[ad_1]

On November 15, Dell raised its share buyback offer for DVMT (NYSE: DVMT). Major shareholders have entered into binding agreements allowing them to vote in favor of the revised offer. Carl Icahn, his most virulent opponent, throws the sponge. The shareholder vote for this transaction is scheduled for December 11, 2018 and is expected to be finalized by the end of 2018. Following this IPO, Dell Technologies will once again become a publicly traded company.

What is the fair value of the shares of Dell Technologies (which will be listed on the NYSE with the DELL ticker)?

Michael Dell's point of view

In its first share repurchase offer from DVMT, Dell awarded Dell Technologies $ 79.77 per share.

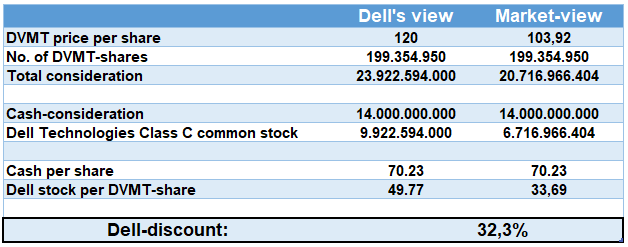

The $ 109 offered was a somewhat hypothetical number: The shareholders of DVMT would get some money, but mainly common shares of Dell Technologies, and there was no market for the common shares of Dell Technologies yet. Michael Dell valued at $ 79.77, but investors were skeptical. DVMT shares never touched nearly $ 109, suggesting that they place much lower value on Dell's shares than Dell's. They applied what we call a Dell discount.

In the new and probably latest offer, the holders of DVMT are guaranteed an exchange rate of 1.5043, which corresponds to the total value of 120 USD per share, judging by the valuation of Dell of 79 , 77 USD.

But if the DVMT share price implies a lower value for Dell's shares, the exchange ratio will then be adjusted upward to reflect the realities of the market and give the holders of DVMT greater ownership of the merged company. .

Exhibit 1: Exchange Ratio

The intuition about this complex offer is that the market will send two signals on the value of Dell's stock.

One is the trading price of DVMT:

- If the shares are trading at $ 120, that means the Dell package is worth what it says ($ 120), which means Dell's valuation used in the calculation of this package ($ 79.77) is correct.

- If stocks are trading below $ 120 (as is currently the case), this means that investors think Dell is worth less.

The other is the election of cash:

- If all DVMT shareholders choose to receive Dell shares, it means that they think the Dell shares are worth more than the supposed value.

- If each shareholder of DVMT chooses to receive money, it means that he thinks his value is less.

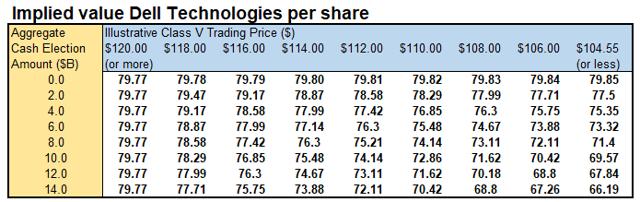

We can deduct a corresponding implicit value per share for Dell Technologies shares. According to Dell, this value is between 79.77 and 66.19 dollars.

Table 2: Implied Value Dell Technologies

Given the resentment against Michael Dell, we expect most shareholders to opt for money. In this case, and based on the current price of the DVMT share, the default value Dell's share of Dell without Dell rebate is 66.19 USD.

The Dell-discount

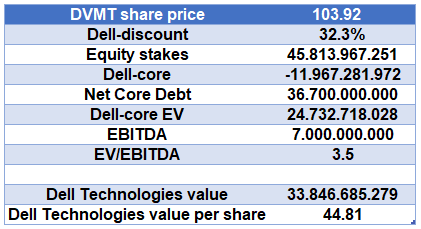

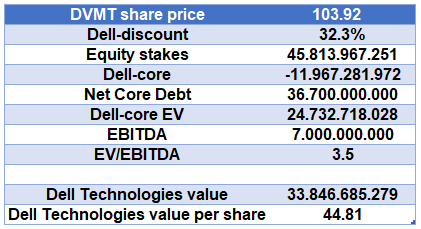

Based on the current market price of DVMT, we calculate a Dell discount of 32.3%!

Exhibit 3: Dell-discount

Instead of receiving a value of $ 49.77 in Dell shares, we receive only $ 33.69, which corresponds to a discount of 32.3%.

When we apply this Dell discount, the value by Dell's share drops to $ 44.81 …

We expect Dell shares a haircut for three reasons:

- conglomerate structure,

- heavy debt to peers, and

- poor corporate governance.

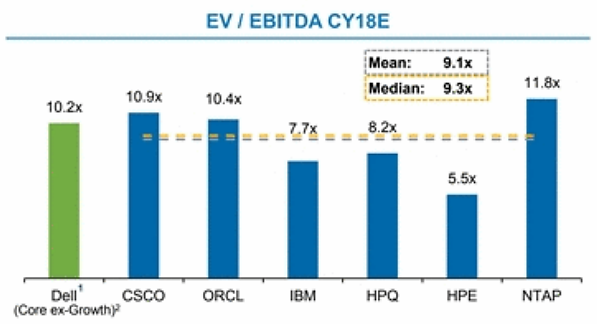

In a presentation, Michael Dell proved that his own assessment of his Dell Technologies assessment was too rosy. Given Dell's high debt to peers, one would expect it to trade at a lower price than peers. Dell's valuation gives it a premium on average and median peer ratings!

Table 4: Dell overvaluation

Reduction on the conglomerate

The term conglomerate discount refers to the tendency of markets to value a diverse group of companies and assets at a price lower than the sum of its parts. A conglomerate, by definition, has a controlling interest in a number of small, independent companies.

In the Harvard Business Review, Benjamin Gomes-Casseres wrote about the end of the conglomerate model in general and the model of General Electric (NYSE: GE) in particular. "GE is not dead and it is possible that she will live again and flourish as a business. After all, IBM came back from the dead in the 1990s. But the GE model is dead. The GE conglomerate combined a wide range of industrial companies under one roof. Unlike a pure holding company or a modern hedge fund, the GE model was designed to create value by actively sharing capabilities among its different businesses, which, with one exception, were all rooted in the manufacturing sector. Private capital growth, activist investors and disclosure requirements led GE to prove that it was worth more than the sum of its parts.

John Elkann, director of Exor (OTCPK: EXOSF), commented on the performance of family conglomerates in a letter to Exor shareholders.

Exor is the vehicle through which the Agnelli family manages its assets and in which it holds a 51% stake. Most of Exor's investments are listed on the stock exchange: Fiat Chrysler (NYSE: FCAU), CNH Industrial (NYSE: CNHI) and Ferrari (NYSE: RACE) account for nearly 70% of the value of its gross assets. The full-service partner Partner Re accounts for 26%.

Elkann's explanation of outperformance includes:

- the ability of these companies to invest anywhere as opportunities arise,

- the conservative nature of their finances, which avoids over-indebtedness and the serious erosion of shareholder value, and

- the much longer time horizon given to investment planning than is typical in a large company.

Given Dell's over-indebtedness, we can not congratulate ourselves on the conservative nature of its finances and we must fear a serious erosion of shareholder value in the form of a conglomerate reduction. The most obvious way for a conglomerate to narrow the gap between the price of its stock and its net asset value would be to carry out major share buybacks. Again, given Dell's high level of debt, it's simply not possible to get a rebate reduction from a conglomerate.

Discount on corporate governance

Lucian Bebchuk and Kobi Kastiel of Harvard Law School see three risks and governance costs that Dell's IPO would create for public investors holding Dell's restricted voting shares:

- Lifelong Rooting by Michael DellHe would be able to keep control indefinitely even after he stopped being a proper leader and even became disabled or incompetent.

- Minority controllerAlthough Michael Dell initially holds the majority stake, Dell's structure would allow it to offload most of its stock while retaining control even with a small equity stake, and its status as a small minority controller should produce money. significant risks and costs of governance.

- Modifications of the median current: Dell's governance structure would allow Michael Dell to adopt subsequent changes to governance arrangements, without any support from public investors, which would increase Dell's governance risks beyond the risks associated with a small minority controller .

Each of these governance risks can be expected to:

- Decrease the expected future value of Dell by increasing agency costs and distortions, and

- increase Dell's share-to-share discount to which Dell's low voting shares can be traded.

Both types of effects would have the effect of reducing the value to which public investors' weak voting shares would be traded and should therefore be taken into account in the risk assessment of Dell's intended structure for these investors. .

Sum of the valuation of coins

The Dell conglomerate consists of different parts:

- The core business of Dell / EMC hardware

- Participation in VMware (NYSE: VMW)

- Participation in Pivotal Software (NYSE: PVTL)

- Participation in SecureWorks (NASDAQ: SCWX)

- Heavy debt

To calculate the value of investments in listed companies, VMware, Pivotal Software and SecureWorks is simple. The value of the debt is also known. Please note that Dell Technologies will borrow an additional $ 5 billion from banks to fund its revised tracking offer.

At the current price of the DVMT share, the Dell discount is 32.3%. This gives a net worth of $ 33.8 billion for Dell Technologies. This means that the market places a negative net worth at the heart of Dell and a business value of 3.5 times EBITDA, which seems rather low …

Exhibit 5: Dell Evaluation (in $)

At a stock price of $ 110 for DVMT, we get $ 42.0 billion worth of shares for Dell Technologies. This means that the market still attaches a negative net worth to Dell's core and a business value of 4.7 times EBITDA, which is already more reasonable for a highly leveraged and poorly governed company.

Exhibit 6: Dell Evaluation (in $)

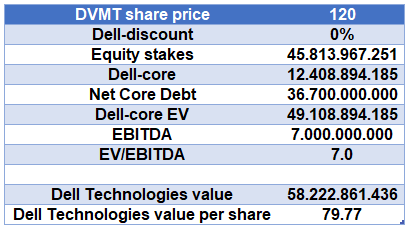

At a $ 120 share price for DVMT, we get a net worth of $ 58.2 billion for Dell Technologies. This means that the market attributes Dell's core value to $ 12.4 billion in equity and a business value equal to 7 times EBITDA, which is quite high for a highly leveraged company. and badly governed.

Exhibit 7: Dell Evaluation (in $)

We value our fair value for Dell technologies at $ 56.3. This implies a conglomerate / governance discount of around 20% and an EV / EBITDA ratio of almost 5, which is reasonable for a highly leveraged company like Dell Technologies.

Hardware companies are not in favor on Wall Street and have low ratings at once when the software is king and the hardware is considered merchandise.

Conclusion

For people who do not care DVMT and are interested in investing in Dell technologies, by buying DVMT shares at current prices may be a relatively inexpensive way to acquire Dell Technologies shares.

For the shareholders of DVMT, we advise you to monitor the evolution of the share price. The higher the price, the higher the ownership percentage of Michael Dell in Dell technologies is high. If the price exceeds $ 110, they could start thinking about selling (although there may be tax implications) their DVMT shares in the market.

If the price remains so low, it may be wiser to keep the shares received from Dell Technologies and sell them later, when they will not be as cheap.

The best result would always be to receive $ 120 in cash. This will only happen when the total number of cash elections will be less than $ 14 billion. I would not count on it, but that means you should always choose the cash option.

Please click on the "Follow" tab at the top of this article if you like my articles. If you would like to receive real-time alerts about upcoming updates and articles, make sure that the "Receive Email Alerts" box (located under the "Follow" tab) remains checked.

Warning: This article provides opinions and information, but does not contain recommendations or personal placement advice to specific people for specific purposes. The information provided is for educational purposes only and in no way constitutes a recommendation as to the suitability of an investment strategy for a particular investor.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link