[ad_1]

Alibaba (BABA) is often called "Amazon (AMZN) of China", but I think that does not do justice to this technology giant. I suspect that many investors have been clear because of the political uncertainty and that they just do not know what BABA is doing. This makes sense – because Baba has operations mainly in China, it's almost impossible for the typical American to really understand what he's doing. After reading this article, you will know exactly what BABA does, why it should be a basic position, and why this is my last purchase of belief

(Note: all dollar figures are shown in USD unless otherwise indicated.)

Band

BABA has been an absolute horse since its IPO in 2014:

(Yahoo Finance)

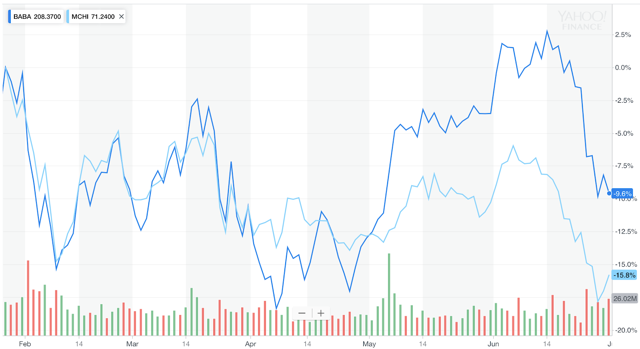

For many investors who are not so familiar with their business model, they can be quick to shout "bubble". However, even after the race, I first, China saw a huge market sell last year, probably due to the rise of trade war tensions with the United States, which has also caused price pressures.

Baba to see his actions sell in sympathy:

(Yahoo Finance)

This makes the big Chinese technology companies attractive. Using the same logic that companies like Facebook (FB) and Alphabet (GOOGL) seem little exposed to the effects of a potential trade war due to the lack of direct exposure to China, companies Chinese technology companies such as BABA can also be considered unaffected due to not having a lot of exposure in the United States (they mainly operate only in China).

Secondly, there has been considerable discussion about the possibility for Chinese technology companies to formally register their shares in Chinese stock exchanges. Because BABA is listed on the New York Stock Exchange, this means that Chinese citizens are not able to buy shares! It's as if US citizens were not able to buy shares in AMZN. During their recent earnings conference call, management discussed the possibility of establishing a list of Chinese exchanges through Chinese certificates of deposit ("CDR"), which could come later this year. I expect that increased liquidity will help propel stocks forward, as there is a new wave of buying from the Chinese investor base that interacts with BABA day-to-day. .

Sectors of activity – watch out for three basic businesses that I want readers to understand. For everyone, I will give to the American counterpart company that best represents the respective business models

E-Commerce

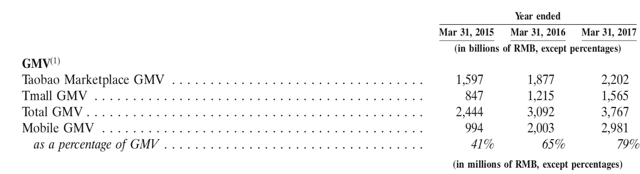

BABA is best known for its electronic business platform consisting of two components: Taobao and Tmall. I must first point out that they are not the same thing. Taobao is a "consumer-to-consumer" platform, which basically allows the average Joe to sell and buy things from the average Joe. Taobao looks a lot like eBay (EBAY) and Craigslist. During the last quarter, they had 617 million mobile users per month.

(2017 Investor Day)

Tmall, on the other hand, is the place where brand name retailers sell their products. One should think of this as an online shopping center, very similar to AMZN. Companies pay BABA a service fee to operate an online storefront on their platform, giving them access to a large Chinese consumer market. As of March 31, 2018, there were more than 150,000 brands on Tmall. Some of the major marks are seen below:

(Investor Day in 2017)

Taobao and Tmall experienced an explosive growth in gross merchantable volume:

(Annual Report 2017)

The author Jae Jun wrote an excellent article explaining in more detail the rigidity of their electronic business platform.

Cloud computing

(Alibaba)

Baba also has a cloud division that provides customers with cloud computing capabilities. For those who do not know what "cloud" means, these services include data storage, relational databases, data processing, DDoS protection, and content delivery networks (CDNs). . BABA notes that according to IDC, they are leaders in the Chinese infrastructure-service market (IaaS) with a market share of 47.6% in 2017, compared to 42.4% in 2016. They continue to earn customers globally The cloud computing business figure increased 101% year-over-year to reach 13.390 million yuan ($ 2.135 million) over the past year. fiscal year 2018, due to strong growth in paying customers and increased revenue. customer, reflecting products with higher added value. They recently added major customers to China National Petroleum Corporation, Malaysia Digital Economy Corporation and Cathay Pacific.

Digital Media and Entertainment (YouTube)

(Youku)

Youku is an online streaming platform that is very similar to Youtube. Users can view and download their own videos as well as broadcast TV series. I must note that China differs from the United States in that there are many competitors in this space, including iQiyi (IQ) and Tencent Video (OTCPK: TCEHY). Youku is part of the "Digital Media and Entertainment" division, which grew 34% of its revenues and 160% of its daily subscribers on average last year.

We have seen that Baba owns the eBay market platform, Amazon's e-commerce and cloud services, and an online streaming presence like Youtube.

Strategic Investments

In addition to its core businesses, BABA also holds stakes in a number of companies. This includes a 33% stake in Ant Financial that they incurred during the 2011 fiscal year, which is the owner of Alipay. Alipay is very similar to Paypal (PYPL) and has 870 million active users a year in the world. While it may be unbelievable for Americans to believe this, China is arguably more advanced in accepting mobile payments, with as many stores accepting mobile payments as CNBC has recently stated that it is more likely to be more mobile. money was almost dead in mainland China:

(PYMNTS.com)

Alipay is currently the leader in the mobile payments market, closely followed by TCEHY's WeChat salary

Social Media Presence

As reported in their annual report, they also 31% stake in Sina Weibo (WB). While many have given the title of "Facebook (FB) of China" to WeChat of Tencent, in reality WeChat is more like Facebook Messenger. The real application that gives you this famous "Facebook feed" and this profile page is actually the giant of the internet Weibo:

(weibo.com)

In his last quarterly report, Weibo reported a 20.5% growth of UAE to 411 million UAE

Financials

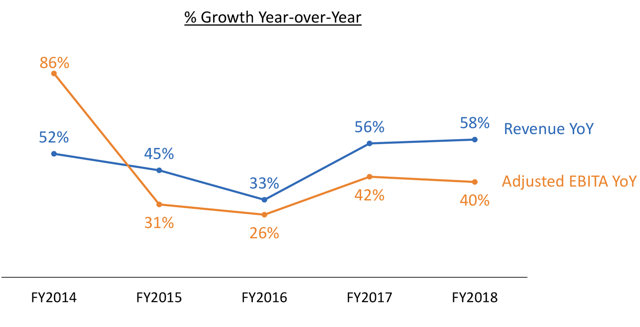

As a weed, Baba has seen good financial results:

(Presentation in the quarter of March 2018)

For fiscal year 19, they predict a growth in their revenues of more than 60% of a year on l & # 39; other. With a market capitalization of 484 billion dollars, BABA achieves 47.5 times its profit. In addition, they have a strong balance sheet as typical of great technology stocks. In the last quarter, BABA had a cash balance of $ 32.7 billion, debt of $ 18.9 billion and equity investments totaling $ 22.3 billion. It is a company that is doing well at just over 42 times the anticipated profits.

If we consider all of the attractive companies, very strong growth and equally attractive valuation, everything is underway. This business benefits from a growing economy, a growing market and a pricing power.

In 2016, famed short-seller Jim Chanos publicly revealed a short position on Baba due to "accounting irregularities". evidence (at least publicly) to its assumption, this raises an important point about non-US companies in that they can not undergo the same rigorous scrutiny as US companies. There can always be a bias towards these companies. And I'll be honest, when I went through their financial statements, I also thought I was looking at an accounting scam.

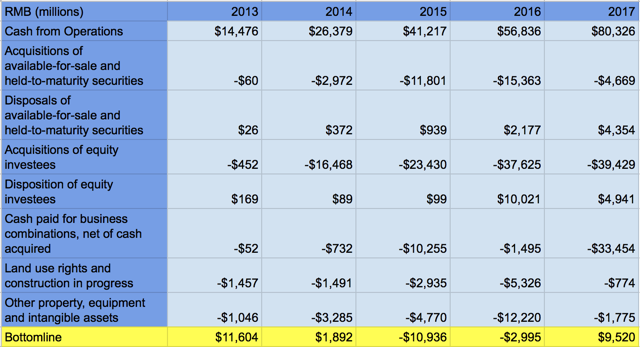

Looking at their cash flow statement, I noticed something concerning:

(Graph by Author, Data from Annual Reports)

While they produce large amounts of cash from operations, they invest every year in funds in "equity acquisitions". "Is it possible that they send money to these" affiliates "who in turn" repay "that same money to Baba, giving the appearance of a growth in the account "It was one of Chanos' biggest concerns that wondered if Baba used such methods to simulate the numbers."

After some research though, it appears that their payments to these "affiliates" Are direct acquisitions of companies or equities, such as their acquisition of Youkou in RMB of RMB 28.7 billion in 2016. However, a complete breakdown of all their equity investments in list form would further clarify their positions.

"Available for sale and held until maturity The securities" sound like safe bonds, with which I can live, but I'm hopeful that " they will highlight these investments in their balance sheets, just as do the big tech companies in the United States. I, and I believe that other shareholders too, really want to know exactly what investments they own.

The fact that they retain so much profit for acquisitions increases the risk that these acquisitions will lose value in the future, thus requiring great confidence in the management's assessment of acquisitions. A good share buyback program and dividends would go a long way towards demonstrating management's commitment to returning cash to shareholders. It's something I even believe that technology companies in the United States need to improve (I'm not a big fan of cash), but Baba even more because of the "Chinese bias" added.

They "only" China

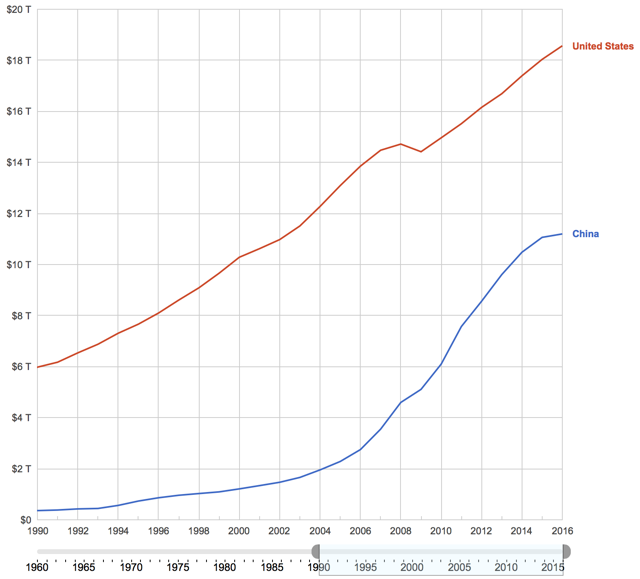

For now, one of the main problems that BABA is facing is that their platform has mainly been used only for domestic purposes. So, a typical response of the bear is: how much can the Chinese economy grow?

In terms of GDP, China has experienced accelerated growth over the last decade:

(World Bank)

Looking at these numbers, I do not have any concerns about the Chinese market.

Like AMZN, Baba also benefits from the strong trend of business towards e-commerce. Combine this trend with a growing global economy, and you have the very strong tailwind fabric. Even though I believe that Baba will eventually grow on a global scale, the point here is that "only China" is more than OK

What about the government?

I can not finish without discussing the potential risk of the Chinese Government. With President Xi Jin Ping recently edifying the maximum warrants (he will be president for life), it is reasonable to be skeptical of this government. In addition, BABA operates as part of a complex structure of variable interest entities ("LIFE") incorporated in the Cayman Islands to avoid the more stringent regulations applicable to companies incorporated in the United States. Mainland China. This means that BABA shareholders own a holding company whose contracts give them "ownership" of Alibaba's profits. Will the Chinese government continue to allow this in the future? It is true that the Chinese government could at any time choose to invalidate the VIE to the detriment of the shareholders. I do not think that would happen. The consequences would be long-lasting and effectively cut off access to American (or foreign) capital in the future. However, readers should keep this risk very serious in mind.

Conclusion

BABA is a fast-growing technology behemoth that has the activities of AMZN, EBAY, PYPL, YouTube and FB in one roof. Investors may have stayed away due to political risk, opaque accounting and simply because they do not know what BABA is doing. I believe it is one of the largest growth companies of our time, which is precisely in a world far away from here. This recent withdrawal made its valuation very attractive, so I share a purchase of conviction.

If you liked this article, scroll down and click "Follow" next to my name to miss any of my future posts. I have a reputation for responding to every comment, leave a comment below!

Disclosure: I am / we are long GOOG, FB, TCEHY, BABA, AMZN.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose title is mentioned in this article.

Editor's Note: This article deals with one or more securities that are not traded on a large US market. Be aware of the risks associated with these stocks.

[ad_2]

Source link