[ad_1]

With a dividend yield of 13%, an annual price / earnings ratio of 7.8x, EPS is expected to increase in the next year. My hands are itching for Barnes & Noble shares (BKS), trading again mid-session Thursday at its lowest level, after a very short bounce in the second quarter of the year.

Breaking My Enthusiasm is the company's most recent earnings report, which could not be much worse than in the past. Results were slightly below expectations in terms of revenue and net loss per share of $ 833.4 million and $ 0.09, respectively. Retail sales fell 6.5%, gross margins decreased by one percentage point, and EBITDA margin decreased by 30 basis points, despite improved performance over fast absorbable revenues .

Credit: BGR

The most optimistic investor could stick to the fact that comps started to improve gradually over each of the last four months, almost crossing the positive territory in August against a dreaded second fiscal quarter 18. The favorable trend was probably a key contributor to management's $ 175 million to $ 200 million year-over-year guidance, suggesting a 2.5x EV / EBITDA valuation at the high end of the range. Prospects materializing, however, will strongly depend on the performance of the company during the decisive holiday season that will take place in less than three months.

Why might one be tempted to buy BKS?

The realistic investor will likely conclude that Barnes & Noble is at the heart of a period of secular and irreversible decline. The company has virtually lost the battle against Amazon (AMZN) for book sales, and revenues and profits are expected to widen gradually over the next few quarters and years.

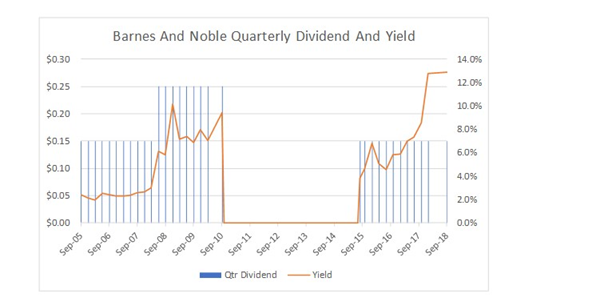

Those who choose to buy BKS despite full knowledge of the company's low chances of success would probably do so for the dividend. As the chart below illustrates, dividend payments have not been consistent over the last 13 years, but the current yield is about as good as ever.

Source: DM Martins Research, using data from Dividend Information

Simple calculations suggest that at a current yield of 13% and assuming no reinvestments, it would take about seven and a half years for a shareholder to recover his investment in BKS only through dividends. Anything that the share might be worth at the beginning of the year 2026 or any dividend payment that could be made to shareholders after that date, ignoring the time value of money for the sake of simplicity, would count as an advantage for the initial investment.

The big "if" here is whether Barnes & Noble will continue to pay the same dividend, or one, for several more years. First, the company is undergoing changes in management, with former CEO Demos Parneros having stepped down from the executive position in July after a very short 14-month term. Activist investors have expressed dissatisfaction with the way management directed the company, and the board may be forced to reduce disbursements to give Barnes & Noble the best chance of survival.

President Len Riggio, in the call for results, did not seem very reassuring:

I see no reason to reduce the dividend at this point, but we will have a board meeting as usual, we approve it quarterly. We'll see where it's going.

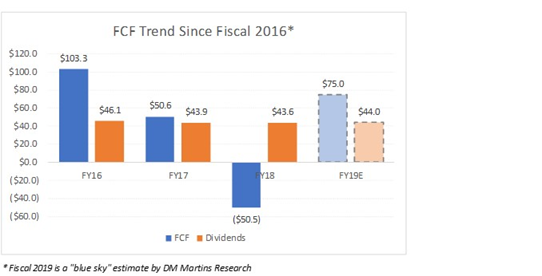

Secondly, cash flows did not seem very robust in recent years, as shown in the graph below. Barnes & Noble made average annual dividend payments of $ 44 million to shareholders, despite a three-year average CLF of only $ 35 million (and a steady decline). Confidence in the company's EBITDA guidance for FY 2019 would suggest an improvement in free cash flow this year, more than enough to cover dividend payments. But with profits virtually guaranteed to reach the target and a growing debt level needed to replenish cash reserves, which could lead to higher interest charges, the dividend policy could likely change in a foreseeable future.

Source: DM Martins Research

My last thoughts

Given the above, I am prepared to resist the temptation and refuse the low-yielding, multi-multiple shares of BKS. A substantial improvement in financial results later this year could largely reward the brave investor who chooses to join current levels. But I think the potential benefits of owning the stock today do not outweigh the huge risks associated with the long position.

Note from the author: If you enjoyed this article, Follow me by clicking the orange "Follow" button next to the header, making sure that the "Receive Email Alerts" box remains checked. And to deepen my knowledge of how I've designed a diversified risk portfolio, designed and tested to generate market-like and risk-free returns, join my storm-resistant growth group. Enjoy the 14-day free trial, read all content written to date and get immediate access to the community.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link