[ad_1]

1. Great Expectations: The US government releases its first glimpse of second quarter GDP at 8:30 am ET, and it could be big.

Economists surveyed by Thomson Reuters predict that economic growth will reach 4%.

The combination of tax cuts and a tense labor market may have contributed to the growth of electricity during the quarter. Some economists say that trade concerns may have also increased the numbers, as countries ran to import US goods before tariffs were applied.

The US economy has been growing for nine years, making it the second longest boom ever recorded.

2. Amazon book: For the first time in its history, the technology company made a quarterly profit of $ 2 billion, an impressive result fueled by the continued growth of premium subscriptions, cloud computing and its fledgling advertising activity.

Amazon announced Thursday that it had made a profit of $ 2.5 billion for the three months ending in June, a staggering leap from the $ 197 million it had posted at the end of June. during the same period last year.

It marked for the third consecutive quarter that Amazon made a profit of $ 1 billion, a remarkable feat for a company formerly renowned for having invested so much in its business that it often lost l & # 39; money.

The shares of Amazon ( AMZN ) were up in the pre-commercial trade.

3. Disney deal: Disney ( DIS ) acquisition of most of the 21st Century Fox ( FOX ) is about to become official. Fox shareholders are expected to meet on Friday and should approve the deal.

Comcast ( CCZ ) had made an offer for the same assets but had abandoned earlier this month.

During the bidding war, the market value of Fox jumped by 36%. Disney can now have the most formidable content portfolio in any Hollywood, adding to an already impressive stable that includes Marvel, Pixar and LucasFilm.

Before Bell's News Letter: Important News of the Market. In your inbox Subscribe now!

4. MarketForters: Twitter ( TWTR ) The stock is down 15% before placing on the market after the flat Email platform announced earnings before the opening. The company saw its user base decline in the second quarter.

Shares in Expedia ( EXPE ) and Chipotle ( CMG ) were among the most important pre-sale business.

Facebook ( FB ) Stocks rebounded 2% in pre-sales after suffering record losses on Thursday.

The shares of the Chinese e-commerce company Pinduoduo ( DDP ) which climbed 40% when they debuted at Nasdaq on Thursday, are expected to rise of 7%.

Intel ( INTC ) and Electronic Arts ( EA ) fell prematurely as investors reacted to latest wins.

5. Dealers: Shares in BHP ( BBL ) rose 4% in London after the company announced that it had sold its US shale assets for $ 10.8 billion. Most were bought by the British energy giant BP ( BP ) .

Chesapeake Energy ( CHK ) also entered into an agreement: The firm announced that it was selling all its shale lands in Ohio to Encino Acquisition Partners for about $ 1.9 billion. The Chesapeake stock jumped 10% before the sale.

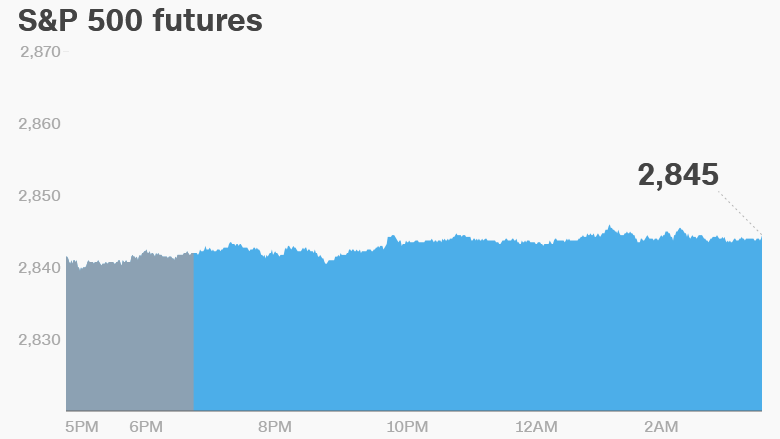

6. World Market Overview: US equity futures were maintained.

European markets were largely on the rise early in the session. Asian markets ended the day with mixed results.

Markets Now Newsletter: Get a snapshot of world markets in your inbox every afternoon. Register now!

7. Coming this week:

Friday – Exxon Mobil ( XOM ) and ] Merck ( MRK ]) declare his earnings; 21st Century Fox ( FOX ) holds a meeting of shareholders; United States publishes data on GDP in Q2

CNNMoney (London) First published on July 27, 2018: 5:07 AM ET

[ad_2]

Source link