[ad_1]

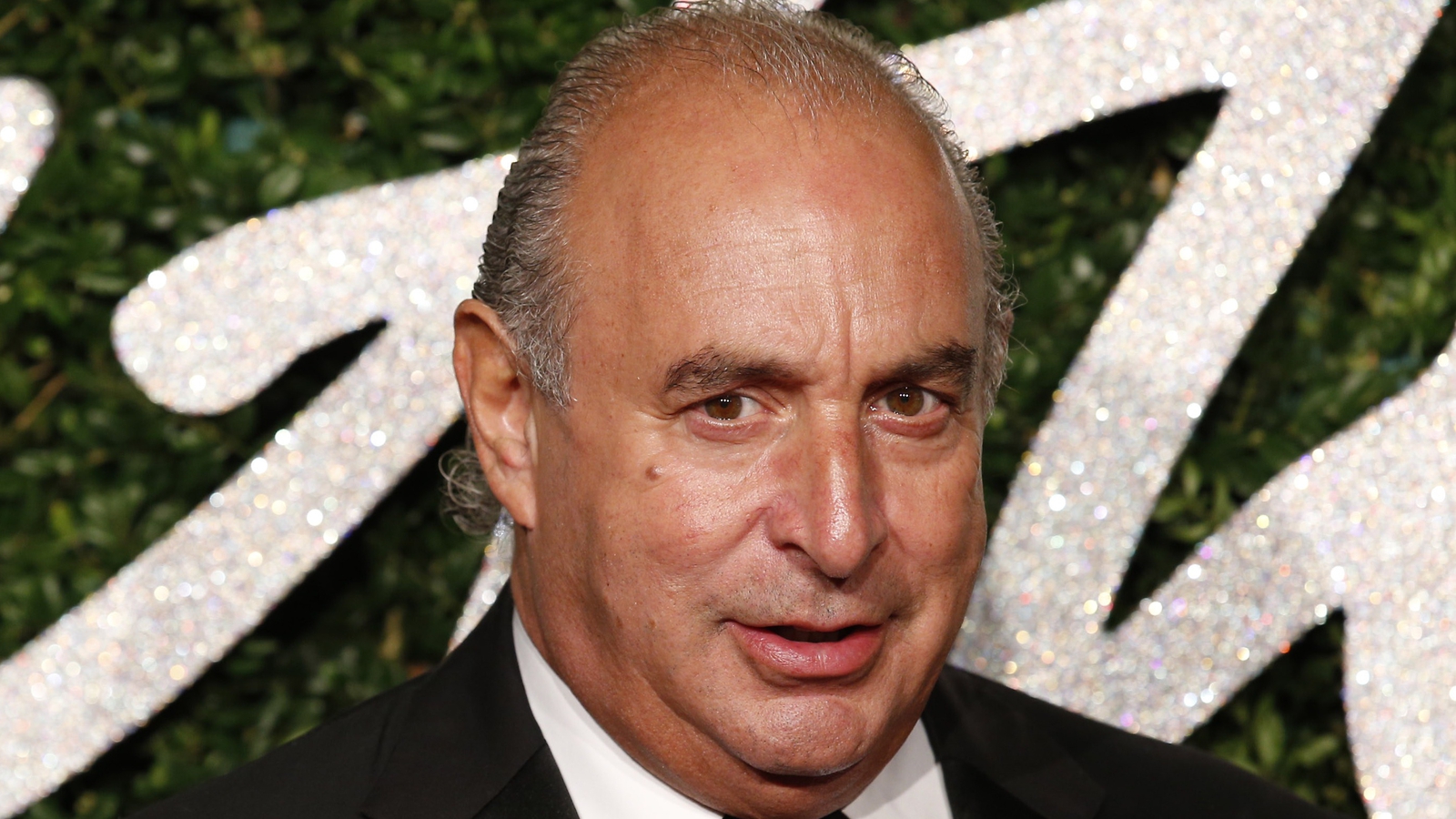

British billionaire Philip Green has been named to Parliament as a businessman accused of sexual harassment, racist abuse and bullying in the latest #MeToo scandal.

An article published this week in The Telegraph, highlighting the allegations, did not name him because of an injunction granted by the businessman.

But the founder of Topshop was appointed this afternoon in the House of Lords by Peter Hain, under parliamentary privilege.

The Labor colleague said that he felt it was his "duty" to appoint Mr. Green because it "is clearly in the public interest".

Mr. Hain said: "Having been contacted by a person closely involved in the case of a powerful businessman using non-disclosure agreements and substantial payments to conceal the truth about the Serious and Repeated Sexual Harassment, Racist Abuses and Continuing Harassment Pursuant to parliamentary privilege, it is my duty to appoint Philip Green as an individual in question, as the media has been subject to injunction preventing the publication of all the details of a story that is clearly in the public interest. "

The story of Telegraph is the result of an eight-month investigation into the allegations against Mr. Green.

The intervention comes after UK Court of Appeals judges temporarily banned the Telegraph from publishing "confidential information" provided by five employees about a personality the newspaper described as of "main businessman".

The newspaper wants to reveal what he calls "alleged sexual harassment and racial aggression against staff," who have been barred from discussing their claims under non-disclosure agreements.

Mr. Green is a retail mogul whose reputation has been shaken by the collapse of the former British department store BHS.

In the late 90s, he made himself known by buying and carving the Sears empire.

In 2002, he bought Arcadia, the parent company that controls Topshop, Topman, Burton, Dorothy Perkins and Miss Selfridge.

Other highlights of his career include the failure of the £ 9 billion takeover bid for the iconic Marks and Spencer chain in 2004.

In 2006, he was knighted for his services in the retail sector, but he is perhaps best known for his role in the demise of BHS.

The collapse of the retailer in April 2016 left 11,000 people unemployed and a black hole of 571 million pounds sterling in its pension fund.

The mogul was criticized for collecting £ 400 million in dividends from BHS before selling the heavily indebted company for £ 1 in 2015 to businessman Dominic Chappell, who had no retail experience who had been declared bankrupt twice.

In 2017, Mr Green sold £ 363 million to the BHS pension fund.

[ad_2]

Source link