[ad_1]

One of our favorite movie scenes comes from the film "Rounders". It is very rare that an investment situation aligns almost perfectly with your forecasts because there are so many unknowns. For example, "What will be the future?" is a good starting point. But in the case of oil markets, there are two things that will never change: 1) the laws of physics, and 2) the laws of supply and demand. If the oil market is under-supplied, prices will rise. If the oil market is oversupplied, prices will go down.

The goal is then to understand where the supply and the demand are going. Because once you can cripple the variables in perspective, it's just about determining how sure you are of those chances.

We call this article "Oil Prices – Oil Prices Go Higher" because we are going to break down the OPEC variable for you. Even if the Gulf countries (Saudi and friends) increase oil production in 2019, the world will still be under-supplied because declines in Venezuela and Iran will offset any increases and more.

Recap of our bullish oil thesis up to now

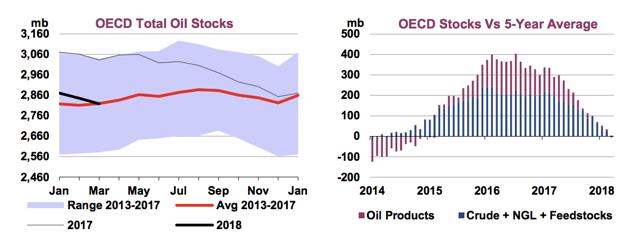

Global oil markets continue to rebalance, with the latest oil market report from the IEA showing that the OECD's oil storage is officially below the five-year average of 1 million barrels.

Source: IEA

Are we going towards a shortage of oil?

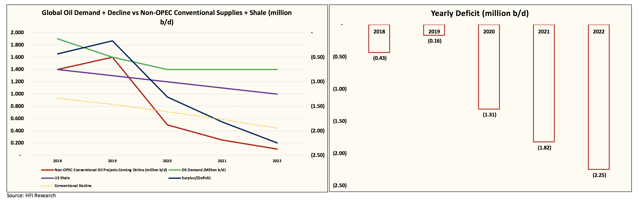

We wrote a two-part series entitled "Asleep at the wheel – No one sees the oil shortage coming." In these two articles (Part 1) (Part 2), we explained how the fundamentals of the global oil market continue to illustrate a global deficit in the years to come. In addition, we wrote another article here detailing how investors should time the oil market cycle. That's the chart we posted:

Essentially, what is happening in the oil market today, is that global models of oil supply and demand continue to indicate a scenario where global reserves of oil will continue to fall. It will fall to a level where oil prices will have to rise to the extent of the destruction of demand. It is only then that oil prices will come down again.

How do we know this scenario will happen? What is the probability of these ratings?

On May 14, we wrote a piece called "How to differentiate signal from noise? Stay focused on what matters, we explain the fundamental balances of the 2019 oil market. "

We have plunged into the variables needed to keep oil markets underfunded, but a lot has changed since then. For example, the Venezuelan situation worsens, while President Trump has pulled the United States out of the Iranian nuclear deal. OPEC and Russia also reported that they were considering a potential increase in production to offset the loss of production from Venezuela and Iran. But how bad will the declines be? What do the models of the world oil market look like?

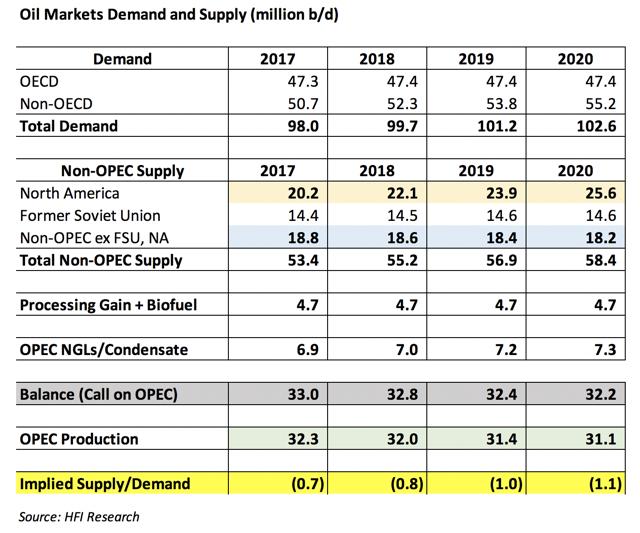

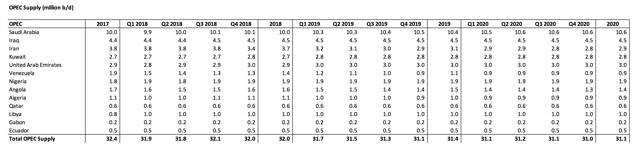

OPEC production decreases, even in a rising Saudi oil production scenario

As you can see in the model of the world oil market, the call for OPEC in 2019 will be 32.4 million b / d. But we have reason to believe that OPEC production will decline even in a scenario where production will increase. How?

Source: HFI Research

Three main factors explain this assumption: 1) Iranian production goes from 3.8 million b / d to 2.9 million b / d at the end of 2019 or almost 900 bp / d lower, 2) Venezuela's oil production goes from 1 , 5 million b / d by the end of 2019, to 0.9 million b / d, and 3) Angola and Algeria, together, will lose 400,000 b / d in because of the acceleration of production declines.

All these declines are then offset by the increase in Saudi oil production to 10.5 million b / d by the end of 2019 compared to the current 10 million b / d. Kuwait and the United Arab Emirates simultaneously increase production by a total of 300,000 b / d. Iraq is exploited from growing production, so no production increases there. Nigeria and Libya are expected to remain stable, which could prove difficult.

As you can see from the decomposition of the variables, the variable that sweeps the delta the most is the Iranian hypothesis. How are we certain that Iran's oil production will decrease by a million b / d?

The loss of Iranian oil production could reach 1 million b / d

At present, the investment community does not really consider the potential supplies lost in Iran. Why? Some think that it is too difficult to estimate potential decreases in supply. But we took the liberty of trying to understand the changes in exporting by country (thanks to Kpler) and see where the export supplies could be lost.

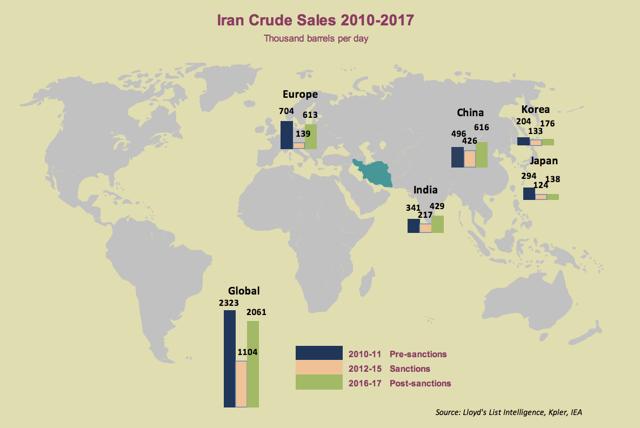

In addition, the IEA had an excellent chart in the latest OMR illustrating changes in Iran's crude sales between 2010 and 2017.

But that does not really give you the full scope, because the IEA data only take into account the 2016-2017 period as opposed to what is happening now. How do these numbers compare?

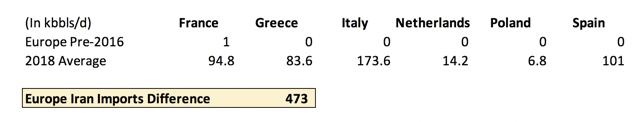

In Europe, we identified six countries that accounted for a large part of the increase in Iran's crude.

From 2013 to the end of 2015, these six countries averaged zero imports. But following the lifting of sanctions in January 2016, the figure jumped 473 kb / d.

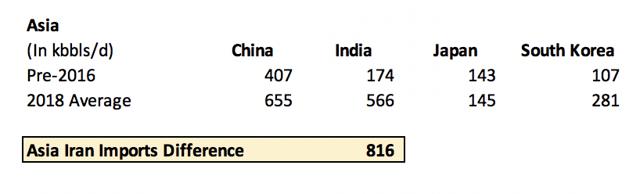

In Asia, we identified these four powers, which accounted for most of Iran's crude purchases.

The difference between the time of sanction and the 2018 average is 816 kb / d.

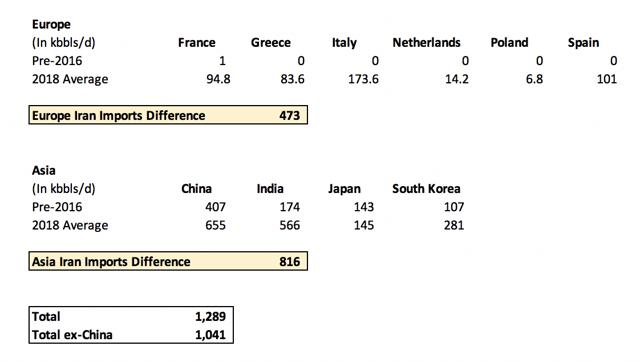

By putting these two numbers together, here's what we get to:

Source: Kpler, HFI Research

As you can see, even if China does not succeed in buying crude oil from Iran, the potential loss in the export market could reach 1.041 million b / d.

What is the probability that Iran will lose these markets?

Physical oil traders as well as refineries from India, South Korea and Japan echoed fears that if they continued to buy oil from Iran, the sanctions could have serious repercussions on their businesses. Uncertainty in the air will likely push buyers away from Iran just in time for the moment when US crude oil exports are on the rise.

Take, for example, what Reliance Industries, the owner of the world's largest refinery complex, said this week:

Reliance Industries Ltd., owner of the largest refining complex in the world, plans to stop oil imports from Iran, two sources close to the record, saying new US sanctions are forcing buyers to avoid oil purchases in Tehran. Reliance's move is expected to take effect in October or November.

Total (NYSE: TOT), the French energy giant, also announced that it would abandon the large Iranian gas project following the sanctions. Even LUKOIL (OTC: LUKOF) withdraws its plans to develop Iranian fields as a result of the sanctions.

In our opinion, oil exports from Iran to Europe should be a given. European refineries are trading all the time with their US counterparts and, as a result, the 473,000 b / d increase is expected to disappear completely by November. It is the figures of exports to Asia that give analysts a sense of uncertainty. However, we believe that India will mitigate oil imports from Iran and align with Reliance's recent comments. Japan is expected to remain stable and South Korea will post a decline.

Overall, we believe that there is at least 1 million b / d of oil exports at risk. If this is the case, Iranian oil production should reflect it by the fourth quarter of 2018 and up to 2019. Meanwhile, floating storage should increase as exports will fall and once the storage capacity is reached, the fields will be closed.

What about the idea that Iran exports its oil through Iraq?

Earlier this week, we wrote an update on Iran. At first we thought that Iran's oil production would not be badly affected as it would simply export oil through Iraq. But as a result of questions from Aaron Bradley, our chief analyst, we looked at the data and they completely contradicted our original presumption.

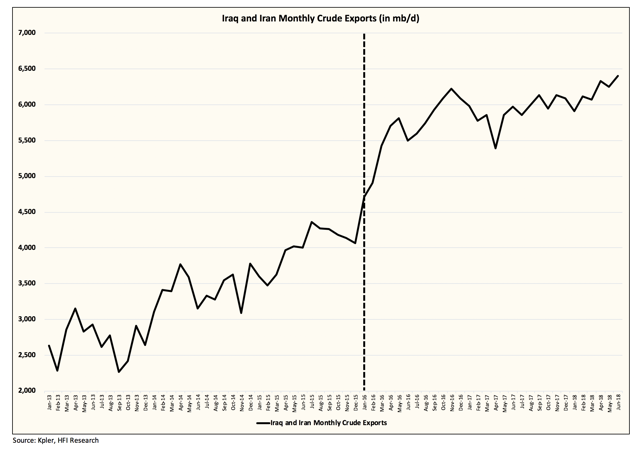

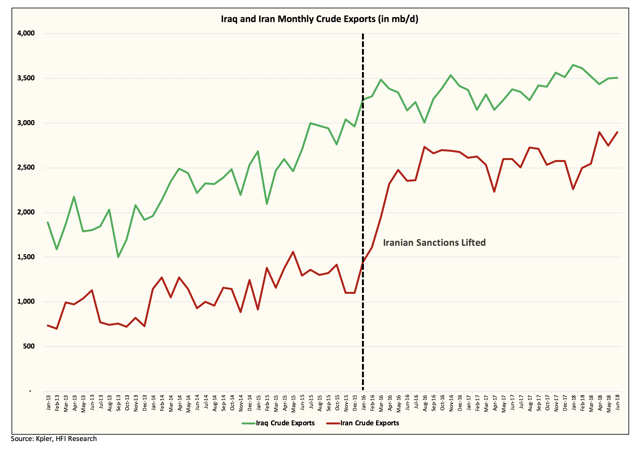

The graph above represents the total exports of crude oil from Iran and Iraq. As you can see, after January 2016, combined exports increased. If the assumption that crude exports from Iran were crossing Iraq was right, then we should have seen only a small bump, but this was not the case. not the case. In addition, if the original premise was right, we should have seen Iraq's crude oil exports fall as a result of the sanction, which was not the case either.

As you can see in the graph above, Iraq's exports have actually increased after Iran's sanctions lift, invalidating our original assumption.

Now, by taking these two data points and combining the data we see on each country's exports, we have reason to believe that once sanctions are reimplemented, Iranian oil production will have to be halted given the Limited market that she can sell. in.

What does this mean for oil prices?

The configuration is now even better than we thought before. Now the situation is that even as Saudi Arabia and its allies of the GCC reach their full regime, the oil market deficit will increase – leaving the precarious oil market on unused capacity. Our analysis shows that the increase in Kuwaiti and UAE oil production will be offset by declines in Algeria and Angola. The lost Iranian production will be offset by Saudi Arabia. And production lost in Venezuela will be partially offset by Russia, but a drop to 0.9 million b / d will send the deficit shock to the rest of the world. All of this will come at a time when the Permian's delivery capacity is put to the test and Brazil's oil production is disappointing down (the CEO has just resigned from Petrobras (NYSE: PBR)).

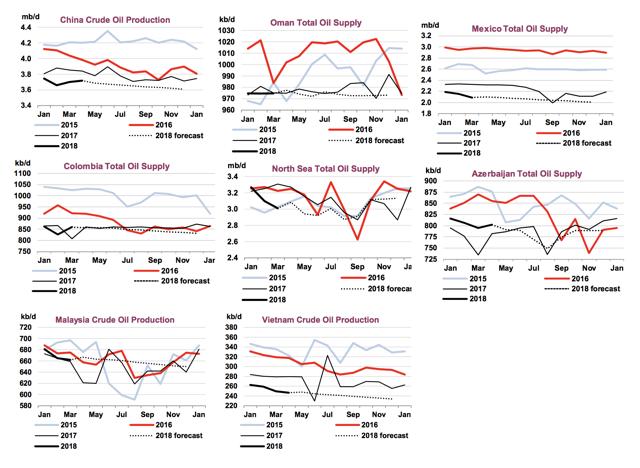

Non-OPEC ex-U.S. and Canadian supplies are also beginning to surprise the downside, with the IEA predicting production losses from one year to the next everywhere:

Source: IEA

In our view, this forecast of supply and demand indicates that, one to two years from now, oil prices will have to reach a level where the destruction of demand is important.

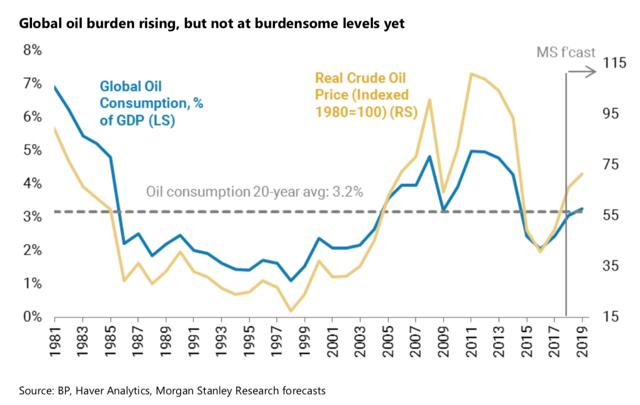

Using the chart that Morgan Stanley created, called the "global oil load," which measures global oil consumption as a percentage of GDP, this indicates that oil prices will need to materially exceed previous highs in 2011-14 (blue line) in order to seriously start reducing the demand for oil. This would put the expected oil price in the $ 140 + range.

But the path to $ 140 + oil will not be smooth at all. Markets will remain nervous about the prospects for increasing OPEC oil production as the investment community remains uncertain about Iranian oil production in 2019. But our analysis indicates that the closer we get to the date of sanction (4 November), plus oil analysts Start doing the same analysis as we did instead of throwing a pie into the sky figure and quickly realize that Iran's oil production could fall severely. Governments around the world will likely release the SPR once oil stocks reach critical levels that will help cushion the sudden spikes in oil prices, but if our analysis is accurate, OPEC's spare capacity will be nonexistent after the collapse of Iran and Venezuela. The scenario of soaring oil prices is inevitable.

Game over, there is no avoiding this now

The global economy looks like the Titanic right now. The iceberg is soaring oil prices and the community of complacent investors will not even know what strikes them. We will closely monitor developments in the balance of global oil supply and demand over the coming months. Our forecasts show a steepening deficit by 2020 as Venezuelans, Iranians and non-OPEC ex-US. and production losses in Canada are increasing. This scenario will be played out even if the Saudi and GCC allies increase oil production alongside the American shale. Once the storage of the OECD reaches a critical level, the market will have to raise oil prices as the destruction of oil demand begins to occur. It could also lead to a downward spiral of risky assets, which we believe will be well positioned to benefit.

The game is up, and there is no avoiding an environment of rising oil prices now.

Thanks for the reading. If you liked this article, please leave a "I like" below.

If you have found our interesting oil market articles, we know that you will find our premium service to offer you more value. We have been one of the few research firms to have defined the fundamentals of the oil market, and if you have any questions, we have answers. See here for more information.

Since June 1st, HFI Research limits the number of public articles we publish. Weekly oil storage reports will continue, but all storage estimates, including next week's estimate, will be reserved for HFI subscribers.

Disclosure: I am / we are long CRC, GXE.TO, MEG.TO, CVE.TO.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link