[ad_1]

(Source: imgflip)

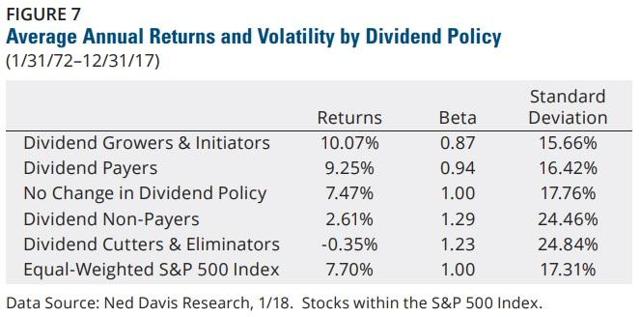

In the past, long-term investors had two proven methods for achieving strong, above-market returns that could help them achieve their financial goals over time. The first is to buy quality dividend growth stocks, which have been the best performing asset class in history.

Since 1972, not only did dividend-paying stocks beat the market by 31% a year, but they did so with a lower volatility of 13%, achieving an annualized adjusted risk return of 51%.

The second is to buy these quality companies at a good price, that is, at fair value or better. A study by Yale revealed that between 1881 and 2016, the starting EP at which you bought a stock had an impact on total returns up to 30 years.

So, my goal is always to find good dividend growth ideas for readers (and myself) who are trading at fair value or better. So when first-class dividend growth stocks fall into a bear market, my counter-current value flourishes because I know these are the best opportunities to add Class A dividend growth stocks to your wallet.

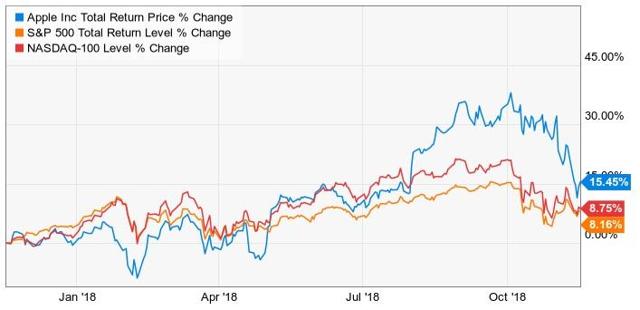

Apple (AAPL), for a long time the darling of Wall Street, is the last name of high-tech flying to fall into a bear market. However, given that the company is still recording a 15% increase for the year, many investors do not know if the stock represents a significant purchase at current prices, or may fall further.

So let's take a look at four things investors need to know about Apple's recent dive. In particular, the reason why Wall Street was so irritating to the company, which is probably missing in the market and why Apple remains one of the main pillars of the long-term dividend growth you can own over the next decade. More importantly, find out why Apple is probably a good buy, even if it's not necessarily good, at today's much lower prices. This is because it will probably be between -11% and 3%, but it should still be able to generate about 14% of annualized long-term total returns over the next decade.

1. Why Wall Street Panicked Apple's Revenues

Given the violent negative reaction to the stock price, one might think that Apple's latest results were horrendous. In fact, it could not be further from the truth.

|

Metric |

Q4 2018 |

Exercise 2018 |

|

Increase in income |

19.6% |

15.9% |

|

Growth in operating profit |

22.9% |

15.6% |

|

Growth in net income |

31.8% |

23.1% |

|

Free cash flow growth |

41.4% |

26.2% |

|

Share the number of growth |

-6.5% |

-4.8% |

|

EPS growth |

40.6% |

29.3% |

|

FCF / Growth of the action |

51.2% |

32.6% |

|

Dividend growth |

15.9% |

13.3% |

|

FCF dividend distribution ratio |

21.5% |

21.2% |

(Sources: publication of results, Morningstar)

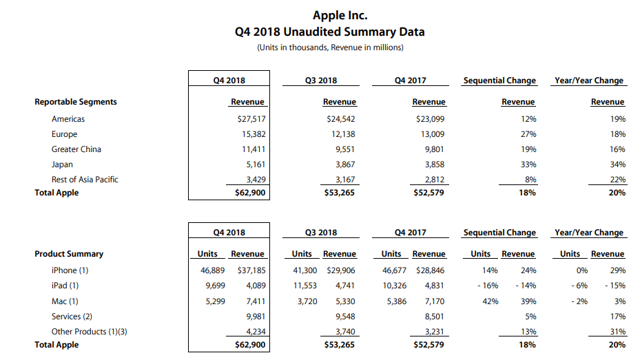

The company actually posted 20% revenue growth in the last quarter of its fiscal year, the fastest growth rate in three years.

(Source: publication of the results)

This was largely motivated by three things. The most notable is the 29% increase in iPhone sales, entirely due to the fact that the average selling price of ASP reached $ 793, compared to $ 618 in Q3 2017. This was due to the launching much more expensive iPhones this year (price of up to $ 1,450 per phone).

Despite the much higher prices, Apple continues to delight its customers. This is what CFO Luca Maestri told analysts at the last teleconference:

"The latest survey of US consumers among 451 searches indicates 98% customer satisfaction for the iPhone X, the iPhone 8 and the iPhone 8 Plus combinedand among the professional buyers who plan to buy smartphones in the December quarter, 80% plan to buy iPhones."- Luca Maestri (it's us who underline)

Services and "other products" are the other engine of growth, consisting mainly of the company's wearable devices (Apple Watch) and the HomePod speaker (growth of more than 50% over one year). Not only did these sectors post strong growth, but they also accounted for 23% of the company's sales, showing that Apple has made good progress in diversifying its business since its over-reliance on from the iPhone. So, if Apple's results were so strong and set a new record for the company, then why did the stock price fall?

What has freaked on Wall Street is the growth of the fourth quarter forecast, which implies a revenue growth of only 3% in the medium term. This is far from the very impressive figures released by Apple throughout the year and the 16% growth expected by analysts in 2018. Many investors assume that this means that sales of "advanced iPhone" will lead to much slower growth in the future. About 2% of this slowdown in Q4 revenue growth will be attributable to the strength of the dollar.

These fears of growth have been fueled in recent weeks by analysts speculating that iPhone sales during Apple's holiday quarter would be much lower than expected. This speculation was triggered by Lumentum Holdings (LITE), a key Apple supplier that canceled its forecast for the fourth quarter, citing "a request from one of our largest industrial and consumer customers for laser diodes for 3D detection to significantly reduce the shipments destined for them during our second fiscal quarter. Previously placed orders were originally to be delivered during the quarter. "Although Apple has not been specifically mentioned, Wall Street has a long history of hasty conclusions regarding supplier delivery discounts, which means that iPhone shipments are in trouble.

Ming-Chi Kuo, a respected analyst at TF International Securities, recently reduced his forecast for fourth-quarter iPhone volumes from 100 million to 70 million. This is largely the result of two factors. The first is the trade war with China, which should weigh on iPhone sales in the Middle Kingdom. On top of that, Kuo is worried about growing competition from competing and less expensive products such as the Huawei Mate 20 series. In addition, Apple's strong growth in emerging markets is expected to be impacted by the rise in the US dollar, which is largely driven by rising US interest rates and stronger growth relative to other developed economies.

"Emerging markets where we are seeing pressure on our markets such as Turkey, India, Brazil and Russia. These are markets where currencies have weakened in the recent period, which has sometimes led to higher prices and these markets are not growing as we would like. – Tim Cook

Finally, investors were frightened by the management, which announced that it would no longer sell to the unit for any of its iOS products, including the iPhone. Management stated that it was because:

"As evidenced by our financial performance in recent years, The number of units sold during a 90 day period does not necessarily represent the underlying strength of our business. In addition, a sales unit is less relevant to us today than in the past, given the extent of our portfolio and the greater dispersion of selling prices within a company. given product range ….if you look at our income over the last three years, if you look at our net income in the last three years, if you look at our stock price over the last three years, there is no correlation with the units sold during a given period. ."- Luca Maestri (it's us who underline)

Although what Maestri says is objectively true, Wall Street, obsessed with a long unit, still considers that the lack of disclosure of future unity is a negative factor, fearing that Apple has "something to hide." But if I'm optimistic about Apple, it's because I think Wall Street's fears are exaggerated, and I'm expecting the company to continue to show double-digit growth in its bottom line and bottom line. dividend growth in the coming years.

2. What's missing on the street

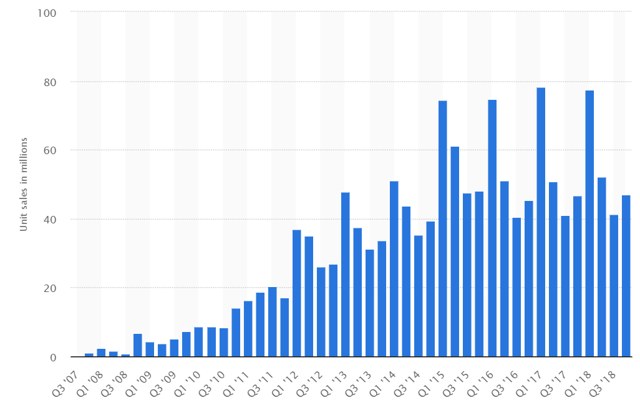

There are three reasons why I am not at all concerned about Apple's ability to generate strong growth in the future. First, as pointed out by Apple's chief financial officer, the record volume of Apple's iPhone units did not hurt the company.

Volume of iPhone units per quarter

(Source: Statista)

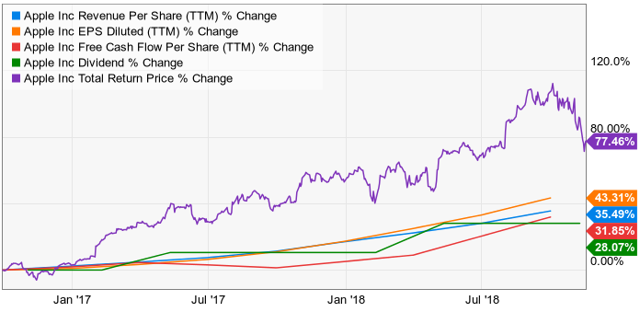

First, let's not forget that iPhone unit volumes peaked several quarters ago, in the first quarter of 2017 (with 78.3 million). Since then, Apple's fundamentals have steadily improved.

(Source: Ycharts)

In the end, what counts for investors are the fundamentals, ie EPS, FCF / share and dividends. As long as they continue to grow steadily, no matter how Apple achieves this positive growth.

Second, we can not forget that Apple's long-term growth strategy is not based on steady growth in iPhone unit volumes, but rather on the monetization of its sticky and sticky iOS ecosystem. The gap in this ecosystem remains wide, thanks to customer satisfaction and loyalty figures, among the best in the industry. For example, according to the analysis firm, 80% of iPhone users planned to buy another iPhone, and 70% of survey respondents said they would not even consider another phone.

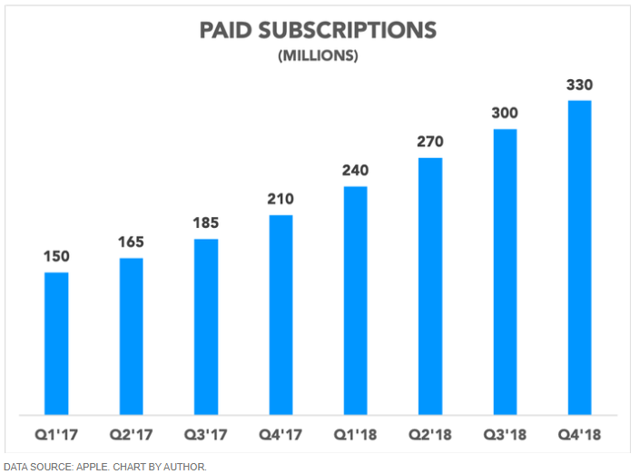

Apple plans to convert the 1.3 billion iOS device users into an ever-growing number of paying subscribers, able to generate a steady stream of revenue and lucrative cash flow from customers. ;to come up.

(Source: Motley Fool)

Over the last two years, Apple has done a remarkable job of increasing the number of subscribers, which has allowed its service revenue to continue to grow by more than 20% per year. These subscriptions cover the company's broad range of services, including App Store, Cloud Services, Apple Care, Apple Music, and Apple Pay. During the last quarter, paid subscriptions grew by 50% year-over-year compared to the third quarter of 2017, despite an already significant user base.

(Source: publication of the results)

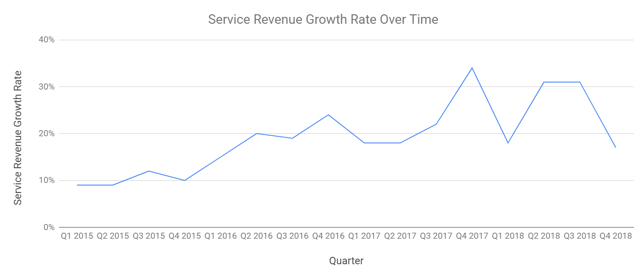

And keep in mind that in the third quarter of 2018, service revenue growth would have been 27% without the one-time accounting benefit of the third quarter of 2017, which would have added $ 640 million to this quarter's figure. Essentially, this means that Apple's service sector, which represents extremely stable and lucrative recurring revenue, continues to grow at an impressive rate, despite its annual rate of return of $ 40 billion.

(Source: publication of the results)

In fact, management had previously said it wanted to achieve $ 50 billion in service revenues by 2020. In the last 12 months, service revenues amounted to $ 37.2 billion and, since the beginning of 2015, Apple's service revenue growth averaged 19%. This gives the company a head start on its already ambitious goal of service revenue. Here's what this business unit will look like in the coming years if Apple manages to maintain this average growth rate (which is significantly slower than in recent quarters).

|

Year (fiscal year) |

Services Annual turnover |

|

2018 |

$ 37.2 billion |

|

2019 |

$ 44.3 billion |

|

2020 |

$ 52.7 billion |

|

2025 |

$ 125.7 billion |

(Source: publication of the results)

Why do I think Apple can maintain this type of service growth rate? Because the service sector is at the center of many growth opportunities, including mobile payments.

"I want to highlight the outstanding performance of Apple Pay Which one is by far the world's first contactless mobile payment service. The volume of transactions tripled compared to the previous year. And to put that in perspective, Apple Pay has generated far more transactions than PayPal Mobile itself, with a growth rate four times that of the market."Tim Cook, (it's us who underline)

So, I see Apple as a great way to invest in the "death of money" where the convenience and incredible loyalty of the iOS user base gives Apple Pay a major competitive advantage over its smaller rivals .

Ultimately, what matters to Apple's shareholders is whether earnings and cash flow per share of the company (and dividends) can continue to grow. As you can see, analysts are currently expecting the company to continue to record double-digit growth over the next few years.

|

Time range |

EPS analyst growth consensus |

|

Exercise 2019 |

13.4% |

|

Fiscal 2020 |

9.9% |

|

5 years |

13.0% |

|

10 years |

13.1% |

|

Last 5 years |

11.7% |

(Source: Yahoo Finance, Fast Graphs)

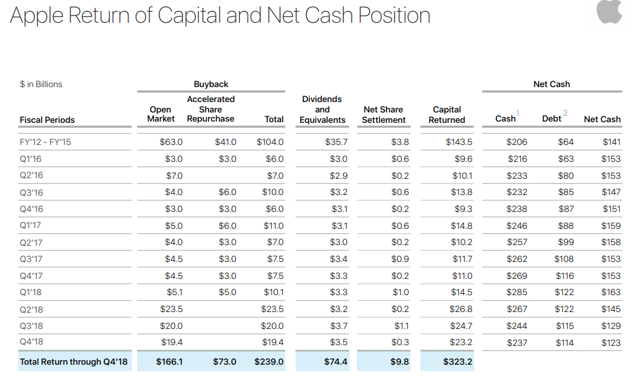

This is despite a slowdown in revenue growth at mid-rate (4% to 7%). How can Apple meet these expectations? This is because the company remains committed to its epic cash return program, including the most aggressive share repurchase program in history ($ 239 billion to date).

(Source: Apple)

Do not forget that Apple has said it wants to reach a net cash position of zero and that its cash position is currently rising to $ 123 billion. And the mountain of net cash of Apple is not the only thing that will fuel his redemptions. Over the past 12 months, the company generated $ 64 billion in free cash flow and, after paying the dividend, retained $ 50 billion in the free cash flow.

(Source: Ycharts)

Since starting to bring money back to shareholders, the number of Apple shares has decreased by 6.2%, and in the third quarter it has accelerated to 6.5%. As stock prices have fallen significantly over the last few weeks, Apple can probably be expected to accelerate its fourth-quarter buybacks somewhat. After all, in the second quarter of 2018, during the latest stock market correction, the company bought back $ 23.5 billion of stock. But will Apple not run out of cash to finance these massive buyouts? Of course, but assuming repurchases of $ 20 billion per quarter and no growth in the retained FCF, it would take about six quarters to achieve it. During this period, Apple's free cash flow after dividends would likely allow it to repurchase $ 75 billion of additional shares for a total of $ 198 billion in redemptions, and reduce by 20% its share of capital. .

The bottom line is that while Apple's double-digit revenue growth is likely behind, the company's overall business model remains as strong as ever. The loyal customer base, which management is converting into an army of service subscribers, means that Apple will likely remain a machine to manufacture free cash flow. The one that continues to present one of the most attractive long-term dividend profiles on Wall Street, which means that higher double-digit total returns than marketing are likely to continue for many years.

3. Dividend Profile: Apple still retains outstanding dividend with long-term double-digit return potential

The dividend profile is the most important element for all income investments. It consists of three parts: yield, dividend security, and the long-term growth potential of payments (an indirect indicator of earnings and cash flow growth). Combined with the valuation, this is what usually determines the total returns.

|

Business |

yield |

TTM FCF payment ratio |

Expected earnings growth over 10 years (consensus of analysts) |

Potential total annual return over 10 years |

Adjusted total return potential of the valuation |

|

Apple |

1.5% |

21% |

13.1% |

14.6% |

13.5% to 14.9% |

|

S & P 500 |

1.9% |

38% |

6.4% |

8.3% |

0% to 5% |

(Sources: Financial Reporting, Morningstar, BlackRock, Vanguard, Gurufocus, Fast Graphs, Simply Safe Dividends, Yardeni Research, Multpl.com, Gordon Dividend Growth Model, Dividend Yield Theory)

Even after a 20% drop from the all-time highs, Apple's performance is no surprise. But what it lacks in terms of current income, Apple largely offsets dividend security and long-term growth potential. This is thanks to the very low distribution ratio of 21% of the FCF during the last year. This means that Apple retains $ 50 billion of FCF after paying its dividend and could easily raise it at a high-to-high double-digit rate for many years.

The second part of the dividend security equation is the balance sheet.

|

Business |

Debt / EBITDA |

Interest coverage ratio |

S & P credit rating |

Interest rate |

|

Apple |

1.3 |

26.9 |

AA + |

2.8% |

|

Average of the industry |

2.1 |

51.6 |

N / A |

N / A |

(Sources: publication of Apple's results, Morningstar, Gurufocus, Fast Graphs)

Even taking into account the company's debt of $ 114 billion, Apple's debt ratio remains well below the industry average. And the extremely high interest coverage ratio shows that Apple has no problem managing this low-cost debt. Apple's average interest rate is actually slightly lower than that of the US Treasury (2.9%) even before taking into account the interest deductibility it still enjoys under current US tax law. This is thanks to one of the best credit ratings of US companies. And of course, we can not forget that, since Apple has a net cash of $ 123 billion, the measure of leverage is almost debatable. The Apple dividend is, in simple terms, one of the most secure on Wall Street and is expected to continue to grow rapidly in the foreseeable future.

How fast? It depends on how management wants to structure its future capital return program. Tim Cook announced that Apple would increase its dividend each year, without however specifying the speed with which it was going. But since the restart of its dividend at the end of 2012, Apple's payout has increased by 11.5% of the CAGR. For my return model, I assume that Apple will maintain the current very low FCF payout ratio in order to maximize the retained FCFs that it can channel into its massive buyout program.

Nevertheless, even that would mean that Apple's dividend would likely increase in the same way as EPS (and the FCF / share), which analysts say should increase by 13.1% of the CAGR over the next decade. Combined with this modest return, this would mean that Apple's shares are expected to generate approximately 14.6% of total returns over time. It is based on the Gordon Dividend or GDGM growth model, which has been relatively effective in predicting total business returns since 1956. The GDGM indicates that, over time, total returns take into account the return + the rate of return. growth in earnings per share / mutual fund / dividend. The model assumes that valuation changes cancel out over time because, over several years, the share price is purely a function of earnings, cash flows and dividends (fundamentals).

Even considering Apple's range of valuations (slightly underestimated to slightly overvalued), I believe Apple should generate a total long-term CAGR return of between 13.5% and 14.9% . In terms of context, the S & P 500 has historically generated total CAGR returns of 9.2% and, based on current valuations, I expect only 8.3% of long-term market returns. This may be overly generous, as BlackRock, Morningstar and Vanguard founder Jack Bogle expect the market to generate returns between 0% and 5% of the CAGR over the next five to ten years. coming years.

Ultimately, Apple remains a world-class dividend growth leader, likely to generate strong double-digit net income and dividend growth in the coming years. This should allow it to stay ahead of the market and attractive in most growth portfolios.

That said, despite its recent fall, I do not consider Apple a "very good" purchase of new money today. This is because, although it has improved a lot in recent weeks, the stock is very close to fair value or even slightly overvalued.

4. Valuation: not necessarily a good deal but potentially a good buy immediately

(Source: Ycharts)

Even with the recent bear market, Apple has managed to deliver solid total returns over the past year, far exceeding those of the S & P 500 and most technology stocks. But that raises the question of how Apple is a good place for new money today? It's not necessarily easy to answer because there are dozens of ways to value a business. But to help you decide if Apple is a good buy for you, here are three approaches that have proven historically useful for blue chips like these.

The first is to look at the company's PE ratio and compare it to its historical norms.

|

TTM PE report |

PE ratio ahead |

5 year average PE ratio |

Implied 10-year EPS growth rate |

Analysts consensus on 10-year EPS growth |

|

16.3 |

14.4 |

14.0 |

3.9% |

13.1% |

(Sources: Simply Safe Dividends, Fast Graphs, Gurufocus Benjamin Graham)

Apple is trading at 16.3 times net profit, compared to 22.3 for the S & P 500. On a PE term basis, Apple looks rather cheap at only 14.4, compared to 17.3 for most technology companies and online with its five-year average of PE. of 14.0. More importantly, this late PE ratio implies that a long-term EPS growth of only 3.9% is incorporated into the stock. Even if you do not agree with analysts that Apple will be able to achieve long-term growth of 13%, buybacks alone will be enough to break this very low bar . This implies that Apple is actually undervalued, or at least close to fair value.

To confirm this, I often turn to Morningstar's discounted cash flow or discounted three-step cash flow model. This is because Morningstar analysts are 100% focused on fundamentals and generally use more conservative growth assumptions than most analysts.

|

Fair Morningstar Value |

Discount at fair value |

Boost valuation |

Total return adjusted to the valuation |

|

$ 200 |

3% |

0.3% |

14.9% |

(Sources: Morningstar, Money Chimp, Gordon's Dividend Growth Model)

Today, Morningstar estimates that Apple is worth $ 200 per share, about 3% undervalued. This means a very modest increase in long-term valuation (10 years) that could allow Apple to generate about 15% of total returns over the long term.

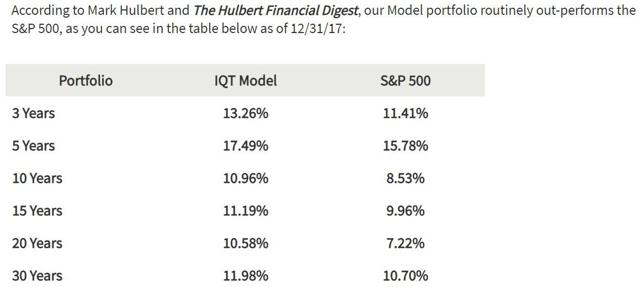

A final valuation model that I consider, and one that is by far my favorite, for first-rate dividend growth stocks, is called dividend yield theory or DYT. This has proven to be very accurate for stable business model companies like Apple since 1966. That's when the Investment Quality Trends fund manager / newsletter publisher began using DYT exclusively to generate decades of higher returns than the market. This is on all periods and with a volatility lower by about 10%.

(Source: Investment Quality Trends)

DYT simply says that a dividend yield tends to be stable and reverses over time. This means that we are going around a long-term historical average that approximates fair value. Comparing the return with the fair value return can give you an idea of the undervaluation / overvaluation of a dividend stock, and hence the improvement in the long-term valuation of the return to its standard. historical.

|

yield |

Average yield over 5 years |

Median yield over 6 years |

Estimated return on fair value |

|

1.5% |

1.7% |

1.7% |

1.7% |

(Sources: Simply Safe Dividend, Gurufocus, Dividend Yield Theory)

Apple's return has been stable, on average and on average, around 1.7% since the reinstatement of the dividend. This is the return that my Gordon valuation-adjusted dividend growth model uses to estimate the long-term total return potential of the CAGR (over 10 years).

|

Fair estimated value |

Discount at fair value |

Improved performance of long-term evaluation |

Expected total return (from fair value) |

Total return adjusted to the valuation |

|

$ 172 |

-11% |

-1.1% |

14.6% |

13.5% |

(Sources: Simply Safe Dividend, Gurufocus, Dividend Yield Theory)

Unfortunately, this higher yield means that Apple could still be overvalued, about 11%. The good news is that over time, equities will appreciate only 1.1% of the CAGR more slowly than the BPA / FCF / dividend ratio. This ultimately means that Apple could be overvalued from 11% to 3% undervalued. Investors can therefore expect long-term total returns of between 13.5% and 14.9%.

For a top-notch program like this, it's still strong enough for me to recommend stock at current prices. But for my own portfolio (which targets higher total returns), I personally expect Apple to reach my target return of 1.8%.

But of course, whoever buys Apple today must be comfortable with his risk profile.

Risks to consider

For a thorough review of Apple's fundamental risks, see this article (non-paywalled).

For this article, I will discuss the recent volatility of the title and point out that, like all big companies, Apple is not immune to the intrinsic forces of creative destruction that characterize capitalism.

"Amazon is not too big to fail … In fact, I predict that someday, Amazon will fail. Amazon will go bankrupt. If you look at large companies, their lifespan tends to last more than 30 years, not more than 100 years … If we start to focus on ourselves, instead of focusing on our customers, it will be the beginning of the end. We must try to delay this day as long as possible. "- Jeff Bezos (it's us who underline)

Jeff Bezos, founder and CEO of Amazon (AMZN), stresses that even the most dominant companies in their respective sectors should never rest on their laurels. Apple is today one of the most popular mainstream technology brands on the planet, and its evolution towards wearables and subscription services probably means that its future is bright, at least for the next decade. But no company is a real investment "buy and hold forever", but a purchase "until the thesis is broken". Consumer technology is replete with examples of once dominant phone makers (including Nokia (NYSE: NOK), Motorola, and BlackBerry (NYSE: BB)) who took their customers for granted and were relegated to the ranks of # 39; history.

What would imply the thesis on Apple? Tout d’abord, deux à trois années consécutives de baisse des bénéfices et de FCF, ainsi qu’une forte décélération des ventes de services et «autres». Notez que je ne prédis pas que cela se produira nécessairement dans un avenir rapproché, mais que les investisseurs devraient être à l'affût de ces problèmes.

Pour le reste de cette section sur les risques, je tiens à souligner que Apple, comme toutes les valeurs technologiques, connaîtra des périodes normales de forte volatilité négative. C’est parce que les valeurs technologiques ont généralement des bêta plus élevées (volatilité par rapport au S & P 500):

- Bêta d'un an: 0.70

- Bêta 3 ans: 1.22

- Bêta 5 ans: 1.26

- Bêta de 10 ans: 1,29

- Bêta historique: 1.12

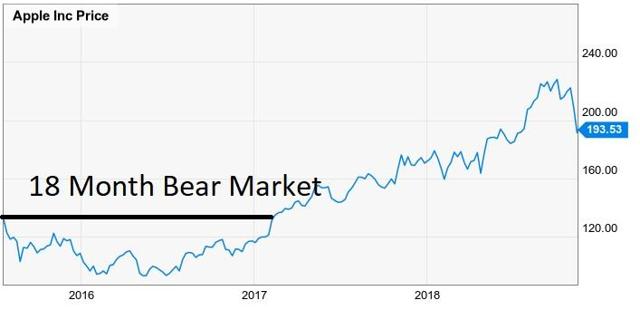

Même à l’ère de l’ère moderne dominée par l’iPhone (et à croissance lente), les actions d’Apple peuvent chuter de près de 30%, et ce, pendant une économie en bonne santé et un marché haussier séculaire.

(Source: Ycharts)

Les investisseurs peuvent s'attendre à une chute potentiellement beaucoup plus importante de 30% à 40%, voire davantage, lors de la prochaine récession et du marché baissier global (pour le S & P 500). C’est parce que le marché deviendra obsédé par les risques (ce qui pourrait mal tourner avec les fondamentaux), y compris par la manière dont une récession pourrait entraîner une baisse significative des dépenses de consommation pour les produits de haute technologie. À ce moment-là, quels que soient les résultats réels de la société, les actions l’auront probablement.

Le dernier marché baissier majeur d’Apple a également été déclenché par une crainte similaire de «pic d’iPhone», ce qui signifie qu’il a fallu au moins 18 mois pour que le titre retrouve un nouveau sommet de tous les temps.

(Source: Ycharts)

Je ne m'attends pas nécessairement à une répétition cette fois-ci, car chaque marché baissier est légèrement différent. Cependant, le fait est que les investisseurs doivent être prêts à recevoir des rendements stables sur une période allant jusqu'à 12 à 24 mois sur Apple, ce qui est bien loin des rendements extraordinaires des deux dernières années.

Rappelez-vous que les périodes de prix stables sont le moment idéal pour les investisseurs à long terme d’ajouter progressivement à leurs positions. Étant donné que les bénéfices, les flux de trésorerie disponibles et les dividendes d’Apple continueront probablement de croître régulièrement (mais à un rythme plus lent), les actions deviendront de plus en plus sous-évaluées à mesure que le prix de ses actions languira. Tant que le modèle commercial fondamental de la société restera intact (écosystème iOS puissant et de plus en plus monétisé via des services et des périphériques portables), Apple restera l’un des plus attractifs sur le plan de la croissance du dividende technologique que vous pouvez acheter.

En fait, si le prix de l’action se maintenait suffisamment longtemps au niveau actuel, je me ferai un plaisir d’ajouter Apple à mon propre portefeuille de retraite à croissance à dividende élevé, car le titre figure sur ma liste d’achat baissier avec un rendement cible de 1,8%. C’est le rendement auquel, selon moi, les actions génèreraient un rendement total de plus de 15% du TCAC au cours de la prochaine décennie.

Bottom Line: Les marchés baissiers sur les actions de dividendes de qualité sont le meilleur moment pour acheter des investisseurs à long terme

Personne ne peut prédire l’avenir et je ne peux donc pas vous dire si les actions d’Apple sont en baisse ou non. À court terme, le sentiment instable du marché dominera et Apple pourrait très bien devoir encore chuter.

Toutefois, ce que je peux vous dire, c’est que, malgré ce que la récente chute du titre peut sembler indiquer, la thèse de la croissance à long terme d’Apple n’est PAS brisée. C’est à peine la première fois que les craintes de «pic iPhone» font plonger les actions d’Apple. En fait, les volumes unitaires d’iPhone ont atteint leur point culminant il ya près de deux ans. Pourtant, la société a réussi à maintenir une solide croissance de son chiffre d’affaires et de ses résultats depuis, ce qui lui a permis d’obtenir des rendements exceptionnels, supérieurs à ceux du marché.

Et, s’il est vrai que la croissance des revenus d’Apple à deux chiffres est probablement toujours derrière, nous ne pouvons pas oublier qu’Apple reste l’une des sociétés les plus rentables du monde. En particulier, la montagne de liquidités nettes sur laquelle elle repose (123 milliards de dollars), combinée aux 50 milliards de dollars de FCF annuels retenus, signifie que le programme de rachat épique de la société va se poursuivre dans un avenir proche. Cela, combiné à ses activités en plein essor et à ses activités de services, devrait permettre à la société de continuer à afficher une croissance à deux chiffres du BPA, du FCF / action et des dividendes pendant de nombreuses années.

Aujourd’hui, la valorisation d’Apple, bien qu’elle ne soit probablement pas sérieusement sous-évaluée en raison de ses perspectives de croissance réalistes, me permet de la recommander à la plupart des investisseurs. Bien que j'attende personnellement un meilleur rendement pour l'ajouter à mon propre portefeuille, sachez que j'attends avec impatience le jour où je pourrai rejoindre les rangs des actionnaires d'Apple. Et plus le stock baisse, ou plus il croupit longtemps autour des niveaux actuels, plus ce jour sera rapide.

Disclosure: Je suis / nous sommes longs AMZN.

J'ai écrit cet article moi-même et il exprime mes propres opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link