[ad_1]

The Barnes and Noble (BKS) stock price has had its ups and downs over the past month. Today, there was no exception, stocks rebounded smartly, up 16.5%, on buyout rumors. It was after the action crashed on Thursday after posting weak results in the first quarter of 2019.

In terms of fundamentals, on the one hand, the bearers believe that society is in decline, unable to innovate and compete in the highly competitive brick and mortar space. They highlight the negative trajectory of sales at Eastman Kodakesque's comparable stores. In addition, the recent public clash between former Barnes and Noble CEO and longtime President Leo Riggio intensified and encouraged the bears. On the other hand, the speculators of BKS highlight the last argument of the company, the focus on the fruits at hand can be improved to enhance the business (site correction , best in-store experience, toy industry development, etc.) and think that the company has a turnaround potential.

Although I am not convinced, as such, I am a valuable investor and I am more in the bullish and I think that a turnaround is possible. However, I am not very optimistic and have traded this stock this year opportunistically (and successfully).

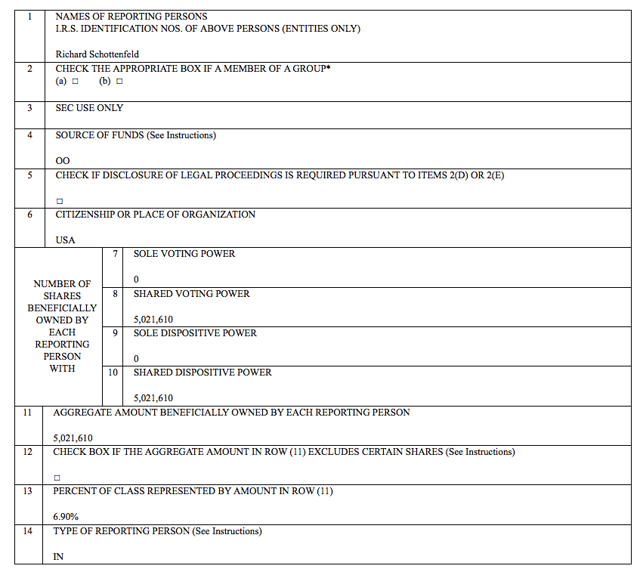

What makes this story more interesting is that on Thursday night, after the bell, Richard Schottenfeld filed a SC 13 D / A form which now says it is now 5,021,610 shares, which is 6.9 % of the society.

See here:

Source: SEC.gov

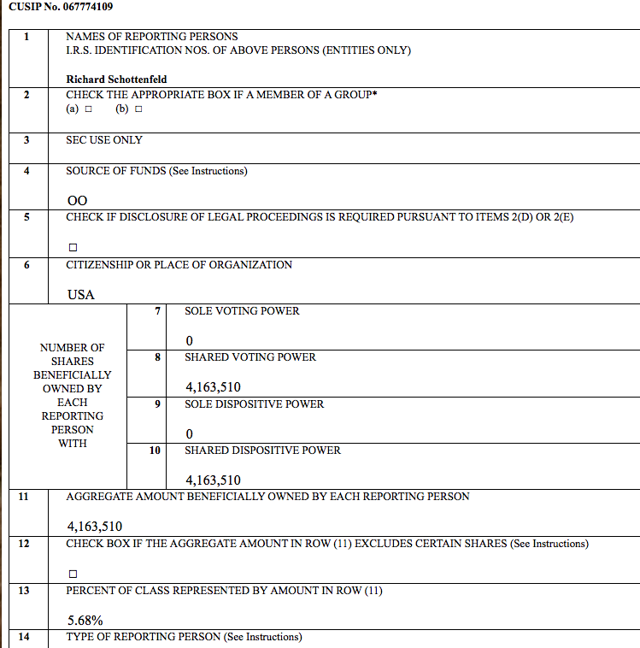

In the context, on July 12, 2018, Mr. Schottenfeld filed a 5.68% interest. This is the news that has brought me back to a long position in Barnes & Noble.

Source: SEC.gov

By the way, Mr. Schottenfeld has already been involved in a significant position at Barnes & Noble. He is therefore a strategic investor and he knows both the company and the company (see this article from December 2012).

Incidentally, Friday morning, the commercial excitement of BKS did not disappoint. In connection with the increase in Mr Schottenfeld's participation, there was an article on the Bloomberg terminal, "Barnes & Noble gets $ 10 / share of private value at Gabelli". This was written by Janet Freund and by Mr. Schottenfeld, Janet suggested that Waterstones, based in Canada, based in Indigo or the UK, might be interested in buying Barnes & Noble.

This news has created a nice recovery after the sale yesterday on the disappointing results of Q1 2019.

Source: Fidelity

Let's go to the first quarter 2019 teleconference (see here)

Let's discuss some negatives first and then, I want to share some green shoots.

The negatives

- EBITDA of $ 7.7 million for the first quarter decreased $ 3.5 million from the prior year, as the decrease in sales was significantly mitigated by the expense reductions.

- Same store sales decreased 6.1% for the quarter, with the largest declines occurring earlier in the quarter as we launched our new in-store store model and adjusted our merchandise assortment.

- On the balance sheet, we ended the quarter with borrowings of $ 179 million under our $ 750 million credit facility. Debt levels will rise in the next quarter, as we build inventory in anticipation of the holiday season. We expect debt to rise to a high level early in the third quarter of the year, given historical trends. "

And management cautioned against the 2018 adjusted EBITDA guidance of $ 175 million to $ 200 million.

"In the future, we are still aiming for a profit of $ 175 to $ 200 million for fiscal 1919. These forecasts are based on the continued improvement of sales trends and positive compilations during the holiday season, better gross margins and ongoing spending reductions. That said, we believe we are taking the right steps to improve financial performance and deliver value to our shareholders. "

Now that we are discussing the likelihood of reaching the adjusted EBITDA for fiscal 2019, I want to present a seasonal background.

However, before readers quickly conclude that the estimates of the adjusted first quarter 2019 EBITDA do not hinder the forecast for the 2019 fiscal year, keep in mind that historically, the lion's share of BKS's adjusted EBITDA is in the third quarter, vacation period.

For example, in the third quarter of 2018, BKS adjusted EBITDA was $ 137.7 million.

Consolidated third quarter EBITDA loss was $ 6.6 million Excluding non-recurring charges, third quarter EBITDA would have been $ 137.7 million compared to EBITDA of 157.8 million. $ million for the previous fiscal year. "

Adjusted EBITDA guidance for the 2018 fiscal year was $ 140 million, at $ 160 million.

"With respect to the full-year guidance, the company expects comparable comparable sales to be down $ 140 to $ 160 million, excluding unusual or non-recurring items."

And to deepen this point, let's look at the 2017 fiscal year.

In the third quarter of 2017, Adjusted EBITDA was $ 158 million.

"Third quarter EBITDA decreased by $ 11 million year-over-year as lower sales were partially offset by these expense reductions."

Adjusted EBITDA for fiscal 2017 was $ 180 million, at $ 190 million.

"Based on our third quarter results and our fourth quarter forecast, we now expect consolidated EBITDA of $ 180 to $ 190 million, excluding charges."

In the third quarter of 2016, Adjusted EBITDA was $ 169 million.

"Once again, thanks again, Andy, today I'm going to give you an overview of our third quarter results, as well as an update on our strategic initiatives." Our EBITDA in the third quarter was $ 169 million, slightly higher than last year. "

I therefore agree that same store sales were 6.1% and adjusted Q1 2019 was $ 7.7 million, down $ 3.5 million from the first quarter of 2018. , constitute an unfavorable beginning. However, it really is about improving the Q2 2019 and putting in place a plausible path to recovery. It is too early to conclude that this company can not show any signs of a positive turnaround and deliver solid quarterly results in the third quarter of 2019. In other words, the jury is still out.

In terms of green shoots

Room A

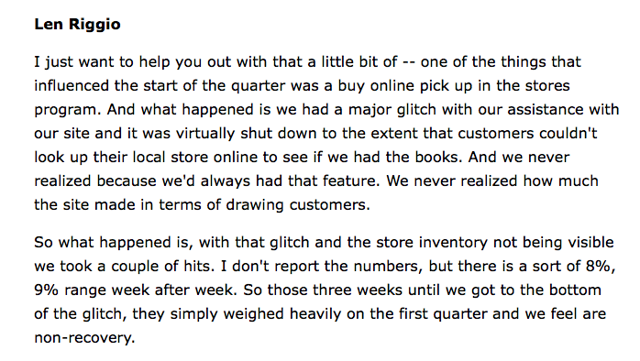

The management of BKS has described the major technical problem as the main negative factor of the poor performance of the first quarter of 2019.

And as the quarter progressed, comps improved sequentially and August 2018 counts fell only 0.8%. It's a big sequential improvement.

"Sales trends have improved as our processes evolve. Comparable store sales improved sequentially during the quarter, down 7.8% in May, 6.1% in June and 4.5% in July. a drop of 0.8% for August ".

Room B

According to merchant leader Tim Mantel, reading clubs seem to be a promising strategy for generating traffic.

"Through the Barnes & Noble Book Club, we have demonstrated that we can drive additional traffic to our stores, the titles selected for a book club are promoted by each of our marketing channels to engage readers and generate a disproportionate market share.

The book clubs attracted thousands of customers to our stores, who enjoyed discussing good books with their friends and neighbors. We look forward to our next selection, an exclusive edition of an absolutely remarkable thing by the blogger, podcaster and musician Hank Green. "

Room C

A stronger pipeline of what could be new popular books could bode well for the second quarter of 2019.

"As for the fall, we expect a more robust publication schedule than last year, and there are large versions to support growing genres such as personal growth, news, and history and religion.As there is a new book every week this fall, including fear, Trump at the White House by Bob Woodward that draws so much media attention this week.

Nick Sparks, Joni Mitchell and Mitch Albom, who do not publish each year, will be on the shelves by October. Other headlines include Michelle Obama, Becoming a Memory of the Former First Lady. The Reckoning, by John Grissom, which is his fortieth title, will certainly delight his fans and will be one of the greatest fiction books of the season. Fire & Blood will give fans of George R.R. Martin a new appreciation of the dynamic and fascinating history of Westeros. "

Room D

With the bankruptcy and liquidation of Toy 'R & # 39; Us, BKS has cleverly developed the children's toys sector. This is a differentiated opportunity and a way to generate traffic.

"Toys and Educational Games is a Critical Grade for Barnes & Noble In our unique approach to the category, smart toys for smart kids of all ages are a source of strength for Barnes & Noble in the current realignment of market share. Under the impetus of exclusive consumer knowledge, we have initiated strategic reviews with all major suppliers of toys and specialty toys in order to develop assortment strategies, improve positioning. inventory and plan the marketing.

We drive business in the market and we develop store spaces, adding an assortment and improving presentations and holiday time. While staying true to our goal of development and educational toys; we will have good educational toys for kids and good blogs for all kids. "

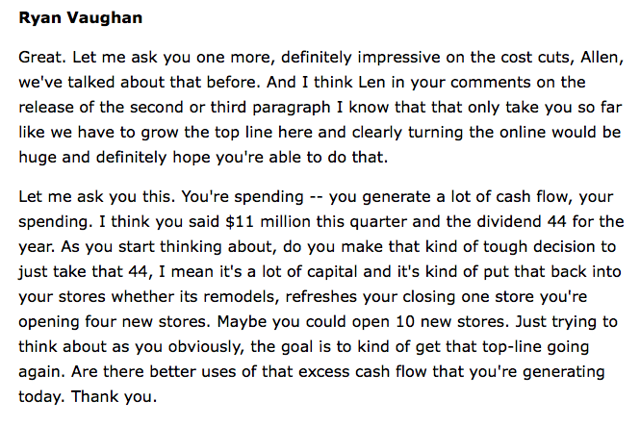

Dividend

Also, here is the comment on the dividend. They plan to maintain it for at least one quarter and then have to evaluate the performance and cash flow for the third quarter of 2019.

Here is Leo's answer.

"So, what we are doing is that we are continuing the dividend, we have reduced our buyback program.We have continued with the dividend and we will see, I mean, I think this holiday season will be really really important for us, although I see no reason to reduce the dividend at this point, but we will have a board meeting as usual, we approve it quarterly. go. "

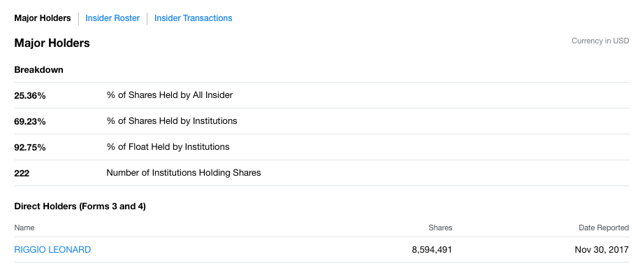

And by the way, Leo owns about 8.6 million shares of BKS.

Evaluation

With 73 million shares outstanding x $ 5.30 (Friday closing price), we are considering a market capitalization of $ 387 million. With $ 179 million taken from the revolver, we have a $ 566 million EV. So, if you think that BKS can only generate $ 150 million in FY 2019 adjusted EBITDA and that its debt remains constant at $ 179 million, assuming an adjusted EBITDA valuation of 4X, then, not a lot of growth based on these multiples and valuation assumptions.

However, if you are more optimistic and think that BKS can break the $ 175 million mark and use a multiple of 4 times adjusted EBITDA, this would translate into $ 7.14. price.

So, it all depends on where 2019 Adjusted EBITDA is, which multiple you want to assign to it so you can determine if the current price of $ 5.30 is undervalued or overvalued.

In addition, please note that there were 8.5 million BKS shares sold short at August 15, 2018.

To take away

Barnes & Noble has become another stock of interesting battlegrounds. Both bears and bulls have convincing arguments. In the end, however, it is too early to say for sure which side has the best argument. From my point of view, I opportunistically traded BKS shares on the long side. And at present, the combination of Mr. Schottenfeld on board, a low valuation (if you estimate that an adjusted EBITDA of $ 175 million is possible), and a short-term interest of decent size I've tipped into this moderate encampment.

Adventures of the market

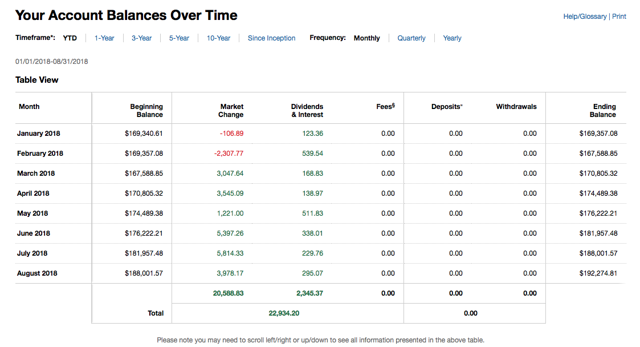

As a full time investor, I search every day for new ideas for my portfolio and I always eat my own cuisine. Although holding 50% of the portfolio in cash for most of the year, my Tactical Portfolio has increased 13.3% since September 7th. Develop the S & P 500 of about 500 bps. Below is Fidelity's monthly performance up to August 31, 2018.

Disclosure: I / we have no position in the mentioned actions, but we can start a long position on BKS over the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional disclosure: I sold my BKS shares at $ 5.40 Friday, after buying more shares at $ 4.50 Thursday and more before Friday at $ 4.55. I would still be buying on a dive.

[ad_2]

Source link