[ad_1]

(Google)

Wednesday, a potential deal was announced between a Canadian cannabis company Aphria (OTCQB: APHQF) and tobacco manufacturer Altria (MO).

The US tobacco giant, Altria Group Inc., is in talks to acquire an equity stake in Canadian cannabis producer Aphria Inc., according to several sources.

The details of the investment proposed by Altria in Aphria have not yet been finalized, said the sources, who asked to remain anonymous, because the interviews are private. They said Altria has expressed interest in acquiring a minority stake at a producer based in Leamington, Ontario with the intention of possibly holding the majority of the shares of the company.

The sources warned that the two companies could be slow to reach an agreement and that the talks could still fail. "

The Globe and Mail (paywalled article)

Aphria's shares traded at C $ 17.24 on the Toronto Stock Exchange (TSE: APH) and had quickly climbed to C $ 20.36. The stock currently stands at about $ 20 Canadian, at the time of writing this article, up 16% after being down before the news.

For its part, Aphria basically said, "No comment." The answer of Aphria:

"Aphria Inc. today responded to a request from the Investment Industry Regulatory Organization of Canada regarding media information, suggesting that the Company was in talks about a potential investment in Aphria. While Aphria is discussing with potential strategic partners and / or investors, At this point, the company notes that there is currently no agreement, understanding or arrangement with a potential investor.

Aphria will inform the investment community of any material changes, if any, in accordance with applicable disclosure requirements. "

Aphria press release

Potential benefits: global expansion

An investment from Altria could pay huge dividends to Aphria. Altria could also benefit from access to the huge potential cannabis market – worth $ 200 billion by 2032, according to Canopy Growth – to offset the decline in tobacco.

From Aphria's point of view, they would have access to a vast reservoir of capital and knowledge. Altria has been operating in a regulated industry for decades and has extensive experience working with regulators around the world. Altria also has decades of experience in a related sector and could help Aphria in the areas of marketing, supply chains and distribution.

Aphria is not short of money. In my recent article on Aphria, I noted that it had a free cash flow deficit of about C $ 56 million per quarter and a net cash position of C $ 335 million. It is expected that the cash free deficit will become very positive soon – recreational cannabis will be legalized next week and Aphria 's expansion plans should be commissioned by early 2019. At this point, Aphria will not have a much higher and much lower operational cash flow. capital expenditures – they should be significantly positive in terms of cash flow.

However, Altria could provide a capital injection that will offer Aphria an option. One of the most important benefits of Canopy Growth – which I mentioned in "Growth of the canopy: the king of cannabis does not come at a good price" – Do they have billions of dollars in the bank. Globally, cannabis laws are evolving rapidly. While cannabis laws are loosened around the world (for example, in Germany last year), Canopy Growth will be able to use its capital to expand into any new country legalizing cannabis:

"So it's really fuel for rockets. It adds a lot. Looking around the world, we will increase production, we will do more research, we will develop more intellectual property. We will create more leading brands, we will have more products and we will be much more global.

If you think about it, it proves that Canopy is the cannabis platform for Constellation. And that's a lot of focus and trust, and we took it seriously as a management team. All members of my team were extremely excited to move on to the next step where we could truly globalize ourselves and do it with and for Constellation. "

Bruce Linton, CEO of Canopy Growth, Q1 / FY19 CC (August 2018)

Although Aphria does not need additional capital to increase its Canadian production to 255,000 kg / year, an investment in Altria could give it the "rocket fuel" it needs to think globally and compete. for the global cannabis markets as the laws become liberalized and these markets open up at the same time. medical and recreational cannabis.

History of investments in cannabis

This is still only a rumor and the deal could still fail. If the agreement is finalized, it would be another investment in Canadian cannabis from alcohol and tobacco manufacturers.

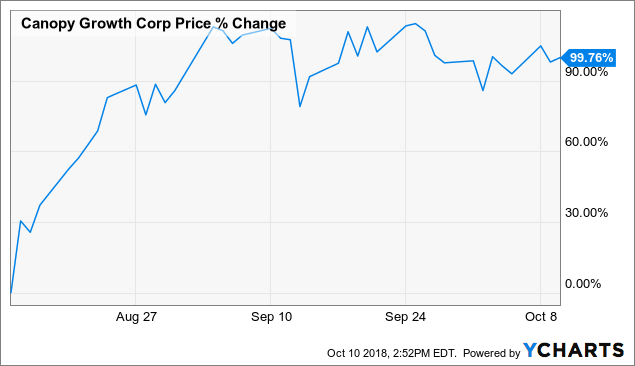

CGC data by YCharts

The most notable investment is Constellation Brands (STZ) $ 4 billion in investment in forest cover growth (CGC). I already wrote about the Constellation Contract ("The risky gamble of The Constellation on the growth of cover") and the growth of the canopy itself ("Growth of the canopy: the king of cannabis does not come at a good price") on this platform.

(Growth of the canopy / Presentation of the constellation)

This investment seems quite similar to the investment proposed by Altria in Aphria: Constellation has acquired a minority interest in Canopy Growth and has sufficient guarantees to extend this participation to a majority position. Constellation also has the right to nominate a majority of Canopy Growth's Board of Directors as a result of the agreement.

The shareholders of Canopy Growth were the big winners of the contract signed with Constellation. US Canopy Growth stocks quoted in the US closed at $ 24.62 the day before the placement in Constellation (8/14). Yesterday (10/09), shares closed at $ 48.72 – up 98% since Constellation's investment. Aphria shareholders expect to see similar gains from an Altria investment.

Although the agreement with Constellation represents the largest investment in Canadian cannabis, it is not the only investment.

Back in August Molson Coors (TAP) has entered into a joint venture with hexo (OTCPK: HYYDF) to form a company that will sell drinks containing cannabis. This joint venture now has a name, as of October 4:

"The joint venture, Closed, will be headed by former Molson Coors executive Brett Vye as CEO. Vye will report to the Truss Board of Directors consisting of three members appointed by MCC and two members appointed by HEXO.

"With the support of two deep-rooted partners in Canada, proven success and market-leading experience in Canada's beverage and cannabis industries, Truss will get the job done," said Brett Vye, President. Chief Executive Officer of Truss. "When consumable cannabis becomes legal in Canada, Truss will be ready to make its mark as a responsible leader in providing high quality beverages to the Canadian consumer. Why? Truss? We put together the vast experience and excellent practices of each partner to create a solid foundation for the future. & # 39; "

Molson Coors Canada and HEXO launch a farm

Molson Coors owns 57.5% of the Truss joint venture, while HEXO owns the remaining 42.5%. As part of the transaction, Molson Coors received 11.5 million HEXO share warrants with an exercise price of $ 6 CAD for a 3-year term. HEXO is currently trading at C $ 8.70, up ~ 85% from its pre-agreement price with Molson Coors.

CannTrust (OTC: CNTTF) also has an exclusive partnership with Breakthru Beverage Group, a leading liquor distributor in Canada. In monetary terms, this transaction is much smaller than that of Canopy Growth or HEXO. As part of this transaction, Breakthru has invested Can $ 9 million in CannTrust for approximately 900,000 shares and Breakthru has options to purchase an additional 2,000,000 shares for a 15% discount.

There have also been other rumors, such as rumors of an agreement between Coca Cola (KO) and Aurora Cannabis (OTCQX: ACBFF). Nothing has come of these rumors yet. However, given the interest shown by the alcohol companies (STZ, TAP), a tobacco manufacturer (MO) and, potentially, manufacturers of soft drinks (KO) for cannabis, the announcement of other contracts may only be a matter of time. The most likely targets would be other cannabis producers with a large production capacity – able to grow enough cannabis to provide a product distributed worldwide, whether it is based on CBD or THC. .

To take away

Two weeks ago, I wrote "Aphria: The best value for money of the" top 5 cannabis producers "" and give a BUY rating to Aphria. This note is only reinforced by a possible investment by Altria – Aphria will be able to use all the capital it receives to continue its dynamic expansion in Canada and to conclude international expansion agreements as well.

That said, the moment is very volatile to buy Aphria shares. Shares are up sharply today on an agreement that has not been finalized yet. Buying based on this rumor can be risky, since the deal might still fail or rumors could prove to be false or exaggerated.

In addition, any investment in cannabis will be a risky investment – it is a speculative and volatile market. For this reason, I suggest investors to diversify their holdings within the industry. Consider an approach like mine Cannabis template wallet, available for The growth operation subscribers, which holds nine different cannabis companies. There is no need to "pick a winner" because there is a good chance that there are several winners in this market. Holding a diverse group of companies will allow you to withstand storms that may affect isolated companies while allowing you to grasp the long-term benefits of this market.

Aphria could also be volatile this week as they should announce their first quarter results October 12, 2018. I will write more about these results when they will be published later this week.

Aphria is still part of my personal portfolio and my model cannabis portfolio, made available to The Growth Operation subscribers.

It's an exciting time to be a cannabis investor, but invest responsibly.

Members of The growth operation, my exclusive community, receive:

- Exclusive access to my in-depth research articles on small cannabis businesses.

- Access my Cannabis template wallet.

- Latest news and updates on cannabis companies.

- Access to my full, live wallet.

This month alone, the subscription is 25% for your first year. Prices will go up in October, so sign up for a free trial today. (If prices rise later, the first members get exclusive prices, forever.)

Disclosure: I am / we are long APHRIA, AURORA CANNABIS, CANOPY GROWTH, CANNTRUST.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Editor's Note: This article deals with one or more securities that are not traded in a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link