[ad_1]

Apple's earnings appeal (AAPL) was a mix. Management has firmly moved away from reporting unit sales data to the Services segment. Despite this change and poor forecasts, very few analysts have changed their ratings to underperform them. On the other hand, the active fund managers underweight this action.

This discrepancy could be due to a shorter investment horizon for fund managers. However, he also points out that most fund managers do not think that Apple would be able to outperform the broader index. The Apple Services business accounts for only 14% of the company's total revenue. Even if Apple manages to post better growth in sectors such as advertising and streaming content, it will take several quarters for services to have a significant impact on EPS growth.

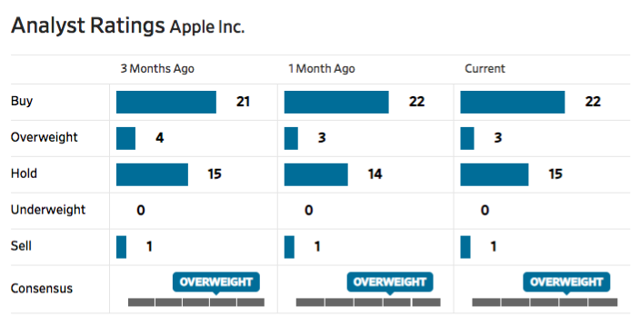

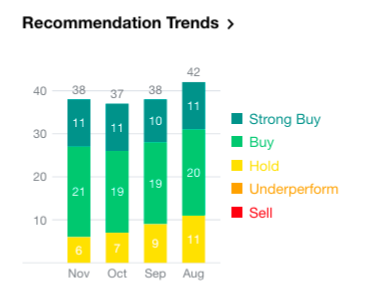

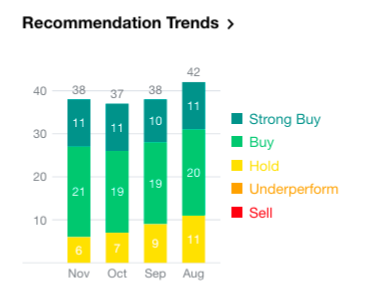

Analysts remain optimistic about the stock

Fig: Recommendation of an analyst on Yahoo. Source: Yahoo Finance

Source: Recommendation of an analyst on WSJ. Source: WSJ

We can see that the bullish sentiment of analysts towards Apple has not changed since the recent results. Morgan Stanley has recently set a price target of $ 253 for Apple, because of the strong growth potential of the streaming industry.

Even if Apple has service activities that could grow in the future, it will probably take some time before moving away from the product segments. The majority of EPS growth over this period will depend on redemptions and revenue growth within iPhones and other products. The repurchase rate is already very high. With dividends, Apple has reported nearly $ 90 billion in the last fiscal year. The increase in EPS due to lower taxes is integrated and the comparison over one year will be more difficult from the next quarter.

The short-term challenges Apple faces may be one of the main reasons why fund managers underweight this stock. According to the UBS report, Apple's active weight among fund managers in the United States is -2.1%.

Short term vs long term

Although fund managers may be reluctant to Apple, Warren Buffett has consistently shown his optimism for the company. The recent 13B deposit of Berkshire Hathaway (BRK.A) (NYSE: BRK.B) shows that it has added half a million additional shares to its already huge stake in Apple. Apple now makes up more than 25% of Buffett's investment portfolio. We know that Buffett's bets are long term and that unlike fund managers, he is not under continuous pressure to beat the index. It can ignore some of the short-term fluctuations in the stock and focus on the long-term potential of the company.

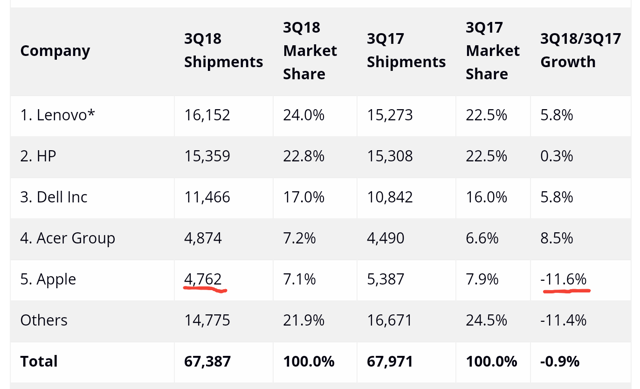

Given the recent changes in the reporting structure, Apple's stock can experience significant fluctuations, as external sources are more important to assess the performance of iPhone, iPad and Macs. External sources, even those of reputable organizations, have not always been accurate. The recent IDC report on Mac sales in the last quarter is a good example. According to IDC, Apple would have 4.762 million units of Mac sales. In the recent report on the results, Apple showed 5.3 million units of Mac sales. As a result, IDC was down 8.9%.

Source: IDC

If Wall Street does not get accurate data from Apple, it will rely on these sources and may be wrong about the performance of the company. This, in turn, will lead to greater stock fluctuations and more speculation. With the change in the reporting structure, investors should focus more on the long-term direction of the company than on annual unit sales in different product lines.

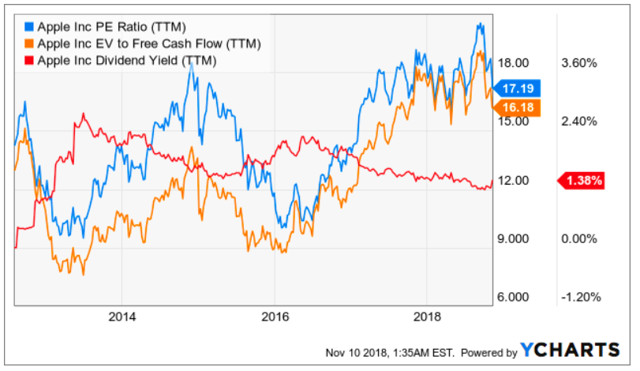

Evaluation

Despite a minor correction, Apple still trades at a high valuation multiple compared to its past valuation. The 12-month PE ratio is above 17 times, while the dividend yield is close to 1.4%.

The lack of data from Apple could lead to further short-term correction as new reports arrive on unit sales of iPhones. Already, it has been reported that Apple assembler, Foxconn (OTC: FXCOF), had reduced the number of assembly lines by 25%, from 60 to 45 production lines. There are also quality issues in some products. These reports can certainly put a strong bearish feeling on Apple's stock because there is no accurate data coming from the company.

Some of the service companies have tremendous growth potential. Advertising activity, which should reach $ 500 million in the current year, can reach $ 2 billion by 2020. This activity has a very high margin, similar to that of the App Store. Trade will also increase, Apple investing in online content. Apple can offer a combo subscription offer for music, video, news, and other media categories.

However, in the short term, growth in net results would remain difficult, as year-over-year comparisons are increasingly difficult and unfavorable currency hurdles are worsening.

Investor to take away

There is a significant divergence between analysts' ratings and the position taken by active fund managers in Apple's stock. Part of this divergence is due to the different investment horizons of fund managers. Due to the short-term challenges facing the company, it would be difficult for Apple to outperform the index as comparisons become more difficult. Even in the longer term, Apple's Services business will need strong growth to have a significant impact on the revenue base and revenue growth.

Apple's valuation level is relatively high compared to the past valuation multiple reported by the company. This should make it difficult for the stock to acquire a strong bullish sentiment in the near term. The current stock correction phase may take a while.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link