[ad_1]

A mixed bag crypto market

Wednesday / Thursday, as reported by Ethereum World News, the crypto market has rebounded sharply compared to its weekly lows, many digital assets recording a gain of 5% minimum.

For example, Bitcoin (BTC), long regarded as the "king" of crypto-currencies, has grown from $ 6,200 to $ 6,550 a day. And the altcoins, which were apparently in a capitulation phase, experienced unexpected breakthroughs in all areas, Ethereum increasing by 20% at one point.

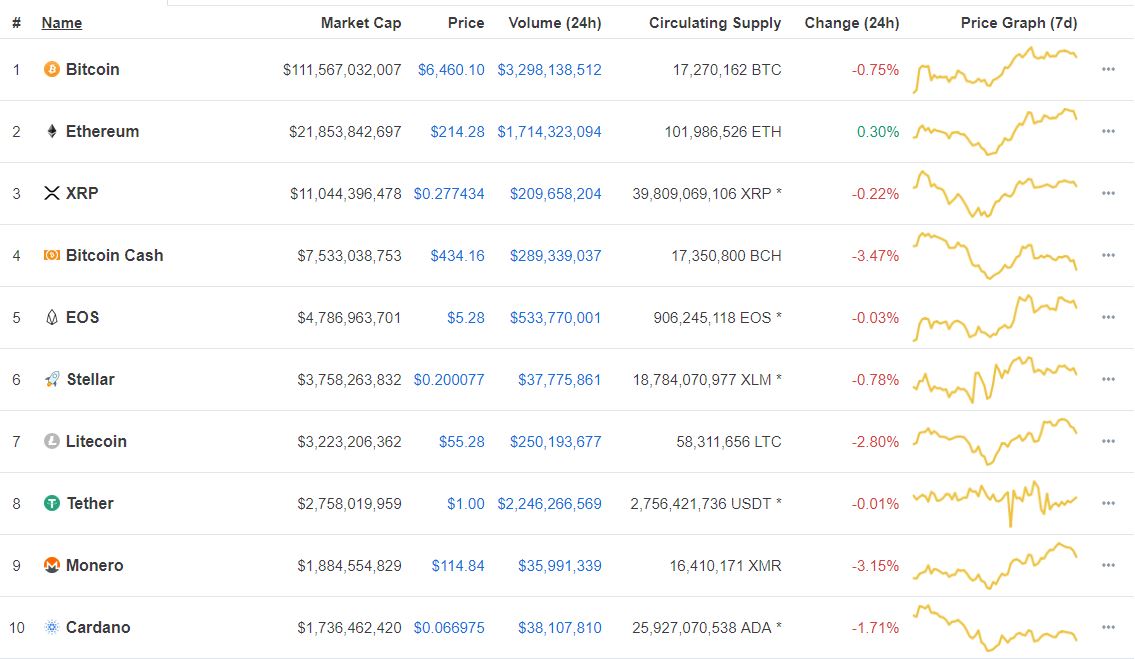

But, now, more than three days after the good rebound, the market has calmed down, with the majority of cryptographic resources barely moving in the last 24 hours. Bitcoin, for one, is down 0.75% and is worth $ 6.460 each, while Ethereum is up 0.3% to $ 214 for each Ether chip.

As seen below, the same was true for the top 10 chips / coins, with the exception of Monero, Bitcoin Cash and Litecoin, which all recorded losses of 3% due to various factors.

Independently, as usual, many investors, analysts and innovators have their eyes fixed on Bitcoin, because the action of the most important encryption asset prices can (and often) dictate the feeling general.

As noted by Brian Stutland, a guest on CNBC's "Futures Now", the $ 6,400- $ 6,500 level can be considered a line of support. indicates that he is ready to go higher. Stutland also noted that it wanted BTC to negotiate more than $ 7,200 in the near future.

Bloomberg analyst: "The sale is exaggerated"

According to an article by Olga Kharif and Kenneth Saxton, via Bloomberg, technical indicators signal that Bitcoin might be ready to introduce it eventually and see a reversal upward. As both indicate, "a reversal indicator of the market that recognizes turning points indicates that the sale is exaggerated".

The lesser-known Williams% R indicator, as it is known in the analysis community, is in a range of 0 to -100 and indicates overbought and oversold levels. Bitcoin is currently at -80, which, as the negative sign suggests, indicates that the asset is currently oversold and that it has been very oversold on it. Bearing this in mind, some believe that Bitcoin could at the very least see a short-term reversal to locate the Williams% R indicator at a level that indicates some form of stability.

However, the indicator may be "subject to [give] "false signals", traders usually take this specific indicator with a grain of salt and use several other methods of analysis to discern future probable price movements. Anyway, even though Bitcoin is oversold, the technical analysis recently revealed that if Bitcoin did not exceed $ 7,316, it would remain in its downtrend.

Photo by Andi Whiskey on Unsplash

loading…

Source link