[ad_1]

U.S. the bank shares could be set to a record set of defeats behind them as results from a second round of the Federal Reserve's resistance test signaling that it is time to buy . Analysts Goldman Sachs and Bank of America say that there could be a catalyst for relief as the results could "trigger a new bid in the banks."

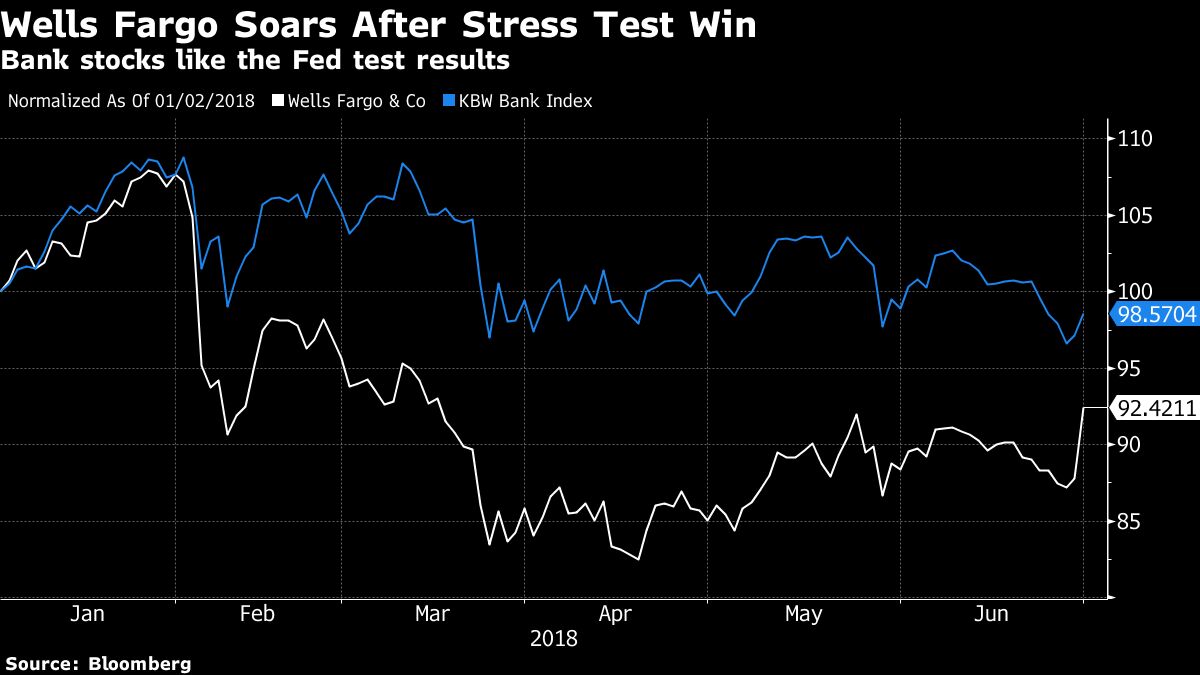

Wells Fargo, formerly in the Fed penalty, and now considering to buy back up to $ 24.5 billion in shares and increase its dividend. Wells Fargo shares rose 6% early in the session, the highest level since November 2016. Ally Financial and Santander Consumer USA received an analyst upgrade after the results; Ally is up 4.9% and Santander Consumer USA up 3.7%. The KBW Banks Index is up 1.8%, led by Wells Fargo

Here is a sample of commentary by analysts:

Bank of America, Erika Najarian

"The Results CCAR could trigger a new offer in banks "Banks can increase their dividends by 34% and buy back $ 80.3 billion of shares, up from $ 60.5 billion last year.

Najarian sees the big regional banks outperform while banks will earn 114% of profits and 10% of market capitalization. The expected results of a first series of stress tests and a risk context, which means that "bank shares have been sloppy over the past week". It does not believe that the banks that used the "mulligan" – JPMorgan, KeyCorp, M & T Bank, which had to resubmit the initial capital applications because of the DFAST results – will be penalized. She highlights Wells Fargo, JPMorgan and Huntington as "the most notable positive surprises."

Goldman, Richard Ramsden

Banks can find a catalyst for a "relief rally" as a second-round test of resistance the results have been better than expected and dividends are expected to rise. Goldman sees the biggest relative winners like Wells Fargo, Huntington, Regions, SunTrust and Fifth Third, and notes that the $ 24.5 billion Wells Fargo buyout is expected to reduce the actual stock count by 9%.

Morgan Stanley, Betsy Graseck

harder CCAR … but a flexible and pragmatic Fed means you should not be surprised to see banks re-submit for more return on capital. CCAR's review of this year was more difficult for banks, he also presented a Fed that seems to have a more practical, "Graseck notes that the Fed has allowed three banks to pursue their capital plans by non-profits. conditional objections, despite undervalued capital ratios relative to the required minimum level due either to ad hoc adjustments of the tax revision or multiple standard deviations shifts in the global market shock. Will remember that Wells Fargo, BofA and Citigroup are most likely to resubmit their plans later this year, while Northern Trust, Wells Fargo and BB & T could make the most of the surplus of capital

RBC, Gerard Cassidy

"The financial centers, Citigroup, JPMorgan and Wells Fargo were winners, led by Wells Fargo." Cassidy also points to Bank of America among the winners. "The results of Morgan Stanley and Goldman were less satisfactory, but could have been worse."

KBW, Brian Kleinhanzl

"The gross capital distribution ratios were below our expectations, but the payments went up by seven percentage points.In the end, the Fed applied more stress than expected in the DFAST, which is reflected in the final capital plans submitted by the banks. "

Janney, John Rowan

Rowan updates Ally and Santander Consumer USA neutral after the Fed did not oppose their investment plans, both of which included a significant increase in capital distributions in the form of redemptions and dividends. "Notably, the stock repurchase plan 39; Ally is 32% higher than last year and Santander Consumer now has a buy-back plan in place. "

Evercore ISI, Glenn Schorr

" We call this a pretty successful CCAR season (and better than what the DFAST results implied) then ue total payments approved by the Fed rose slightly year on year, although the payout ratio declined slightly due to higher profits (tax reform), a tougher test and a handful of companies.

"The regionals were very good (especially Wells Fargo) while the cards were down with little expectation. The Goldman and Morgan Stanley brokers "were a bit low (but got a pass)."

Credit Suisse, Susan Roth Katzke

Some large-cap banks were better off, some worse, with banks covered approved for net payments of 94% and 89% net (against an estimate of 102% gross and 92% net). "In terms of amounts, overall approved capital returns were 1% lower than forecast."

Bernstein, John McDonald

"CCAR's results for 2018 were broadly sound, with The performance has varied from one bank to another, with significant increases and decreases (Wells Fargo, SunTrust, Regions) and some were below expectations and / [ou] return less to shareholders than last year (PNC, BB & T, Morgan Stanley). "

Portales, Charles Peabody

" It is worth noting that when JPMorgan resubmitted its application, it probably chose to maintain its dividend. demand, while reducing its share repurchase request, suggesting that Jamie Dimon is beginning to see less value in stock repurchases at the current high levels of the price to the book. "

" The focus on dividends industry. "

" Wells Fargo, Huntington Bancshares and Ally Financial generated the biggest surprises, while Morgan Stanley, PNC and State Street were the biggest disappointments. "

Height Capital Markets, Ed Groshans

The results of CCAR" were very strong. view, with some notable exceptions. "JPMorgan Chase, American Express, Keycorp and M & T Bank" appear to have submitted aggressive capital return plans that had to be adjusted downward according to the Federal Reserve model. "As expected, the Fed challenged Goldman Sachs , Morgan Stanley and State Street Corporation. "

Compass Point, Isaac Boltansky

" We ended up with three conclusions related to the politics of publication: (1) this test shows the value of mulligan, with more successful than ever in this cycle; (2) this Federal Reserve has been lenient with one-off tax issues (Goldman, Morgan Stanley) and a counterpart (State Street), which we consider to be a more generous paradigm than under the leadership of the Federal Reserve, and (3) the banking system remains incredibly well capitalized, reinforcing calls for further close adjustments to resistance. "

Cowen, Jaret Seiberg

" CCAR was tough and the banks had more problems with this than in recent years. Still, the Federal Reserve was not rigid enough to punish banks for circumstances beyond their control such as when Congress passed a tax reform. "

" This reinforces our broader view that the new Federal Reserve team will seek to ease the burden on banks, but they generally support the post-crisis regulatory regime and are more interested in adjustments common sense that the wholesale repeal.

Susquehanna, Jack Micenko

"Despite Payment Increases, We Remain"

Guggenheim, Jeff Cantwell

American Express "appears to have been as aggressive as possible with this year's redemption request. "Increases target price from $ 106 to $ 106, reiterates neutral rating.

Source link