not likely to trigger a recession or provoke a widespread financial crisis. It is investors in risky car lenders and private equity firms that are suffering because the big banks are not burdened by risky car loans.

What about the growing debt of student loans? This is due to two main factors.

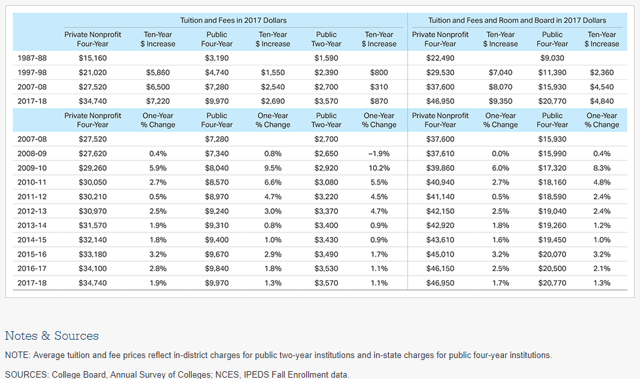

First, the adjusted annual cost of college inflation, both private and public, has more than doubled over the last 30 years. This is because the value of a university degree has increased immensely since the Great Recession.

Since 2009, about 75% of all net new jobs have been entrusted to college graduates. In fact, about 10,000 baby boomers retire every day and companies must replace these highly skilled and experienced workers with people who can perform similar tasks.

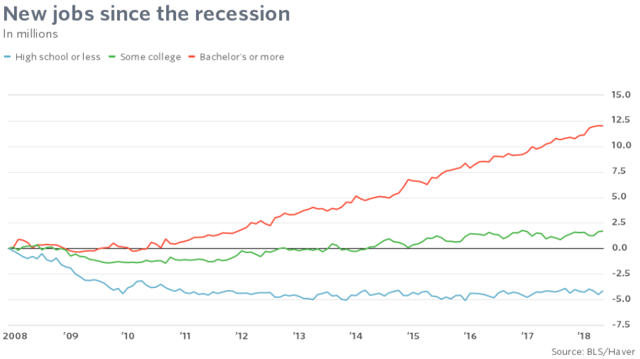

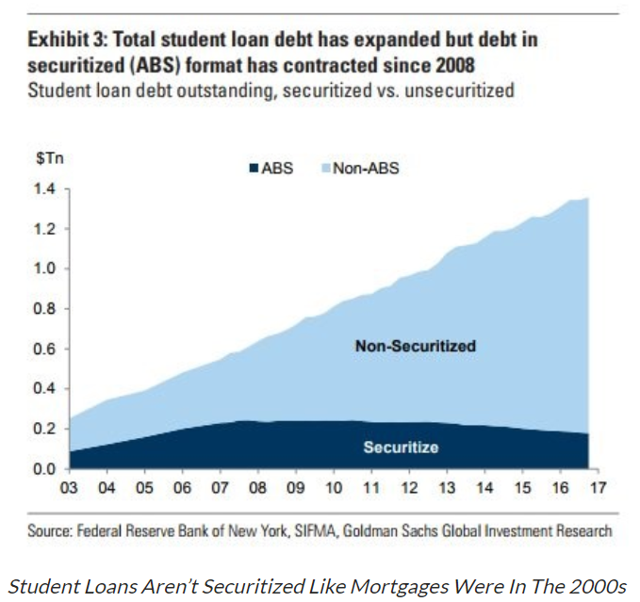

But no matter how much more debt students incur, student debt does not represent a risk of a new financial crisis? In fact no, for several reasons. The first is that very few (less than 20%) student loans are securitized and can therefore spread the financial risk such as subprime mortgages.

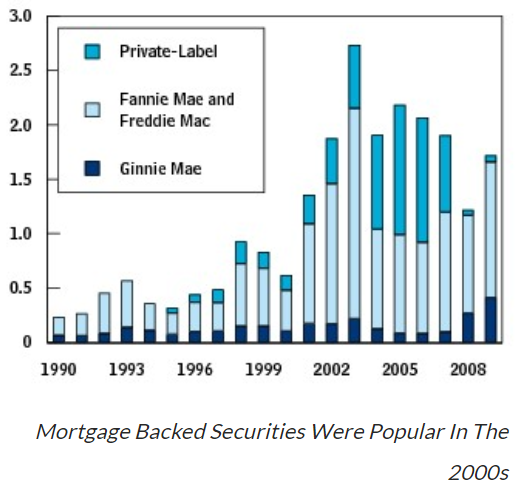

Securitization backed by a mortgage in trillions of dollars

(Source: upfina.com)

Then there is the size of mortgage securitizations that we have seen in the real estate bubble. Each year, more home mortgages have been grouped into loans (including those secured by NINJA risky loans) than the cumulative burden of student loans. This small scale alone means that student loans are not likely to cause another financial crisis. How can we trust that? Because student loan default rates have been rising or rising for about five years now and they have not upset banks' balance sheets.

(Source: upfina.com)

Ok, so maybe sub-prime auto loans and student loans are not going to cause another financial crisis. But what about the fact that total consumer credit again reaches unprecedented highs? Does this not mean that another crisis is imminent? Well, no, in fact, because we have to remember to situate the total levels of consumer debt in their context.

… It's not likely to cause another financial crisis

Yes, consumer debt has never been higher in the history of the United States and has grown by more than $ 600 billion since 2008. However, we must keep in mind two things. First, the US population and economy have grown enormously since then.

- US population 2008: 304.1 million

- US population in 2018: 328.7 million (up 24.6 million or 8.1%)

- United States GDP in 2008 (unadjusted for inflation): $ 14.7 trillion

- US GDP in 2018: $ 20.5 trillion (up $ 5.8 trillion or 39%)

Over the past decade, the American population has increased the equivalent of the combined populations of Florida and Nevada. While US consumer debt has risen 4.7% over the last 10 years, it is spread over an 8.1% larger population. Thus, the consumer debt per person is really lower.

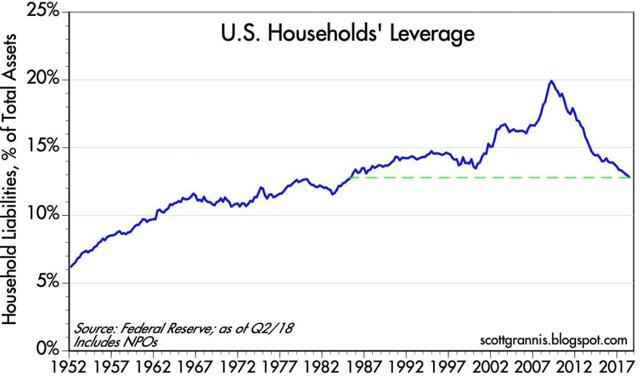

And this debt is now more easily supported by an economy about 40% larger. Of course, this is not adjusted for inflation, but remember that inflation reduces the burden of borrowers, since loans are repaid in dollars with lesser purchasing power . More importantly, at the aggregate level, US household debt (debt / assets) has declined significantly over the last 10 years.

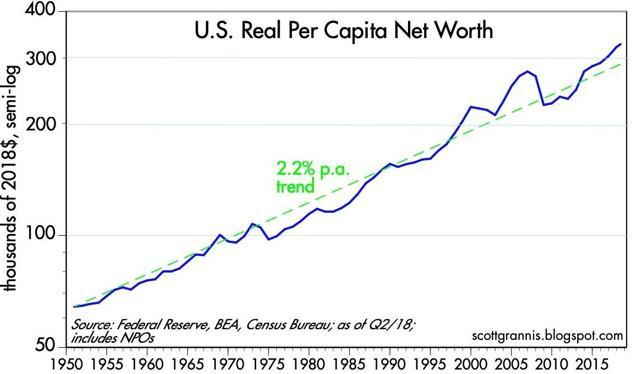

In fact, the debt ratio of US households is now at its lowest level since 1985 (33 years). And as a country, our inflation-adjusted per capita net worth is at an all-time high, meaning that servicing this debt is not difficult.

Now, it is true that greater inequality of wealth means that any given person may not be able to repay a growing debt with the sale of assets. And a lot of these assets come in the form of real estate and stocks, which can quickly lose value or are not very liquid.

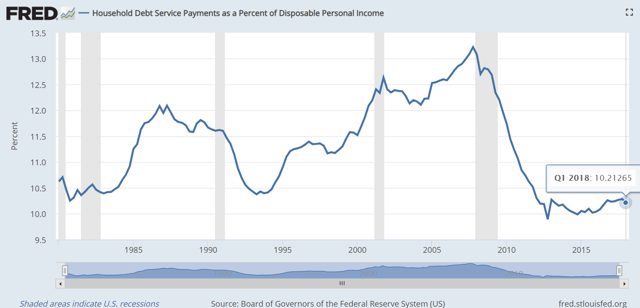

So let's look at what percentage of household disposable income (after tax and mandatory cost of living) will pay interest. In the first quarter of 2018, this figure was 10.2%, one of the lowest levels recorded over the past 40 years. But what about rising interest rates? Will this not cause an increase in consumer defaults, which could revive the financial system?

Probably not for two reasons. First, it should be noted that interest rates are not expected to increase as much as in 2000 or 2007. At that time, households spent 12.5% and 13% of their disposable income servicing the debt.

Second, we can look at the St. Louis Fed's financial stress index to see the state of the current US financial system. It is an indicator composed of 18 indicators monitored each week by the St. Louis Fed. A reading of zero is correlated with the average financial stress over time. Today, this reading is -1.3, indicating below average financial stress. Despite high and rising payment arrears on student and student loans.

Thus, we have further evidence that current consumer debt levels are simply not likely to cause another financial crisis, but will likely not even trigger a moderate recession.

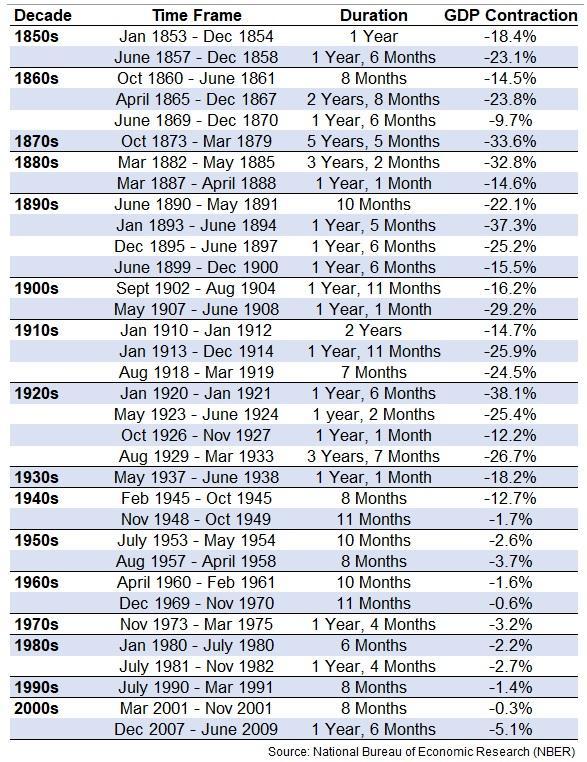

Does this mean that another financial crisis will never be triggered by a consumer debt (or by any type of debt)? Of course not. Financial crises have raged for more than 400 years and will occur every few years. But it is important to remember to put these periods of financial turmoil in their context.

Another financial crisis will happen one day but not likely to cause an economic crisis

Since 1982, no fewer than seven major financial crises have occurred, including:

- 1982: sovereign debt crisis in Latin America: IMF bailout

- 1980: Savings and loans crisis in the United States: more than 700 companies in the science and technology sector went bankrupt

- Crash of US Junk Bond in 1989: bankruptcy of Drexel Burnham Lambert, fifth investment bank of his time

- Crisis of the tequila / Mexican currency crisis in 1994: rescue of the US government / loan guarantee of 50 billion dollars

- Monetary crisis between Asia and Russia from 1997-1998: the IMF and the Fed have made a financial rescue of 40 billion dollars for the long-term management of long-term capital management, a fund of hedge with $ 126 billion in assets under management

- Bubble point over the period 2000-2002: the Nasdaq fell by 80%, many technology stocks fell more and more, many companies went bankrupt

- Financial Crisis 2007-2009: merger of subprime mortgages and toxic derivatives

And note that I do not include even more minor periods of turbulence on the financial markets, such as the sovereign debt crisis in euros from 2009 to 2014. Despite numerous financial crises since 1982, there have been only four recessions in the USA.

With the exception of the Great Recession, all were mild, averaging a 1.5% peak at a trough of GDP. And most of these factors were not directly caused by any of the aforementioned financial crises, but rather a normal part of the business cycle.

The fact is that there is 100% certainty that we will have another financial crisis in the future. In fact, one occurs every 4 years. But unlike the disaster of 2007-2009 that many fear, these resemble the crisis of the euro and only result in the volatility of the stock markets. They do not usually cause negative GDP growth and certainly not a recession "worse than the Great Depression".

Conclusion: consumer loans are not likely to cause another financial crisis, so do not panic and sell all your shares

Financial crises are something that has existed for centuries since the beginning of modern capitalism. Asset bubbles caused by galloping speculation, misallocation of capital and, indeed, excessive debt, will always remain among us.

So, while it is true that another financial crisis will occur at some point, it is important to remember that most of these crises are relatively minor and far less devastating than what is happening. is produced during the Great Recession. It is impossible to determine when and where the next crisis will occur. But given current data on US consumer debt, consumer debt is unlikely to be the trigger point for the next major capital market crisis.

In the coming weeks, we will explore the risks that corporate and government debt pose to the economy and the stock market. We will also explore the best ways for investors, including retirees or loved ones, to protect their wealth and avoid being impoverished even in the event of a new financial crisis.

In the end, the goal of all investors should be to adopt a balanced, evidence-based approach to risk management. It means being aware of global and national economic risks. But in a way that does not let these fears of worst-case scenarios scare you of long-term investments. Indeed, the market history shows that it is the best way to create wealth and achieve your retirement goals.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link