[ad_1]

SurveyMonkey Online Survey Provider (SVMK) will make an IPO on Wednesday, September 26th. At a price range of $ 9 to $ 11 per share, the company plans to raise $ 171 million with an expected market capitalization of about $ 1.2 billion. Halfway through the IPO price range, SVMK currently benefits from our very unattractive rating.

SVMK looks different from many recent IPOs, both positively and negatively. On the plus side, its losses are lower and it does not have a two-class share structure that prevents investors from voting on corporate governance issues. On the negative side, its high debt and slow growth make it hard to believe that SVMK can justify its valuation.

This report aims to help investors sort out the financial documents of SurveyMonkey to understand the fundamentals and valuation of this IPO.

Losses are worse than reported

SVMK generates revenue by charging monthly / annual fees for premium plans offering unlimited surveys and questions as well as customizable features and customer support. The company has more than 16 million active users, but only 600,000 (4%) are paying users. The company had sales of $ 121 million in the first six months of 2018, up 14% year-on-year.

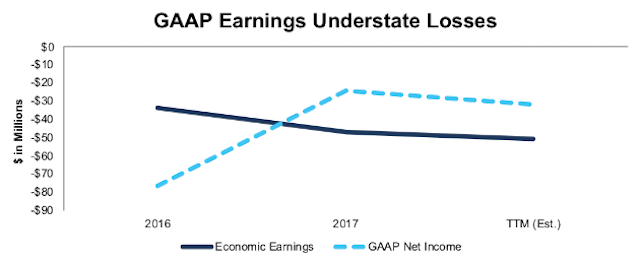

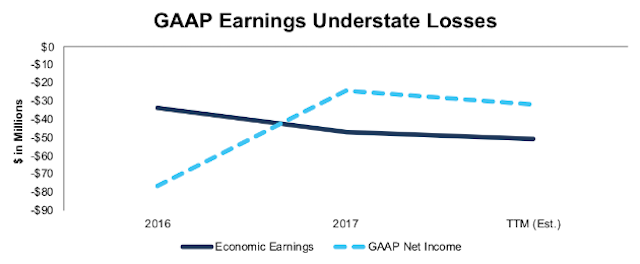

At first glance, SVMK losses under GAAP increased from – $ 76 million in 2016 to – $ 32 million in the last twelve months. However, Figure 1 shows that the economic benefits, true cash flows of the business, decreased during this period. The Company's economic losses increased from – $ 34 million in 2016 to – $ 47 million in 2017 and are estimated at $ 51 million in term.[1]

Figure 1: Net earnings and economic benefits under SVMK GAAP since 2016

Sources: New Constructs, LLC and Corporate Deposits

Non-operating items overstated SVMK's GAAP losses in 2016 and underestimated their losses in 2017. The adjustment to eliminate these non-operating items reveals the company's increasing losses.

The largest non-operating expenses in 2016 were $ 25 million (12% of sales) in restructuring costs.

The most notable non-operating result in 2017 was a tax benefit of $ 12 million (6% of business revenue) through tax reform.

Rising prices can not lead to profitability

The growth of SVMK users has been minimal over the past year, but it has increased revenues by raising prices for existing users. The company increased its average revenue per user (ARPU) from $ 351 in the first half of 2017 to $ 400 in the first half of 2018, an increase of 14%. According to S-1, this increase was as follows:

Largely thanks to a change in our individual user plans in 2017, which offered paying users new plans with more features and required our users to renew their subscriptions at higher prices.

One might think that the price increase should increase margins, but this was not the case. In fact, SVMK's gross margin increased from 71% in the first half of 2017 to 70% in the first half of 2018.

If SVMK's margins decline even as prices rise at double digits, it is difficult to find a path to long-term profitability. SVMK, founded in 1999, is a mature company, unlike many other recent IPOs. After nearly 20 years of losses, SVMK can not continue to claim that profitability is imminent.

Limited market opportunity

In the United States, SVMK estimates that its addressable market is $ 25 billion (versus $ 233 million in TTM revenues), but this figure is based on unrealistic assumptions. To reach this $ 25 billion figure, SVMK assumes that every knowledge worker in the United States is a potential paying customer. Needless to say, we do not think that all white-collar workers in America need a superior investigative service.

A more realistic analysis of Research and Markets estimates the global online survey market at $ 4.1 billion and $ 6.9 billion in 2022. This analysis suggests that SVMK holds about 5% market share.

This 5% market share makes SVMK the second largest online survey provider, but it's behind the 800-pound gorilla in the room, Google (GOOGL). Google surveys account for about 91% of the online survey market.

Google's dominant market share is SVMK's biggest challenge. For low-end users who simply want simple surveys, Google Surveys is the simplest and cheapest option.

Meanwhile, high-end institutional clients are more likely to work with professional marketing companies to create their customer surveys. According to SVMK, they have customers in 98% of Fortune 500 companies, but only 71 of them (14%) have an agreement with them.

With pressure on both ups and downs, SVMK has limited market opportunities with mid-size customers. He will have to capture a significant portion of this market to justify his assessment.

Our discounted cash flow model reveals that SVMK is overvalued

When we use our dynamic DCF model to analyze the future cash flow forecasts related to stock prices, we find that SVMK is overvalued in the middle of its IPO price range.

To justify the midpoint of its IPO range at $ 10 per share, SVMK must immediately get 25% pre-tax margins – equal to GOOGL – and increase its revenue by 11% per year for 10 years. See the math behind this dynamic DCF scenario.

An annual revenue growth of 11% could be possible for SVMK given the expected growth of its underlying market, but the expectation of margin seems unlikely. The company posted margins of -9% in 2017, which was worse than the -4% margin in 2016.

If SVMK can increase its revenue by 11% compounded annually for 10 years, but only gaining 10% pre-tax margins, which equals LogMeIn Enterprise Services Company (LOGM) See the math behind this scenario Dynamic DCF.

High debt limits on the rise and bankers must be reimbursed

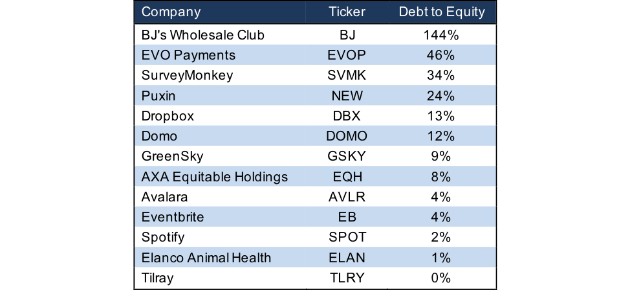

After postponing his IPO for 19 years, it's fair to wonder why SVMK chose to go public today. The answer to this question lies in the company's total debt of $ 417 million. As shown in Figure 2, SVMK's 34% equity debt is the third worst of the 13 IPOs we have covered so far in 2018.

Figure 2: Equity Debt for 2018 IPOs

Sources: New Constructs, LLC and Corporate Deposits

SVMK plans to use $ 100 million to pay off its debt. It is no coincidence that the underwriters of the offer – J.P. Morgan (JPM) and Merrill Lynch (BAC) – are also among the largest creditors of SVMK.

The need to repay debt limits the amount of capital that SVMK can invest in potential growth opportunities. It will be difficult for the company to justify its valuation if most of its available cash is destined for its debt.

No double class share is positive

Corporate governance is the only area in which SVMK has a clear advantage over other recent IPOs. There is only one class of shares, which means that every investor will have an equal voice in corporate governance.

Better still, no investor or group of insiders will own enough stock to control the company's management. The largest shareholder, Tiger Global Management, will hold 25% of the shares after the IPO.

Critical details found in financial documents by our Robo-Analyst Technology

As investors become more focused on fundamental research, research automation technology is needed to analyze all the critical financial details in financial documents. Below are details about the adjustments[2] we do based on Robo-Analyst[3] SurveyMonkey S-1 survey results:

Income statement: We made adjustments of $ 37 million, which had the net effect of eliminating $ 6 million of non-operating expenses (3% of revenue). You can see all the adjustments made to the income statement of SVMK here.

Balance sheet: We made adjustments of $ 26 million to calculate the capital invested, with a net increase of $ 25 million. The most notable adjustment was the write-down of accumulated assets of $ 17 million, mainly due to an impairment of the acquisition gap of $ 16 million in 2016. This adjustment accounted for 4% of net assets declared. You can see all the adjustments made to SVMK's balance sheet here.

Valuation: We made adjustments of $ 458 million, which reduced the shareholder value by $ 458 million. No adjustment had the effect of increasing shareholder value. In addition to the debt mentioned above, the largest shareholder value adjustment was $ 36 million in employee stock options. This option adjustment represents 3% of the market capitalization proposed by SVMK.

This article originally published on September 25, 2018.

Disclosure: David Trainer, Kyle Guske II and Sam McBride receive no compensation for writing on a specific title, style or theme.

[1]The SVMK S-1 does not provide us enough information to definitely calculate its economic gains over the TTM period.

[2]The recent Ernst & Young white paper "Getting ROIC Right" demonstrates the link between an accurate calculation of ROIC and shareholder value.

[3]Harvard Business School Includes the powerful impact of automating research in the case study. New constructions: disrupting fundamental analysis with Robo analysts.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not get compensation for that. I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link