[ad_1]

This week begins with huge news for the offshore drilling sector: Ensco (ESV) and Rowan (DRC). The companies decided to merge, subject to the vote of the shareholders. Under the terms of the agreement, Rowan shareholders will receive 2,215 Ensco shares for each Rowan share they own. At the closing of the transaction, the shareholders of Ensco will own 60.5% of the amalgamated company, while the shareholders of Rowan will hold 39.5%. Rowan CEO Tom Burke will be the CEO of the merged company, while Ensco CEO Carl Trowell will become executive chairman. Here is what I think of the agreement (note that I write these words before the conference call on the topic of fusion).

Consolidation in the offshore drilling market continues. Large transactions began with the purchase by Atco Oceanics of Ansco, a transaction that made me skeptical at the time of its announcement (I have not changed my mind since this moment). Subsequently, Transocean (NYSE: RIG) purchased Songa, which was a de facto purchase of its order backlog and Equinor (EQNR) links. Transocean followed with the planned purchase of Ocean Rig (ORIG). The decision of Ensco is next in this competition "grow up". From this point of view, it makes sense for Ensco.

Here are the reasons for the transaction set out in the presentation of the merger:

- Ensco obtains an exposure to the ARO Drilling joint venture and jack-ups in extremely harsh environments, as well as a presence in Norway.

- Rowan is gaining critical mass in deep sea operations, gaining access to Ensco 's strong relationships with major deep – sea customers and a broader geographic footprint, particularly in Brazil, Africa and the United States. West, Southeast Asia and Australia.

The intentions of Ensco are very clear. The company partners with a solid balance driller, excellent contract coverage for the entire lifting segment, 4 modern drill ships and, most importantly, a leading position in the Middle East thanks to the joint venture with Saudi Aramco. In addition, Ensco is using its equities as a currency and is capitalizing on the recent rise (equities have risen nearly 45% since the beginning of the year) to buy lower-yielding Rowan shares. this year (equities have risen by around 20%). -date):

The question that remains unclear at the time of writing is what Ensco plans to do with Rowan bonds as their repayment will require refinancing.

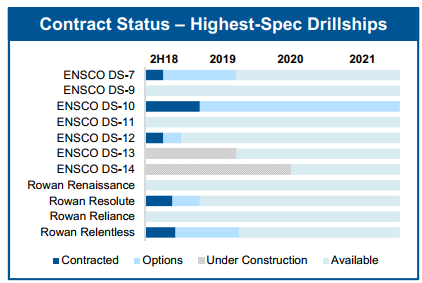

The logic of the agreement is much less clear for Rowan. Rowan joins a company whose balance sheet is degraded and which has many drilling ships, many of which are unemployed, without any firm commitment for its 4 drilling vessels:

Source: Presentation of the merger

Rowan has recently achieved great success in outsourcing its entire jackup fleet and also has the potential offered by the joint venture with Saudi Aramco, with 4 modern drill ships serving as a catalyst for rising if the ultra-deep water market picks up in 2019. not sure that the transaction is beneficial to Rowan shareholders, especially as their shares will be converted to Ensco shares after the shares of Ensco significantly outperformed Rowan this year. This underperformance of Ensco's share is due to the fact that Ensco's shares have come under significant pressure following the merger with Atwood, but whether this will reassure Rowan's shareholders remains an issue.

I see two main aspects of this merger: fundamental and practical. Let's start with the fundamental. The combination of two major drillers is a positive factor for the industry. The combined company (assuming that Rowan bonds are no problem) will have the potential to obtain a better credit rating than the autonomous Ensco company and could have a slightly higher long-term pricing power. For Ensco, the agreement is superb. This is a much better deal than the merger with Atwood. For Rowan, things do not seem so rosy. I'm not sure that the "critical mass in deep water" should have been obtained with the sale to Ensco as part of an all-stock transaction after a large resumption of Ensco shares.

Practical conclusions: the market may initially be positive on the merger because of the increased strength of the merged company, but I am worried about how this will unfold for Rowan's stock in the coming weeks as I do not see not why Rowan would benefit combination as opposed to Ensco, which in my opinion is a clear winner of this agreement. In addition, since the Rowan Shares will become shares of Ensco, shareholders will benefit from contacting a tax specialist if they plan to hold their shares in the merger. This is a major agreement for the industry that, if approved, will have a significant impact on the offshore drilling landscape. I will follow that very closely, so stay tuned.

If you like my work, do not forget to click on the big orange "Follow" button at the top of the screen and click on the "I Like" button at the bottom of this article.

Disclosure: I am / we are long DRC.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: I can exchange any of the above actions.

[ad_2]

Source link