[ad_1]

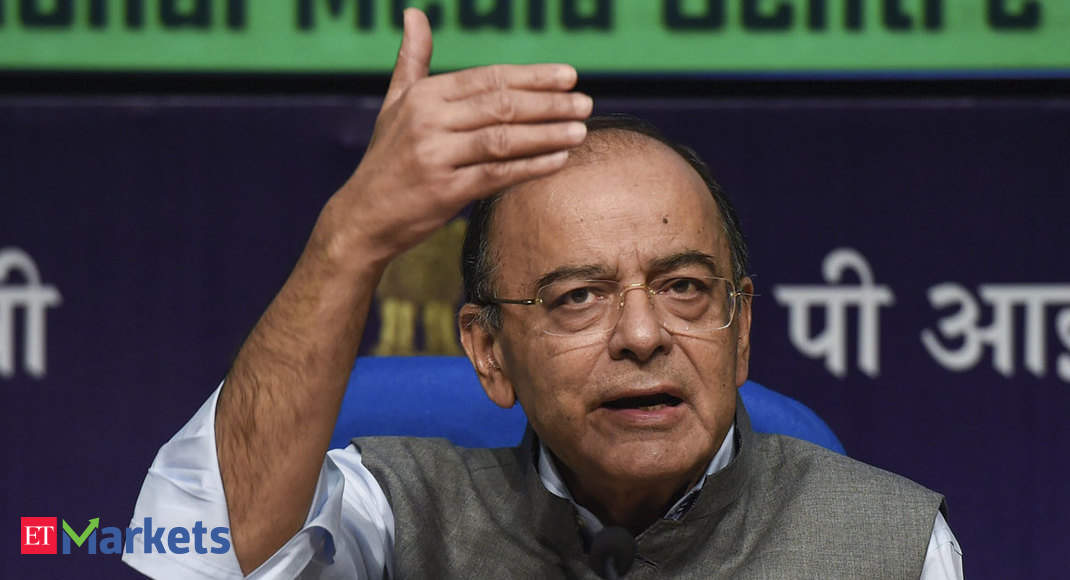

At a press conference, Finance Minister Arun Jaitley said the merger will make lenders stronger and more sustainable while increasing their lending capacity.

According to the government, the merger will be the first three-way consolidation of banks in India, with a combined turnover of 14.82 million rupees, making it the third largest bank in India.

This transaction follows the merger of the State Bank of India, the largest lender, with five of its subsidiaries and the acquisition of Bharatiya Mahila Bank.

Experts Dalal Streets welcomed the news, saying the merger was a positive step for the banking sector.

According to A Prabhakar, head of research at IDBI Capital, the merger will be painful in the short term, but will have positive effects on Indian banks in the long run.

G Chokkalingam, founder of Equinomics Research & Advisory, also echoed similar views, saying the merger was "certainly positive for the banking sector because consolidation will bring size to the banks.

Regarding the benefits granted to some banks, Mr. Chokalingam said that since Dena Bank was the weakest, the merger process will help it the most.

"For larger and more efficient banks like the Bank of Baroda, we would have to wait for the details of the merger," he told ETMarkets.com.

Regarding shareholder benefits, Chokalingam said the merger ratio will decide whether the process will benefit or not.

"For an individual bank, it will depend on the merger ratio and valuations based on their adjusted net worth," he added.

Few experts on Dalal Street expected this announcement of a merger to arrive a little earlier.

"We have long discussed the merger of the weaker (banks) with the stronger, but after this time, I did not expect such an announcement," said ETMarkets Ambareesh Baliga, independent analyst. com

At closing on Monday, the combined market capitalization of the three banks amounted to more than Rs 42,000. Dena Bank shares fell by 0.62% to Rs 15.95, while Bank of Baroda and Vijaya Bank rose by 0.41% and 0.93% respectively.

Overall, Indian state banks reported mixed figures in the first quarter of the current fiscal year.

Bank of Baroda saw its profit more than double at Rs 528.26 crore in June. Net EPS also fell to 5.40% in June from 5.49% in March.

Vijaya Bank reported a 57.5% increase in net income to Rs 254.69 billion in the June quarter, driven by strong growth in retail revenues, helped by a marginal decline in the proportion of bad debts .

However, Dena Bank saw its losses widen to 721.71 billion rupees in June, against 132.65 billion the previous quarter. The loss resulting from the reduction of 1,225.42 billion rupees was recorded in March.

[ad_2]

Source link