[ad_1]

This Sunday is November 11, a propitious date in the Chinese tech community as it marks Single's Day, the largest online shopping day in the world. This year is particularly poignant since it will be the tenth edition of the annual event – also known as Double Eleven – since it was created by Alibaba, the Chinese giant. e-commerce.

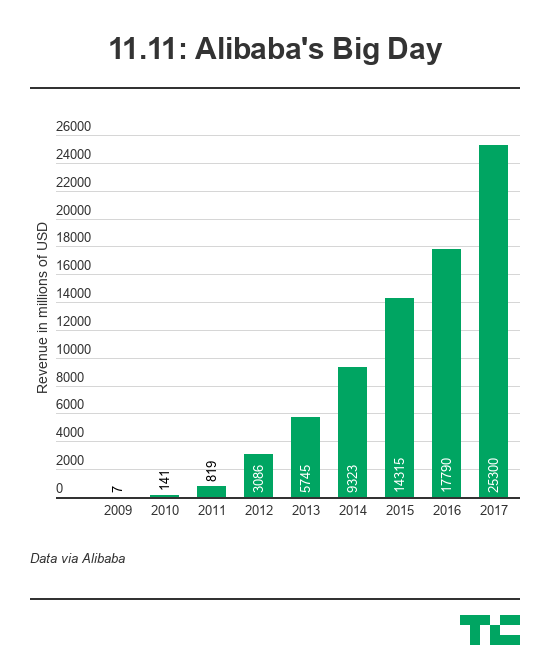

Singles day is a huge deal today. Alibaba sold more than $ 25 billion worth of goods last year, 11.11 companies having left China to settle in other parts of Asia and beyond. The company has consistently increased its revenue year-over-year. So it is fair to hope that trade is trading at $ 35 billion or more this Sunday, despite doubts about the Chinese economy and the continuation of the trade war with the United States.

We looked at the phenomenon so that, this year, you are well prepared for what to expect.

What is it?

The event appears on Black Friday and Cyber Monday in the United States, but is 2.5 times larger than the two dates combined. Alibaba offers a range of products on its online sales platforms, including its Taobao Marketplace, Tmall Brand Store, AliExpress Global Services and – more recently – its global business. Lazada in Southeast Asia and the Indian group Paytm, where Alibaba and Ant Financial are the main investors.

The sale covers obvious goods such as smartphones, televisions and other expensive consumer goods, but also fashion, clothing, furniture, health products and more. The least expected items that sell well include cleaning products, toilet paper and perishable goods. There is also a strong demand for cars.

In total, Alibaba recorded 1.48 billion transactions worldwide last year, with a peak of 325,000 orders per second. His payment service Alipay synchronized 1.5 billion payment transactions for a total of orders 812 million. Meanwhile, 90% of sales were generated by mobile devices, which is well ahead of the United States, which recorded 37% at Black Friday and 33% at Cyber Monday.

Alibaba's 11.11 sales surpassed the record $ 25 billion in 2017 (Image via Alibaba)

Alibaba is also pushing the festival to offline retail, according to its own company, which has grown into physical stores through its own Hema brand and partnerships with major retailers in China, such as the Suning technology giant and hypermarket operator Sun Art.

It was renamed "11.11 Global Shopping Festival" in 2015 to reflect Alibaba's efforts to increase sales outside its main market in China. Last year, he claimed to have attracted more than 60,000 international brands with customers in more than 225 countries.

In the beginning

November 11 was not always synonymous with buying discounted products online. The date first appeared in China in the 1990s, while it was reportedly promoted as a day of celebration of the bachelor's degree because it represents four singles. She then took on a new meaning as a day to celebrate relationships – it's a huge popular date for weddings – and to find potential partners.

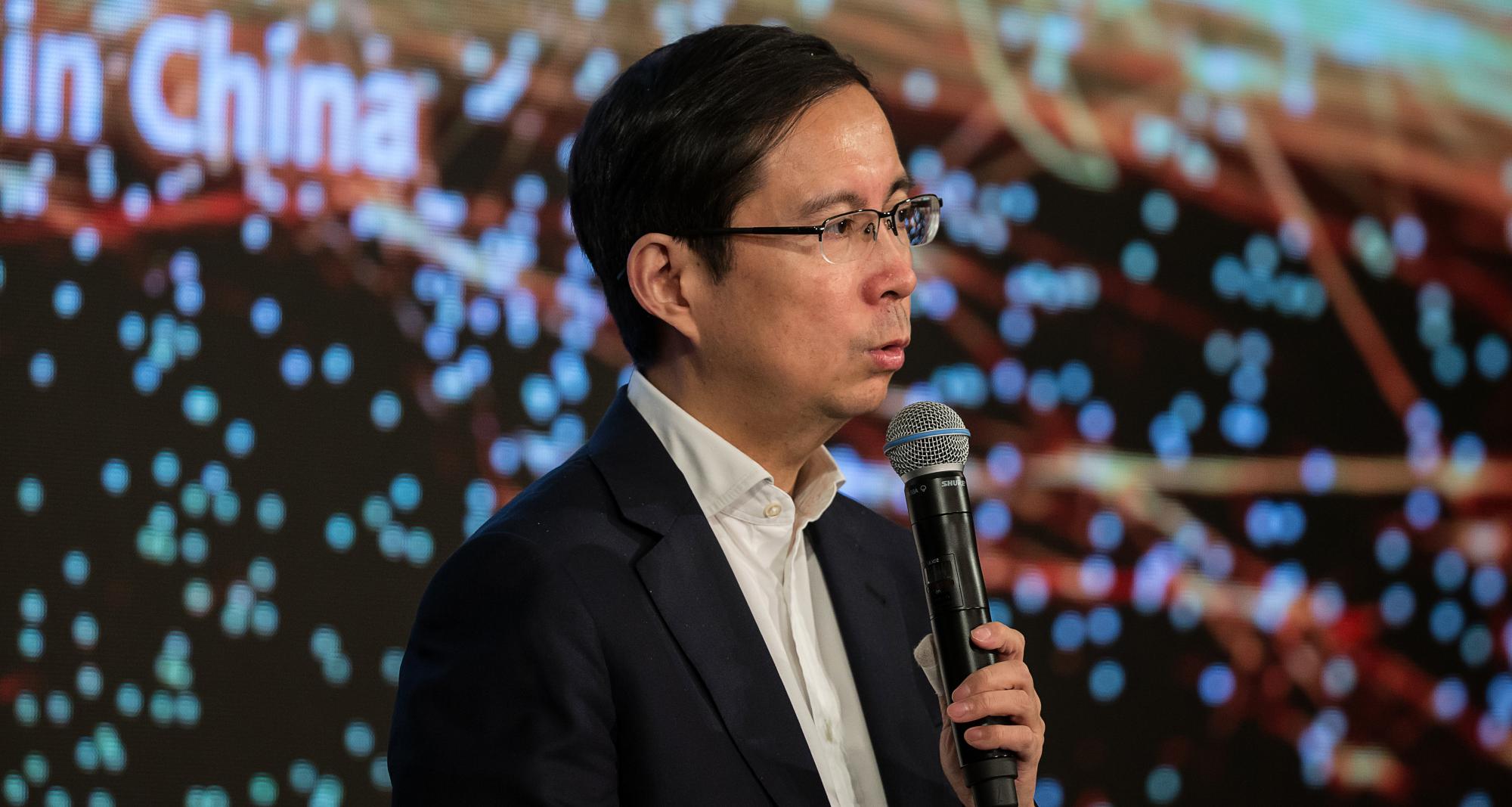

The e-commerce component arrived in 2009 when a leader named Daniel Zhang used this date to promote Tmall, Alibaba's virtual mall for brands, with just 27 participating merchants. Zhang, then head of Tmall's business, is now the CEO of Alibaba himself. He will become the cabinet chairman when Jack Ma – the figurehead of Alibaba for many years – will finally withdraw from next year.

In 2009, Alibaba brought in about $ 7 million on the first day of the single. Sending to CNN this week, Zhang said that he "never expected" that the promotion would become such a huge phenomenon for Alibaba and for the e-commerce industry in general.

Alibaba CEO Daniel Zhang launched the Single Day shopping festival in 2009 while running the company's Tmall business (Image via Vivek Prakash / Bloomberg via Getty Images)

Beyond Alibaba

While Singles Day flourished as a national celebration, other e-commerce players, such as JD.com and Pinduoduo, also teamed up to capitalize on a month of heavy consumption. JD.com, for example, has seen a 21.1% increase in the number of active users of its mobile application on Nov. 11, according to market research firm QuestMobile.

The warm reception of the event also inspired festivals competing throughout the year. In 2010, JD.com, which ranked behind Alibaba in terms of transaction volume, manages its Single Day festival over a 12-day period and launched its own mid-year shopping event that falls on June 18th. Suning, a major Chinese home appliance retailer, turned its August 18 anniversary into a sales event.

However, none of the newcomers has managed to match the size of Singles Day, and Alibaba continues to push the boundaries of the world's largest trade event.

An 11.11 advertisement in New York (Image via Alibaba)

Not just numbers

Singles Day continues to grow each year, but sales have slowed. Year-on-year growth in gross merchandise volume increased from just under 65% in 2014 to around 40% in 2017.

But Jack Ma has always been keen to downplay the importance of these numbers. In 2013, he told the Chinese press on the eve of November 11 that he did not care about the sales figures. He reiterated a similar message in the following years.

Rather than scale, Ma said he was looking for "steady" growth. This is because purchases require a global infrastructure to support functions such as logistics and payments.

Ma's words are in line with the company's constant search for potential partners to feed its retail ecosystem. Last year, Alibaba paid $ 717 million to Huitongda, which manages an infrastructure that allows online retailers to sell to rural customers – who are also participating in Singles Day.

Similarly, Ant Financial, Alibaba's financial subsidiary, has set aside a number of payment solutions companies around the world to support the global reach of the e-commerce company, while the IT division in Alibaba The company's cloud is busy selling $ 25 billion worth of goods each year. Then there is the Cainiao Network logistics platform, which helps handle the 812 million orders placed in China last year.

On the occasion of Single-Day, Alibaba has adopted leading-edge technology on a large scale. Last year, she launched into the RA – Maybelline let her customers try their lipstick virtually – Nike is one of the brands that used gamification to attract customers and Alibaba's Tmall service adopted the "Virtual fitting rooms" to help with the sale of clothing.

Offline sales

Alibaba's president, Ma, also planned what would become a standard for Singles Day today. "We want all e-commerce companies to get involved and all brick and mortar shopping malls to be part of it," he said.

In 2016, Ma coined the term "new retail" to describe a future of seamless integration between online and offline retail sales. Last year marked the beginning of the offline shopping festival campaign. This year, 200,000 physical stores registered for Singles Day to offer discounts to Alibaba customers. For example, a user can get offline offers when he uses Alibaba's Alipay electronic wallet to pay at a mall. Alibaba also uses Alipay to distribute cash prizes in red wallet contests.

Alibaba said last year that New Retail "had shown promises" at 11.11, but declined to provide figures. This year, given the physical advancement of the retail business, Alibaba now operates more than 30 stores and includes payment based on facial recognition. The offline component will be more important than ever. In addition to Hema and InTime physical purchases, this also includes Ele.me deliveries – and Starbucks – and the rest of its local service delivery platform.

Alibaba's 11.11 contracts will now include Starbucks coffee, which can be ordered exclusively through its Ele.me delivery service through a partnership with the American coffee chain (Image via Alibaba)

Expectations for 2018

Forecasts for this year's 2018 Singles Day are difficult, as they fall within the context of China's economic struggles and the US-China trade war, which has led to the pricing of billion of goods. However, with the majority of Alibaba's sales continuing in China, both on November 11 and the rest of the year, it is unlikely that, despite its progress in international growth, US government United are made to feel.

Nevertheless, some key factors:

- Slower growth: Alibaba's quarterly revenues continue to grow healthy (more than 40%), but the rate itself is slowing, the same goes for 11.11.

- Offline: Alibaba is doing a concerted off-line retail campaign to offset the saturation of e-commerce with more offers for direct buyers

- Services: Its services and on-demand distribution platform, valued at $ 30 billion, will play a bigger role in China by offering 11.11 offers

- payments: Alipay expands its 11.11 offerings by offering discounts to paying buyers via the online or offline application

- More global: Alibaba's international footprint continues to grow and it is pushing 11.11 even stronger in Southeast Asia, where it has established links with China-based vendors, while Alibaba now has specific projects in Russia and Japan. Pakistan / South Asia with whom to work.

Whatever it is, Alibaba is organizing a real show for the whole world on 11.11.

There is first an entertainment show that takes place on the eve of the festival and you can expect constant updates from Alibaba's Twitter account during the 24-hour period itself. We will also be following the latest developments for you right here on Techcrunch.com, so stay tuned for more.

The 11.11st edition of this year is the tenth and final finale of Alibaba before Jack Ma's retirement (Image via VCG / Getty Images).

[ad_2]

Source link