[ad_1]

A trend in financial journals that I am not a big fan of is going out with their critical articles when star managers are in the midst of a major crisis. Maybe I should not feel sorry for the billionaires, but it's also a disservice to investors. Why do not you post your articles on clubbing or Einhorn's game when its performance is great? The WSJ even finds an anecdote to discredit Einhorn, director of Greenlight and president of Greenlight Re (NASDAQ: GLRE), which dates back to 2001. Seventeen years ago, he apparently criticized Burbank (another failure recent) superstar who recently closed a fund but deserves more patient investors). Come on, seventeen years ago! Really? If you want to write these critical articles, do it when there are many entries in Greenlight. At present, there is not much money left outside. I do not know what is the exact purpose of the article WSJ but it mentions:

- Does not give a lot of information to customers

- Quotes a few dissatisfied customers

- Recently

- Einhorn plays a lot of poker

- He sometimes spends a lot of money in Vegas

- Loved him with his crew to Vegas in a private jet

- a divorce

I'm going review the concerns above one by one and offer my perspective on the Einhorn crisis. I put the words WSJ in quotation marks like this:

People familiar with the fund partly ascribe Mr. Einhorn's troubles to his unconventional manners – by simply being satisfied with the words. valuing stocks, and keeping customers at bay – this has not changed even when investors are rushing.

Many leading hedge fund managers have unconventional methods. Value investors tend to be a contrarian group. If something seems to be a virtue, Einhorn does not change his habits when he loses. You want him to stay true to his winning behavior and not suddenly start spending a lot of time on meetings with clients. That's one of the things Bill Ackman has severely reduced at the end of last year, and his results have improved a lot this year.

I played poker professionally and I found the transition in the world of almost seamless investment. The psychological and mathematical concepts that help you do well are exactly the same. The only reason I think I am more apt to invest than poker, is that it is much slower. By investing, you can skip any bet that you are not sure about. In poker, the blinds will kill you if you do that. Whatever the case may be, it's not a good idea to have a national newspaper written about your gambling trips. The WSJ ends his article with the particularly unpleasant line …

Last month, Mr. Einhorn was back in Las Vegas, playing poker in a high-stakes tournament.

… failing to mention that this is the World Series of Poker. The most important poker event of the year. I'm not sure that Einhorn plays every year, but I think he plays most years and gives his earnings to charity.

Einhorn divorced in 2017. Research shows that this tends to affect investment results by managers. I would say you're going out now, you're probably too late. Performance tends to rebound.

Why is Einhorn so bad?

I think people greatly underestimate the chance of investing. Just like poker, you can run terrifying while you make the right decisions. An interesting reading in this regard is AlphaArchitect "Even God would be fired as an active portfolio manager." Einhorn is good, but he is not God.

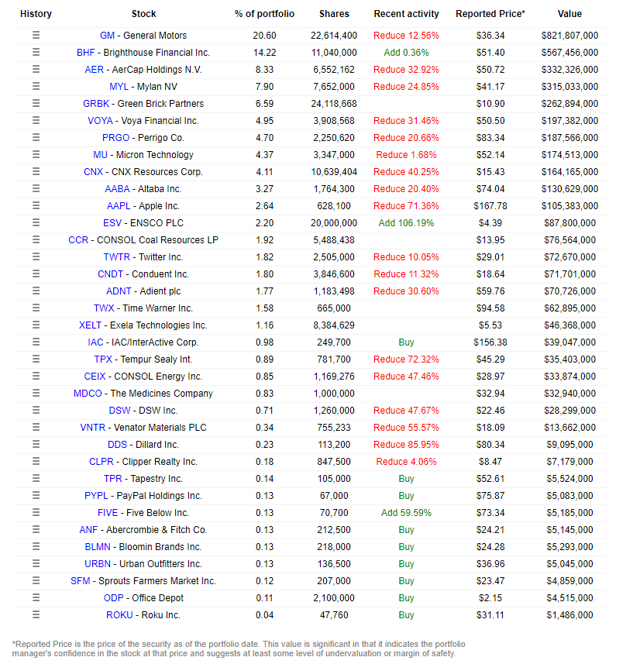

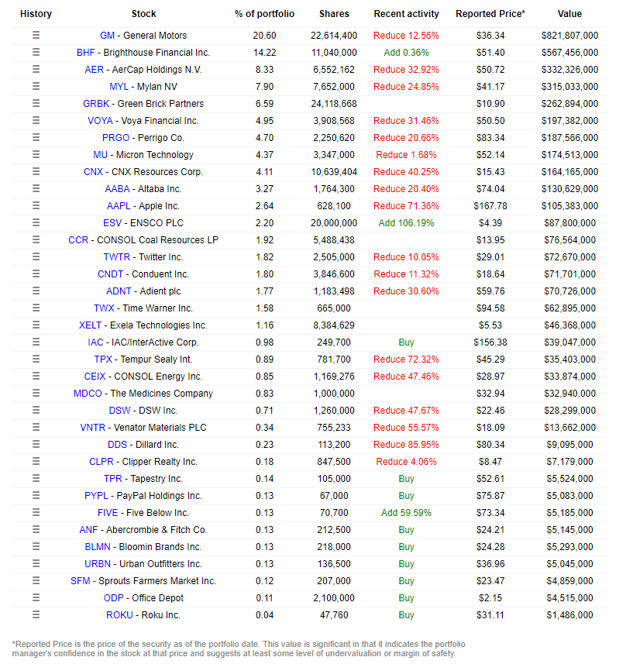

Here is the portfolio of Einhorn after 13-F followed by Dataroma:

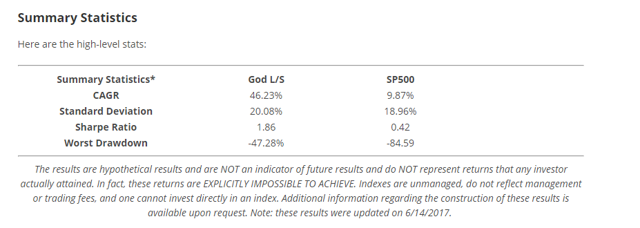

Einhorn also runs a small book against what is smaller in size. Overall, it probably has a net exposure of only 20-40%. From this point of view, a drop of -15% is really bad. But if you look at Einhorn's wallet, you'll notice the huge long positions in the top 5. He's making very concentrated bets. If you take note of AlphaArchitect's research, it shows that a long / short GOD portfolio with 0% net exposure still suffers decreases of -47.28%

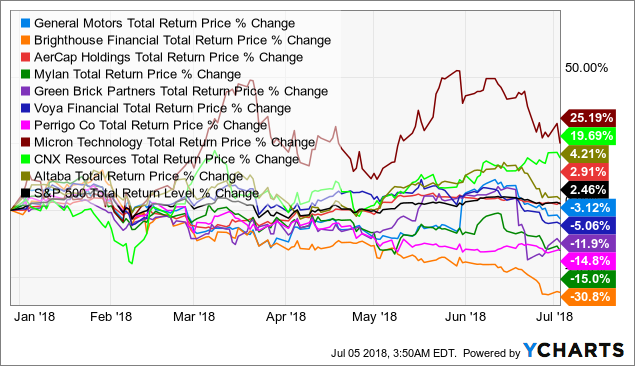

The graph below Below shows the performance of the 10 long positions of Einhorn in the 13-F:

GM Total Yield Data by YCharts

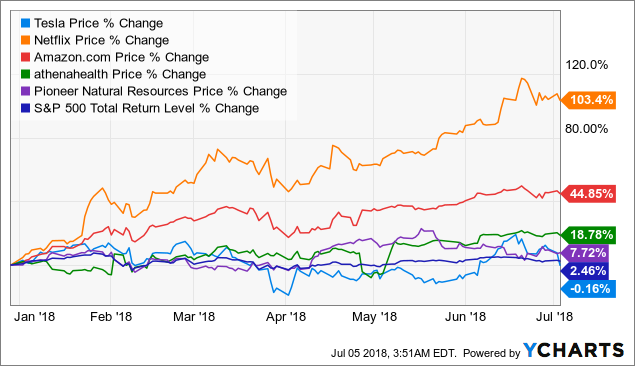

The chart below shows the performances of the short positions that he recently revealed:

TSLA data by YCharts

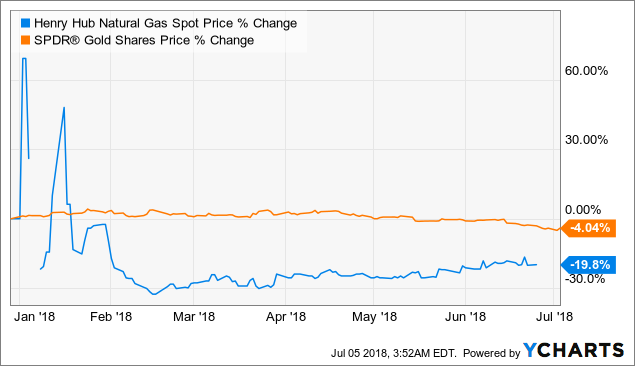

I also think he holds a long position in gold and probably a long natural gas (he may have closed that one) :

Henry Hub Natural Gas Spot Price by YCharts

I can not find a chart, but Einhorn can also be short Italian bonds, and it's a bet that's worth it. has probably gone well recently.

Einhorn is fighting because his shows are hurting me and his shorts are moving against him. This is attributed to him stubbornly in keeping with his value investing philosophy. And indeed, we see this reflected in the value and growth indices. Over the past 5 and 10 years, growth has outperformed the value

The IWN Data by YCharts

This is actually something that only happens very rarely. Historically, value crushes growth:

^ RUJ data by YCharts

Some investors said that they wanted Mr. Einhorn to adopt high-growth stocks like his friend Daniel Loeb, who runs the hedge fund Third Point LLC, which bought two million shares of Netflix (NASDAQ: NFLX) last year.

Of course, investors want you to do something after the fact. It could be argued that the super-investors should have understood the effect of real rates below zero and QE 1-3: stealing growth stocks. I can not blame them for not having planned this. In fact, I think that if it was possible to do stock market simulations after 2008, this could prove to be an unlikely outcome. You have to take into account that since 08, the Fed, other central banks, voters and politicians could have made many different decisions. Some slightly different decisions and some gold, a small important book and long money gains could have turned out a lot better.

Proponents point to Greenlight's stellar annual returns since inception: 15% vs. 8.7% for the S & P 500 and 7.5% for the equity-based average Hedge Fund, according to HFR

. Einhorn had some bad years. It's good to criticize it, but this article WSJ seems to me bad taste. I often study his portfolio and find good ideas among his investments. Rarely I find an investment that I can not understand after examining the fundamentals of the underlying business. Maybe Einhorn is not able to generate 20% per year with a net exposure of 40%. Big surprise. If his long term record ends up at 10% with this kind of exposure, it's still very, very good.

Disclosure: I am / we are long GLRE.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link