[ad_1]

After months of speculation, Bitmain – the world's largest provider of crypto-miners – opened the internal details of its business after submitting its IPO prospectus on the Hong Kong Stock Exchange. And some of the growth figures are crazy.

The document does not specify how much Bitmain, a five-year-old child, intends to step out of his list – this will come later – but this raises the incredible growth in activity that the company was considering like a crypto market 2017. Although this also comes with one question: can this growth continue in this current bear market?

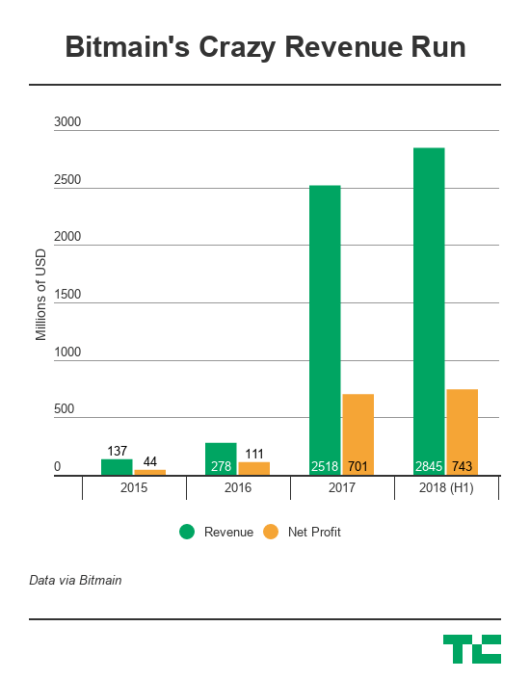

The company achieved a turnover of more than $ 2.5 billion last year, a jump of nearly 10X out of the $ 278 million announced for 2016. Already, revenues for the first six months of this year exceeded $ 2.8 billion.

Bitmain is best known for its "Antminer" peripherals – which allow the owner to exploit Bitcoin and other cryptocurrencies – which account for the majority of its revenues: 77% in 2016, 90% in 2017 and 94% in the first half of 2018. Other revenues are generated by its mining operations, shared mining pools, chips and blockchain services.

The company is factory-free, which means that it develops its own chip design and works with manufacturing partners that make them live as physical chips. These chips are then used to power the mining equipment, which allows the owner to earn a reward by exploiting Bitcoin and other cryptocurrency. Bitmain claims more than 80,000 customers with just under half of sales in China and the rest abroad.

The company reported net income of $ 701 million in 2017, up from $ 104 million in 2016. In the first half of this year, it posted a gross profit of $ 743 million. (Operating profit reached $ 1 billion for this period.)

It's a pretty staggering growth, but there are signs that 2018 will face new challenges.

Margins are down. The gross margin for the first six months was 36%, compared to 48% in 2017 and 54% in 2016. In this respect, the percentage of cost of sales in the first half of 2018 went from 51% to 52% in 2017 and 2016, respectively.

Bitmain is attempting to address these concerns using H1 2018 figures, rather than divide this period into two quarters. This is important because the crypto market has fallen dramatically since January, losing more than half of its value. This has had an impact on most cryptography companies – whether it's trading that sees less trading or traffic less portfolios – and it's certain that Bitmain will have suffered from it.

The question is to what extent?

It's crucial because that's what will give this IPO momentum, but Bitmain does not play ball and shows us the big picture.

Interestingly, Bitmain accepts Bitcoin and other cryptocurrencies as a means of payment for its minors, with about 27% of purchases made last year for crypto use. As a result, these payments are not included in the products, but appear as "cash inflows" when converted into fiat currency and used in the business. This is an accounting problem for 2018.

Bitmain therefore has a negative net cash position in its operational activities, but these become positive when crypto is taken into account. The company reported receiving $ 887 million in crypto in the first half of 2018, $ 872 million in 2017, $ 56 million in 2016 and $ 12 million in 2015 – based on the cost rate. The data seems to show that Bitmain received $ 484 million in crypto in 2017 and that in the first half of 2018, this figure was $ 382 million.

The crazy race of 2017, however, led the company to overestimate demand and, as a result, its stock rose by $ 1 billion.

Here is Bitmain's explanation of how he managed to make it so bad:

At the beginning of 2018, we anticipated strong growth in the cryptocurrency mining equipment market in 2018 due to the upward trend in cryptocurrency prices in the fourth quarter of 2017 and we have placed numerous orders with our investment partners. production. . However, in the first half of 2018, the cryptocurrency market experienced high volatility. Due to this volatility, the expected economic return from cryptocurrency operations has been affected and sales of our mining equipment have slowed. In turn, we increased the level of our inventory and advances received from our customers in the first half of 2018. In the future, we will actively balance our growth strategy, inventory and cryptocurrency levels. good cash position, and we will adjust our supply and forecast plan to maintain an appropriate level of liquidity.

Despite an additional inventory of $ 1 billion, Bitmain estimates having working capital – including the encryption stack and the result of its IPO – to support operations for at least 12 months. According to its figures, this represents approximately $ 343 million in cash and cash equivalents, but it is clear that it requires another product or that the market demand increases again.

Indeed, last week, Bitmain announced its new mining chip – reduced to 7 nm – which, according to her, will offer more power and greater efficiency to minors. These advances, combined with the increasing value of cryptography – that Bitmain's owners can gain – have helped the company to consistently raise the price of its hardware.

The average selling price of its Bitcoin operating machines in 2015 was only $ 463, but it rose to $ 767 in 2016, $ 1,231 in 2017 and $ 1,012 in the first half of 2018.

The co-founder of Bitmain, Jihan Wu, is the face of the company and one of its major shareholders with a 20% stake

Beyond mining, the company is also developing AI chips, the first of which was launched last year. They are used for the development of cloud systems, as well as for the recognition of objects, images and faces.

Citing thirds, Bitmain claims to have a 75% dominant position in the ASIC mining equipment market. It invests heavily in R & D, which reached $ 73 million last year and $ 86 million in the first half of 2018. In addition, about one-third of its 2,594 employees are listed in research and development.

It's likely that Bitmain records more revenue in crypto than any other company on the planet

The Bitmain document confirms that the company has raised some $ 784 million on series A, B and B.

Its investor record is quite public thanks to leaks and includes companies like IDG, Sequoia China and Kaifu Lee's Sinovation fund. However, the prospectus confirms that shareholders include NewEgg retailer, EDBI – the investment arm of the Singapore Economic Development Board – and investor Uber Coatue. The founders Ketuan Zhan and Jihan Wu are the main shareholders and control respectively 36 and 20%.

Bitmain can be expected to flesh out the prospectus with more juicy information, including a target increase that will also generate its valuation. But for the moment, there are more than 400 pages of information to process, you can find them here.

Note: The author has a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Source link