[ad_1]

The transformation of BlackBerry, a struggling smartphone company into a thriving leader in cybersecurity software and connected cars, is on track.

The company now generates more than 90% of its total revenue from software and services. And 81% of these sales are recurring. In other words, BlackBerry is no longer subject to the fickle tastes of consumers and has reached out to its customers.

Blackberry (BB) announced profits and sales on Friday morning for its last quarter, which exceeded Wall Street forecasts. The stock rose more than 15% late in the morning on the stock market.

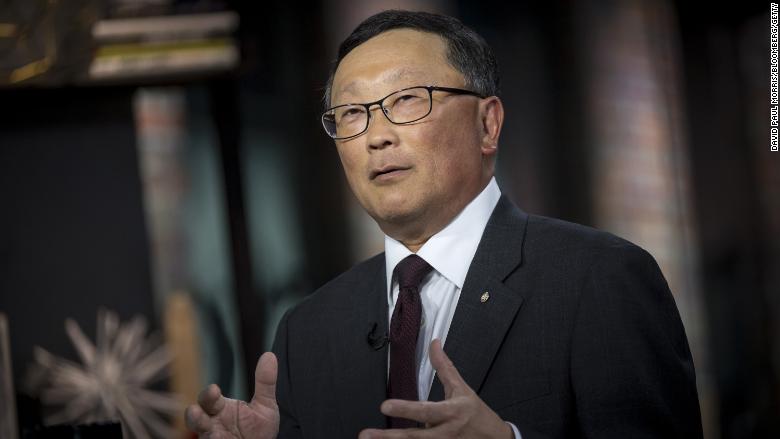

CNN chief executive John Chen said the company's biggest hits this quarter were in the connected and standalone car market, with revenue growth of about 30 percent for the QNX car division. .

Chen said that BlackBerry was working hard to win more customers in the auto market, highlighting an agreement announced in January with the Chinese search engine giant. Baidu (BIDU) jointly develop autonomous cars.

The company, under Chen's leadership, realized a few years ago that it was a lost battle making devices generating extremely thin profit margins at a time when Apple (AAPL) and Samsung (SSNLF) dominate the smartphone race.

That is why BlackBerry decided in 2016 to no longer manufacture its own phones and to outsource the production of devices bearing the name BlackBerry to other manufacturers.

Since then, BlackBerry is all-in on the software.

BlackBerry is hoping for a new 'Spark & # 39;

So, what's next? Mr Chen said he hoped that the new BlackBerry Spark security platform, which is a bit like instant messaging on steroids, could increase its presence in the healthcare market. Spark integrates video chat, text and other forms.

BlackBerry targets health to help the company grow beyond its major transportation markets, governments and financial services companies.

Investors are also pleased with the turnaround. BlackBerry shares have increased more than 60% since the takeover of Chen nearly five years ago. It's solid, but it has been lagging behind Apple's performance and Nasdaq.

Yet Chen has cleaned up BlackBerry's balance sheet. The company now has $ 2.4 billion in cash and only $ 740 million in long-term debt. Rumors that BlackBerry would cease operations are no longer commonplace before Chen's arrival.

The BlackBerry management board is also pleased with Chen's leadership. BlackBerry announced in March that it was extending Chen's contract until November 2023.

It could also put an end to rumors that Chen would only stay long enough to sell BlackBerry to a bigger rival.

CNNMoney (New York) First published on September 28, 2018: 10:41 ET

Source link