[ad_1]

The exodus of the user did not materialize in the third quarter … and it will not be in the future

In my last article on Facebook (FB), I had lowered my price target on Facebook from $ 240 to $ 220. I was afraid that Facebook is reporting an exodus of third-quarter users not only in Europe, but also in North America. Europe and North America are by far the largest monetization markets of Facebook. Therefore, any weakness of Facebook on any one or the other of these markets can have a significant adverse effect on the growth of Facebook's business. But in the third quarter, Facebook released results that were in some ways better than the second quarter on the user side.

In the second quarter, Facebook lost 3 million European DAUs, a sequential decrease of 1%. This is mainly due to the impact of GDPR on user growth. However, in the third quarter, Facebook lost only one million SADs in Europe, despite management warnings that SADs would be hit harder as the GDPR came into effect. Meanwhile, the number of North American Facebook DAUs remained stable for the third consecutive quarter, at 185 million DAU, which shows that the relevance of Facebook in the United States and Canada has not changed. .

The question now is whether the exodus of a user will ever materialize. In my opinion, no massive exodus of users will materialize, which is necessary to trigger a massive slowdown in revenue growth of the Facebook core. From the third quarter data, the exodus of a user from one of Facebook's main geographic regions seems to be a distant chance. In my opinion, the Facebook user base is expected to continue to grow, the question is to know at what rate. Wall Street appears to be facing a catastrophic impact on key Facebook users, while third-quarter data and management's confidence suggest the opposite.

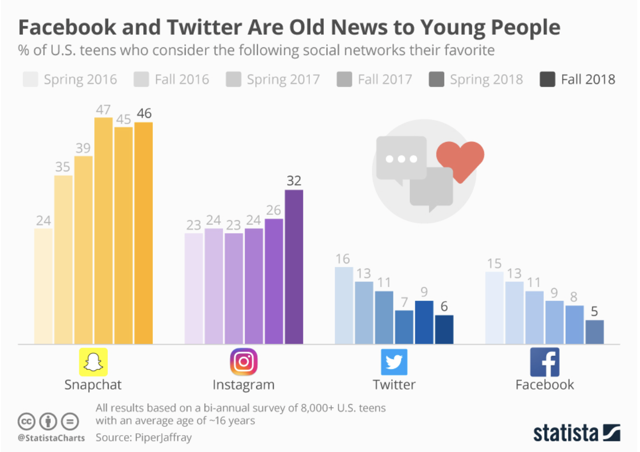

That being said, young people and Generation Y members as a demographic are leaving Facebook. Since older generations have adopted the Facebook platform, Facebook has lost its appeal and is almost unimportant among teenagers. Even Twitter is more relevant among teenagers.

Facebook is expected to lose 2.2 million teenagers aged 12 to 17 by 2022. Future buying trends are dictated by the Z / Teens generation, millennia dictating ongoing purchasing decisions. And with the loss of Facebook users in this key segment, advertisers might be more reluctant to use Facebook for their advertising needs. However, Facebook remains strong among older users. The Facebook user base is active and remains stuck but remains lucrative for advertisers and will continue to be in the future.

In addition, Facebook has "sweeteners" for existing users. Products such as Facebook Watch and Stories could eventually attract users to the Facebook platform and prevent the sinking of the Titanic in the number of Facebook users predicted by some users.

Facebook Core Monetization Track

The astonishing growth rates of Facebook's previous revenue came from the company's ability to combine robust growth in the number of users in key markets (North America and Europe) to increased monetization of the Facebook platform. As demonstrated in the third quarter, user growth in Facebook's major markets is starting to slow down or even stagnate. The only growth of DAU users comes from the Asia / Pacific and Rest of the World segments of Facebook. In my opinion, however, the heart of Facebook does not need a strong growth of the SAD to increase its main business turnover at high growth rates. The real long-term path for the growth of the core Facebook platform comes from Facebook's increased ability to monetize the platform. I think that the combination of the oligopolistic trend in Internet advertising space, global space growth and Facebook's leadership in the market and future market share gains will act as a brake to the monetization of Facebook.

In my opinion, the advertising space on the Internet is controlled by two main actors, a third emerging. These two players are Facebook and Google (NASDAQ: GOOG) (NASDAQ: GOOGL), with Amazon (AMZN) as an emerging player. Since Facebook is starting to gain ground among advertisers, the company has developed a high-quality return on investment that has made them and Google both "must-haves" in the world of Internet advertising. The main reason Facebook has been able to generate this massive return on investment is in its ad targeting practices. Recently, these practices have been frowned upon, with regulators and research analysts on the sellers' side increasingly wary of Facebook's ability to continue its current targeting. Facebook has been accused of collecting all user data, or even tracking it when it operates on the Internet and in the offline world. All these measures allow Facebook to create a digital profile on each of these people.

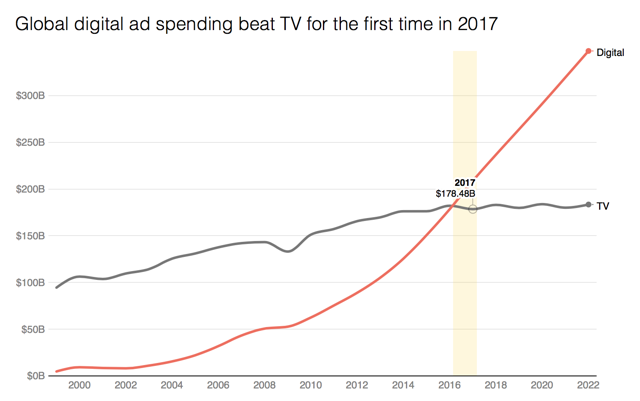

While this may be considered unethical, the Internet advertising industry has always been the advertiser's ability to target its users as effectively as possible for advertisements. Prior to Internet platforms such as Facebook and Google, marketers were using traditional media platforms, such as television and print, to meet their marketing needs. Although these marketing platforms are still used today, the ROI of existing platform advertising is significantly lower than that of Internet-based platforms. Why? It's just because these marketers do not know exactly who they are addressing on a television screen. Marketers only know the basics of who is watching the ads. Think of the user as a puzzle. Marketers have only one piece of the puzzle with traditional platforms. While marketers who use the Internet have almost all the puzzle in front of them. And best of all, it's actually less expensive to use Facebook on Facebook than to broadcast TV commercials. Facebook is therefore cheaper and offers better long-term products to marketers. Here are the current forecasts for the 2019 market compared to the 2016 market.

From 2016 to 2019, the share of the pie devoted to mobile phones should increase from 15% to 27% in three years. Meanwhile, Facebook's CPM is about $ 7. In comparison, the television CPM is about $ 17.

All we need is a negative catalyst to reach the mainstream media. In my opinion, increased competition from platforms such as Netflix (NASDAQ: NFLX), Roku (NASDAQ: ROKU) and some of the traditional media companies themselves in the OTT streaming market could pose a legitimate threat to television and printing. It will be enough for some buyers of recurring ads to see a decline in the use of television and the print media for these companies to extract their budget from traditional media and put it first. Again, Facebook has a CPM of $ 7 against $ 17 for television, which means you can get better targeting, return on investment and reach a much wider audience for about 40% of the price. And as Facebook is the market leader in this huge market, it seems that Facebook would be a likely target for these budgets.

This market is huge and represents a total expenditure of $ 178 billion for 2017.

Ironically, the same traditional media companies that are at risk are accelerating the demise of their old man. Comcast (CMCSA) or CBS (CBS), embarking on the same market as the one that reduces their market share of their traditional live media businesses.

Finally, one of the main catalysts of recurring marketing on existing platforms is the exposure to one-off events that will occur regularly. These events include the Olympics, the NFL or, more recently, the mid-term elections. People regularly tune into TV channels to watch these events unfold. But more and more, these events are affecting social media: Twitter (TWTR) is broadcasting live NFL games, Snap (SNAP) bringing the Olympics closer to its users, and Facebook itself becoming a key source of information for its users. Internet advertising space is fast approaching traditional media, which seem to be trying to reinvent itself to survive.

Regulators will not do anything

Another essential element of Bear's argument is that regulators will undermine Facebook's ability to exploit their current business model. There is a saying that I think sounds right here:

"There is no regulation, or there is too much regulation."

In my opinion, the probabilities that a major settlement violates Facebook's ability to do business is a long-term chance. Why? Let's look first at Facebook's lobbying dollars compared to others.

At the same time, competitor Google spent $ 18 million on lobbying, while Amazon spent $ 12.8 million. But Google and Amazon are working on products that could change the industry and need a boost from regulators to enable them to develop these products. These products include Google's Waymo self-driving division. Facebook, on the other hand, did not create a new product and was hit by the PR nightmare after the PR nightmare. Facebook's lobbying expenses are likely to increase again this year, with more and more PR problems against Facebook since the Cambridge Analytica scandal.

Even if we turn to the EU and the GDPR, there is no negative impact on the monetization trajectory of Facebook, nor on the number of Facebook users in Europe. To my knowledge, lobbying is legal in Europe. And although I do not know the number of Facebook lobbyists in the EU, I think Facebook could have some form of lobbying. That being said, when you talk to small businesses, you see that most of them are investing their marketing dollars in Internet platforms like Google and Facebook. This is due to the low cost and high ROI that these platforms offer users. While regulators are significantly repressing Facebook's monetization efforts, small businesses (a key success point) suffer. Because of this, it is unlikely that regulators, at least in the United States, are implementing a significant form of regulation on Facebook.

Another point I would like to make on EU regulation is the fact that regulators have done very little to harm Facebook's business. The EU imposed tiny fines on Facebook's global revenue stream that happened once. And with the GDPR, no real change is made to how Facebook works in Europe. Simply, Facebook provides its users with more detailed explanations of what Facebook is doing with the data of its users and explains them in a simple and realistic way. That's why we have fewer users in Europe but the pursuit of a strong ARPU.

Until Facebook directly and adversely affects politicians who regulate Facebook, do not expect a lot of changes in Facebook's business model.

Amazon is not a threat, though

A key argument that has been championed by the bears on Facebook and Google, but especially with Facebook, is that Amazon will conquer Facebook and Google's market share in ad space with new deals from Amazon advertising. In many surveys, some marketers have allocated some of their budgets to Amazon and not to Google / Facebook. However, there are a few reasons why the Amazon ad industry will not take Facebook / Google sharing yet.

First and foremost, Amazon's Internet advertising sector is built around ads running on the Amazon site, which limits these ads to consumer goods. The advertising platform of Amazon is a niche. The real problem is how Amazon will spend consumer goods sold directly by Amazon at the entire advertising space encompassing all products. It will be difficult and a roadblock that Amazon will overcome. But everything is timely.

Secondly, Amazon's advertising services are new, with no evidence so far that this company can generate a higher return on investment than Facebook / Google with competitive prices. Amazon is legitimately a threat to Facebook / Google in ads, but they have not yet demonstrated the return on investment that would allow Amazon to take a significant share of the duopoly Facebook / Google. Until Amazon does that, it's not a real threat.

Basic Facebook Targets

For this DCF model, I divide the company Facebook into Instagram and Facebook. I'll start by giving my goals over five years for the Facebook core, and later on Instagram. If you're wondering about the lack of WhatsApp and other growth initiatives, it's simply because any target for other companies is much more arbitrary.

Facebook calculates the ARPU according to its MAU number and not its DAU number. In general, I expect that the current trend will continue, with Asia and the continental right to continue growing, and Europe / North America, to fade slowly. As you can see, however, I expect ARPU / monetization gains despite the loss of users. This model assumes a compound annual growth rate (CAG) of 7.8% of revenue, in an attempt to express how the slowdown in Facebook's economic growth is coming.

Facebook is a growing business

As I showed above, I do not believe that the core Facebook platform is in itself a fast growing revenue generator. In fact, I think that the current slowdown in the growth of the number of users provided by Facebook in recent quarters will be a recurring theme in the coming years, with a steady deceleration in growth in the number of users. users. And even in this case, a CAGR of 8% is not exactly a growing number. That being said, Facebook is a growing business. Facebook's growth will come from Facebook's suite of platforms.

The Facebook activity has jumped from a slowly growing platform to one of the richest online ecosystems on the planet. Facebook will be an integral part of the development of technology for years to come. This is based solely on the relevance of Facebook in the technological space. Let's look at each of these avenues.

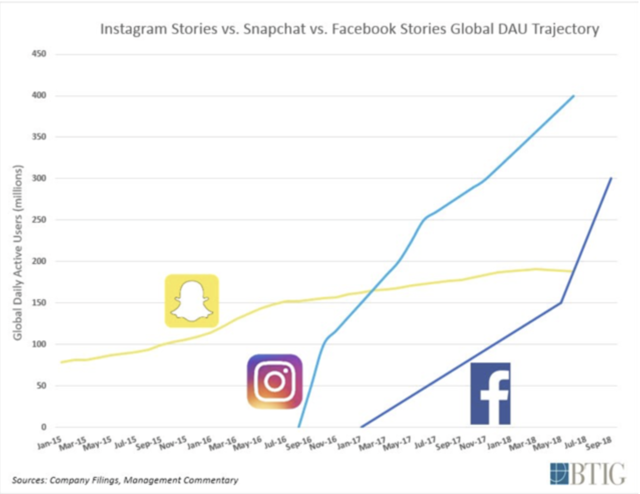

Instagram: The first place is Instagram. Instagram has become an increasingly relevant platform in society. In my opinion, Instagram is the most important part of Facebook's growth. Instagram is a very relevant platform, with 400 million DAU of the Instagram Stories feature and 1 billion MAU.

Since Instagram has copied Snapchat's successful "Stories" feature, it has grown in popularity, allowing Instagram even to get users away from the platform at the origin of the product, Snapchat. The stories have become so relevant among Instagram users that Facebook is making a slow transition from newsreel to news, a transition that has resulted in slower growth than expected. income. Revenue growth has certainly slowed down, but Stories is becoming the next thread of the mobile frontier. While analysts on the Wall Street vendors' side are worried about the slowdown in Facebook's revenue growth rate, they fail to assess the context of this deceleration. It is only inevitable that advertisers will opt for higher ROI and more sticky media. This new media called Stories and Facebook is making the transition to this arena.

The best part of Instagram is that Instagram has not yet taken significant action on monetization, especially with respect to advertising. Ultimately, Instagram will have such a large scale and impact on Facebook's overall revenue that it will split user and monetization data. Until then, however, the assumptions about Instagram's activities are pretty random. Instagram has a lot of leeway, with Instagram taking young users who leave the Facebook and Snapchat platforms.

But the real reason Instagram has such a promising future is the lack of a competitive threat on the horizon. The biggest and most important competitor of Instagram was Snapchat. But Instagram has proven time and time again that Instagram is just beating Snapchat. Here's how it works: Snapchat will spend hundreds of millions of dollars a year on R & D and build a new product. If this product proves to be successful, then Instagram copies it and copies it and gains more traction on the Instagram platform at the expense of Snap. And because Snap does not have this legally protected software, Instagram can afford to receive free millions of dollars of software.

The main mistake that Snap made and that Instagram did not commit is to listen to users. When many users are annoyed by a new feature on Instagram, the Instagram team immediately repairs it. While the Snap team thinks Snap knows more than the user about what's right for the platform. If the user does not like the experience, there is no rule stating that he should continue to use the platform. Instagram worked for users, but not with Snapchat.

As such, it is not surprising that the Snap user base has decreased.

And although I'm no longer short snap, my thesis and short position was entirely based on the belief that Instagram would take Snap users. Indeed, Snap loses users.

There is no denying it. The relevance of Facebook for Instagram is becoming increasingly important and it is becoming one of the most important platforms for all age groups and demographic categories. Facebook can eventually reach an ARPU close to Facebook's levels.

The following ARPU data is based on the number of DAUs instead of MAU. If I estimate the MAU of Instagram, the ARPU would be much higher.

Again, it is difficult to do a detailed breakdown of Instagram because the data are scarce, they are updated every three months instead of every quarter. Given that Instagram plays a larger role in Facebook's overall business, we should expect Facebook to stand out in its earnings releases. Then you have the Facebook messaging platforms, WhatsApp / Facebook Messenger.

WhatsApp Messenger: To be clear, I do not take into account any impact of products other than Facebook and Instagram in my DCF model. In my opinion, the estimation of users and ARPU for platforms such as WhatsApp and revenue for Oculus is almost completely arbitrary. As such, I only provide my analysis on this platform.

Until now, Facebook's email applications have reached a significant scale, but virtually no monetization. This is to be expected however, as monetization of cat-based platforms is more difficult. Showing ads via chat just does not work, with Snapchat as living proof. However, I still think that email applications have many monetization leads. First of all, WhatsApp is not completely a chat application. It also has its own Stories-esque feature known as WhatsApp Status. But advertising is not the only monetization track Facebook has with respect to its messaging platforms. Facebook has created a credit monitoring program installed in Facebook Messenger and has the opportunity to expand to the mobile payments sector, an activity that Facebook has been interested in for some time. And while the monetization of these services is expected to be much lower, the key advertisements advertised on Instagram and Facebook, however, the sheer size of the user base is expected to boost revenue growth for this segment of Facebook's business.

I do not bust this segment of Facebook activities solely because of the lack of data on monetization and growth in the number of users. It is also possible that this monetization initiative was a complete failure, as Snap had a hard time monetizing its user base, which was essentially chat-based.

Overall, Facebook's growth trajectory will come from these two products, but products such as e-commerce, Oculus (VR), Facebook's artificial intelligence tools, original content, smart speakers and more. IGTV could do it. Although projected as a company that is pushing society down, Facebook is investing heavily in R & D and future innovative projects, mainly in the area of software development. Believe that Facebook stays still or even recedes is a major flaw that could ruin the thesis of the bear.

Evaluation

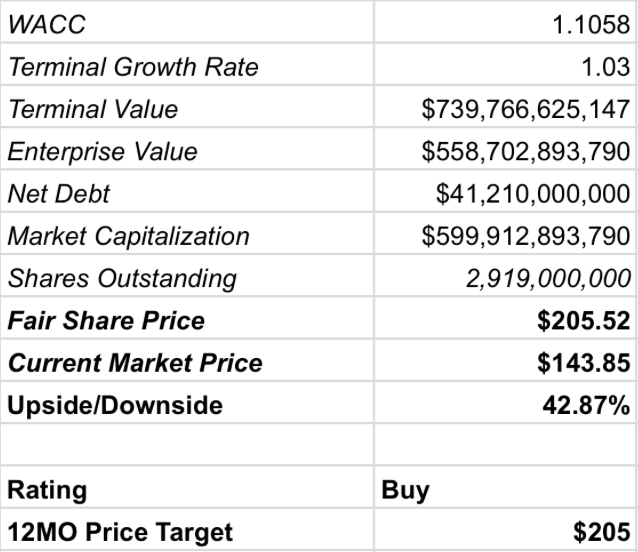

For this valuation (and essentially every valuation I make), I will use a discounted cash flow model. At the moment, Facebook is debt free and has $ 41.21 billion in cash as of the third quarter. Facebook's stack of ginormous tickets is another important reason why I own the stock. On a non-cash basis, Facebook is posting an expected profit of about 17X / 2019, with revenue growth of 24.7%. If you rate Facebook at a PEG of 1 on consensus EPS and growth rates, the Facebook stock would be valued at around $ 184. The stock is about $ 144. So, using a simple PEG ratio helps me achieve a 28% increase goal. But the discounted cash flow model is above 28%.

Here are my calculations for the cost of equity:

This assumes a risk premium on equities of 5.32% over 10-year bond yield of 3.114%. The un-optimized beta version of Facebook for the year is 1.39.

Because Facebook lacks debt and a cost of debt, the cost of equity is equal to that of WACC. So, the Facebook WACC is 10.51%. This is more true, as Credit Suisse analyst Stephen Ju uses a 10.5% WACC in Facebook's DCF valuation.

Here are the combined estimates of Facebook's activities for the next five years:

To evaluate the stock, I use a final growth rate of 3%. Here is the valuation of the stock:

Conclusion

The current price of Facebook's stock market does not take into account the risk associated with Facebook. The company's shares trade at a seemingly multiple value, while being a growing company. The headwinds predicted by bears are irrational. Ultimately, when Facebook overcomes these fears, the market will realize that Facebook is what it is, a growth giant with a portfolio of some of the most valuable digital assets. Coupled with a solid financial situation, an increase in the number of users and a positive long-term trend of the ARPU, the bears are simply wrong. Facebook remains a purchase.

Disclosure: I am / we are long FB, GOOG.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: I am not a financial advisor. This is not a financial advice. All that is said here is my personal opinion. Please do your own due diligence regarding investments in these securities.

[ad_2]

Source link