[ad_1]

General Electric Co. will leave the health and oil markets while General Manager John Flannery will take the most spectacular steps to take out the company 's titan from a worsening crisis. Shares jumped early in the session.

The future company will focus on energy, renewable energy and jet engines, said GE a statement on Tuesday. She is going to separate from her medical equipment business and sell her majority stake in oilfield supplier Baker Hughes.

The changes will fundamentally transform an American trade icon, which is mired in one of the worst setbacks of its 126 year history due to declining demand for industrial equipment, the low-income generation liquidity and an accounting survey by US regulators. When Flannery is finished, GE will not look like the conglomerate that used to count among its NBC assets, appliances, plastics and a sprawling financial unit.

"GE will be a specialized hi-tech industrial company that will be easier to monitor and measure for investors with a significantly improved balance sheet to support its remaining business," the company said in the statement. GE expects to reduce net debt by about $ 25 billion by 2020, the Boston-based company said.

Investors made a first push, as stocks jumped 5.9% to $ 13.50 in pre-trading. GE dropped 27 percent this year until Monday, after a 45 percent drop last year – a collapse that led the Dow Jones Industrial Average's supervisors to GE kick out of the first order index that he had been in over 100 years.

Trian Fund Management, which owns a stake in GE and serves on the board of directors, said it welcomed these changes. "Trian supports the strategic initiatives announced today by GE and believes that these initiatives will create substantial value for shareholders," said the fund led by investor Nelson Peltz in a statement sent via email.

The company will hold a call with investors at 8:30 am New York time to discuss the changes.

Dividend plan

GE said it would maintain its dividend through the health benefits. After that, the company "plans to adjust the GE dividend with a target dividend policy in line with industrial peers."

Investors have prepared for a possible downsizing of GE's situation. Flannery has already reduced the payment in November, a painful blow for the many investors who have come to rely on regular income.

The latest moves by the CEO mark his second turnaround attempt, culminating a strategic review that he has been pursuing since he took the helm last year from Jeffrey Immelt. In November, Flannery the changes unveiled, including the sale of assets and the redesign of the board, while saying that the future of GE would revolve around the energy markets, l & 39; aviation and health care.

Photographer: Christopher Goodney / Bloomberg

This generated criticism from investors who called the measures inadequate, and the shares continued to fall. At the beginning of the year, after GE presented more serious problems than expected in terms of insurance, Flannery promised to explore bigger changes, including a possible breakup.

After Siemens

Since then, Flannery has agreed to offload GE's century-old locomotive operations. On Monday, he announced the sale of an industrial engine business to the Advent International buyout company. Immelt sold most of GE's banking and consumer businesses.

As part of the plan unveiled Tuesday, GE will sell 20% of the health business and leave the rest to its shareholders tax-free. The health sector manufactures imaging machines and other hospital equipment.

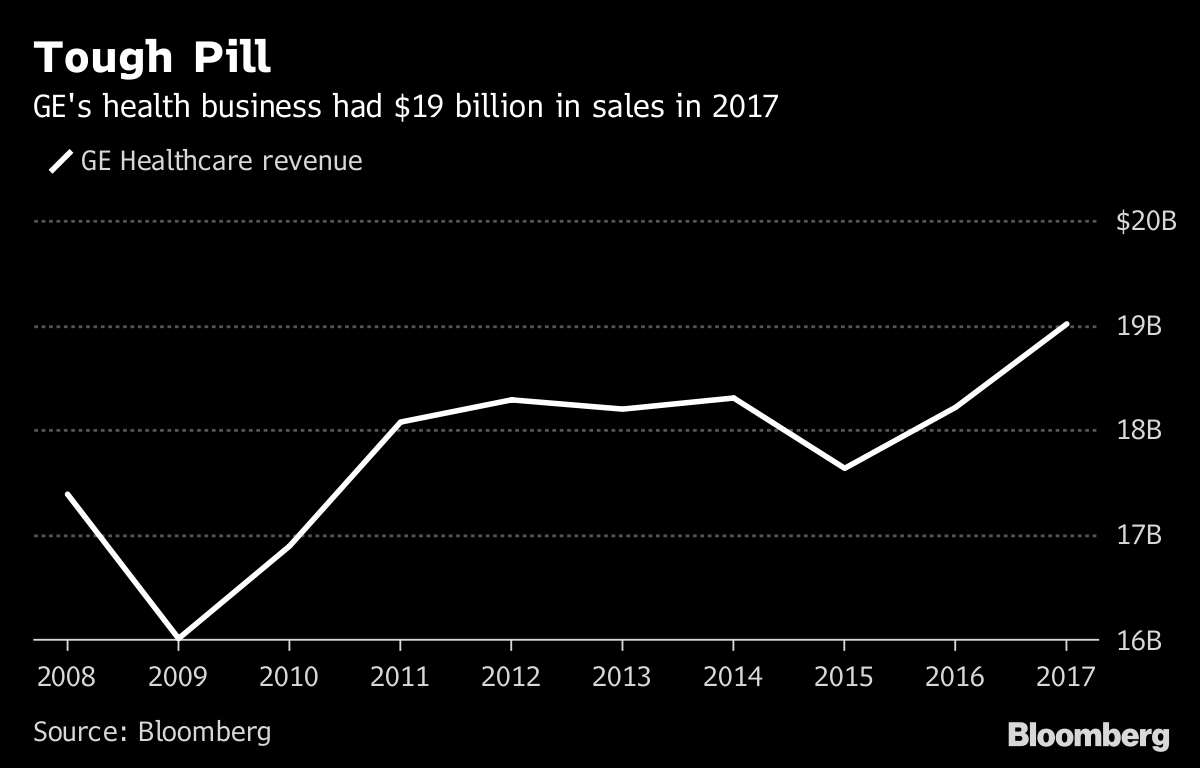

Difficult pill

GE's health business achieved $ 19 billion in revenue in 2017

Source: Bloomberg

The health care exit reflects a similar movement Siemens AG, the German industrial giant that has considerably simplified its conglomerate structure in recent years. The Munich-based manufacturer, which competes with GE in areas such as power generation and medical scanners, sold shares in its subsidiary Healthineers in March, marking the country's second-largest public offering. for almost two decades.

US and European manufacturing titans have historically closely followed the activity of the other, with close competition in power turbines, appliances, medical devices and light bulbs. Siemens is today a much thinner company than it was ten or so years ago, having cut ties with some historical assets such as its communications sector and the sector of Osram incandescent lamps.

Reduction of finance

GE plans to "significantly reduce" the balance sheet of its financial arm, GE Capital, with the goal of selling $ 25 billion of energy assets and industrial financing by 2020. The company is studying also options to reduce its exposure to insurance. GE shocked investors this year with a $ 15 billion deficit in insurance reserves.

The sale of Baker Hughes' stake – expected to take place over the next two to three years – will put an end to GE's short period of time in the oil and gas market.

GE began an aggressive expansion of its crude operations in 2007 with the $ 1.9 billion acquisition of equipment supplier Vetco Gray, relying on a small set of assets. . Over the next seven years, GE spent more than $ 10 billion on additional transactions, buying companies such as Wellstream and Dresser.

Oil trail

Just as GE Oil & Gas was becoming one of the most prominent companies in the business, the market has collapsed. The price of crude fell by more than 60% in 2014 and 2015. As demand fell sharply, the division weighed on GE's financial results.

In addition, GE's oil offerings were still limited relative to its competitors, limiting growth in the event of a recovery. Under the leadership of Immelt, GE decided in 2016 to partner with Baker Hughes, creating a more formidable player with a robust product line that would be more able to compete with the industry leader, Schlumberger Ltd.

It did not last long. Flannery said shortly after resuming last year that GE would explore options to pull out of its 62.5 percent stake without committing to a formal exit plan.

– With the help of Brandon Kochkodin, Cecile Daurat and Scott Deveau

Source link