[ad_1]

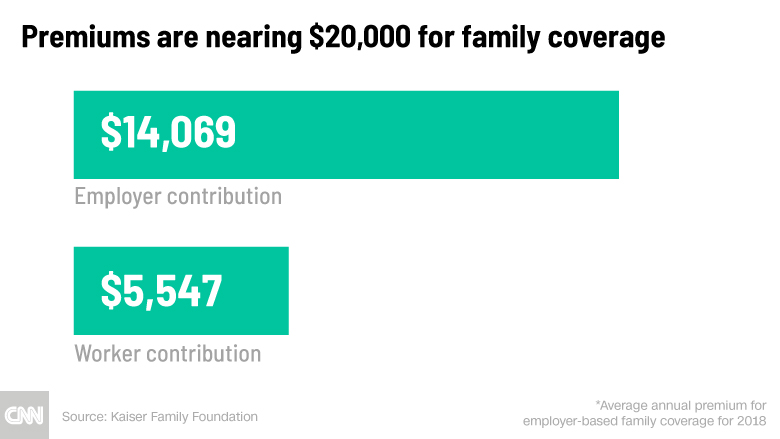

According to a new report from the Kaiser Family Foundation, employers and workers are jointly spending close to $ 20,000 for family health insurance coverage in 2018.

Although premiums have risen quite modestly in recent years, growth has far outstripped that of workers. The average family premium has increased 55% since 2008, twice as fast as workers' wages and three times faster than inflation, according to Kaiser's survey on health benefits of workers. employers.

Companies pay the bulk of the bill and pay an average of $ 14,100 a year. Nevertheless, workers have to pay an average of $ 5,550, up 65% from 10 years ago.

For individual hedges, total premiums reached $ 6,900, on average, up 47% from 2008. Workers contribute about $ 1200 a year.

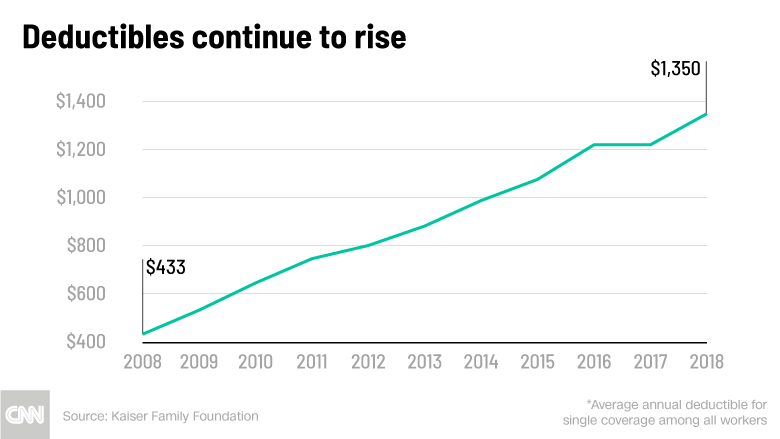

Franchises also continue to burn a deeper hole in workers' pockets. the the average deductible now stands at $ 1,350, up 212% since 2008. This is eight times faster than wage growth.

In addition, more workers are subject to deductibles – about 85% in 2018, up from 59% ten years ago. A quarter of all workers are subject to deductibles of at least $ 2,000, compared with 15 per cent five years ago.

Employers sought to limit premium increases by increasing deductibles. But big franchises are among the biggest complaints Americans have about their health coverage.

"As long as the deductible expenses, drugs, surprise bills and more will continue to exceed wage growth, people will be frustrated with their medical bills and will see health costs as a huge budget and political problems. "said Drew Altman, Kaiser. President.

As employers have been trying to control health care costs for years, the issue has been brought to the fore again.

Amazon (AMZN), Berkshire Hathaway (BRKA) and JPMorgan Chase (JPM) announced earlier this year that they are joining forces to give their 840,000 employees together better healthcare choices and lower costs for both their workers and their businesses.

Related: Amazon, Berkshire and JPMorgan Announce CEO of Health Care Company

An increasing number of companies are also entering into direct contracts with hospitals and providers to take care of their workers, according to a study by the National Business Group on Health published in August. General Motors (GM) and Henry Ford Health System in Detroit recently signed such a contract. The six-hospital system will provide access to more than 3,000 primary care physicians and specialists, as well as hospital, emergency room and pharmacy services, to nearly 24,000 paid GM workers and their families .

Some employers seek to limit their networks to some high quality suppliers, which allows them to reduce costs. Some 11 percent of companies said they have implemented these performance-based networks, up from 3 percent in 2014, according to a poll released earlier this year by PwC, a consulting firm. In addition, 34% of companies said they were considering these networks.

Related: employers find new ways to reduce health care costs

More and more large companies are offering coverage for telemedicine visits to providers, such as video conferencing or remote monitoring. According to the Kaiser study, market share climbed to 74% this year, up from 27% in 2015.

Employees, however, still have to adopt the new technology. Only 0.51% of people with major employer plans had at least one telemedicine visit in 2016, according to the latest data available.

"Many companies pay for telemedicine, but very few employees use it," said Matthew Rae, senior health policy analyst at Kaiser.

CNNMoney (New York) First published October 3, 2018 at 10:02 ET

Source link