[ad_1]

It's time to have a serious discussion about weeds.

Investors achieved impressive returns with pot stocks, including Canopy Growth (CGC), Tilray (TLRY) and Cronos Group (CRON). But the story of growth has reached its peak (at least for the moment), and the pleasure is about to end.

introduction

What's happening now reminds me of what happened with Bitcoin at the end of 2017. People seemed very optimistic when the price reached a maximum of $ 20,000. Everyone was talking about the potential for Bitcoin and blockchain technology. Nobody really talked about the real value of technology aujourd & # 39; hui.

Pot stock investors are overly optimistic about the upcoming legalization of marijuana for recreational purposes in Canada (October 17). And this optimism is reflected in the price of the pottery stock market as CGC. To justify current prices, investors must believe that there will be a massive demand for recreational weeds once it's legal. If they are right, the pot stocks seem pretty valued. But if they are wrong, prices could drop dramatically.

I will focus on CGC for this article, which is widely regarded as the strongest company in the industry. I will start by reviewing the evolution of growth we are selling, then give 3 reasons why I think prices will fall.

$ 4.2 billion to $ 8.7 billion market hidden from view

The forecast for marijuana sales in Canada varies. Canada's Parliamentary Budget Officer (PBO) forecasts sales between C $ 4.2 billion and C $ 6.2 billion; Deloitte estimates that the range will be between $ 4.9 billion and $ 8.7 billion Canadian.

But most importantly, Sands, Chief Executive Officer of Constellation Brands (STZ), noted that CGC had won 35% of Canada's recreational cannabis supply contracts and expected sales in that country to reach US $ 5-7 billion. sales of about $ 2 billion (assuming a 1/3 market share).

We can take the assessment of society and see how it fits these forecasts.

The CGC had a market capitalization of $ 12.7 billion and a price-to-sales ratio of about 192 as of October 15. We must now make certain assumptions. We will stick to generous assumptions to paint as beautiful a picture as possible.

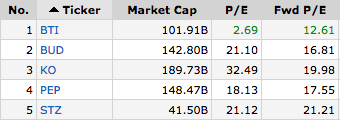

Let's say that once marijuana is legalized, the CGC is able to reach an operating margin of 32% (identical to that of the STZ). This would give CGC an annual profit of $ 640 million and a P / E of 19.8 term, which is of the same order of magnitude as the P / E futures of a basket of companies that CGC aspires to look like (see chart below), including British American Tobacco (NYSEMKT: BTI), Anheuser-Busch InBev (NYSE: BUD), Coca-Cola (NYSE: KO), PepsiCo (NYSE: PEP) and well sure Constellation Brands.

Our ambitious P / E is a little bit higher than BTI's, and matches beverage brands like KO, PEP and the owner of CGC, STZ.

This seems like a reasonable comparison because CGC wants to be more than a commodity producer: it wants to own a diversified portfolio of marijuana brands. Today's assessment seems to assume that CGC will successfully market its line of edible products and cannabis-infused beverages.

Is this realistic?

Probably not.

The above forecast of the size of the marijuana market for recreational purposes is based on estimated sales on the black market, which are by no means guaranteed to completely switch to legal sales. People will continue to buy from existing channels (especially if it's cheaper) and some will only grow themselves (which is not very difficult to do).

In addition, for first-year revenue to reach $ 2 billion, you must assume that CGC will work flawlessly in the coming year and that the government's deployment plans will run smoothly. Today, on the verge of legalization, there are practically no more open cannabis retail stores. There is one in British Columbia. and zero in Ontario, Canada's most populous province. Ontarians will have to shop online for weeds.

Basically, everything has to go well to justify the current assessment.

But if you interview the CEO of Canopy Growth, that's exactly what will happen. Everyone in Canada will want to start smoking grass once it's legal:

Mr. Linton likes to compare his company to technology leaders like Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). The comparison is a bit silly. CGC and its competitors grow marijuana (a plant) and sell products containing marijuana (oils, tincture and soon candies, snacks, drinks, etc.). This is not a technology company. It's not because they give their employees stock options and attractive benefits at work that Amazon or Google.

This is just an example of how this industry is overexpressed. Of course, the global market could be huge (some say $ 200 billion). But it is not there yet.

In addition to the obvious regulatory uncertainty (including the fact that marijuana remains illegal in most markets), here are three reasons why marijuana stocks like CGC are overvalued.

1) The demand will not exceed the offer forever

Canadian cannabis producers seem to be staying calm, as the demand for marijuana for medical purposes outstrips supply. This has led to high margins for marijuana sales for medical purposes.

But with all the investments invested in increasing production, this supply shortage can not last forever. As weed sales become legal in more and more places, trivialization will be felt, competition will increase, and prices and margins will decrease. Companies that can create strong brands will succeed. Others will fight.

The CGC seems well positioned comparatively, but there are many uncertainties. They will face fierce competition from beverages and perhaps even tobacco manufacturers who have much more experience in creating sustainable brands.

2) At the moment, CGC and its competitors are in the commodities sector

Marijuana is a commodity. The real benefits, if and when they materialize, will come from companies that can create strong brands. It remains to be seen if CGC will be able to do this. Admittedly, they are taking steps to achieve this goal.

Of course, many investors see it as a near certaintyy in the light of the STZ recent investment of $ 4 billion in the CGC. But do not be fooled by cannabis drinks and snacks, as the company will have to wait at least a year before getting regulatory approval for the sale of this type of product.

Cannabis sales become legal on October 17, but only in the form of dried cannabis, oil and seeds. No food or concentrate (what you need to make a drink or to vape) will be allowed.

Health Canada specifically left out these types of products, saying they needed more time to "develop specific regulations that address the unique risks posed by these product classes." They are currently reviewing elements such as quality control, packaging and labeling rules and allowable THCs. Portion levels and sizes (most people know how hard it is to know when you have "enough" when eating foods containing cannabis because it takes a while to get there).

In addition, consider that there will be strict limitations on packaging to prevent underage users from eating something that looks like candy. It can be difficult to establish a brand – potentially much more difficult than for the cigarette brands of the time. We live in a very different world.

Health Canada expects to be ready to approve edibles and concentrates in the year following the implementation of the Cannabis Act (Bill C-45). I hope investors are patient.

So I think legalization after October 17th will be a bit of a disappointment for investors who expect pot stocks to increase even more. The real big day will be when edible products become legal in 2019 or later.

3) Weed investors could be particularly prone to upbeat buying

The hype surrounding marijuana stocks seems to have attracted a lot of new people to stock market investments. I've heard stories of people earning 400% or more in a few months putting all their savings into stocks. The most extreme story I've heard concerns a guy who has placed a lien on his house in order to invest as much as he can. That person would now own more than $ 2 million in potted stocks and would be strong.

These people have an incredibly high appetite for risk but little experience. They believe so much in the history of growth that they are ready to put everything into play. At the moment, these investors look like geniuses. But the smartest solution might be to take profits from the table before legalization.

Conclusion

Investors are naturally enthusiastic about any future agreements and acquisitions. They recently signed agreements like the $ 4 billion STZ investment.

If these large beverage companies (and possibly tobacco companies) are willing to invest billions of dollars in cannabis companies, should not individual investors also be willing to invest? Not necessarily.

As individual investors, we can choose to invest or not in any sector. The leaders of the STZ have probably felt compelled to take action and invest in cannabis because A) are facing a decline in revenue from wine and spirits and B) are afraid to miss it. opportunity to get started in the beverage industry. They want to be first on the market. That's why they are willing to pay such a high price (a 50% premium at the time) to get in the door.

But we are not faced with such competitive restrictions or pressures. So we should avoid the temptation to buy pot stocks right now.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Editor's Note: This article deals with one or more securities that are not traded in a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link