[ad_1]

Red lights flicker on Wall Street about Tesla's ability to pay off a pile of debts.

You're here (TSLA) A turbulent stock price – and even more volatile CEO – is in the headlines. But the real story can be the sharp decline in the value of the obligations of the manufacturer of electric cars.

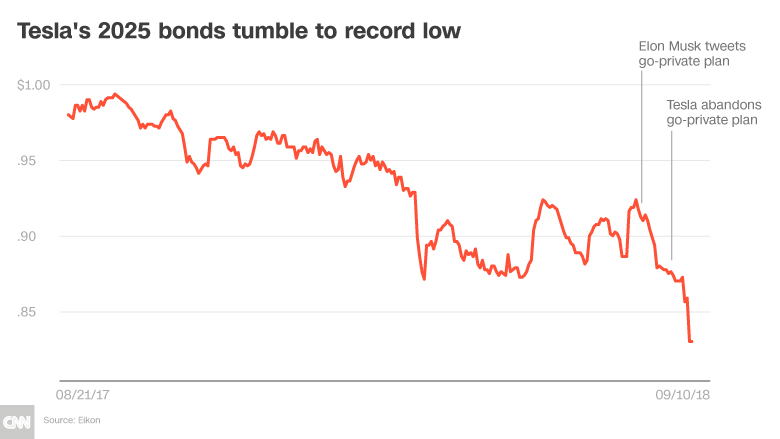

$ 1.8 billion of Tesla bonds maturing in August 2025 plummeted to a record high on Friday. The bonds were traded for only 84 cents on the dollar, against 98 cents a year ago. Yield, which is moving at an opposite price, nearly doubled over this period to 8.6%.

The action on the bond market is a source of growing concern over Tesla's big cable law. Elon Musk is scrambling to speed up the production of Model 3 in order to make a profit – and use that money for imminent debt payments.

"Tesla is in a money situation," said Cowen & Co. analyst Jeffrey Osborne. "The main concern – beyond drugs and podcasts – is the company's ability to generate cash."

Tesla is in debt to accelerate the rapid growth of the company in the world of automotive. This strategy has paid off as Tesla has taken a considerable lead in the race for electric cars, although this position is under intense competition from competing manufacturers such as Mercedes-Benz and Ford (F).

More than $ 9 billion of Tesla's debt is expected to mature before 2025, including a total of $ 2.7 billion this year and next year, according to a Goldman Sachs research report.

"Tesla is extremely profitable – they have a gun at their head dictated by the schedule of debt payments," said Osborne of Cowen, who has an "underperforming" rating on the stock.

& # 39; Erratic Behavior & # 39;

The good news is that Tesla is rapidly accelerating the production of Model 3, which could take the financial pressure of the company. Optimism over the progress of Tesla's Model 3 led analysts at Baird on Monday to issue a note urging investors to "buy even the drama".

However, other analysts doubt that Tesla can accelerate or even maintain this pace of production enough to be profitable.

The financial challenge was exacerbated by Musk's shenanigans. On Joe Rogan's podcast last week, the billionaire brandished a flamethrower, unsheathed a samurai sword and took a whiff of what Rogan said was a combination of marijuana and tobacco.

"The erratic behavior of Elon Musk has caused concern," said Osborne.

The podcast follows a tumultuous August month in which Musk tweeted that funding had been "secured" to take Tesla privately at $ 420 per share. Less than three weeks later, Musk abandoned the privatization plan after what he described as a shareholder revolt. The fiasco reportedly sparked a SEC investigation into the accuracy of Musk's "secure financing" tweet.

Despite a rebound of 6% on Monday, Tesla's share price fell 29% from the peak of $ 389.61 recorded the day Musk tweeted its privatization plan.

Executive Exodus

Tesla's decline was prompted by the acceleration of "credibility problems of management," Needham & Co. analyst Rajvindra Gill said in a report Monday. Gill has a rating of "underperformance" on Tesla.

Tesla shares fell again last week after the company's chief accountant suddenly resigned after less than a month of work.

Gill is "concerned" about the rapid turnover of senior executives at Tesla, which he says has lost 23 executives in the last two years alone.

A spokesman for Tesla referred to earlier comments in which Musk said Tesla was hoping to make a profit in the third and fourth quarters.

On Aug. 1, Musk told analysts that Tesla was planning to pay off its debt instead of refinancing it. Musk also rejected the speculation that Tesla will have to raise money by selling more securities.

"We could raise money, but I think we do not need to do it, and I think it's better not to do it," Musk said.

This is perhaps no longer up to Musk. Analysts say that Tesla might have trouble raising funds until the black cloud lifts an SEC investigation.

CNNMoney (New York) First published on September 10, 2018: 1:22 ET

Source link