[ad_1]

General Electric is turning to a stranger to clean up a mess that has taken decades to create.

Larry Culp, 55, is a proven leader known for his practical approach. He received a Wall Street hero's welcome on Monday after being suddenly installed as GE's new boss. GE (GE) the stock price fell by 10%.

Culp, become CEO of an industrial manufacturer Danaher (DHR) at only 37 years old, GE's restoration to the greatness is a monumental task. The iconic manufacturer of light bulbs, MRIs and jet engines bleeds badly as a result of poorly programmed agreements and unnecessary complexity in its structure. 39; company. and increasing debt.

Nearly $ 500 billion has evaporated from GE's market value over the last 18 years. It's about the size of Facebook (FB).

GE, a company proud of its management excellence, is so desperate that, for the first time in 126 years, it is run by a stranger.

"GE was like watching a slow (but fatal) train wreck," Scott Davis, a senior analyst at Melius Research, wrote Monday.

"15 years of bad decisions will take courage," said Davis. "I would not bet against Larry."

Culp brings credibility

By bringing in fresh blood, GE is betting that he will be able to speed up the recovery plan begun under John Flannery. a veteran of the 30-year-old company who was evicted unceremoniously as CEO to make way for Culp.

"GE must be commended for choosing a credible and experienced GE outsider," said Cowen analyst Gautam Khanna. Culp is likely to "determine more frankly and quickly the seriousness of the problems".

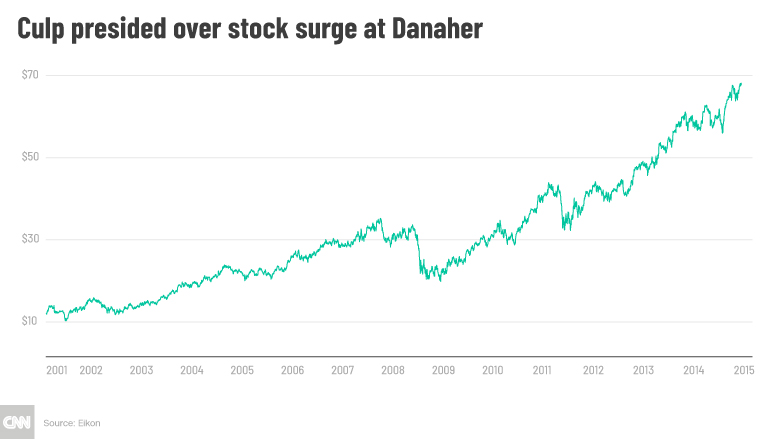

Culp built an impressive track record by taking the helm of Danaher between 2001 and 2015. The company's revenue and market capitalization increased fivefold during this period.

The graduate of Harvard Business School is credited with transforming Danaher, an obsolete manufacturer, into a modern company with a strong health science and technology industry. He pushed Danaher into health care, a company that today sells tools, lights and software used by dentists.

"He has the assets to take over a business of this size," said Jim Corridore, an analyst who covers GE at CFRA Research.

"Disturbs"

Khanna applauded Culp's "cautious" capital allocation story at Danaher, noting that about $ 25 billion had been deployed during his tenure.

After years of bad decisions that have resulted in a build-up of debt, GE badly needs a solid manager of its depleted resources. Analysts say that under former CEO Jeff Immelt, GE was buying far too often high and sold low.

Consider the disastrous purchase of Alstom in 2015, a $ 9.5 billion acquisition that pushed GE Power to turn more towards fossil fuels at the wrong time. GE Power is so upset today that the company has announced that it should proceed with a book value reduction of up to $ 23 billion to reflect the deterioration of the acquired business.

"The magnitude of the distortion is worrisome," Corridore said.

Flannery took over a company in disarray when he became CEO last year. Although he deserved credit for revealing "dirty laundry," he discovered, Flannery did not act quickly enough to restore shareholder confidence.

"John Flannery was really struggling to escape the bad hand he had inherited," said Jeff Sonnenfeld, head of corporate governance at Yale School of Management.

In a statement, Immelt predicted that GE Power would recover under the new management team because of its superior technology and talent.

"Larry Culp will be a strong leader for GE and its board of directors, and its expertise and experience are perfectly aligned with GE's needs," said Immelt.

Will GE continue its transformation?

Now, Culp must decide whether to continue with Flannery's turnaround plan. Culp joined GE's board of directors in April, which led him to join Flannery's drive to revamp the company around energy, its growing aerospace business and renewable energy.

The makeover would force GE to get rid of its health, railways, light bulbs and oil and gas businesses, and use the proceeds of this sale to pay off its debt.

Given Culp's experience in the health field in Danaher, Sonnenfeld predicted that GE might decide to retain its own health division.

GE's extensive business structure, built over the decades by Immelt and Welch, could be reduced by Culp.

Culp led Danaher with less than 100 employees in the head office, and Davis said the new CEO was likely to "dismantle the company to the necessary functions and demolish all the fiefdoms".

Great challenge ahead

But reducing costs will not be enough to repair GE.

Culp has to go to the bottom of trouble at GE Power. Not only does renewable energy raise the company's business, but recently reported blade failures raise fears of quality problems.

GE also faces a large pension deficit due to years of inattention and low interest rates.

And then there is the ghost of GE Capital, the financial arm that almost killed GE ten years ago during the financial crisis. Culp will be accused of repatriating GE Capital safely while sailing in antipersonnel mines, such as WMC Mortgage, the former subprime mortgage business on which the Justice Department is investigating.

Elsewhere at GE Capital, Culp needs to stabilize the long-term care insurance portfolio, which suffered a $ 6 billion loss in January. The news has sparked a SEC investigation – the second GE is currently facing.

By hiring Culp, GE may have quickly improved its serious credibility problem on Wall Street. But make no mistake: it will take much longer to straighten the ship.

CNNMoney (New York) First published October 1, 2018: 3 pm ET

Source link