[ad_1]

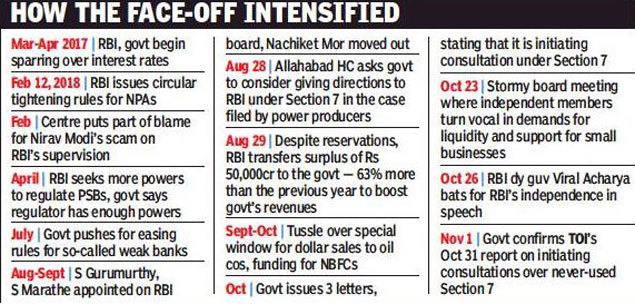

As first reported to you on November 2, RBI refrained from making any public decisions at the October 23 board meeting, even though they had been agreed. At the meeting on Monday, sources said, the two government representatives on the board will want RBI to announce the agreement reached on reducing the flow of credit to micro, small and medium-sized enterprises (MSMEs), a revised framework of corrective measures fast for the weak banks and the alignment of Indian lenders' capital standards on international standards instead of making them more stringent. The government sees this as a crucial step to increase lending.

"The government will want the meeting to start where it ended last month," a senior government official told TOI. The Center also plans to use the platform to look for solutions to alleviate the liquidity pressure on non-bank finance companies (NBFCs), which were struggling with fundraising problems since IL & FS. began not to repay his debts.

The crucial meeting taking place in the context of the threat of invoking Article 7 of the RBI Act, which has never been used, allowing the Center to give instructions, is being monitored after the split between the RBI and the Ministry of Finance. last month (reported for the first time by YOU). Just before that, in a speech, the deputy governor of the RBI, Viral Acharya, had cited the example of Argentina and hinted that undermining the independence of the central bank could be "catastrophic" . Many, including supporters of the RBI, believe that Acharya's statement was excessively aggressive.

This statement came after an unusually long meeting of the board of directors, during which the government's request to address many of its concerns had not been met. As indicated by TOI on October 31, the government had also requested consultations with the RBI on three issues, which was considered a precursor to invoking section 7. This is perceived as the true critical point, given that the Finance and the RBI were not at the rendezvous. same page on several issues for more than a year.

For the central bank, the government's ultimate weapon, Section 7, appeared as a red line. People familiar with the RBI's thinking said that the use of the section would exacerbate the clash between the central bank and the government and worsen the crisis if Monday's board meeting was held under the cloud of secrecy. section 7.

However, the government's aggression may be tempered by the fear that the governor and two of his deputies may choose to leave if they are pushed too far and create an international perception.

Representatives of the RBI should make it clear to its 18-member board that stress in some sectors is not due to lack of liquidity but rather to a crisis of confidence among lenders and the absorptive capacity of small businesses. It is likely that the central bank will retort the argument of available liquidity by pointing out that large short-term NBFC debt repayments took place in November without major default.

However, the government is not impressed by the measures taken so far by the regulator and believes that the pressure on finance companies is crippling their operations and has an impact on the flow of credit in crucial sectors such as construction and small businesses.

Sources suggested that it was best to leave credit flow issues to MSMEs and NBFC issues. On the question of high reserves, they suggested, a large part of the corpus is theoretical. This issue has been debated since 1986, when Finance Secretary S Venkitaramanan had been involved in a bitter battle with RBI Governor, Governor Malhotra, to secure a larger share of the surplus.

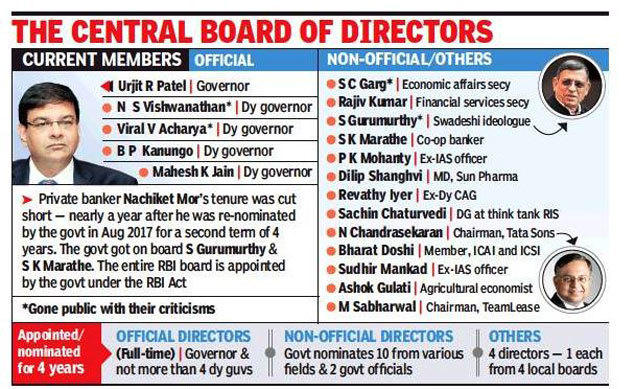

The government has not hidden its wish that the central bank be run by a board of directors – and has been criticized. According to a former central banker, unlike the Fed 's board of directors, the board of directors of the RBI includes people from different backgrounds. They have included CEOs of heavily indebted companies, who should not be allowed to decide on the regulations.

Although the Center may not be using the dreaded Article 7, it wants the council to play a more dominant role, believing that the central bank's management did not meet the needs of the economy and refused to discussions with stakeholders, or even with the government. officials.

If the Center decided to give instructions to the central bank, no academic discussion would be possible and the RBI should implement New Delhi's wishes without going into the details of the decision or providing an assessment of the impact.

A former central banker said that the government should not invoke the article until here unused. "It has not been used during war, famine or any economic crisis. There is no reason for it to be used now, "he said. Many see it as a clash of personalities. Sources said that issues such as the new capital adequacy framework can not be decided during a two-hour meeting, but will need to be reviewed by a group of experts who can deepen the wisdom of the subject and recommend changes.

Source link