[ad_1]

Today's trading has defeated the shares of tech companies, fearing a growing trade war between the US and China, and rising interest rates have convinced investors worried about selling.

The Nasdaq Composite Index, where many of the country's leading technology companies trade their shares, lost 7.928 points, or 3%, to 7 028.48. At the same time, the Dow Jones Industrial Average Index fell 395.8 points, or 1.6%, to 25,017.44.

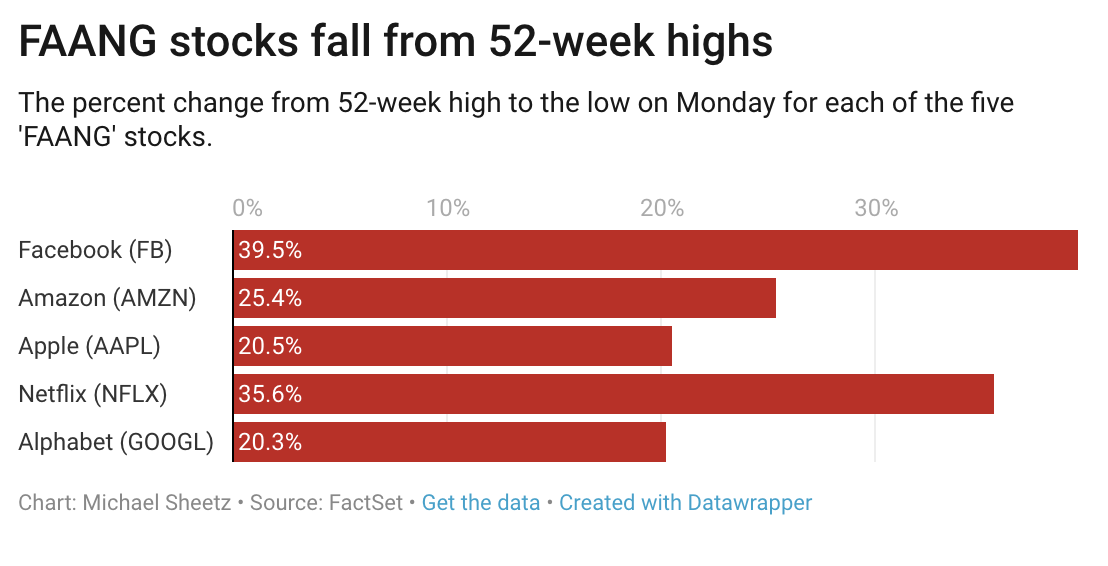

Facebook, Alphabet (the parent company of Google), Apple, Netflix and Amazon have all fallen into bearish trading territory, meaning that the value of these stocks has slipped by more than 20%. CNBC has a handy picture of how the biggest technology companies in the US have struggled.

Some of the problems of technology stocks are not necessarily related to the trade war. Facebook actions were hammered on the back of a New York Times report detailing the missteps and management mistakes involved in the company's response to Russia's interference in the US elections. Investors are likely to fear that company margins will shrink as the company invests more in content moderation.

Some of the problems of technology stocks are not necessarily related to the trade war. Facebook actions were hammered on the back of a New York Times report detailing the missteps and management mistakes involved in the company's response to Russia's interference in the US elections. Investors are likely to fear that company margins will shrink as the company invests more in content moderation.

And apple has seen its shares fall on reports that sales of its new iPhones may not be as optimistic as expected by the company – although the holiday season is expected to increase these numbers. According to a report by the Wall Street Journal, Apple has lowered the targets of all its new phones because of uncertainties surrounding sales.

The Journal reported that in recent weeks, Apple had reduced its production orders for all iPhone models unveiled in September, which spilled over the entire supply chain. Specifically, the goals of the new iPhone XR have been reduced by a third compared to the 70 million units that the company had asked suppliers to produce, according to WSJ sources.

These sales figures impacted Apple's entire supply chain, impacting the prices of several suppliers and competitors.

But the escalation of the trade war between the US government and China is undoubtedly a concern for the technology industry, as tariffs may affect supply chains and drive up prices.

According to a research note from Chris Zaccarelli, investment director at the Independent Advisor Alliance, quoted in MarketWatch, interest rates and the slowdown in global growth accentuate the pressures of the trade war to drive down the price of technology stocks.

"Technology continues to be caught in the crosshairs of the triple threat of rising interest rates, fears of global growth and trade tensions with China," Zaccarelli wrote. "The trade war problems with China are weighing on the global supply chain of large technology companies, while fears of global growth are of great concern to see future profits down," he said.

Source link