-

Sen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the Census, on Capitol Hill, Wednesday, Oct. 3, 2018 in Washington. (AP Photo/Alex Brandon) less

Sen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the … more

Photo: Alex Brandon / Associated Press

-

17 things you might not know about Kamala Harris

When she was 13 and living in Montreal, Kamala Harris organized the children at her apartment complex to protest not being allowed to play in the building’s grassy courtyard, her sister Maya told The Chronicle. “It was only a matter of time before we were playing soccer,” Maya Harris said.

less

17 things you might not know about Kamala Harris

When she was 13 and living in Montreal, Kamala Harris organized the children at her apartment complex to protest not being allowed to play in the building’s

… more

Photo: Charles Gullung/Getty Images

-

She was political practically from birth. In her book “Smart on Crime,” she wrote, “My mother used to laugh when she told the story about a time I was fussing as a toddler. She leaned down to ask me, ‘Kamala, what’s wrong? What do you want?’ and I wailed back, ‘Fweedom.'” less

She was political practically from birth. In her book “Smart on Crime,” she wrote, “My mother used to laugh when she told the story about a time I was fussing as a toddler. She leaned down to ask me, ‘Kamala, … more

Photo: Onur DAngel, Getty Images

-

Her first-ever political race was for freshman class representative on the student council at Howard University; she said it prepared her for a career in public service.

Her first-ever political race was for freshman class representative on the student council at Howard University; she said it prepared her for a career in public service.

Photo: Westend61/Getty Images/Westend61

-

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-c’,

container: ‘taboola-interstitial-gallery-thumbnails-5’,

placement: ‘Interstitial Gallery Thumbnails 5’,

target_type: ‘mix’

});

_taboola.push({flush: true});

-

She owns many, many pairs of Converse sneakers, she told New York Magazine.

She owns many, many pairs of Converse sneakers, she told New York Magazine.

Photo: Gabrielle Lurie, The Chronicle

-

When she ran for her second term as district attorney of San Francisco in 2008, it was the first uncontested race for DA since 1991, and she won more than 98 percent of the vote. She was the first woman to serve as DA of San Francisco, the first black woman to serve as a DA in California, and the first Indian woman in America to hold a top prosecutor’s job, according to media reports at the time. less

When she ran for her second term as district attorney of San Francisco in 2008, it was the first uncontested race for DA since 1991, and she won more than 98 percent of the vote. She was the first woman to … more

Photo: Michael Maloney

-

![She defended Too Short fans from being stereotyped by her coworkers, telling them she used to have the Oakland rapper's tape in her car. During a commencement speech at Howard, she told the following story:]()

She defended Too Short fans from being stereotyped by her coworkers, telling them she used to have the Oakland rapper’s tape in her car. During a commencement speech at Howard, she told the following story:

“So one day I was in my office at the courthouse, and I heard my coworkers talking outside my door. They were talking about how they’d prove certain people were gang-affiliated.

So they mentioned the neighborhood where the arrest had occurred — the way the people were dressed, the kind of music they were listening to.

And hearing this conversation, well you know I had to poke my head outside my door. And I looked at them and I said:

‘Hey, guys. You know that corner you were talking about? Well, I know people who live there.’

‘You know the clothes you were talking about? I have family members who dress that way.’

‘And that music?” — and now I’m about to date myself — ’Well, I have a tape of that music in my car.’

And in case you all are wondering, that tape was of Oakland’s own Too Short.

So they looked up, a little embarrassed. And needless to say, they realized they needed to think differently about who does what and where.”

less

She defended Too Short fans from being stereotyped by her coworkers, telling them she used to have the Oakland rapper’s tape in her car. During a commencement speech at Howard, she told the following story: … more

Photo: Steve Ringman, The Chronicle

-

She dated Willie Brown for two years (prior to the point at which this picture was taken, in 2005), and San Francisco Chronicle columnist Herb Caen predicted the two would wed. “Keep an eye on those two,” he wrote …

less

She dated Willie Brown for two years (prior to the point at which this picture was taken, in 2005), and San Francisco Chronicle columnist Herb Caen predicted the two would wed. “Keep an eye on those two,” he

… more

Photo: Carlos Avila Gonzalez

-

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-c’,

container: ‘taboola-interstitial-gallery-thumbnails-10’,

placement: ‘Interstitial Gallery Thumbnails 10’,

target_type: ‘mix’

});

_taboola.push({flush: true});

-

… and when Brown won the election for mayor, it was Harris who gave him a blue hat that said, “Da Mayor,” on it.

… and when Brown won the election for mayor, it was Harris who gave him a blue hat that said, “Da Mayor,” on it.

Photo: CHRISTINA KOCI HERNANDEZ, Associated Press

-

Her sister Maya, third from left, also has a background in law, and used to be executive director of the American Civil Liberties Union of Northern California. Maya Harris conducted the ceremony when Kamala Harris married her husband Douglas Emhoff in Santa Barbara in 2014. less

Her sister Maya, third from left, also has a background in law, and used to be executive director of the American Civil Liberties Union of Northern California. Maya Harris conducted the ceremony when Kamala … more

Photo: Lacy Atkins, The Chronicle

-

As state Attorney General, she declined to prosecute now-Treasure Secretary Steve Mnuchin, pictured here in 2018, for allegedly breaking foreclosure laws during his time as CEO and then chairman of OneWest Bank. The Justice Department wanted to pursue a civil enforcement action against the company but Harris overrode their recommendation. less

As state Attorney General, she declined to prosecute now-Treasure Secretary Steve Mnuchin, pictured here in 2018, for allegedly breaking foreclosure laws during his time as CEO and then chairman of OneWest … more

Photo: Pablo Martinez Monsivais, Associated Press

-

She’s coming out with a memoir in 2019, entitled ““The Truths We Hold: An American Journey.”

She’s coming out with a memoir in 2019, entitled ““The Truths We Hold: An American Journey.”

Photo: Saul Loeb / AFP / Getty Images

-

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-c’,

container: ‘taboola-interstitial-gallery-thumbnails-15’,

placement: ‘Interstitial Gallery Thumbnails 15’,

target_type: ‘mix’

});

_taboola.push({flush: true});

-

She campaigned for Jesse Jackson when he ran for president in the 1980s.

She campaigned for Jesse Jackson when he ran for president in the 1980s.

Photo: Frederic Larson /San Francisco Chronicle

-

At Howard University, she chaired the economics society, was on the debate team, and was a member of Alpha Kappa Alpha sorority. When she went back to her alma mater to give a commencement speech in 2017, several of her sorority sisters came to support her. less

At Howard University, she chaired the economics society, was on the debate team, and was a member of Alpha Kappa Alpha sorority. When she went back to her alma mater to give a commencement speech in 2017, … more

Photo: Kamala Harris

-

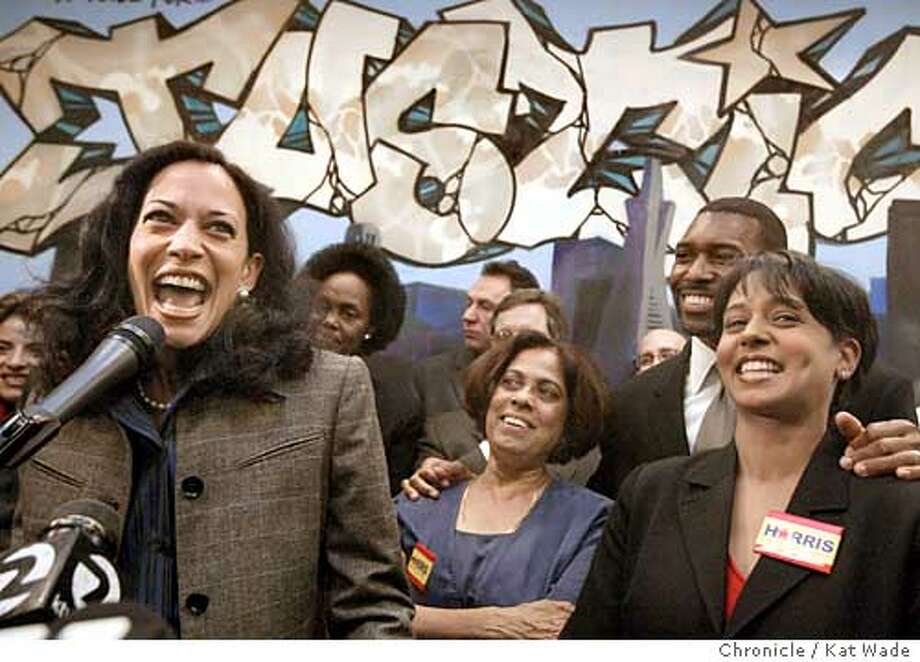

Her mother Shyamala Gopalan, center, was a noted breast cancer researcher. “My mother was supposed to return home to India and an arranged marriage when her studies were complete,” Harris wrote in her book, “Smart on Crime.” “But she was drawn to the Berkeley civil rights movement where she met my father, and she opted to sidestep traditions that, in my family, go back to 500 B.C.”

less

Her mother Shyamala Gopalan, center, was a noted breast cancer researcher. “My mother was supposed to return home to India and an arranged marriage when her studies were complete,” Harris wrote in her book,

… more

Photo: Kat Wade

-

To unwind at the end of a long day, she reads recipes by chefs like Alice Waters, pictured here.

To unwind at the end of a long day, she reads recipes by chefs like Alice Waters, pictured here.

Photo: Mike Kepka / The Chronicle 2011

-

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-c’,

container: ‘taboola-interstitial-gallery-thumbnails-20’,

placement: ‘Interstitial Gallery Thumbnails 20’,

target_type: ‘mix’

});

_taboola.push({flush: true});

-

In high school while living in Canada, she co-founded a dance group called “Midnight Magic” that performed at Canadian retirement homes and other venues, her friend told Canadian outlet CTV News.

In high school while living in Canada, she co-founded a dance group called “Midnight Magic” that performed at Canadian retirement homes and other venues, her friend told Canadian outlet CTV News.

Photo: Matteo Marchi/Getty Images

-

San Francisco’s felony conviction rose to its highest rate in a decade when she was the city’s district attorney.

San Francisco’s felony conviction rose to its highest rate in a decade when she was the city’s district attorney.

Photo: Mike Kepka/The Chronicle

-

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-c’,

container: ‘taboola-interstitial-gallery-thumbnails-23’,

placement: ‘Interstitial Gallery Thumbnails 23’,

target_type: ‘mix’

});

_taboola.push({flush: true});

Photo: Alex Brandon / Associated Press

Sen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the Census, on Capitol Hill, Wednesday, Oct. 3, 2018 in Washington. (AP Photo/Alex Brandon) less

Sen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the … more

Photo: Alex Brandon / Associated Press

Kamala Harris proposes bill to repeal GOP tax cuts, give money to working class families

Amid speculation of a 2020 presidential run, Sen. Kamala Harris, D-Calif., has introduced a bill that would replace GOP tax cuts with new tax credits for working class and middle class families.

The bill would allow families making less than $100,000 a year to receive a $6,000 annual tax credit, and for single filers making less than $50,000 a year to receive a $3,000 annual tax credit.

In a Thursday press release, Harris unveiled LIFT (Livable Incomes for Families Today) the Middle Class Act, a bill that has almost no chance of becoming law with a Republican-led House, Senate and White House.

“Americans are working harder than ever but stagnant wages mean they can’t keep up with cost of living increases,” Harris said. “We should put money back into the pockets of American families to address rising costs of childcare, housing, tuition, and other expenses. Our tax code should reflect our values and instead of more tax breaks for the top 1 percent and corporations, we should be lifting up millions of American families.”

Under the bill, people would be able to choose whether to receive the tax credit on either a yearly or monthly basis. Under the monthly plan, families would receive a tax credit of $500 a month, and individuals would receive a tax credit of $250 a month.

An analysis from The Atlantic found that this proposal would cost roughly $200 billion a year, which is similar to what the GOP’s Tax Cuts and Jobs Act cost.

It was unclear how much of the GOP tax cut legislation Harris would repeal, although it’s probably a safe bet to assume the bill would include tax increases for the highest earners and an increase in the corporate tax rate.

“It is absolutely unconscionable that while many families continue to struggle, President Trump and Republicans in Congress are giving tax cuts to the top 1 percent and corporations while threatening Social Security and Medicare,” Harris tweeted. “It’s time to change that.”

In the GOP tax bill, the top rate (for individuals making over $500,000 a year and families making over $600,00 a year) was reduced from 39.6 percent to 37 percent. The corporate tax rate was reduced from 35 percent to 20 percent.

If the entirety of the tax cuts are repealed, then families may not receive the full intended tax credits, since the rate for every tax bracket was reduced in the GOP bill.

For example, individuals making $40,000 a year used to owe $10,000 in federal taxes (prior to deductions), but after the GOP tax cuts, now owe $8,880 since their rate was cut from 25 percent to 22 percent. A full repeal of the GOP bill would force these individuals to pay an additional $1,120 annually, which would eat into the $3,000 tax credit Harris proposes.

Harris has long been rumored to be mulling a presidential run in 2020, and this is a bill that likely won’t get serious consideration unless a Democrat is occupying the White House.

Eric Ting is an SFGATE staff writer. Email him at [email protected] and follow him on Twitter

Start receiving breaking news emails on wildfires, civil emergencies, riots, national breaking news, Amber Alerts, weather emergencies, and other critical events with the SFGATE breaking news email. Click here to make sure you get the news.

Sen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the Census, on Capitol Hill, Wednesday, Oct. 3, 2018 in Washington. (AP Photo/Alex Brandon) lessSen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the … more

Sen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the Census, on Capitol Hill, Wednesday, Oct. 3, 2018 in Washington. (AP Photo/Alex Brandon) lessSen. Kamala Harris, D-Calif., waves to another member of the committee during a hearing of the the Senate Committee on Homeland Security and Governmental Affairs for Steven D. Dillingham to be Director of the … more