[ad_1]

Ten years ago, the collapse of investment bank Lehman Brothers traumatized Wall Street and, along with the economic and financial crises, forced the government to take unprecedented steps that reshaped the financial world.

With massive investments in a collapsed US high-risk mortgage market, resulting in billions of dollars in losses and a grim stock price, Lehman Brothers desperately needs a white knight – outside investor or government bailout – to survive. When no much needed source of capital materialized, Lehman Brothers filed for bankruptcy on Sept. 15, 2008 for the Chapter 11 bankruptcy – the largest filing of its kind in the history of the United States.

The bankruptcy of Lehman Brothers is just one of the many moves that happened quickly. Merrill Lynch was forced to sell to Bank of America, while the venerable institutions Fannie Mae and Freddie Mac were placed in a government tutelage. In a few days, the American economic landscape has been reversed.

"During the shocking sequence of day-to-day and almost hour-by-hour events, the powerful waves of log damage have shown how much we are all tied to the financial system," said Darren Cronk, president of Wells Fargo Investment. Institute, said in a recent note.

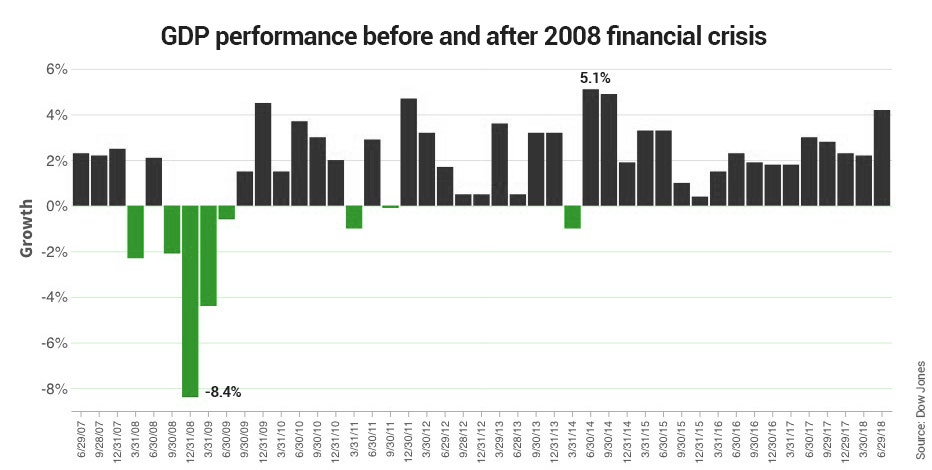

The collapse of the bank after more than a century of business had a catastrophic impact on the US economy. The Dow Jones Industrial Average plunged more than 500 points in a single day after the announcement. The US unemployment rate quickly surpassed 10% and tens of thousands of Americans lost their homes following a seizure, including more than 800,000 in 2008 alone, according to RealtyTrac data.

Facing the possibility of the total collapse of the national economy – and therefore the global economy – the US government has injected $ 1.5 trillion over five years to help key financial institutions survive and maintain liquidity on the financial markets. The US Federal Reserve reduced interest rates to near zero to encourage spending and launched a bond buying campaign that more than quadrupled the size of its balance sheet.

After a decade of retreat, radical measures seem to have worked. US markets have erased the losses from the crisis and reached historic highs, while unemployment is currently below 4%. Ten years after the closure of Lehman Brothers, the effects of the 2008 financial crisis are still being felt.

Here are some key lessons that emerged in the years following the bankruptcy filing.

Stricter regulation works

The collapse of Lehman Brothers and the near-implosion of the other major banks have been a key factor in the US government's implementation of the Dodd-Frank Wall Street Consumer Protection and Reform Act, a federal government bill. 2010. Dodd-Frank has adopted a long series of requirements to improve transparency between financial institutions and prevent another crisis that could tip the big banks.

Banks must now be subject to annual "stress tests" to prove that they have enough cash to survive following a major financial crisis. The 35 largest US banks have all passed the latest edition of the Federal Reserve's annual test last June.

Risk management is a necessity

The 2008 financial crisis effectively forced banks to give more credit to risk management, which involves assessing potential weaknesses in their portfolios before they can cause permanent damage. The role played by high-risk mortgages in the collapse of Lehman underscored this need.

"Responding to risk management in advance and regularly reviewing portfolio risks against objectives can help us stay up to speed and be flexible when the next inevitable tremors shake the fundamentals," said M Cronk.

Markets are resilient

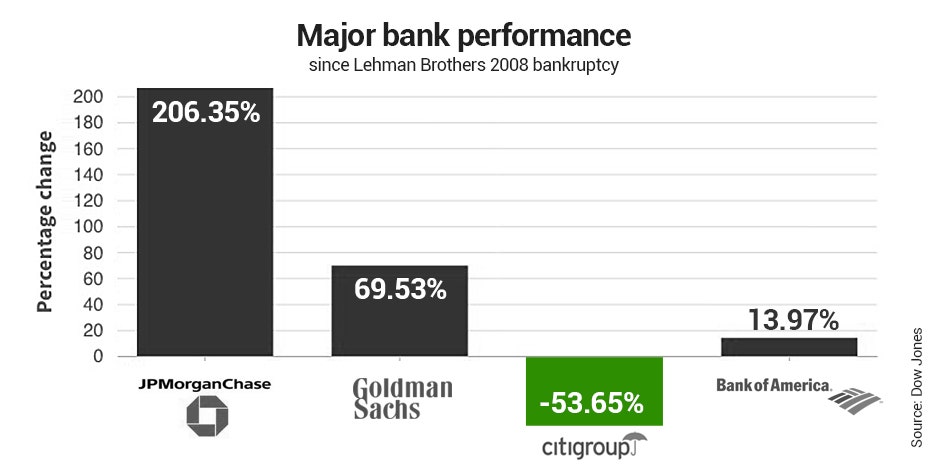

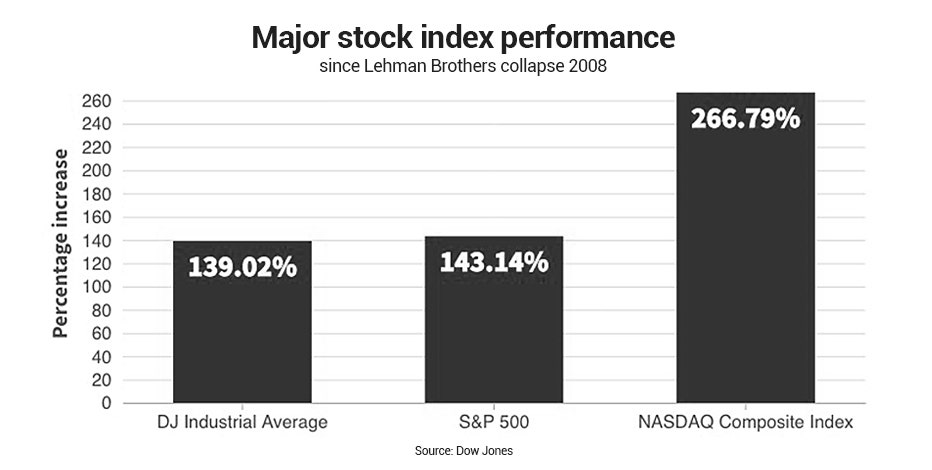

After recording significant declines that exacerbated economic fears during the financial crisis, major stock indexes have more than recovered their losses. Since Lehman's implosion, the Dow Jones Industrial Average has risen 139% since the Bank's bankruptcy, while the Nasdaq Composite Index has increased 266%.

The impact of the 2008 crisis is still felt

The US economy will probably never fully recover from the 2008 financial crisis, according to a recent report by the Federal Reserve Bank of San Francisco. The near bankruptcy of the banking sector resulted in a "continuing decline in production" of about 7 percentage points, which cost the average American worker thousands of dollars in potential revenue.

"In dollar terms, this represents a loss of lifetime income in terms of present value to about $ 70,000 for every American," the report says.

Associated Press contributed to this report.

Source link