[ad_1]

New Chipotle Mexican Grill General Manager (NYSE: CMG) Brian Niccol, took the lead of the fast-casual pioneer early March. While he was hinting at some of his plans for the brand on the company's revenue call in the first quarter of late April, Niccol unveiled his comprehensive strategic plan at a press conference call. analyst Wednesday afternoon.

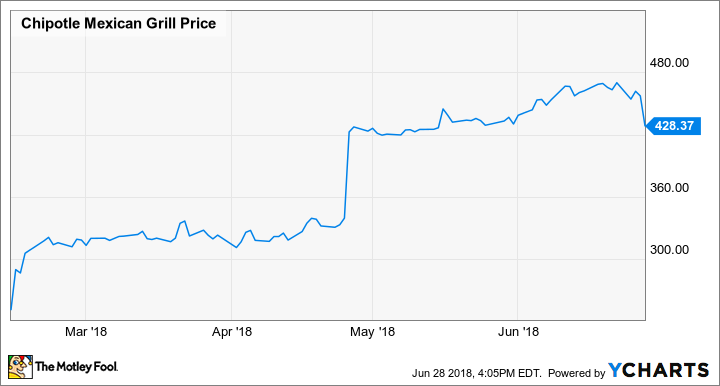

Chipotle lost more than 6% on Thursday suggesting that investors were not entirely satisfied with what they heard. That said, the Chipotle stock had jumped 87% between Feb. 13 – the date the CEO was announced – and the end of last week, so Niccol should have stepped on the water to answer the question. high expectations of investors

Performance of Chipotle shares, February 13, 2018-present; given by YCharts.

However, leaving aside expectations, Niccol and his management team presented a promising turnaround plan. The plan will take time to grow, but over the next few years it should lead to a necessary rebound in sales growth and profitability in Chipotle.

Major changes to the horizon

Four of them seem particularly important: the innovation of the menus, the update of marketing, the introduction of a loyalty program and focus on digital sales.

First, Chipotle recently tested several new kitchen products in New York: "quesadillas, nachos, chocolate milkshakes, tostadas to avocado, and a new salad." Chipotle will also try to offer a special happy hour taco at $ 2 between 2pm. and 17 pm, in order to drive the traffic of "nibbling" during the quieter hours of the afternoon.

In general, Niccol wants Chipotle to continually develop and test new articles. However, there will be a rigorous process governing the deployment of new items. They will first be tested in a handful of Chipotle restaurants to ensure that the customer's reception is positive and the flow remains high. It is only after new objects encounter these obstacles that they will become national. This process can take 18 to 36 months in many cases, especially if the items require new equipment.

Chipotle restaurants will get new menu items – eventually. Image Source: Chipotle Mexican Grill

Second, Chipotle is making big changes to its marketing strategy. Niccol and Chris Brandt, Chipotle's new marketing director, have discovered that the company has not effectively allocated its marketing funds. In the future, Chipotle will rely more on TV spots, which it used barely in the past. They also believe that the company's advertising campaigns must be more attractive and lightweight.

Third, Chipotle will finally launch a permanent loyalty program, which will be tested in late 2018 before a full rollout in 2019. Details still need to be worked out, but the program will reward purchases made in-store or via the Chipotle app . Like many loyalty programs, the Chipotle program will be designed to encourage customers to visit more frequently and try new items, and it will enable one-to-one personalized marketing.

Fourth, Chipotle will work to raise awareness -Improved mobile application. The company works in partnership with third party delivery services to enable the delivery of most of its restaurants, and at the end of the year, customers will be able to order delivery from the Chipotle app in the most places.

mobile pick-up stations to make it easier for customers to find food. A secondary benefit is that the stations announce the availability of the mobile order. In the long run, Chipotle sees digital sales as a multi-billion dollar opportunity. By way of comparison, digital sales did not even reach $ 500 million last year

Investors wanted more details

The main grievance of analysts who participated in it Last week's call was that management did not say much. did not give enough details about the proposed initiatives

For example, Chipotle provided no target profit or estimate of the impact of the various initiatives described on Wednesday. In addition, the expected timing of the expected turnaround remained unclear. Since Chipotle shares were traded more than 50 times by analysts in 2018 before the analysts call, it's easy to see why investors left unsatisfied.

It's a solid plan

Although investors' frustration is understandable, it was not realistic to expect a firm timetable and dollar amounts for the impact of each initiative. For example, Chipotle's disciplined approach to menu expansion means that management can not say how many items will be tested in the full chain or when that will happen .

Similarly, it is too early to estimate sales growth that could be driven by better marketing. Chipotle is still months away from getting the end results of its customer search. Meanwhile, Chipotle's loyalty program is likely to evolve as it is tested, complicating any estimate of its potential impact.

However, although management has not provided firm figures, it is clear that this opportunity is enormous. Sales per restaurant are expected to increase by 30% just to reach the previous peak, which was reached in 2015 with lower menu prices and much lower volumes of catering and mobile orders, which can be prepared on a separate line. In addition to boosting sales, rising sales per restaurant would have a huge positive impact on Chipotle's margin performance.

Chipotle is finally on the right track, with many promising initiatives to boost sales and profit growth. Investors who want to stay patient for a few years can make substantial gains.

[ad_2]

Source link