[ad_1]

The IPO window in the US could be largely open to Chinese tech companies, but electric vehicle manufacturer Nio has cautiously reduced its listing target to $ 1.5 billion after publishing a price range for its actions.

The company plans to sell 184 million shares between $ 6.25 and $ 8.25. This range would result in a total increase of $ 1.518 billion, down from the initial target of $ 1.8 billion set when the company was first filed in August. Of course, this range is subject to change and does not include income from the "green shoes" option – which allows subscribers to allocate additional shares – but nevertheless, this is a significant development.

Nio also revealed in its new record that its existing investors have committed to investing $ 250 million in the IPO, which would represent 22% of the allocation in the middle of the range.

There are many possible explanations for which Nio has reduced his overall estimate of fundraising.

The most basic can relate to sales. The company is just starting to generate revenue. Last year, she opened sales of her ES8 vehicle, but she did not start selling until June. So, until now, he has filled only 481 orders, but he claims that 17,000 customers have booked a model and are waiting to buy it.

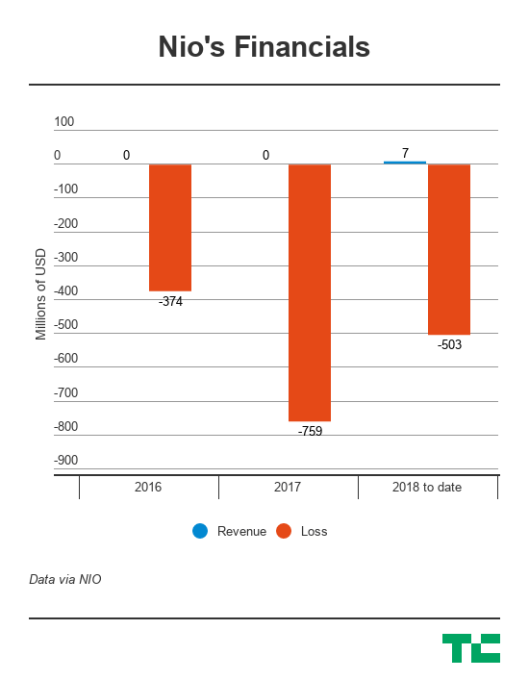

This means the company has incurred heavy losses – a negative $ 759 million in 2017 and less than $ 503 million this year so far – as it has moved up a gear in R & D and preparation. Only one month of revenue makes it difficult to assess this potential, even though Nio plans to expand and open its own manufacturing plants.

In addition, it may also be related to general concerns in China.

Nio is an international company that develops technologies in Silicon Valley and has design teams in Germany and the UK, but China is the only market on which it focuses for sales. This makes a lot of sense since China is the world's largest market for electric vehicle sales, but there is of course a gap between the country and US stock market investors. While Chinese companies have performed well in US government markets – Alibaba holds the record for the world's largest IPO and the window is very open for Chinese technology companies now – but EVs remain a new concept, even in the technological world .

There is also the permanent problem of politics. In particular, President Trump continued the trade war with China – the United States doubled last week with a series of new tariffs – and some concerns about Beijing's interference with China's biggest tech companies.

Tencent, the $ 500 billion giant, had outstanding results last quarter due to government interference in some of its core businesses, while its big rival Alibaba criticized how its latest financial data was good . Indeed, the two companies – which are the first Chinese technology companies – have seen their prices drop: the current price of Alibaba is down 15% compared to January 1, while Tencent is down 25%.

All of these concerns have probably lowered Nio's price in a more conservative way, but we will have to wait for the price to be certain. However, we are considering a $ 1 billion IPO for the company, considered by many to be Tesla's closest competitor. – although it does not currently have a sales plan in the United States.

You can find out more about Nio's activities from our original article on the stock exchange below.

Source link