[ad_1]

Intel (INTC) was defeated and downgraded due to supply constraints, performance issues and delays in the introduction of 10nm chips. In an open letter sent on September 28, 2018 to his clients and partners, Bob Swan, Inter's chief financial officer and chief executive of Interim, made several comments in a company press release, highlighting a number of problems that the company is facing and the way in which it is considering in the short term.

In this article, I wish to address Swan's comments because (1) he did not explain to investors that, in my opinion, they resulted from a poor commercial and technological direction, and (2) his comments on Investment spending has led investors in supply chain companies to mistakenly assume a windfall in short-term revenues.

1. Shortage of PC processors at Intel

Swan from INTC commented:

"The surprising return of PC TAM's growth put pressure on our network of factories. We prioritize the production of Intel Xeon and Intel Core processors so that we can collectively serve the high-performance segments of the market. That said, the supply is undoubtedly tight, especially at the entry-level PC market. We continue to believe that we will have at least enough supply to meet our forecast for the year we announced in July, which is $ 4.5 billion higher than our January forecast. "

In other words, Intel neglected to interface with its PC customers as sales increased and the company had to manufacture more chips. But at the same time, this question is much more insidious, because it shows once again the efforts made by Intel to prioritize the production of high-end chips at the expense of low-end chips.

Almost 10 years ago, on January 8, 2009, I wrote an article on Seeking Alpha titled "Does Intel Misjudge the Netbook's Success?" In what I've described as "Atomic bomb of Intel", I calculated that:

"The Atom is treated with 45-nm line sizes on 300-mm wafers and measures 25 mm squared. It costs around $ 29. A total of 2,436 atoms can be created on a wafer for a total selling price of $ 70.6K (neglecting edge losses and yields for this quick calculation).

Intel's Penryn Core 2 processor is used in laptops. It is also treated with 45 nm line sizes on 300 mm slices and measures 107 mm squared. It costs about $ 279. A total of 660 Penryns can be manufactured on a wafer for a total selling price of $ 184.1K. "

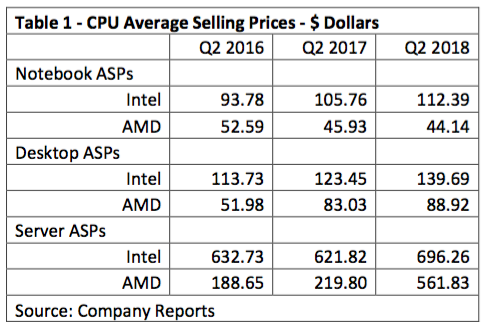

Ten years later, Intel seems to give priority to the production of expensive chips for servers, while misunderstanding the demand for cheap chips for PCs. As shown in Table 1, server chips are selling six times more than PC chips, which is similar to the Penryn 4X price differential compared to the Atom processor.

The focus on AMD processors in the industry is one of the reasons for the focus on processors, in addition to rising chip revenues and profits. AMD introduced the first generation of its EPYC server chip family in 2017, a system-on-a-chip (SoC) solution. It is composed of four dice inside a multi-chip module, currently manufactured in 14 nm and integrates AMD's new Zen processor cores, according to The Information Network's report titled 'High Packaging' density (MCM, MCP, SIP, 3D-TSV): Market analysis and technological trends. "

According to Table 1, in the second quarter of 2016, the price gap between the INTC server chips and AMD was 3.35 times. AMD introduced EPYC chips for servers, as well as Ryzen for desktop computers and Ryzen Mobile for laptops, with ASPs greater than twice its legacy processors. As AMD's sales mix evolves into new products, global combined ASPs have increased. Thus, in the second quarter of 2018, the price gap between INTC server chips and AMD fell to 1.24.

The third factor that explains the importance that server processors place on INTC is the need for the company to power its customers because the company's 14-nm Skylake processors lose their technical competitiveness with the introduction of EPYC chips. hearts, cache memory and capacity. In 2017, INTC held 99.7% of the server CPU market, but EPYC processors are expected to erode this share.

2. Increase in Intel's investments

Swan from INTC commented:

"We are investing record capital expenditures of $ 15 billion in 2018, up about $ 1 billion from the beginning of the year. We are investing $ 1 billion in our 14-nm production facilities in Oregon, Arizona, Ireland and Israel. This capital, combined with other efficiencies, increases our offer to meet your increased demand. "

This comment ignited stocks of INTC suppliers, including Applied Materials (AMAT) up 0.78%, Lam Research (LRCX) up 0.75% and Ichor Holding (ICHR) up from 1.79%.

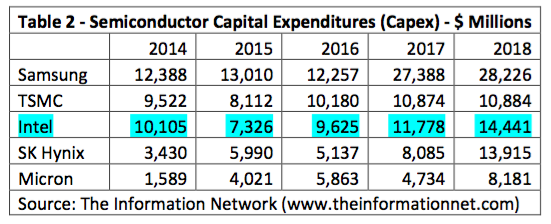

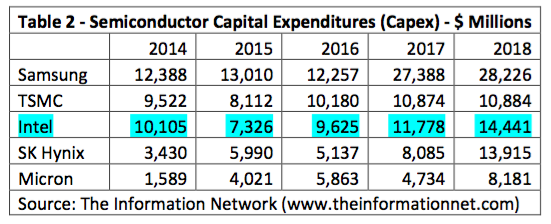

Table 2 presents an analysis of investment expenditures by The Information Network from its report entitled "Global Equipment for Semiconductors: Markets, Market Shares and Market Forecasts", before the announcement of the increase in investments by INTC.

For 2018, INTC plans to increase its initially planned capital expenditures by $ 14,441 million to the $ 15 billion announced. If this is the case, the increase will be approximately $ 560 million. So, if we round up, that gives $ 1 billion, as announced. However, $ 560 million represents only an increase of 3.88%. Significantly, or should I say insignificant, based on the information network analysis that investment spending in global semiconductor companies will be $ 104,434 million 2018, the additional 560 million represents only 0.54% of investment expenditure.

To deepen the analysis, investment spending includes the construction of equipment and buildings. INTC Swan noted "capital expenditures" and not equipment. In 2017, global investment expenditures were $ 99 119 million. Semiconductor equipment revenue was $ 56,620 million. Thus, equipment accounts for 57.1% of investment expenditure. By extrapolating to 2018, 57.1% of the $ 560 million in capital expenditures represents $ 320 million in equipment.

In other words, the enthusiasm shown by traders and investors for suppliers of equipment and materials in the supply chain was excessive.

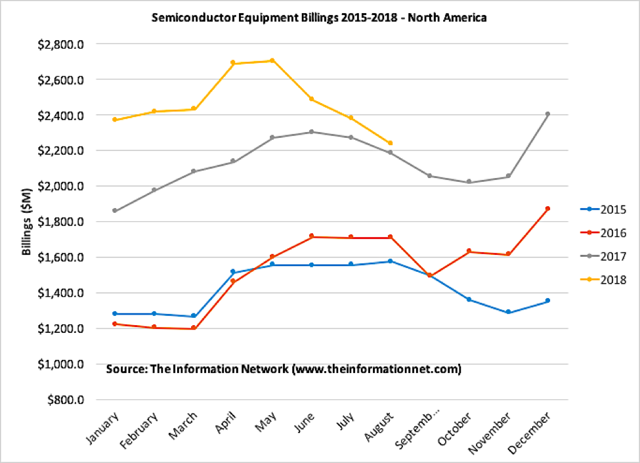

Chart 1 shows billing data for North American semiconductor equipment manufacturers. I mentioned in an article by Seeking Alpha published August 1, 2018 and entitled "The research on Lam is rising, weak prospects, what is a hollow?

"There is a huge uncertainty in the semiconductor equipment market, which has grown 31.1% year-on-year in 2017. Mr. Lam now expects equipment spending for 2018 to be up from the previous year." order of 1 to 2% previously. "

Until August 2018, semiconductor equipment sales grew 15.5% over the same period in 2017. If LRCX and others are correct, if the growth of the Year-round is up 'mid-figures', billing the next four months before the end of the year are expected to average 2.11 billion dollars a month, this which represents a growth of 10% compared to 2017. The bills amounted to 2.24 billion dollars in August 2018; The overall increase in INTC investment expenditure of 0.54% has minimal impact on equipment revenues. The invoices in Chart 1 represent only North American equipment suppliers, such as AMAT, INTC and KLA-Tencor (KLAC). As a result, the potential increase of $ 320 million in INTC capital expenditures must be shared not only among NA suppliers, but also with European and Asian suppliers. further dilute the impact on AMAT or INTC.

3. Intel 10 nm delay

Swan from INTC commented:

"We are progressing with 10 nm. Yields are improving and we are still forecasting volume production in 2019. "

When calling the first quarter 2018 results, Intel announced that the 10nm volume output would be shifted from 2H 2018 to 2019 due to performance issues. Several analysts have reacted negatively to the 10 nm delay. Raymond James downgraded Intel. Chris Caso, RJ analyst, said:

"Intel's biggest strategic problem is their delay in producing 10nm. We do not expect Intel's 10-nm server chip before two years. Delays of 10 nm create a window for competitors and this window could never close again. "

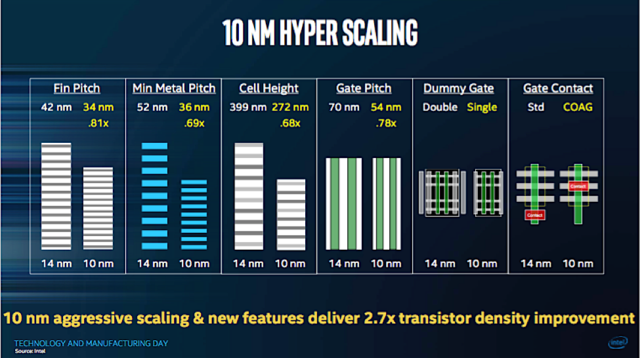

Chart 2 illustrates the technological improvements implemented by Intel to go from 12 to 10 nm. Intel has made two major changes:

- 10nm Offers Aggressive Height Scaling – The World's First Self-Aligned Quad Patterning (SAQP) Model

- The active door contact (COAG) is a revolutionary feature for another area scaling of about 10%

Intel has made a further change to the 10-nm process: the use of cobalt interconnects on the lower metal layers (M0 and M1) of its processor, replacing copper with metal to improve performance.

Information on the use of cobalt by other semiconductor companies is fragmentary. Taiwan Semiconductor Manufacturing Corp. (TSM) and Global Foundries use cobalt, but only as Co / TaN liners to replace Ta / TaN. Intel is the only one to my knowledge to use it for metal layers. All companies use copper with a layer of cobalt and plugs at layers M2 to M5. In addition, all use SAQP. While all 10nm node companies use similar processing technology, Intel is the most aggressive: no metal minimum of 36nm, SAQP, full cobalt M0 and M1 and COAG.

Investor to take away

In 2019, AMD will capture a lower market share in the spectrum of performance in the personal computer market. In the server market, AMD's market share can grow from 0.3% in 2017 to over 5% in 2019 and to nearly 10% in 2020, based on acceptance by the 7 nm chip clientele made for AMD by the TSMC smelter.

This 10% represents perhaps the highest share that AMD can reach on servers. Intel's 10-nm technology, which I believe is comparable to TSMC's 7-nm technology, will go into production just months after AMD.

Intel's Swan reiterated the full-year revenue forecast of $ 69.5 billion, up $ 4.5 billion from the January forecast and 11% growth over the previous year. ;last year. Thus, despite concerns about PC processor shortages and 10-nm delays, these headwinds will have minimal impact on Intel until the end of 2018.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link