[ad_1]

Co-produced with Nicholas Ward for high dividend opportunities.

AT & T (T) has attracted the attention of many income-oriented investors throughout 2018 due to the weakness of its course. We have long been investors as long-term investors and beat the tables because of the irrational treatment that this strategy has given the market for a year. We said that AT & T does not cost much at these levels in the USD 30 and that we believe that the acquisition of Time Warner will be a major benefit to the company in the long run. In this regard, I have personally recently added a position. Keeping all this in mind, we thought it made sense to update AT & T, which yields 6.5% after its recent sale.

Durability of the dividend

The fact that AT & T's dividend yield is now more than double the US 30-year interest rate seems to indicate that the market believes that AT & T's performance is not sustainable. In short, we do not agree. In this article, we will examine AT & T's performance indicators in terms of income, as well as the value proposition that equities represent for investors at levels lower than today. For us, the current treatment of the market by AT & T is irrational. T's relative strength index has fallen into oversold territory, and this equity treatment could create an attractive long-term opportunity for income-oriented investors.

We feel compelled to write this bullish report on AT & T because it is a company that so many people love to hate, and honestly, we do not see why. To a certain extent, we believe that AT & T has been politicized, unconsciously or not, because of the current administration's attacks on CNN and the new owner of this network by Time Warner. Nowadays, it seems that everything is too politicized in this country. We think it's a pity. But whether you watch CNN or not and appreciate the content provided, the network continues to be profitable, which matters most for AT & T. Instead of focusing on sentiment-based elements, such as opinions We believe that investors are much better served by focusing on T's cash flow, its underlying fundamentals and the valuation of its shares.

Convincing evaluations

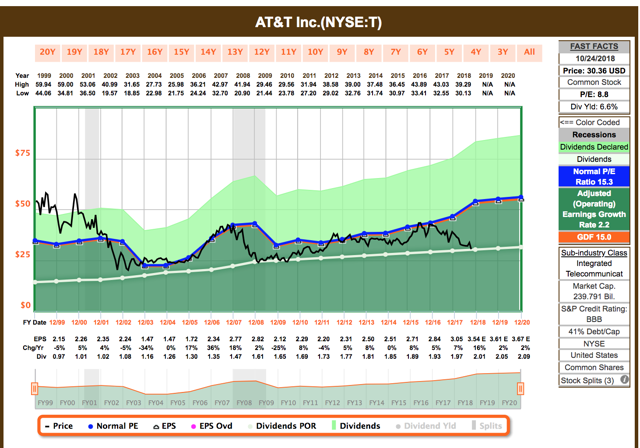

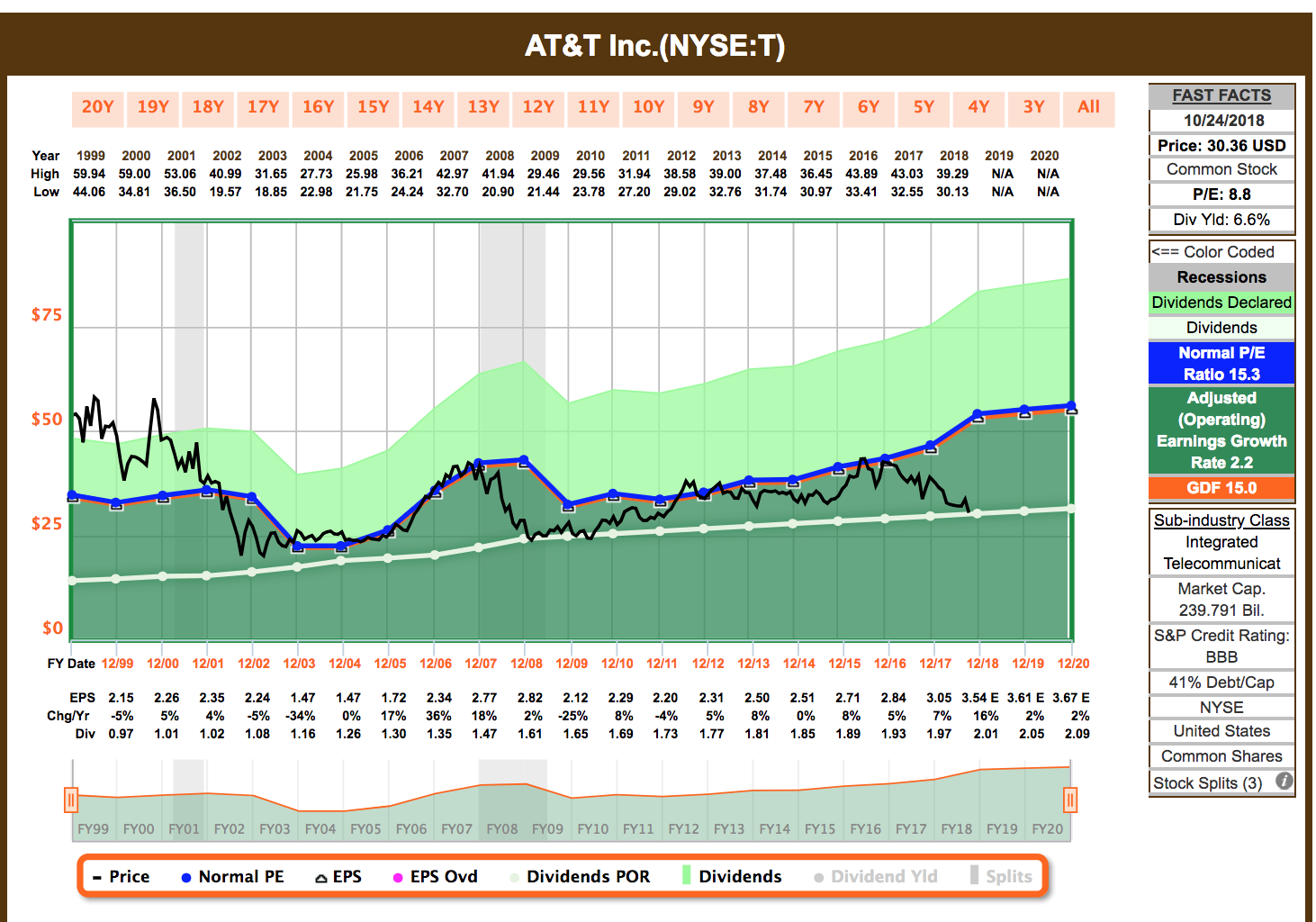

With this in mind, we want to highlight the fact that, due to its current weakness, AT & T is now trading at unprecedented valuations since the depths of the Great Recession. As you can see on the F.A.S.T. Chart below, AT & T is currently trading for less than 8.8 times earnings over the next 12 months ("TTM"), which is below the level reached by the stock in spring 2009!

Source: F.A.S.T. graphics

We can not rationalize that. Admittedly, AT & T has a huge debt that we will address, but with respect to business prospects, we do not know why the market attributes the same premium to stocks as today, while some thought that the modern financial system could potentially collapse.

On a prospective basis, T is even cheaper. This is another reason why we think actions are irrationally small. Analysts are not expecting significant growth in EPS in 2019 and 2020, but they expect growth. The price of this stock is evaluated as if it were entering a major recession, and that's not what the 30 Wall Street analysts who cover the company paint. At this time, the average EPS estimate for 2019 is $ 3.61. The consensus estimate of BPA for 2020 is USD 3.67. This means that stocks are trading for only 8.3x 2019 estimates and 8.17x 2020 estimates!

Recent earnings report

AT & T has just released its Q3 results. In the results report and the accompanying teleconference, AT & T 's management reiterated its EPS target of $ 3.50 for the full year. It was slightly below market expectations of $ 3.53; however, this still represents a strong double-digit growth from the 2017 $ 3.05 figure. At this point, we believe it is fair to note that not only did AT & T's EPS increase to double digits in the third quarter, but also sales, cash flow from operations and free cash flow . This forecast of $ 3.50 per year is well in excess of the company's $ 2.00 annual dividend, representing a payout ratio of 57% (or a dividend cover of 174%).

Management also reiterated its free cash flow forecast for the full year of approximately $ 21 billion. This is well above the $ 17.6 billion FCF generated by T in 2017. This figure is also well above T.'s dividend responsibilities. In the third quarter recently released, the dividend payout ratio in free cash flow was 56.1%. It should be noted that this ratio is less than 54.2% a year ago. This is because the growth in T's dividend expenditures exceeded free cash flow growth in the quarter. This strong increase in both figures is due to the acquisition of Time Warner.

Continuous growth Go from the front

In the future, we think that it is likely that this trend will reverse. We suspect that AT & T will increase its quarterly dividend by $ 0.01 / share when it will announce the December dividend, which would only increase the dividend payout to a figure below 10. %. clip car AT & T further integrates Time Warner's assets into its distribution model.

A dividend aristocrat

Speaking of the $ 0.01 T dividend increase, it is now time to mention that we are talking about a dividend aristocrat here. AT & T has increased its dividend for 34 consecutive years! The good thing about adding reliable dividend growth to a high dividend yield is that investors not only receive the passive income they are looking for, but that the purchasing power of this income stream is protected from the 'inflation. That's why we prefer to own stocks to bonds when we are looking for passive income. While bonds offer more security, they do not protect against erosion caused by inflation over time.

This long history of increases is another reason why we believe the AT & T dividend is safe. Shareholders, both institutional and retail, rely on AT & T to generate revenue. They had for decades. Society knows it. And, therefore, he is well aware that any dividend reduction would lose the trust that it has built with the income-driven market and is causing considerable harm to equities.

No CEO wants to be responsible as a series of decades of dividend growth is within reach. Of course, all this is speculative and not based on hard numbers, but we are pretty sure AT & T CEO Randall Stephenson would do whatever it takes, even if it meant selling assets to preserve the sanctity of T's illegal dividends In the third quarter teleconference slide show, AT & T's management notes that considerations relating to the sale of non-core assets and the capital market are potential options, if the free cash flow did not cover the needs of the debt, without however mentioning a reduction in the dividend).

Debt look

Fortunately, the CEO should not have to take these drastic measures to reduce the dividend. The main threat that many see when it comes to T's return is the huge debt of the company. By the end of the third quarter, T had reported total debt of $ 183.4 billion and net debt of $ 174.7 billion. This is a disturbing figure, without a doubt. However, about 90% of the company's debt is fixed rate, which means the company is protected from rising rates. In addition, as indicated by management at the recent teleconference, the rate hike is actually somewhat optimistic for the company (as it increases at a slow and steady rate) as it reduces the company's pensions, which is a kind of hedge. against the difficulties that the rate hike may have on the non-fixed portion of T's debt portfolio.

At present, the pro forma adjusted net debt / EBITDA ratio is 2.85. The company plans to pay off its short-term debt to bring it down to 2.5x by the end of 2019. Management has expressed confidence that it will be ready to do so in its recent quarterly report. They also indicated that they plan to restore normal historical leverage ratios by 2022.

In reviewing the maturities of AT & T's debt, we find that the company will have to repay $ 73 billion of debt over the next five years. This sounds huge, but it is important to realize that this company will produce $ 21 billion in free cash flow in 2018 and by 2023 this figure could reach nearly $ 30 billion a year.

Thus, as long as T's free cash flow growth is greater than the company's dividend growth, it seems highly likely that T will be able to continue to provide investors with a reliable growth dividend and reduce debt in the future. deadlines. The company is currently receiving a BBB credit rating from Standard & Poor's. Although not quite exceptional, this is the investment category, which will help them benefit from competitive rates if they have to postpone future maturities.

An unjustified selloff

If the debt does not seem to pose a serious threat, what other reason could have caused the stock to sell close to 22% so far this year?

In large part, this seems to be due to the company's exposure to the media sector. AT & T has chosen to embark on the path of integrating media / entertainment assets into its existing distribution system. Some (like us) see this as a bullish divergence on the part of management. The content that T can provide with its distribution network differentiates it from its competitors.

We live in a digital age now. The 5G revolution seems to be imminent, which will completely disrupt the traditional media landscape. The high quality streaming content will be easily accessible once the 5G infrastructure is put in place. This, along with the rise of the "Internet of Things", should create a huge demand for data from suppliers. We think this request will trivialize the data over time. As the world becomes more and more dependent on broadband, I can predict a time when these providers will be regulated as utilities are regulated with electricity. In this situation, a diversified income model and access to alternative growth markets will result in valuation premiums. AT & T should have this with its multimedia / entertainment content as well as the advertising platform it develops alongside Time Warner's assets.

Perspective

In the short term, we believe that T's exposure to the media could continue to be subject to a headwind. The markets hate the uncertainty and the phenomenon of the cut of the cord creates a little that in the media landscape. However, once this process is complete, we believe leaders left on the ground will be the ones with the strongest content portfolios. Historically, there has been a consolidation in the entertainment industry and I do not think that will change. Scale is important when selling advertisements and, ultimately, the brands that attract the most visitors are winners.

T is about to become one of those successful giants with Time Warner assets, including CNN, TNT, TBS, Warner Bros. Studios and one of the most successful platforms in the world: Home Box Office (& # 39, HBO & # 39;). With Time Warner, AT & T now has access to a wide variety of live and scheduled TV programs, including many sports rights (including the NBA, which is arguably the most popular sports league in America in terms of growth) and major film productions. Very few media names can compete with T's portfolio at this time and we expect it to continue to grow with cash surpluses (once the debt has been brought back to a normal level in the medium term).

Media names are very attractive now. This is largely due to what we call the Wall-E thesis, which is based on the future reality depicted in the Disney animated film, where it gets its name from the fact that humans stay seated all day , grow and consume content as the robots take care of them. We do not think that this will necessarily happen in exactly the same way, but as 5G ushered in greater automation, human society will become ever more efficient. This should allow users more free time, which should translate into increased demand for entertaining content that will fill much of this gap. We want to belong to companies that will benefit from this trend. The vast majority of them are low-yielding, like Walt Disney (DIS) or Comcast (CMCSA), but for those looking for high dividend opportunities, AT & T is one of the best options on the market.

Bottom line

In conclusion, we therefore believe that AT & T offers investors a fascinating opportunity in the high-yield bond segment. The company sells 6.5%, offers a safe dividend with a 174% hedge, a long history of dividend growth, showing that the company has a culture of generosity towards its shareholders and an extremely cheap valuation. It is rare that a single investment checks all these boxes. For the time being, debt is the main disadvantage of AT & T, but, as noted above, management appears to have a plan to reduce it and the company's large cash flow supports this plan. Any investment in shares involves risks. No dividend in the market is intrinsically safe; they all risk being cut. However, companies like AT & T do not become aristocrats of the dividend by accident and when we were looking for a reliable high yield, we were willing to bet some of our savings on this wonderful company. The recent setback creates a single point of entry for conservative dividend investors; High quality 6.5% yield by selling at a lower cost.

A note on diversification: To achieve an overall return of 9% to 10% and an optimal level of diversification, we recommend a maximum allocation of 2% to 3% of the portfolio in high yielding equities such as AT & T, and a maximum allocation of 5%. in high-yielding stocks. exchange-traded products (such as ETFs, ETNs and FECs). For income-dependent investors, diversification typically generates more stable dividends, mitigates the risk of loss and reduces the overall volatility of your portfolio.

If you enjoyed this article and would like to receive updates on our latest searches, click "Follow" next to my name at the top of this article.

We are the largest community of income and retiree investors with more than 1,600 members. We provide a full service, ranked # 1, dedicated to high yield securities – with an overall target return of 9 to 10%. The subscription includes:

- A managed portfolio of securities currently reporting 10.0%.

- A "dividend tracking" that lets you know exactly when you expect to receive your next dividend.

- A "Portfolio Tracker" to track your dividend holdings, your income and your breakdown by sector. For the video, click here.

If you are looking for the highest profitable dividend ideas, you are in the right place. For a free 2 week trial, please click here.

Disclosure: I am / we are long T.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link