[ad_1]

Aurora Cannabis (OTCQX: ACBFF) released Monday evening results for the fourth quarter of fiscal 2018 (ended June 30, 2018). We believe that the financial results were correct and less relevant as MedReleaf was not included, but we were impressed by the level of detail provided by management regarding operations, integration, development. Quarter marks a milestone in terms of disclosure and shareholder communication for cannabis companies and that Aurora is leading the pack in this case. While other companies have been secretive or have reduced their disclosure, we believe that Aurora has just made it clear that they are ready to behave like adults in the business world.

Preface

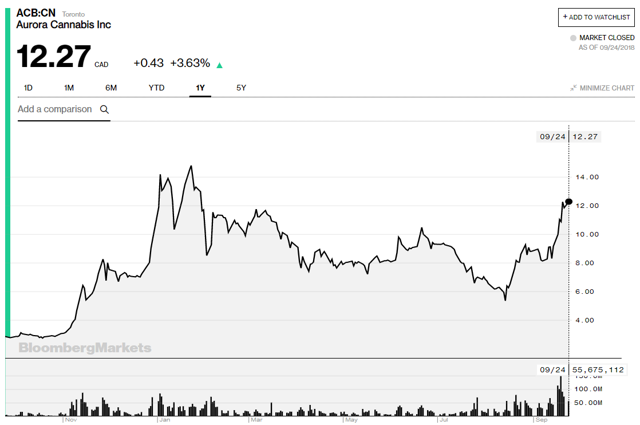

Our attitude towards Aurora has slowly changed in recent weeks. Initially, we became cautious about the acquisition after the acquisition of MedReleaf because we thought the company had paid too much for an asset it needed to acquire to become a national player. Integration was a major concern for us, given Aurora's suite of acquisitions, including CanniMed and, more recently, MedReleaf. However, after a rebound caused by the recovery of the sector, the title has rebounded by nearly 50% in two weeks thanks to the rumor of Coca-Cola (KO) and the announcement of the US listing. We believe that Aurora offers a better risk / return ratio than Canopy and that it is certainly a better investment than Tilray because of the valuation of it. Aphria (OTCQB: APHQF) has been our top 3 for a while and we think with Aurora that they are currently the big-name big names for cannabis investors.

Exam F2018 Q4

Aurora had a good quarter, despite some areas of concern that had a good quarter. It is also important to note that this quarter and the 2018 fiscal year ended June 30, 2018, which means that the acquisition of MedReleaf (OTCPK: MEDFF) is not included because it was completed in July. The acquisition of CanniMed (OTC: CMMDF) was completed on May 1, 2018, which means that this quarter only includes 2/3 of CanniMed.

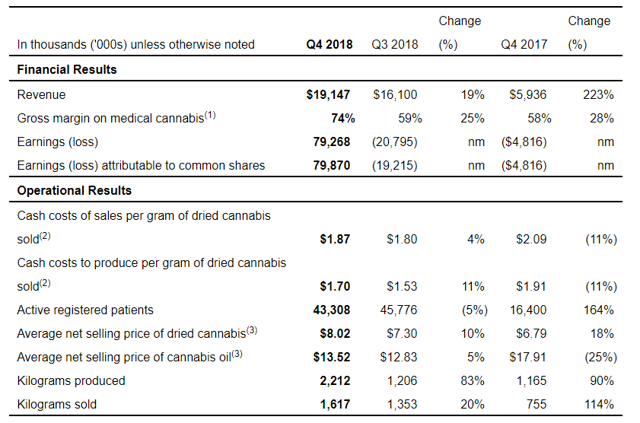

Regarding the financial results of 2018 Q4, the turnover increased by 223% compared to last year and 19% in the last quarter. Aurora also mentioned that the quarter's revenue would have been close to $ 33 million pro forma for the acquisition of MedReleaf. The cash cost actually increased during the quarter, which can be attributed to the opening of new facilities and the ramp-up of new facilities. Average net selling prices increased due to higher prices for dried cannabis and oils. The company was able to harvest 83% more cannabis than last quarter and sold 20% more, which allowed for a good inventory buildup in anticipation of legalization in October. The only area of concern is the number of patients which decreased by 5% compared to the last quarter. Despite a strong year-over-year comparison, it should be noted that the number of patients is rarely decreasing for cannabis businesses, particularly because income has increased rapidly.

(Press release)

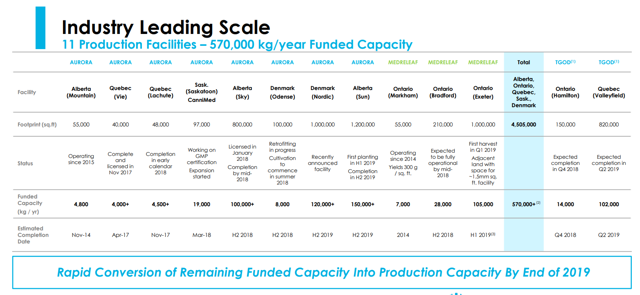

With respect to some of Aurora's accomplishments during the quarter, we believe the company is poised to complete its vertically integrated cannabis empire. First and foremost, the company is increasing its capabilities at a faster pace than anyone else. The company has 11 facilities currently in service or under construction, which would provide a combined annual capacity of 570,000 kg once all have been completed. As of September 2019, the company had a capacity of 45,000 kg / year and is expecting to 150,000 kg / year by the end of the 2018 calendar year. We do not doubt that we have a capacity of 45,000 kg / year. In 2019, Aurora will become one of the two largest cannabis producers in the world. .

(Presentation to investors)

Aurora has also provided an update on its investment portfolios, which we all know are important and diversified. We will discuss some of the keys. Alcanna (OTCPK: LQSIF) plans to open the maximum allowed of 37 cannabis stores in Alberta and to enter other provinces once licensed, such as Ontario. The company increased its stake to 52% in Hempco (OTC: HMPPF), the Canadian hemp company specializing in hemp production and processing. The investment in Hempco completes the hemp acquisitions of the EU announced last week. Aurora also owns 17% of Green Organic Dutchman (OTCQX: TGODF) and is expected to increase its stake to more than 50% when TGOD reaches certain thresholds

(Presentation to investors)

From a balance sheet perspective, Aurora has finalized the C $ 200 million Canadian bank loan, which is a milestone for the cannabis industry. The loan will be secured by Aurora's production facilities and will allow cannabis companies to access the bank debt markets. As of June 30, Aurora also had $ 89 million in cash, which might seem small, but the company holds more than $ 700 million in government securities from its various investments. In any case, Aurora has the opportunity to liquidate its public investments to free cash. Aurora also has a $ 50 million Canadian accordion with its BMO loan, which can be used for mergers and acquisitions if necessary.

What is important, the company has provided an update of its integration that has long been one of our main concerns for Aurora. The company said the CanniMed integration is now complete and that it is starting to integrate MedReleaf. We are relieved to learn that the company has hired experts and takes a systematic approach to integration. We like what we read, but again, we need to see specific numbers before we are fully convinced. The next quarter would be messy, given that MedReleaf will only be partially included in the first quarter F2019, but we will be able to get a snapshot of the assets for which Aurora has paid dearly.

The company also confirmed that it was applying for direct registration in the United States but did not provide a specific timeline. We think this is probably good news for the stock given what happened to the three US listed stocks, including Tilray (TLRY), Canopy (CGC) and Cronos (CRON). It is an advantage to be listed on the US Stock Exchange and Aurora has acquired the right to become the fourth to do so. We believe the stock will directly benefit from a direct listing as US investors have greater access to the stock.

summary

If you read Aurora's press release, you really feel the desire and willingness on the part of management to share what is happening in the company. The information provided was useful and answered all the key questions we had in mind, including financing, US listing, integration and retail strategy. It's really hard to discuss what Aurora could reveal more. We are starting to love Aurora more because it is becoming more investor-friendly and continues to see our vision of integration. We expect the coming quarters to be crucial, as the results will begin to show that CanniMed and MedReleaf have been included, reflecting the quality of the integration. For years to come, any beverage partnership or listing on the US side will boost this stock.

Note from the author: Follow us to receive our latest publications on the sector. We also publish the widely read Weekly Cannabis Report, which is the best way to stay informed about the cannabis industry.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that are not traded on a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link