[ad_1]

Tuesday, one day after the entry into force of an additional $ 200 billion tariff on Chinese products, Donald Trump was addressing the United States General Assembly and it was enough to say that his position on the trade was unchanged.

As expected, the president criticized China's trade practices and suggested that Beijing undermine the World Trade Organization.

"The global trading system is in urgent need of change," Trump said, before accusing the Chinese of "violating all the principles on which the WTO is based". China, Trump continued, "commits dumping, forced technology transfer and intellectual property theft".

He went on to warn that the United States "will no longer tolerate abuse" and insisted that "distortions in the Chinese market and the way they are negotiated can not be tolerated".

Although I am not quite sure of why, I still feel obliged to add the following warning when I quote the President: I am not making an assessment above about the relative merits of the Trump's position. These are direct quotes from his speech. In other words, it's just what he said, nothing more and nothing less.

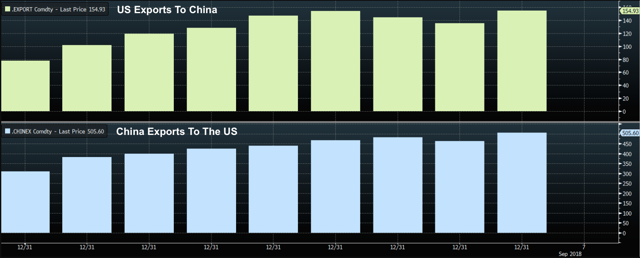

Again, this comes a day after the official entry into force of the new tariffs. Hours before Trump's speech, Peter Navarro's trade czar confirmed to Fox News that any retaliatory action on the part of Beijing will be satisfied by other Washington tariffs. Presumably, it was an allusion to the president's threat to impose duties on an additional $ 267 billion in Chinese products. If this happens, the United States will tax everything China exports to America (see the bottom of the table below).

Navarro was cautiously optimistic about the possibility of reaching an agreement with Canada, telling Fox that "little things stand up well."

Later, US Trade Representative Robert Lighthizer offered the following at an event in New York:

Canada does not make concessions in areas that we feel are essential. It would be unfair to everyone involved [to not] go ahead with Mexico.

This is of course a reference to the bilateral agreement that the Trump administration reached with Mexico at the end of last month with great fanfare. To be clear, it is likely that an agreement with Mexico, while beneficial for both parties, will result in a mixed reception at Capitol Hill if Canada does not intervene.

The reason I wanted to tell the latest developments on the commercial front for readers is that analysts have more and more the feeling that it will not go away. Despite all the efforts made to extrapolate something about the calculation of Trump's decision, it seems more and more that the President intends to do exactly what he said that he was going to do: rewrite the rules of world trade.

Take it from someone ((me)) who spends his days reading voluminous amounts of macroeconomic research on Wall Street: no one was completely prepared for it. At every moment, analysts have tried to incorporate the latest developments in a framework of political calculations before the deadline or the idea that the administration is more concerned about the stock market than about the prevailing world order. trade

Bottom line: It starts to feel as if everyone was wrong.

The best evidence to support the assertion that the president is serious may have arrived late last week when Bloomberg said the administration did not have a process in place for US companies to request exemptions and exemptions. Consider this, according to an article published last Thursday:

The Trump administration has not put in place a process that allows companies to obtain 10% tariff exemptions on $ 200 billion worth of Chinese products, contrary to previous rounds of transactions .

The US justified their decision by saying it was giving companies more than three months to bring their supply chains from China before raising rates to 25 percent in January, according to one official.

This may change, but even if it is, the fact that there is no exemption process before the implementation of tariffs clearly indicates that the President is ready to force American companies to revise their supply chains.

Readers will invariably have their own opinions as to whether this would ultimately be a good or a bad thing, but it is not debatable that it is not easy to find and contract new reliable suppliers in three months to sentence. Supply Chain Management is a comprehensive field of study in business schools and the idea that huge multinational corporations can simply slam China to get out of business. Equation is obviously exaggerated, even if you think that it is inherently desirable.

Do not get me wrong, this will affect some of the companies you own stocks assuming you have a wallet full of blue chips.

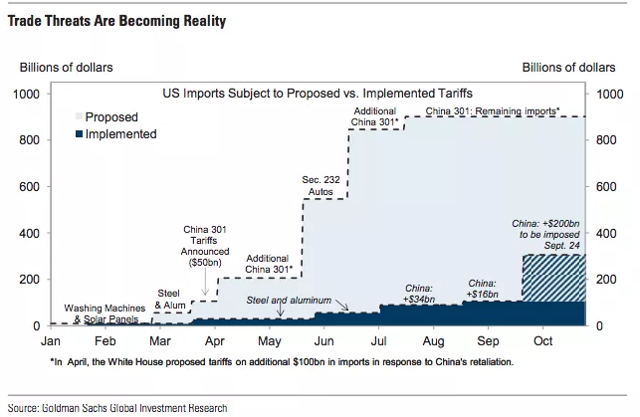

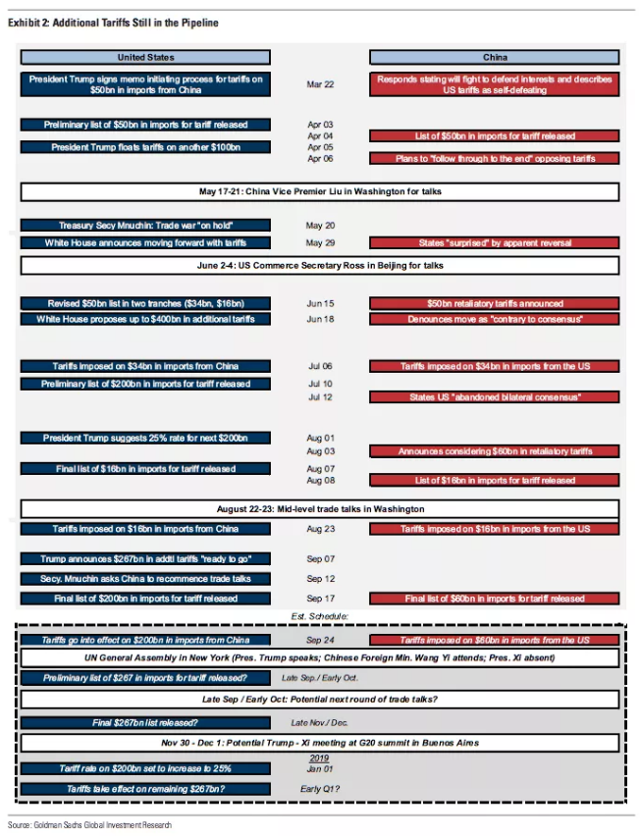

It is now more likely that it is unlikely that more rates will be added to those that came into effect on Monday. For its part, Goldman has raised its subjective probabilities of the administration taxing all Chinese imports by 2019 to 60%. Consider the following color and visual that accompanies the note of the weekend:

As shown in Exhibit 2, the Trump Administration has followed up on its earlier informal proposals to increase rates after Chinese retaliation. On July 6, after China imposed retaliatory tariffs of $ 34 billion on imports, the United States responded four days later by officially proposing tariffs of $ 200 billion. When the United States imposes tariffs of 10% on about $ 200 billion in imports on September 24, we believe that China will respond to the announced retaliation tariffs. formally proposing tariffs on all remaining imports from China ($ 267 billion).

On the positive side, the Trump administration has signed a new trade deal with South Korea this week (although the details leave some doubt about what was considered the previous deal), a move seen in the context A bilateral agreement with Mexico potentially points towards the end of the tunnel for agreements that do not concern China.

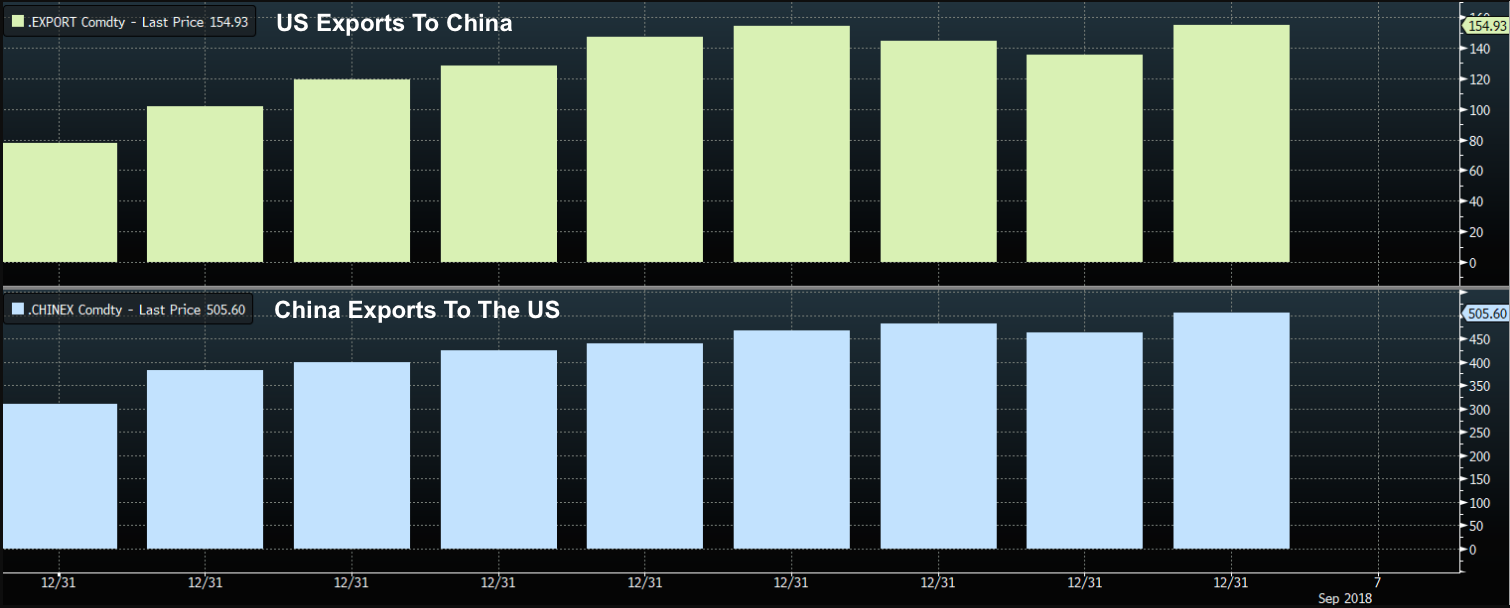

However, it is not possible to completely eliminate a scenario that sees things escalate to the point where the total amount of goods subject to tariffs approaches the dotted line of $ 900 billion in the following visual of Goldman:

(Goldman)

Indeed, for months on my site, I argue that the administration considers trade tensions with China as a political advantage and not a responsibility. Last Wednesday, Ethan Harris of BofAML wrote a quick note that reinforced this characterization. Namely, from the note:

The main "key call" in the global economy has been that trade wars worsen until clear signs emerge on both sides. What has been less clear is exactly what these pain thresholds are. In our opinion, the pivot from Europe to China and the escalation to the American midterms tell us a lot about what motivates the Trump administration. We believe that the Trump Administration regards this "trade war" as politically positive and reinforces the arguments for a long battle. Recall that President Trump was elected on a platform against globalization. In addition, commercial actions against China are enjoying popular support, with the US public having a negative view of trade relations with China.

For its part, Beijing has taken a series of measures to "prove" that China is serious in its openness. Last week, for example, Prime Minister Li Keqiang made a move to cut tariffs on most of the country's trading partners. Bloomberg later expanded the story, noting that the cuts could come into effect in October.

But note that if this seems conciliatory, it is equivalent to an escalation vis-à-vis the United States. Here is BofAML, from a note dated September 21st:

China's proposed import tax cuts send a mixed message for the trade war with the United States. On a positive note, they urge the United States to reach an agreement: if the long-term tariffs were removed, the United States would now face a lower tariff rate on exports to China. Large scale tariff reductions also allow China to yield to US pressure. China can argue that "we are only doing what we would have done anyway and we are not giving special treatment to the United States". On a negative note, China's tariff cuts are part of a wider effort to inoculate the economy of trade war. Specifically, lower tariffs on other imports would partially offset the negative effect of tariffs on $ 113 billion of US products imposed this year.

In addition, America's European allies announced Tuesday the formation of a special vehicle specially designed to allow the circumvention of US sanctions on transactions with Iran. Needless to say, this is likely to exacerbate tensions between Washington and Brussels and may well prompt the Trump administration to take a more recalcitrant stance on the highly controversial auto tariff issue (Probe 232).

All of these points indicate, at best, a fragmented international trade regime.

Again, there are arguments to argue that Trump 's approach to administration is the "good one". Personally, I do not think that's the case, but it's an area where the president has good points. For example, consider the following excerpts from an interview conducted by Goldman with Jennifer Hillman, a former member of the WTO Appellate Body, who was also commissioner at the Trade Commission. United States and General Counsel at the United States Bureau of Commerce. Representative:

Allison Nathan: Is the WTO and other trade executives sufficient to respond to what the Trump administration considers to be an injustice in trade with China?

Jennifer Hillman: No, I may disagree with many of the President's tactics, but on this point, he is right. In part, I do not think anyone has anticipated the pace, depth, and extent of China's growth and, more importantly, its market structure. When China joined the WTO, it agreed to do a lot of things that, according to other members, put it on the path to a market economy. This obviously did not happen. In 2014, 136 of the world's 1,000 largest companies were Chinese; 70 of them were wholly owned by the state. And state ownership has meant production far beyond market demand. In the steel sector, for example, China has added nearly 60 million metric tons of production capacity each year for more than a decade, reaching a capacity of 1.2 billion tons metrics. Steel production in the United States, at its peak in 1973, was 137 million metric tons; last year, it was 87mn. In a normal economy, many Chinese steel companies would have gone bankrupt.

I emphasize these passages not only to give a glimpse of someone with experience on these issues, but also to point out that contrary to popular belief, Wall Street and other experts are not determined to suggest that the position of the administration on China is entirely without merit.

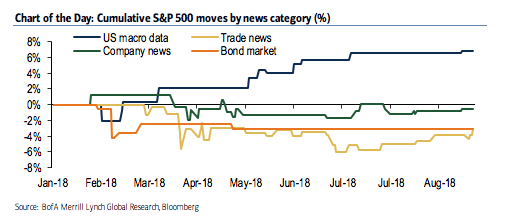

The problem, however, is that if you are an investor trying to understand all of this, it does not matter who is "good" and who is "wrong". To date, US stocks (SPY) have been resilient to the escalation of trade as global equities have collapsed. This resilience is partly due to robust earnings, partly from buybacks and robust US economic data (see graph below on this last point):

(BofAML)

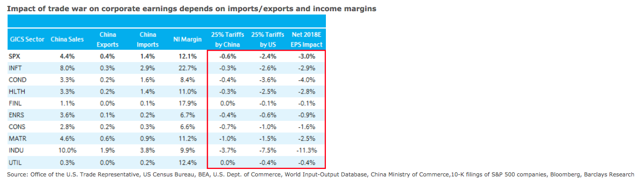

That said, if it continues in the right direction, it will affect business results and directions.

One important thing to note is that it's quite possible that US stocks are going up anyway. Heaven knows nothing has been able to derail the US rally, so I suppose stocks could theoretically continue to rise even as earnings growth decelerates and management teams cut forecasts to account for the impact. commercial frictions.

But I think even bulls among you would agree that this is not a safe bet, especially as the effects of tax cuts and tax incentives will begin. , by definition, decrease at the same time (25%). of the $ 200 billion Chinese products that were taxed at 10% from Monday, come into effect. It would also coincide with Goldman (and others) predicting that tariffs on the rest of China's exports to the United States will be applied.

Regarding the resilience of the US private sector to trade tensions, consider the following from Barclays, who notes that if this year were good, next year could be another story:

Moderate market reaction was expected due to strong earnings growth in the first half of the year and, as we reported in July, the impact of US-China tariffs was n & # 39; 39, was only about 3.0% for S & P 500 companies. Aggregate level.

Although the potential impact on 2018E's results seems insignificant given our expected annual growth in CY2018E EPS of ~ 23.3%, they represent a significant drag on the decline in the annual growth rates of 2019Q1 and 2019Q2 respectively of 8, 3% and 2019.

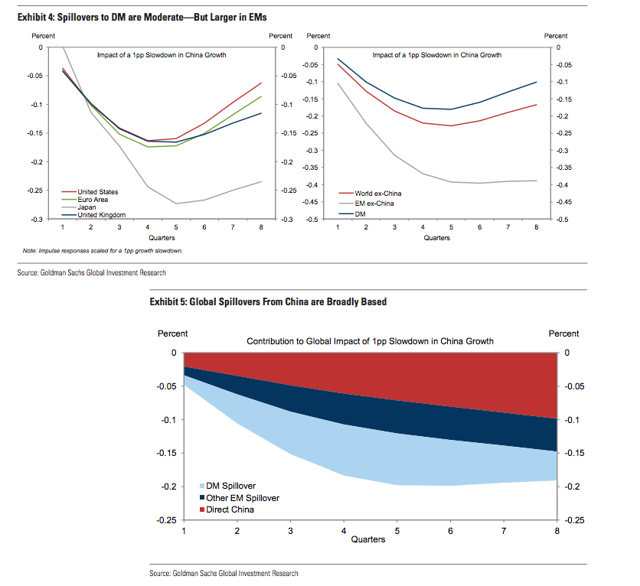

Also keep in mind that none of these points is beginning to affect the potential impact of a sharp deceleration of the Chinese economy. The problem of estimating the potential domino effect is that it is not possible to predict what a series of mediocre economic data from Beijing would entail for market sentiment. You can try, but what you can not do is a scenario in which, for example, China decides to devalue the yuan (CYB) to boost exports. For what it's worth, here are Goldman's efforts to put numbers on it:

Our simulations imply moderate spillovers from China into DM economies, but larger effects in EM. A 1-percentage-point slowdown in China reduces US GDP by 0.1 to 0.2 percentage points after one year, which is the average of the DM and 0.4 percentage point of GDP. ex-China. The global impact of a slowdown in China is around 0.2 percentage point, of which a third is the mechanical effect of China itself, the rest being attributable to d & # 39; 39, other impacts.

The consequence of all this is that investors would do well to examine what analysts, until now, were unwilling to accept: The idea that when this president intends to rewrite the rules of world trade he just mean that.

We can all argue until the cows come back to the question of whether this is a desirable approach from a normative point of view, but the market view is that, early or late late, especially once the impact of the stimulus fades.

The fact that it causes a sharp decline in the shares of these companies is another matter, but again, to the extent that you take into account the benefits when you decide which companies to tackle your financial car, it will be impossible to ignore a certain point.

For now, I leave you with Peter Navarro's assessment of the volatility potential of equity markets, as communicated to CNBC on Monday:

That's the beauty of Trump's business strategy. Sometimes this creates volatility in the stock markets because the president rightly takes strong market positions.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link