[ad_1]

Chinese financial markets are rediscovering an unparalleled risk appetite for months, inspiring the government's biggest push to boost the slowdown this year

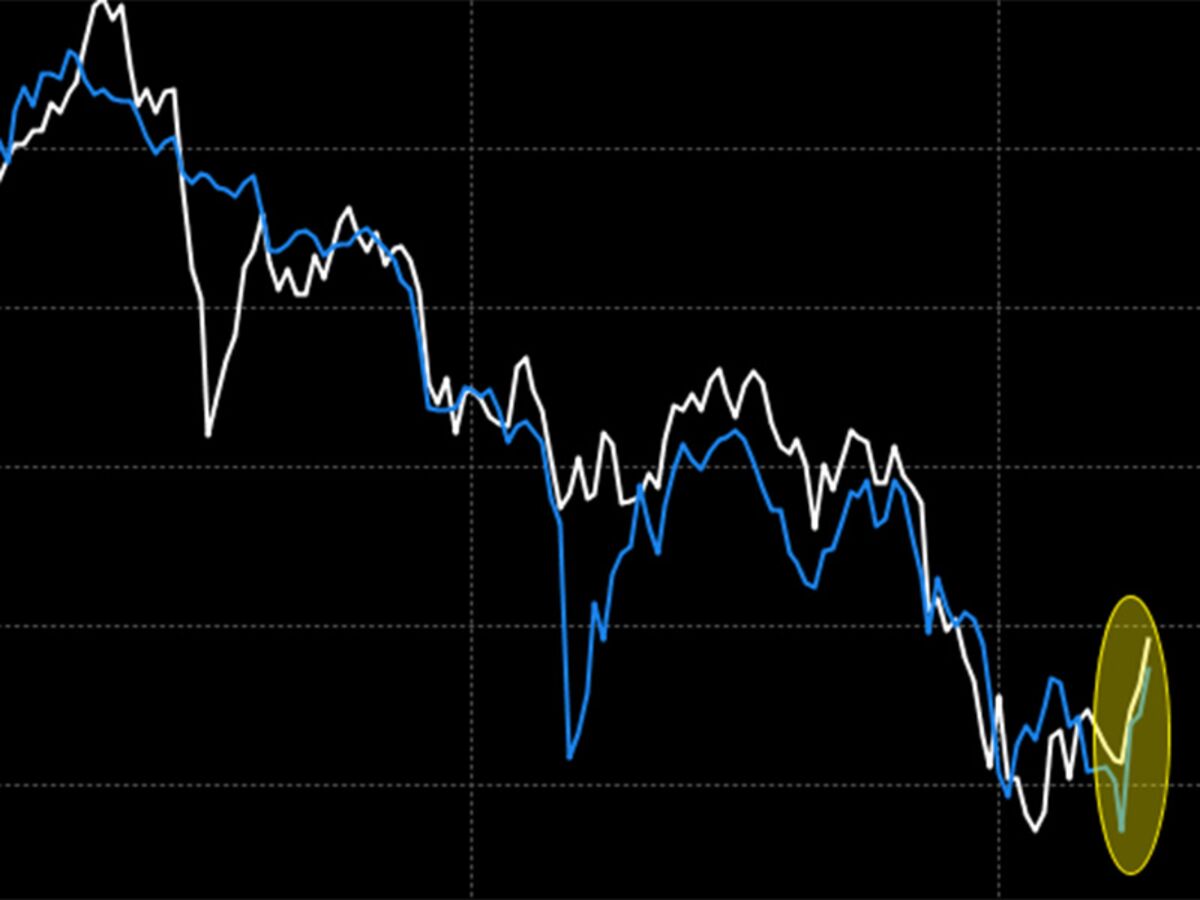

The CSI 300 Continental Equity Index soared 1.6% on Tuesday. Three-day gain since mid-August 2016, when economic indicators confirmed China's efforts to stabilize a slowdown at the time. Although there is no guarantee of success this time, with the X factor of a trade dispute with the United States at stake, traders are betting big.

The yuan fell Tuesday to the weakest in more than a year against the dollar, a day after a record injection of financing to lenders by the People's Bank of China. And 10-year government bond yields rebounded from their lows since April of last year.

These movements could herald the end of bearish sentiment that has been shaking Chinese markets for months. Investors fled the equities and bonded themselves, frightened by a deleveraging campaign that contributed to a record number of corporate failures and a decline in public investment. The outlook for US tariff increases on a growing share of Chinese exports has not helped. "This is a concrete sign of coordinated stimulus and one of the key factors weighing on Chinese markets," said Aidan Yao, senior economist at AXA Investment. Asia Ltd. in Hong Kong. "Fiscal and Monetary Authorities Provide Cash to Support the Economy For markets last week has really reduced domestic risks."

Among the measures taken by policy makers who encourage traders:

- ] A statement from the State Council Monday that tax policy should be " more proactive." 19659010] The PBOC's offer of 502 billion yuan ($ 74 billion) in loans from A year to banks on Monday, greater use of the medium-term loan facility since its launch in 2014.

- easing the implementation of the more stringent regulation of wealth management products [19659011] that had fueled the shadow banking sector.

- Guo Shuqing, head of China's Banking and Insurance Regulator summoned leaders of the country's largest banks on July 17 and urged them to take the initiative to revive loans, especially to small and micro enterprises.

Banking stocks were among the biggest beneficiaries of the current recovery, rising by 6.5% in three days for their best performance in almost two years. Industrial companies – a group that would benefit from infrastructure projects – climbed 3% Tuesday, their strongest rally since May 2016. Materials stocks also recovered.

The CSI 300 experienced a big turnaround a low of 14 months. Even the forecast of the best earnings growth in eight years was not enough to attract buyers.

There are many reasons to be cautious. Some analysts say China should not accept the magnitude of the stimulus measures of past years, with President Xi Jinping and his lieutenants repeatedly voicing their concerns about the dangers of leverage and l Accumulation of financial risks. The end of President Donald Trump's game to limit Chinese companies' access to the world's largest economy is also unknown.

"Even if the stimulating measures support the market and the economy, that does not change anything" Asian economist at Banco Bilbao Vizcaya Argentaria SA. "China will continue to crack down on the shadow banking system, which will further weigh on banks' long-term liquidity – it's just that the pace will be slower.This is not a turning point for sustained growth in riskier stocks and bonds. "

This will probably not prevent equities from joining the PBOC's upcoming easing move. Economists generally expect further cuts in the reserve requirement ratio, unlocking liquidity in a financial system constrained by the steady decline in money supply gains.

Recent measures "provide important guarantees to pro-active government policy investors to contain growth risks." Economists at United Overseas Bank Ltd., Suan Teck Kin and Ho Woei Chen wrote in a note to clients on Tuesday [19659002] – With the help of Yinan Zhao and Tian Chen

Source link