[ad_1]

Investment Thesis

Apple (NASDAQ: AAPL) makes for one of the safest long-term investments available in the market. Although the stock will have volatile periods, investors should let the company's long-term prospects lead their investment decision. And above all, they should be guided by their valuation at all times.

Recent Developments

Apple released its Q4 2018 results, which showed everything investors needed to know: the top line grew by 20% and EPS at 41%. That's it! Investors do not need to think about it. Investors do not need any particular insights – everyone else is trying that game already. It was an astonishing quarter with a solid and well-rounded performance. This information, together with its valuation (below), is all about the insight of investors.

Yet, surprisingly, investors are willing to exit the stock. This part I find surprising. Apple is a well-established giant tech. Over time, the company is attempting to broaden its revenue stream from its dependence on the iPhone. Yet, it has struggled to be so, because the end of the day, the iPhone is an amazing product.

The Best Way To Invest In Apple

Even more important, the iPhone is the main gateway to the company's Business Services (up 17% YoY). Apple is showing a strong ability to leverage its key product, the iPhone, with other business lines. Yet, because investors are exiting their investment, which is counter-intuitive.

Most investors in Apple are not going to stop investing altogether; investors (read savers) will deploy this capital.

Moreover, investors shoulds Being able to do this is one of them. It is always OK to do nothing when swiftly down or up.

A lot of analysts, investors, and a lot of noise accumulates. I, on the other hand, advocate that the best way to compound their earnings is by spending time in the stock market rather than going into the stock.

Paid Subscription Numbers: Fast Growing

CFO Luca Maestri used Apple's earnings call to highlight the company's success. This is Netflix's (NASDAQ: NFLX) numbers. Also, astonishingly, Apple's paid subscriptions are growing much faster. YoY growth, while Netflix's growth YoY growth is roughly half this figure.

However, one thing which Netflix has gotten to grips with is very important. Hence, rumors are now out that Apple might be looking for high-quality free to its device owners, thereby incentivizing consumers to pay the heavy price tag associated with the devices.

Can Apple Gross Margins Still Improve?

In essence, what Apple is able to do, by establishing such a stronghold through its services offering, is to ensure that going forward their margins remain as strong, if not stronger than they have been in the past.

Remember, in the past, the company was connected to different parts of the world. This will still take place going forward, but over time, Apple's total gross margins will get a boost from its services offering, as it's revenue is an asset-light business unit that continues to grow rapidly.

Therefore, it does not seem out of reach that over the next 3-4 years Apple's gross margins will indeed succeed in crossing into the low-40% range. Which would imply that growth would increase, its profitability would still increase.

Strong Message: Share Repurchases

Apple carries a net cash position of $ 122 billion. CFO Maestri has, for several quarters, repeated the message that the company is looking for this large sum of cash towards stock repurchases. That is, they are already going to increase their ownership of Apple simply by doing nothing but waiting.

Thus, with all these different avenues where shareholders can come out by Apple investors, it is possible that the company's valuation remains so attractive for now.

Rated

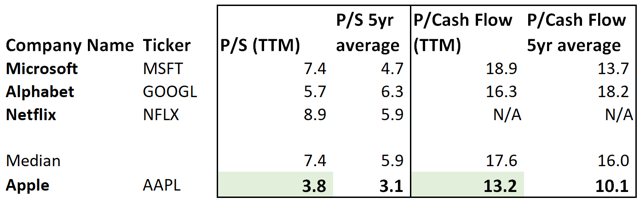

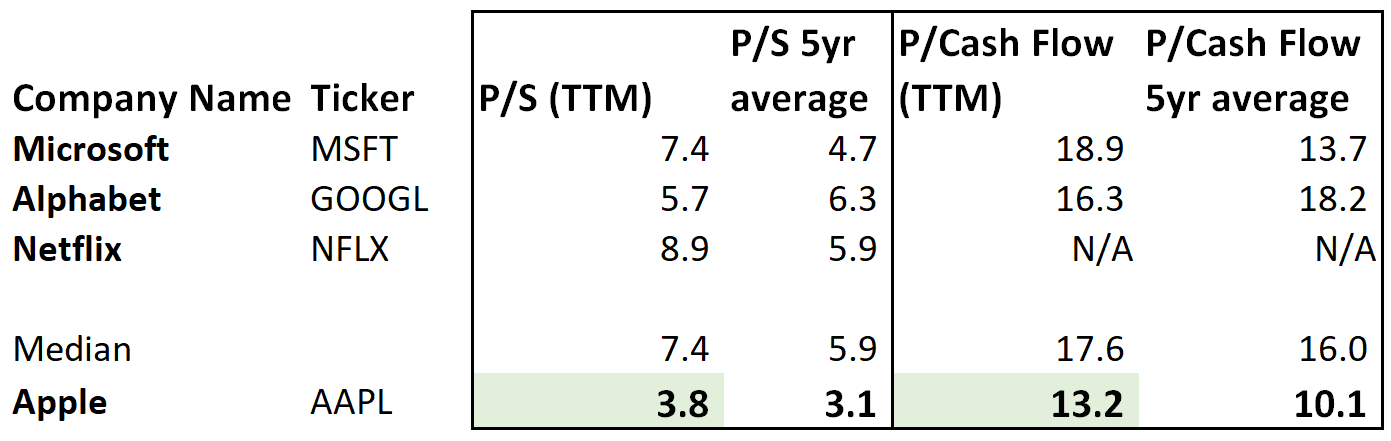

Source: Author's calculations, Morningstar.com

No investment is risk-free. That is not how investing works. But sometimes, some things do make intuitive sense. As the table above, Apple's valuation is not egregious.

Realistically, Netflix is not a direct competitor to Apple, but my argument in this article is to highlight how Apple's Services opportunity has some of the same economic tailwinds as Netflix. And I use Netflix in the table to point out how much investors are willing to pay for a company when the story "sounds" right, even if the reality does not match up to their expectations.

Having said that, obviously Apple will have bad quarters too. But overall, you can trust that Tim Cook, Maestri and the rest of their team are highly competitive and will do everything they can to increase Apple's intrinsic value.

Takeaway

When Apple share price rises, investors focus on all the different opportunities the company is investing in, such as its Business Service. However, when the share price starts to fall, investors essentially ignore all else. In this article, I have attempted to argue that this is not the correct approach to investing.

Author's note: The only favor I can grow my Seeking Alpha friendships and our Deep Value network.

Disclaimer: Please do your own due diligence to reach your own conclusions.

Find alpha in unloved names with huge upside potential!

At Deep Value Returns, I'm laser-focused on two things: free cash flow and unloved businesses. Companies going through troubled times, but that are otherwise stable and profitable. If you're looking for a deep value investing approach inspired by Buffett, Icahn, and Greenblatt that can help you get between 50% and 200% potential upside in just a few years, then sign up for your two-week trial with Deep Value Returns today!

Disclosure: I / we have no positions in any stocks and 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with this article.

[ad_2]

Source link