[ad_1]

CEOs use the market boom to quietly cash their own chips.

According to an analysis of regulatory filings by TrimTabs Investment Research, insiders in US companies sold $ 5.7 billion in shares this month, the highest level recorded in September over the past decade.

This is not a new trend. According to TrimTabs, insiders, which include executives and directors, also sold stocks in August at the fastest pace in 10 years.

The sale is noteworthy as it took place as the market rebounded sharply after falling in early 2018. Fueled by tax cuts and a strong economy, the Dow recently recorded its first record since January.

Some business insiders have a large portion of their net worth in stock, so they may just exercise caution. The bull market, already the longest in history, can not last forever.

"It's very prudent for them to unload certain stocks, no matter how much they like the stock," said Joe Saluzzi, a co-associate of brokerage firm Themis Trading. "It does not necessarily mean that they see something wrong."

TrimTabs does not break down the number of pre-planned insider sales. The SEC allows executives to plan stock sales in advance to avoid the onset of insider trading.

While Corporate America captains cash, they do exactly the opposite with shareholder money.

According to TrimTabs, US public companies have authorized an impressive number of share buybacks of $ 827.4 billion in 2018, a record for a year. Apple (AAPL) only announced plans for $ 100 billion of buybacks in the last quarter.

The wave of redemptions was perceived by investors as a sign of confidence among CEOs.

"Insiders do not announce redemptions because they think stocks are cheap," said David Santschi, director of liquidity research at TrimTabs. "What they do with the shareholders' money and theirs is very different."

Companies use redemptions as a way to return excess cash to shareholders. Share buybacks benefit investors – and principally paid principals in stock – by providing persistent demand that tends to drive up prices. Redemptions also artificially boost earnings per share by eliminating the number of shares outstanding.

US companies profit from record profitability thanks to strong economy and strong reduction in what they owe to Uncle Sam. Republican tax law has reduced the corporate tax rate from 35% to 21% and has also allowed companies to reduce their profits abroad.

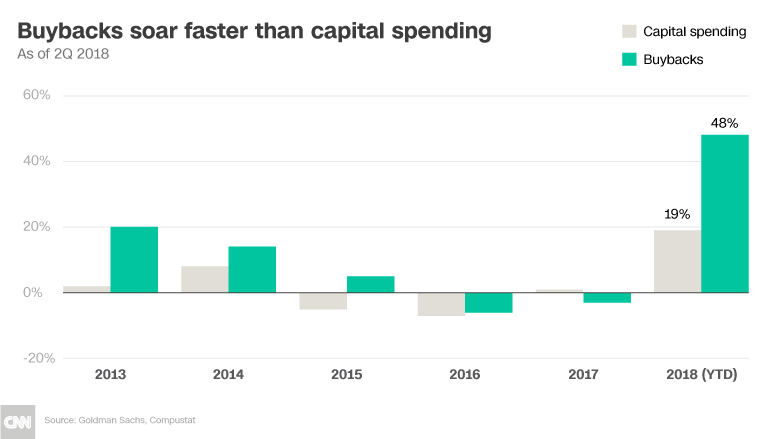

The fiscal windfall has also allowed companies to spend more on job-creating investments, such as new equipment and research projects. But the redemptions increase even faster. In fact, Goldman Sachs found that redemptions accounted for most of the S & P 500's cash expenditures for the first time in a decade.

Given the ramping up of buybacks, Saluzzi said it would be odd for insiders to quickly dispose of shares outside of planned trades.

"You have to raise your eyebrows and watch what's going on here," said Saluzzi.

CNNMoney (New York) First published on September 26, 2018: 12:42 ET

Source link