[ad_1]

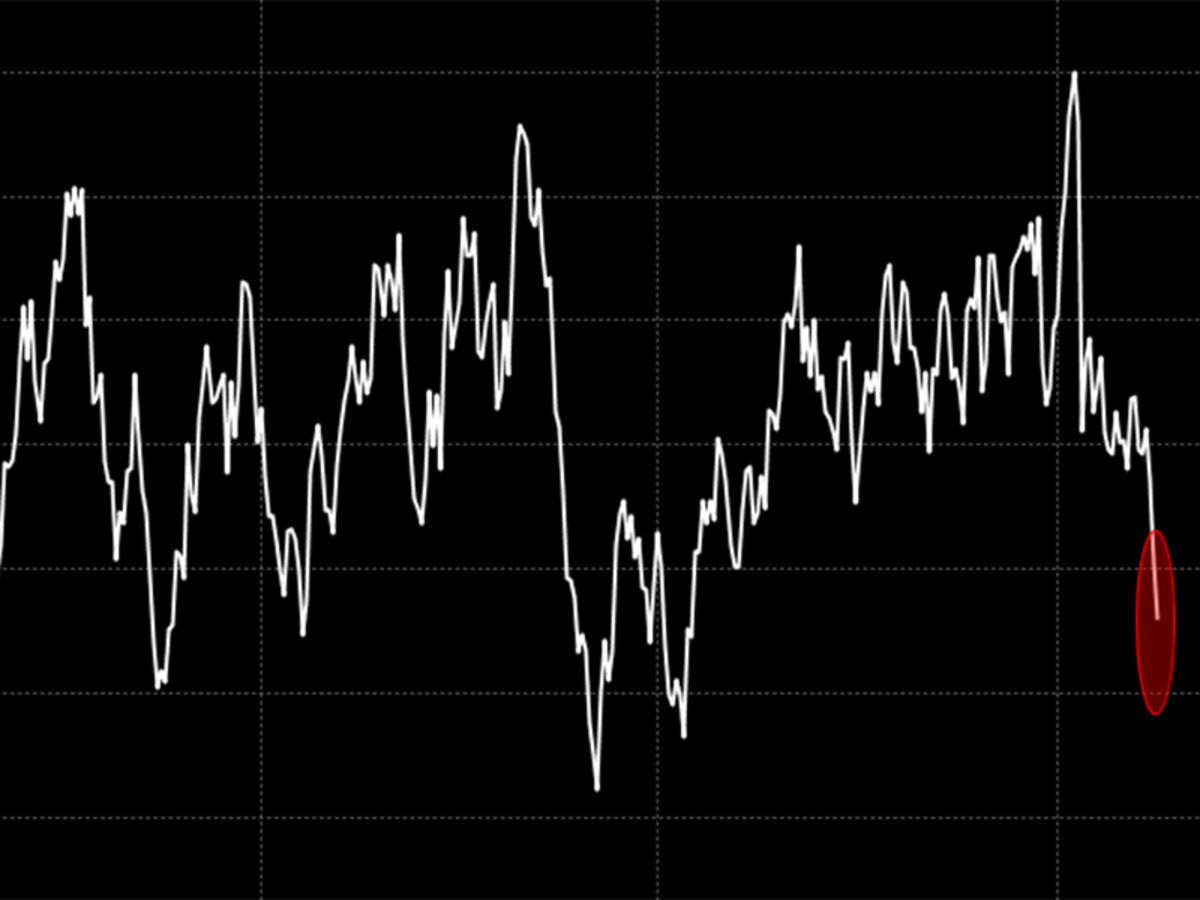

The Hang Seng China Enterprises index shows how much the needle on China has gone from greed to fear.

In January, the Hong Kong-listed Chinese stock index was up at the fastest pace among major indices, with a dizzying 16% gain that included a record-breaking 19-day series. Sellers were hard to find because investors were afraid of missing a rally few saw finishing soon.

Now, the 50-member tonnage of some of the biggest Chinese companies has entered a bear market, having fallen more than 20% from its peak this month. Concerns about the economy of the nation are once again in the minds of investors, while a weakened currency brings up fears of a competitive devaluation amidst a risk of trade war. The collapse of domestically traded stocks is also becoming too important to ignore, with the Shanghai benchmark plummeting to its lowest level in two years.

The Hang Seng China index closed down 2.2% at the close, the lowest since September. In a mirror image of the January hype, superlatives are easy to find. The measure has fallen for nine of the last 10 days, while its relative strength is the weakest since a defeat in early 2016.

The Industrial and Commercial Bank of China Ltd., one of the largest companies in the country, has lost a record for 13 days. Air China Ltd. lost 26% in a 10-day decline, as the depreciation of the yuan pushed up the cost of repaying dollar denominated debt of airlines. Tencent Holdings Ltd., last year superstar, has resulted in a global technology rally with a collapse of $ 120 billion. Ping An Insurance Co., which more than doubled in 2017, has fallen 12 percent this year.

The Hang Seng Index, which includes non-Chinese companies, is doing a little better. The gauge lost 14% from its January high, thanks to gains made by Hong Kong companies such as Hang Seng Bank Ltd. and Wharf Real Estate Investment Co.

Source link