[ad_1]

Hello and welcome to our coverage of the global economy, financial markets, the euro zone and businesses.

It's a great day for news from the central bank. Policy makers from the Bank of England, the European Central Bank and the Bank of Turkey are all meeting today to set monetary policy and also trigger some fireworks.

After raising interest rates to 0.75% last month, the BoE should not do it again today. But it may leave clues as to when the next rate hike could occur. We could also have an update on the Brexit Bank's views, now that Governor Mark Carney has agreed to extend his term until January 2020.

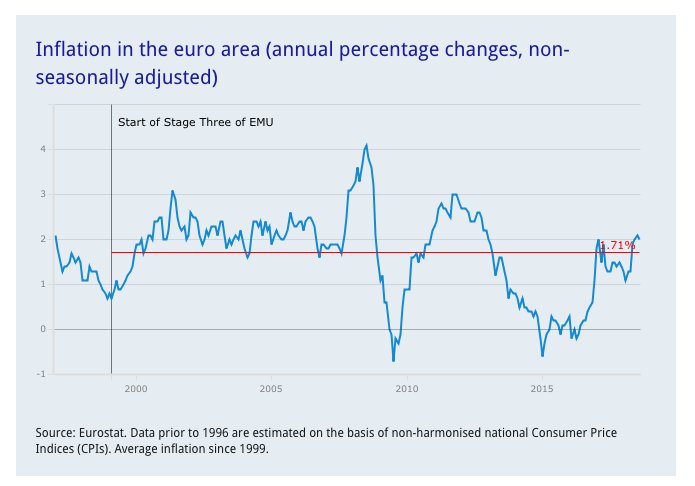

The European Central Bank will not raise interest rates either today. But there will be a deterioration in its growth forecasts for the region, according to a leak yesterday.

This could lead to a difficult meeting today, as the ECB recently agreed to end its stimulus package in December.

ACEMAXX ANALYSIS

(@acemaxx)ECB should cut forecasts for eurozone growth rate, reports @ mattmiller1973 @BloombergTVgraph @ECB pic.twitter.com/uQOeUcnHzw

And what about Turkey? As inflation rises and its currency falls to record levels last month, the Central Bank of the Republic of Turkey (CBRT) has every reason to consider a substantial increase in borrowing costs. However, there are political ramifications – President Recep Tayyip Erdoğan is a strident opponent with high interest rates.

Today's meeting is therefore a real test of the independence of the CBRT.

Overall, traders expect a sharp rise in Turkey's benchmark rates from 17.75% to perhaps 21%. This would make life much more difficult for borrowers, but could also make reading difficult.

Kathleen Brooks, Director of Research at Capital Index, says the decision made today

A rate hike would be symbolic for the global financial community. One of the reasons the lira fell so sharply during the summer was partly due to fears about the political climate and President Erdogan's takeover of the central bank for his own economic gain. .

He vehemently denounced the rate hikes, saying that rising interest rates do not dampen inflation, which runs counter to traditional economic theory. He also placed his son-in-law in the Ministry of Finance, which frightened investors and triggered the turmoil in the Turkish financial markets.

If CBRT can return to traditional economic methods to decide the policy, without presidential interference, global investors can then regain confidence in the economic management of the country and return to its financial markets.

Hümeyra Pamuk

(@humeyra_pamuk)Credibility is the word – #Turkeys c. the bank is expected to raise interest rates at Thursday's MPC meeting. The predictions for the hike vary widely between 225 and 725 basis points. "The decision would reflect the priorities of the Turkish authorities" https://t.co/ZGvrQHz0he

It's also a big day for the UK retail sector, with the results of John Lewis and Morrison.

European stock markets should dive into early trading:

IGSquawk

(@IGSquawk)European opening calls:#FTSE 7302 -0.16%#DAX 12004 -0.24%#CAC 5317 -0.29%#MIB 20914 -0.23%#IBEX 9283 -0.26%

L & # 39; s calendar

- 12:00 BST: Bank of England decision on interest rates

- 12:00 BST: Bank of Turkey decision on interest rates

- 12.45 BST: Interest rate decision of the European Central Bank

- 13:30 BST: Press conference of the European Central Bank

- 13:30 BST: US inflation figures for August

[ad_2]

Source link