[ad_1]

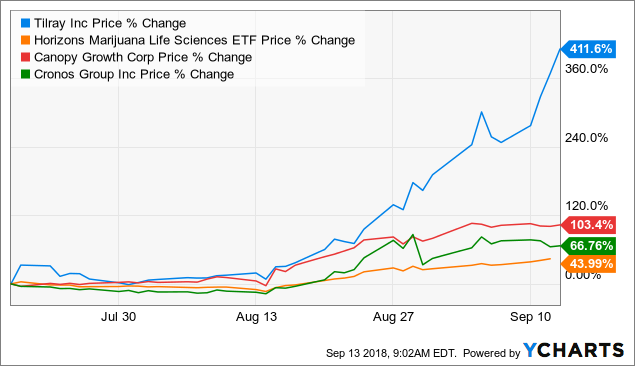

TLRY given by YCharts

summary

Tilray (TLRY) is a good Canadian cannabis company at a crazy price.

As a company, Tilray is a good cannabis company. It holds the third largest number of supply agreements in seven Canadian provinces and territories, behind only Canopy Growth (CGC) and Aphria (OTCQB: APHQF). By 2019, Tilray will have a 912,000 sq. Ft. Cannabis growing area, a growth of 51,000 kg / year. To date, Tilray's supply agreements include ~ 8,600 kg / year of supply and can reach ~ 26,000 kg / yr, including those whose volume has not been disclosed.

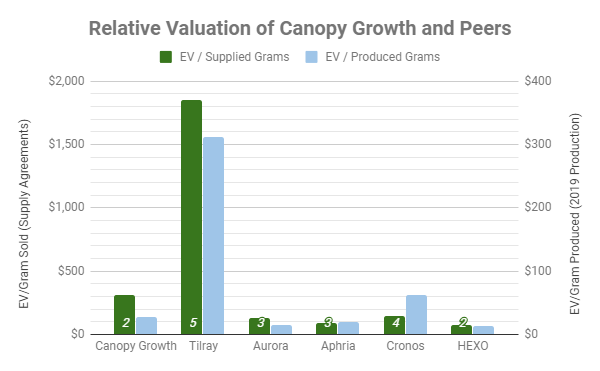

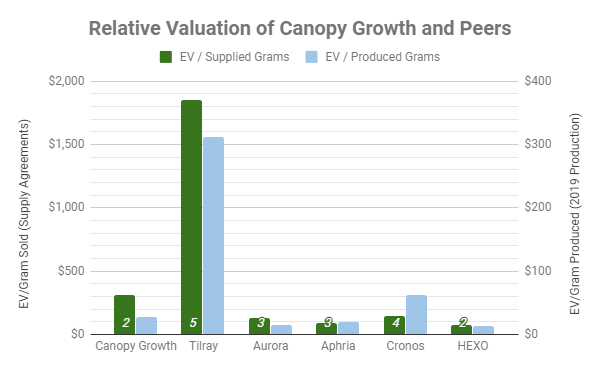

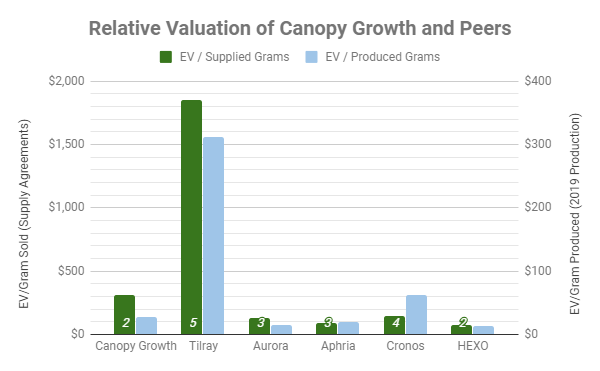

There is nothing wrong with this case, but the price of the action is irrationally high. Consider this relative evaluation with peers:

(Author, number in italic is a supply contract the volume of which has not been disclosed, in Canadian dollars)

Tilray costs about 11 times and 6 times more than Canopy Growth on these two parameters respectively. And Canopy Growth itself is already trading at a price higher than its major Canadian listed competitors – perhaps justified by its excellent execution. But Tilray, in my opinion, does not guarantee a higher premium than Canopy Growth, let alone a 6-11x premium.

Tilray's price is held back by a small float – Privateer Holdings holds about 81% of the shares, and these shares are frozen until January 2019. Thus, supply and demand dominate, and they have degenerated.

I do not recommend being long Tilray at these prices. If you own shares, sell them. If you wish to own shares of Tilray, wait until the end of the lock-up period in January.

These high prices are not sustainable and, if they are, invest elsewhere in cannabis as all other prices of cannabis stocks are expected to increase dramatically if it is a sustainable market level. I recommend investing in other companies rather than in Tilray if you are looking to invest in Canadian Cannabis. I've recently written about two of my favorite cannabis companies in my Marketplace community, The Growth Operation, and I've publicly talked about Canopy Growth in "Growth of the canopy: the king of cannabis does not come cheap" These cannabis companies – or frankly all other cannabis company – would be better investments than Tilray.

I also do not recommend shorting the shares because of the extremely high costs. Borrowing rates on Interactive Brokers, to date, represent around 350% interest. Prices that expire after the January lock-in period have a balance price of ~ $ 60, a decline of nearly 50% from current prices. Both trades are overcrowded and not investments that I would make.

To avoid.

Float and why avoid Tilray

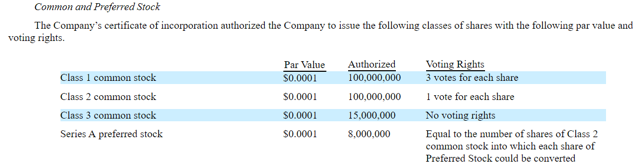

Tilray has a two-class structure – unusual among Canadian cannabis companies. This is a disadvantage for investors – Class 1 has three votes / share (or ten? See below) and Class 2 has one vote / share. This will allow Privateer Holdings to maintain control of Tilray, even after the sale of many of its Class 2 shares once the lock-up period is over.

(Q2 / 18 10-Q)

More importantly, Tilray has a very low float. The IPO has put 10,350,000 shares on the market:

"On July 23, 2018, we completed our initial public offering of our Class 2 Common Shares pursuant to which we issued and sold 10,350,000 Class 2 common shares at a price of $ 17.00 per common share. ($ 22.45 per share).), including the shares sold as part of the exercise by the underwriters of their option to acquire additional shares of our Class 2 common shares. " – Q2 / 18 10-Q

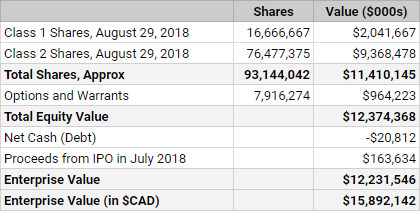

In total, there are 16,666,667 Class 1 common shares and 76,477,375 Class 2 common shares (as at August 29, 2018), for a total of 93 million shares. Among these shares, Privateer Holdings holds the majority (75 million or 81%) and maintains control of votes:

"Privateer Holdings is the beneficial owner or controller 16,666,667 shares [100%] of our class 1 common shares and 58,333,333 shares [76%] of our class 2 common shares, representing 93% the voting power of our social capital. Class 1 ordinary shares, which are 100% owned by Privateer Holdings, have 10 votes per share, Privateer Holdings continues to hold majority of votes of all the outstanding shares of our capital stock and check all the questions which may be subject to the approval of our shareholders provided that they hold at least approximately 10.01% of all outstanding shares of our capital stock. " – Q2 / 18 10-Q

Those who are attentive will notice that this part of the 10-Q lists ten votes / share while the above part lists three votes per share. I am not looking for the reason for this ambiguity, but commentators are invited to inform us. me too asked @Tilray on Twitter. I have not received an answer yet.

Since Privateer controls 100% of the Class 1 Shares and 76% of the Class 2 Shares, the ambiguity is not significant at the moment – Privateer controls the vote with one or the other. 39, other voting structures.

Of the 93 million shares outstanding, 75 million shares (81% of the outstanding shares) of Privateer are subject to a 180-day lock-up, expiring in January 2019:

"Privateer Holdings has sold a substantial number of shares of our common shares in the public market or the distribution of shares to shareholders could occur at any time after the expiration of the contractual lock-in period, which is the 180 days from the date of this offer. " – S-1 / A

Due to the weakness of the floating on Tilray and this blocking clause, I would invite all investors: Do not invest in Tilray until the lockout has expired. Prices are crazy right now because of the supply / demand and the low float.

Even if you like Tilray as a business, I recommend you invest once the lockout has expired.

Business Overview

(High Park, Tilray Recreational Cannabis Arm)

Tilray is a Canadian cannabis producer based in Nanaimo, British Columbia, on Vancouver Island. It should be noted that Tilray was the first Canadian cannabis company to have made an IPO in a US exchange. While Cronos (CRON) and Canopy Growth are also American titles, Cronos [CRON.TO] and canopy growth [WEED.TO] both are also traded on the Toronto Stock Exchange.

(High Park Brands)

Tilray's recreational cannabis arm under High Park includes the above brands, including Dutchy and Marley Natural.

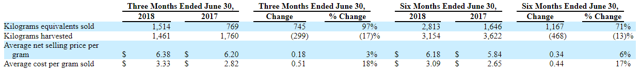

(Q2 / 18 10-Q)

Today, Tilray sells medical marijuana in the form of dried cannabis and cannabis extracts, including drops of oil and purified capsules. Sales made good progress, with 97% volume growth and a slight increase in selling prices.

However, Tilray's assessment is not based on its medical sales, but on future leisure sales. Until recreational cannabis is legalized, it is more useful to review Tilray's production and supply agreements rather than its results so far.

Production

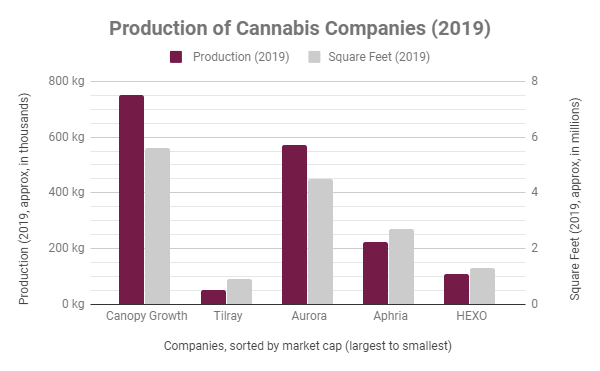

(Author based on company records, some figures are approximate such as CGC production and APHQF square footage)

Tilray is aggressively expanding its capacity from 60,000 square feet to 912,000 square feet. By the end of last year, Tilray planned to harvest 51,000 kg / year of cannabis by the end of 2018. It should be noted that this figure might not be accurate because it is safe to use. was acting from August 2017.

Today, the company seems reluctant to give production figures – its S-1 / A does not describe capacity per kilogram. This is not particularly alarming – Canopy Growth also prefers to report square meters of production area rather than the expected yield in kilograms. As a result, Tilray's kilray production may be greater than that shown, although it is still likely to be less than 100,000 kg, given its target of 912,000 square feet.

As stated above, it is a very small production capacity given the market capitalization of Tilray. Tilray has less production than small businesses (in value) like HEXO (OTCPK: HYYDF) [HEXO.TO] and Aurora (OTCQX: ACBFF) [ACB.TO].

Supply agreements

Although I think Tilray is overvalued, he has been successful in securing supply agreements. Tilray has seven provincial supply agreements, the third in the country behind Aphria and Canopy Growth.

Tilray has supply agreements with:

In summary, these offers cover 81% Canadians. The announced total of ~ 8571 kg / year covers 27% of Canadians – which may involve a total of about 3 times that total, or about 26,000 kg / year. However, this estimate is very rough and I will not put much weight on it.

Tilray also has a supply agreement with Supreme Cannabis. [FIRE.V] (OTCQX: SPRWF) to to receive more than 2 million Canadian dollars of Supreme's cannabis. Supreme's past transactions have been valued at C $ 6 per gram, making it likely that this deal will be 333 kg, a relatively modest transaction.

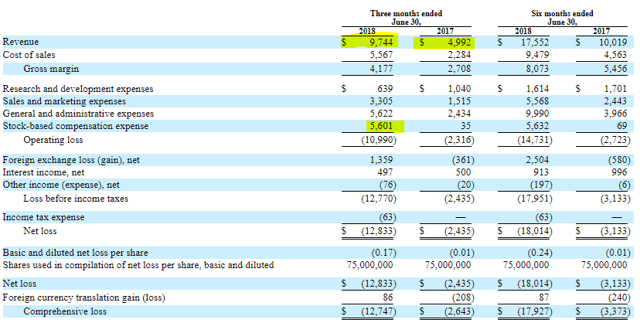

Income statement

Until recreational cannabis is legalized in Canada, I do not believe that tax returns are a very significant part of the results of a cannabis business. The price of these companies is a function of their future ability to sell recreational cannabis products, not their current ability to sell medical cannabis products.

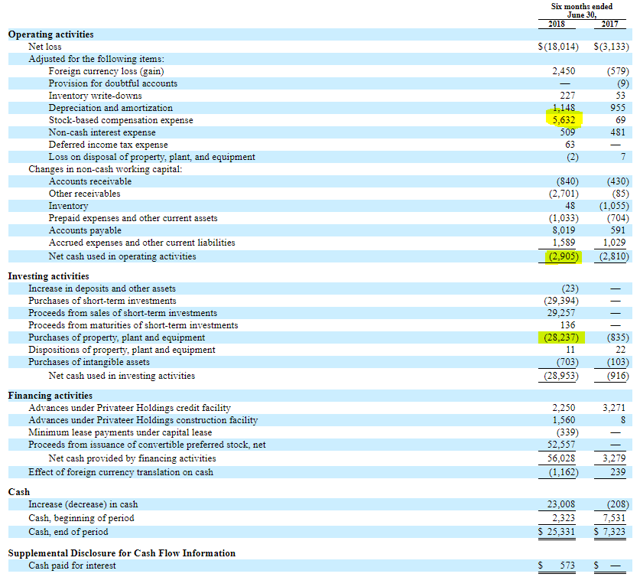

(Q2 / 18 10-Q)

That said, Tilray's income statement shows attractive revenue growth – up 95% year-over-year. Although this figure is nothing compared to its market capitalization, it shows some management ability to successfully develop sales in the medical field. Time will tell how this management capacity translates into the leisure market.

The other note of the income statement is the very large amount of stock-based compensation. More than half of Tilray's operating expenses were in stock-based compensation. This is not surprising or even necessarily worrying; Tilray is not profitable, and it makes sense to minimize cash expenditures. In addition, it was one quarter immediately preceding an IPO, and stock – based compensation generally increases at the time of the IPO.

However, we will have to compensate for the dilution caused by this SBC when estimating a market capitalization and a business value for Tilray.

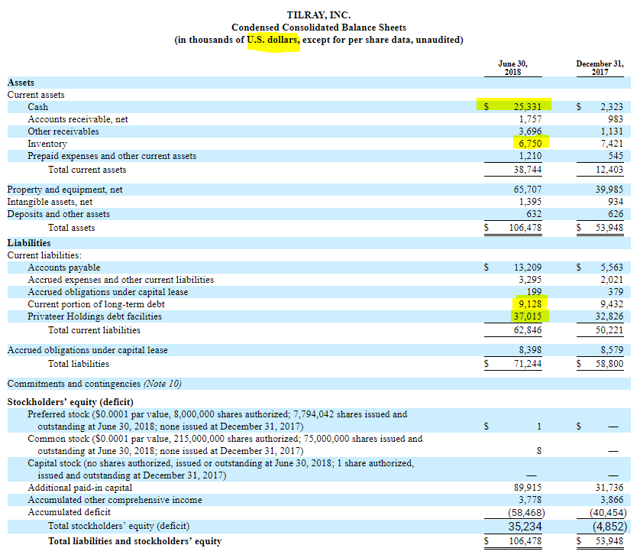

Balance sheet and cash flow

(Q2 / 18 10-Q)

Tilray's balance sheet shows a surprising debt for a cannabis business. Most cannabis companies have no debt or only convertible debt. It's wise because these companies are not profitable; It makes sense to finance a business using shares rather than debts when you are not profitable and you do not have the income to pay the interest.

Tilray (as at June 30) had $ 25 million in cash and $ 46 million in debt, for a net cash position of – $ 21 million as of June 30.

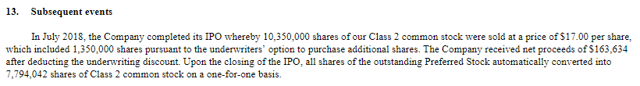

(Q2 / 18 10-Q)

With $ 164 million of proceeds from its IPO, Tilray has net cash of $ 143 million. It should be noted here that 10 350 000 shares only participated in the IPO, a small number of shares compared to the total number of outstanding shares of Tilray.

(Q2 / 18 10-Q)

In the first half of 2001, Tilray lost $ 3 million in operating cash flow and spent an additional $ 28 million on capital expenditures. This translates into an operating cash flow of – $ 31 million for the first half of the year. Given that the company has net cash of $ 143 million, the pre-legalization of free cash flow is not a problem. It has enough money to complete its expansion plans and maintain the negative operating cash flow until the legalization of cannabis for recreational purposes on October 17, 2018.

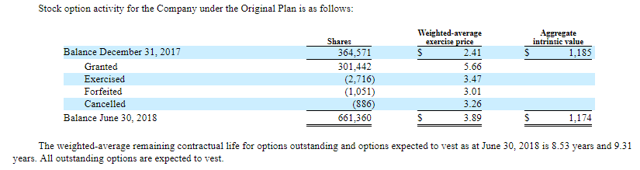

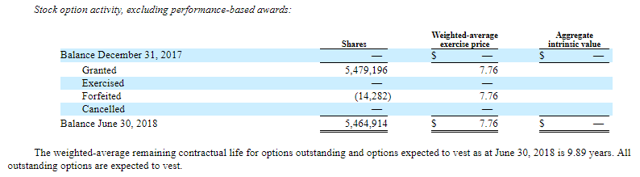

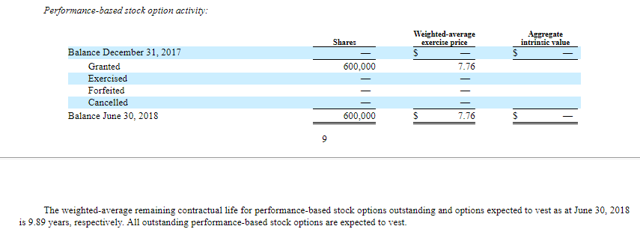

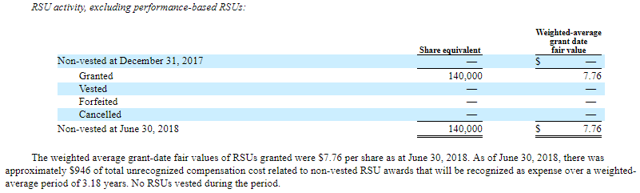

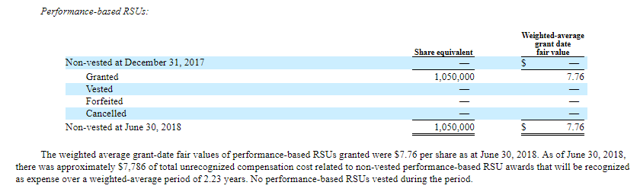

As in the income statement, I also pointed out that the company paid $ 5.6 million in stock-based compensation in the first half of the year 18. This expense will result in dilution, so it is important that we were evaluating outstanding options and warrants as we review Tilray's market capitalization and business value. These dilutive options will dilute the shareholders and limit the increase in shares.

Sharing structure and dilution

According to Tilray & # 39; s 10-Q, as at August 29, 2018, it held 6,666,667 Class 1 common shares and 76,477,375 Class 2 common shares.

Tilray's two-class structure is rare among Canadian cannabis companies. Class 1 shares have 3 or 10 votes / share while Class 2 shares only have one vote per share. This structure benefits Privateer and hurts shareholders, even if, given Privateer's 81% ownership, it would have control even without this structure.

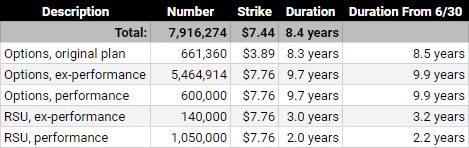

Tilray also has outstanding options and warrants that dilute common shareholders. These included:

(Q2 / 18 10-Q)

In summary, this translates into 7.9 million options and UANR outstanding, with an exercise price of $ 7.44:

(Author based on the above)

Based on a Black-Scholes model, at a price of $ 1,250, an implied volatility of 148% (IBKR, based on the March 2019 option prices) and a risk-free rate of 2.98%, these options are worth around $ 960. millions of dollars. .

(Author based on the above)

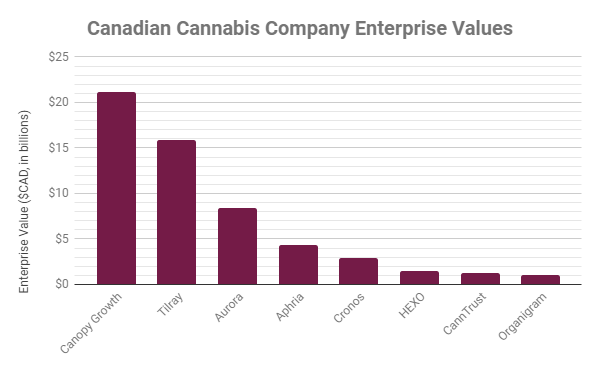

The approximate market capitalization of Tilray – including the value of options – is approximately $ 12 billion and its corporate value is also in the range of $ 12 billion. In Canadian dollars, which is useful since all comparisons will be made in Canadian dollars, and all comparable companies all have Canadian dollar value, the value of Tilray 's business is approximately $ 16 billion. dollars.

This makes Tilray the second largest cannabis company in Canada, after only Canopy Growth:

(Author based on the same calculations for all companies as above)

Comparison with peers

As in my article on canopy growth, I like to compare cannabis companies based on the value of their business relative to their production capabilities (in kilograms / year starting in 2019) and their agreements total supply.

This comparison is not perfect: if all companies are overvalued or undervalued, you will not see it in a relative valuation measure like this. However, I think we can do our best until we see significant cash flow allowing a more detailed analysis, such as a discounted cash flow, or that the price / earnings ratios of EBITDA become more significant.

(Author, number in italic is a supply contract the volume of which has not been disclosed, in Canadian dollars)

To say that Tilray is expensive is a euphemism.

On an EV / produced basis, Canopy Growth costs $ 28 / gram. It's rather expensive – more than its Canadian counterparts. Tilray costs $ 311 / gram. Tilray costs more than 11 times more than Canopy Growth, which is already trading at a higher price than companies like HEXO.

On an EV / gram basis provided, Canopy Growth is costly again: it is more expensive than its major competitors listed in Canada and superior to Cronos on this point. The growth of the canopy costs about $ 312 / gram provided. Tilray costs approximately $ 1,850 / gram provided. Tilray is almost six times more expensive than Canopy Growth, which is already trading at a price higher than all its major competitors.

The price of Tilray is irrationally high.

Too expensive at short

I do not recommend shorting Tilray. Shorting such a volatile stock plays with fire. Even the options are not attractive to play:

(TD Ameritrade)

It would cost between $ 55 and $ 59 to buy coins for March – after the lockout period. To balance these options, prices would have to drop to $ 60 – and that's just to make the expense. This is the hope of a very sharp decline, simply to reach the breakeven point. In addition, these options require a risk of $ 5700 for 183 days. Prices can be irrational, but there is a lot of money to risk and you have to make a huge correction to achieve balance. Others may be willing to take that risk, but I am not.

In addition, the actions are too expensive to borrow:

(Interactive Brokers)

Shorting the shares at a 346% interest rate is too expensive for me – and that's even if you can even find stock to borrow. It is a crowded and very expensive business. In addition, equities may continue to rise irrationally – they have risen 14% today as I type this – despite their vast overvaluation.

The best way to play is to not play at all.

Risks and Options

Frankly, you should not have a position in Tilray in a long or short direction. If you do not have a job in Tilray, there is no risk.

Taking a position in one or the other direction exposes you to a lot of risks. Owning shares is, in my opinion, crazy. Prices are irrationally high, well above all peers. If you really believe that cannabis companies are worth the same (and that they are not), buy shares in all other cannabis companies.

If you really want to own Tilray, wait until the end of the blocking period. I think it will be much cheaper then and it can not be much more expensive.

In general, owning Canadian cannabis stocks is risky – they are all very volatile. I strongly recommend using portfolio management and limiting your positions in cannabis companies to a small part of your portfolio. This is doubly true for Tilray. Please invest very carefully.

Take away food

Tilray is a cannabis company with seven supply contracts, nearly 1,000,000 square feet of production and solid revenue growth in the medical cannabis field. The brand is attractive and its medical marijuana products appear to be reasonably successful in Canada and with some exports to Germany and the United Kingdom. As a business, it's good, and at the right price, I could consider investing there even with a two-part structure.

However, the price of Tilray shares is irrationally high.

Do not invest in Tilray at these prices. It is held by a small floater, Privateer Holdings holding approximately 81% of the outstanding shares subject to a lock-up period. In addition, Tilray's share structure ensures that even when Privateer Holdings sells, it will maintain control of Tilray.

Investors will be burned by Tilray.

It will not be me.

Do not let him be you.

Members of The Growth Operation, my exclusive community, have priority access to the cannabis companies I believe in and invest in. The Growth Operation articles focus on the same indicators as in this article, but not on peers. Recently, I published profiles of three different cannabis companies with better growth prospects than Tilray. Register today for a free trial.

Disclosure: I am / we are long CGC, HEXO, CNTTF, ACBFF.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Editor's Note: This article covers one or more shares traded at less than $ 1 per share and / or with a market capitalization of less than $ 100 million. Please be aware of the risks associated with these stocks.

[ad_2]

Source link