[ad_1]

Posted at 6:30 am EST October 16, 2018

If you plan to rely solely on your social security check for your retirement, you may want to reconsider your decision. Here's why.

USA TODAY & # 39; HUI

Find out what are the typical benefits of the program.

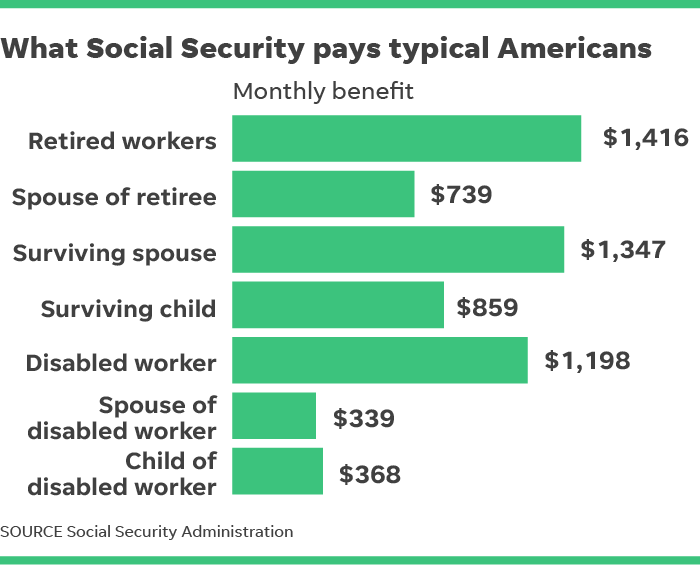

When planning your retirement, it is helpful to know what social security is likely to pay. Although your own employment history plays a key role in determining the exact amount you will get from social security, the following average figures from the Social Security Administration provide a useful starting point for getting you into the right range.

One thing to keep in mind is that social security has never been designed to be the only source of financial support for workers after their retirement. Although the amounts usually paid by social security are large and useful, they are usually not enough on their own to cover all the living expenses that an average American has to pay in retirement.

However, you can also see the role that social security plays in protecting families from financial ruin after tragic events. Survivor benefits for spouses and children are essential to help families after the death of the worker, and disability benefits generate income when an illness or injury prevents the worker from making a living.

Social security payments will not support a lavish lifestyle, but they are a valuable asset in your retirement planning. Add your own savings and you'll be well on your way to a comfortable retirement.

More: Can you afford to retire at age 40? Or do you need to wait until 70 years old?

More: Nearly 40% of millennials say that saving for retirement is not a priority at the moment

More: Medicare monthly premiums increase by $ 1.50 in 2019. Franchises will also increase

Motley Fool has a disclosure policy.

Motley Fool is a USA TODAY content partner offering financial information, analysis and commentary designed to help users take control of their financial lives. Its content is produced independently of USA TODAY.

Motley Fool Offer: The Motley Fool Offer: The 10 Best Stocks to Buy Now

Motley Fool co-founders, Tom and David Gardner, have spent more than a decade beating the market. In fact, the newsletter that they publish, Equity Advisor Motley Fool, tripled the S & P 500! *

Tom and David have just unveiled their top ten stock picks to investors.

Click here to access the full list!

*Equity Advisor returns from August 6, 2018.

When you retire, you do not want to pinch pennies. According to GOBankingRates, these are the 10 states that are the least fiscally favorable to retirees.

USA TODAY & # 39; HUI

Read or share this story: https://www.usatoday.com/story/money/personalfinance/retirement/2018/10/16/how-much-does-social-security-pay-aver-retired-workers/38089843/

Source link