[ad_1]

Overnight, Dow Jones Industrial Average Futures dropped by 44 points to 19:54. ET, signaling that the stock market crash in October has intensified on Wednesday could continue Thursday. The futures imply that the Dow will open Thursday down 135.74 points.

"The weakness of October has intensified today with the increase in sales volume and widespread sales," said Bruce Bittles, chief investment strategist at Baird, in a statement. note after Wednesday's closing. "We may need evidence of exhaustive sales, increased investor pessimism and a healthier downgrade to suggest that short-term risks are going down."

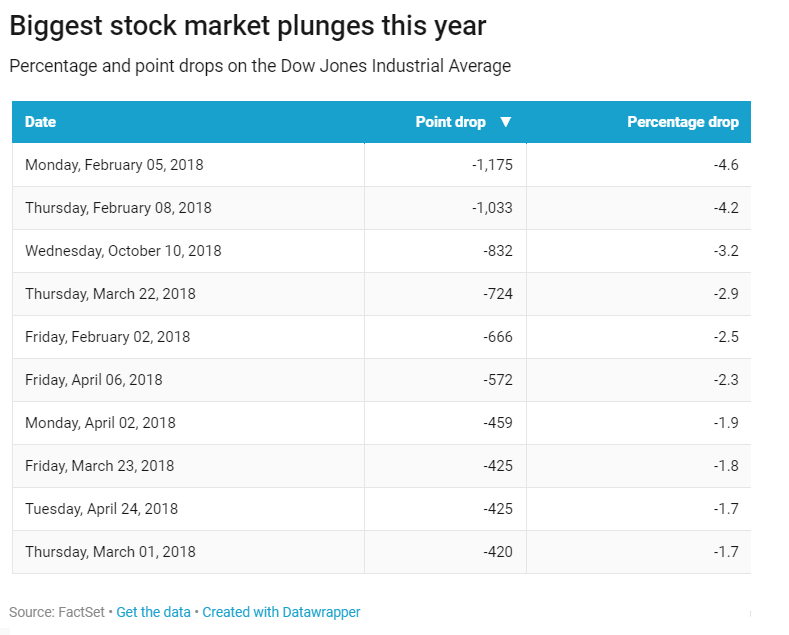

The Dow Jones Industrial Average index closed down 831.83 points to 25,598.74, while Intel and Microsoft fell more than 3.5% each. The Nasdaq Composite fell 4% to 7,422.05, while Amazon's shares and chips fell. It was the worst for the Dow and the S & P since February.

The Invesco QQQ Trust, which follows the Nasdaq-100, lost 0.7% Wednesday after trading hours, signaling that tech stocks would be under pressure again during Thursday's trading session.

The S & P 500 fell 3.3% to 2,785.68, while the technology sector underperformed. The broad index also posted a series of five-day losses – the longest since November 2016 – and fell below its 50-day and 100-day moving averages, largely followed by technical levels.

"While seasonal trends are becoming more and more favorable towards the end of the year, we have not yet seen evidence that overall sales have reached their downward burnout," said Bittles. "For the moment, caution remains."

The Dow Jones and S & P 500 indexes recorded their largest single day decline since the beginning of February, while the Nasdaq recorded its biggest single day sale since June 24, 2016.

Inventories fell sharply this month. For October, the S & P 500 and the Dow are down more than 4.4% and 3.3%, respectively. The Nasdaq, meanwhile, has lost more than 7.5%.

Source link