[ad_1]

Lions Gate (LGF.A) (LGF.B) had its first momentum of optimism last week, sparking speculation about a possible takeover by Amazon.com (AMZN). This is a welcome respite after months of decline as investors are concerned about negative year-over-year revenue growth in the last quarter and the seemingly dry film that awaits them.

I regularly buy Lions Gate shares that have fallen over the past year, accumulating losses since Lions Gate has lost more than 25% of its value since January, but confident in the company's future . For me, negativity on Lions Gate does not make sense. The low pay last year is due to the fact that Lions Gate had major theatrical successes last year (La Land) and suffered from the expiration of one of his anchor franchises, Games of hunger. The studio sector is cyclical – we can not expect Lions Gate to generate dozens of box office successes and several Oscar winners each year. But the fact that the company has established experience in this area gives me confidence that Lions Gate can still achieve creative success in the near future.

Meanwhile, investors have left Lions Gate for dead, ignoring the tremendous potential of this company. This year, the media has talked a lot about the search for new content by media giants. Almost all other media titles have risen this year, supported by speculation about takeovers after the merger between AT & T (T) and Time Warner (which The iron Throne HBO owner in the hands of the telecommunications giant), but Lions Gate has been largely left behind.

That's up to now. John Kornitzer, of Kornitzer Capital Management (about $ 7 billion in assets under management) and Lions Gate's fourth largest shareholder, said in an interview with Bloomberg TV (link here) that he hoped that the company's partnership with Amazon would lead to a takeover.

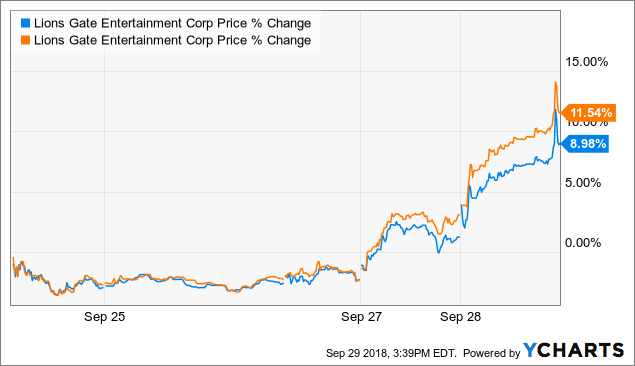

Of course, Amazon's takeover speculation has invaded almost every sector. At the end of last year, Carl Jr. even lamented that Amazon acquired it through a Twitter publication (TWTR). But a Lionsgate-Amazon wedding makes a lot of sense, which is why Lions Gate shares have risen by about 10% in the past week alone (the blue line below represents class shares). A, the class B orange line):

LGF.A Price data by YCharts

But even if Amazon does not respond to this invitation, there are many other potential contenders. Verizon (VZ) has been designated as such, without a media partner, while its major rival, AT & T, closes the acquisition of Time Warner. The list of possibilities is endless – Lions Gate, as a content-rich leader with a complete library of award-winning titles and positive operating profits, is incredibly attractive as a medium-sized takeover idea for any business late content. In my opinion, Lions Gate has been systematically undervalued throughout the year and, whether a merger or acquisition event materializes or not, the renewed hope of a such merger will help Lions Gate recover its fair value.

Unpacking the capitalization structure and evaluating Lions Gate takeovers

Lions Gate has a two-class share structure and, on its last August 10 Q deposit, it had 82.0 million Class A shares and 132.0 million Class B shares outstanding. .

The Class A Shares are entitled to one vote and are trading at $ 24.39 each; The Class B Shares are non-voting and are trading at $ 23.30. Both stocks have fallen about 27% since the beginning of the year since January.

Figure 1. Number of Lions Gate Shares

LGF.A data by YCharts

At current stock prices, Lions Gate has a market capitalization of 5.08 billion dollars, approximately $ 2 billion of which is Class A Voting Shares and approximately $ 3 billion of Non-Voting Shares. Again, with this market capitalization, Lions Gate is one of the only mid-market entertainment generators / entertainment studios on the market. Adding $ 316 million in cash to the company and $ 2.50 billion in debt business value (acquisition price) of 7.26 billion dollars.

Note that this type of redemption price would be a pebble for Amazon. Three months ago, she bought the online pharmacy start-up PillPack for "just under a billion dollars" and last year she spent $ 13.7 billion for Whole Foods. Needless to say, Jeff Bezos has his eyes riveted on just about every area of activity under the sun and that Lions Gate would continue its advance to Hollywood.

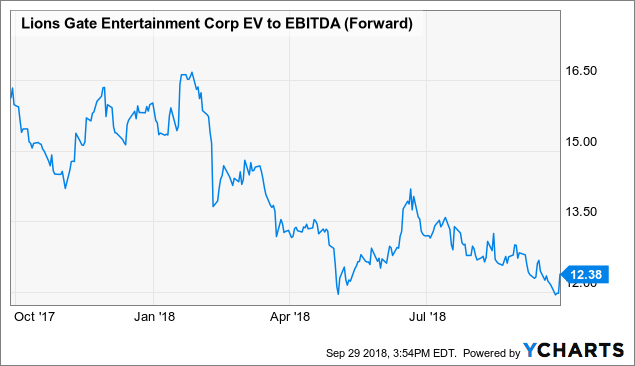

Unlike many of Amazon's goals, Lions Gate is also very profitable. The company trades at a multiple of its forward EBITDA multiplied by 12, which is significantly below the market average:

Data from LGF.B EV to EBITDA (Forward) by YCharts

It is not difficult to see the appeal of a film studio with a library of blockbuster movies, a recent wave of creative contracts in the areas of television and film production and profitable profitability.

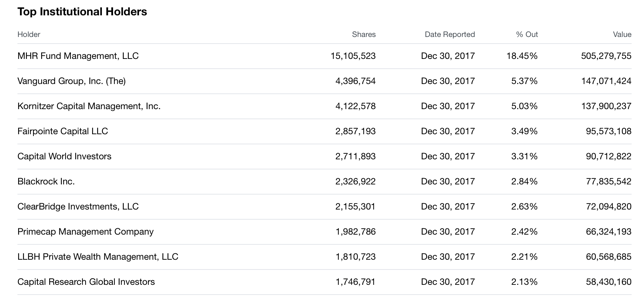

Here is also an overview of the main shareholders of the company:

Figure 2. Principal holders of class A

Source: Yahoo Finance

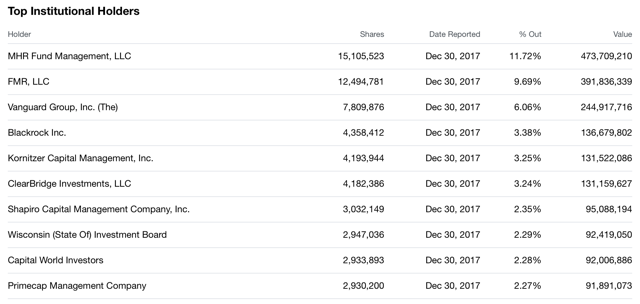

Figure 3. Major Class B Holders

Source: Yahoo Finance

John Kornitzer, behind the speculation on the buyout, owns 8.32 million shares (split roughly equally between categories A and B), a value of & B actions,,,,,,,,,,,,,,,. approximately 200 million USD and representing a stake of about 4% of the company's capital. It is clear that Kornitzer has a lot to gain if an acquisition succeeds, but the reasons for its viability are still valid.

A boost for Amazon Prime Video

Prime Video is a relatively new offer. Amazon has started to offer Prime Video as a bonus to Premium subscribers (priced at $ 13 per month or $ 119 per year), but most of the time, Amazon has failed to replace the major incumbent, Netflix (NFLX) .

The reason is, of course, the content. As a "free" offer (or at least, not generating direct revenue from subscribers) of a company already heavily criticized for not generating enough profits, Amazon does not have the bandwidth needed to spend as generously on content. licenses like Netflix could. While Prime Video has some third party headlines in its library (Jack Reacher, Transformers: the last knight, and Baywatch There are several blockbusters currently available), the Amazon Video library is not as long as the Netflix library.

In addition, its original content engine is even further behind Netflix. Most investors attribute the early success of Netflix and its widespread appeal to the launch of its first successful original series: House of cards, Orange is the new black, Narcosetc. (With House of cards The final season will air in November and, with the fall of lead actor Kevin Spacey, there is quite a gap to fill in the original content space.

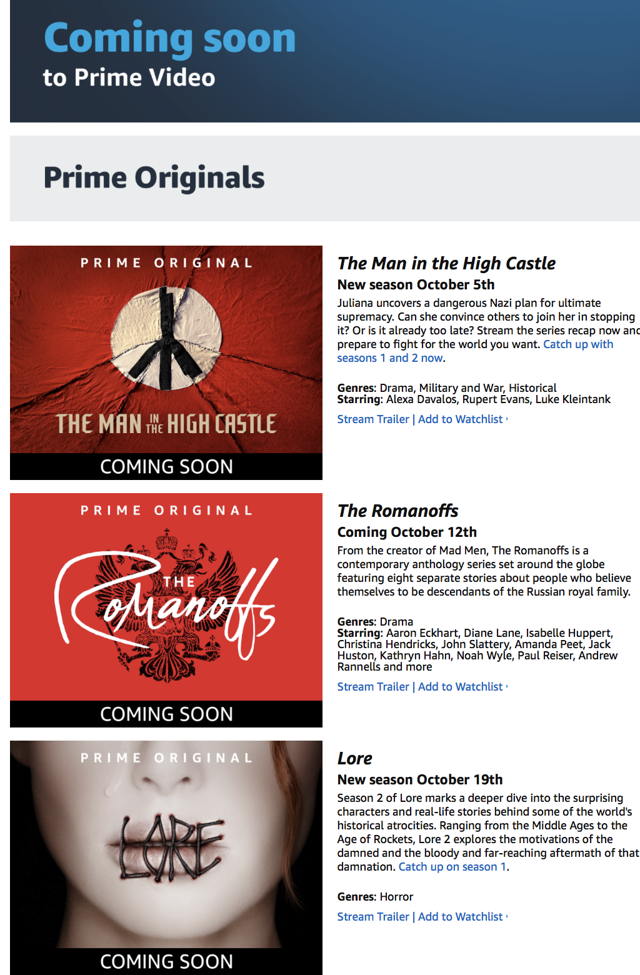

Amazon, by contrast, has had mixed success. His first big hit of original content was Man In The High Castle, a drama of the Second World War that will broadcast its third season in early October. Apart from this release, however, Prime Video's original content efforts have not really caught fire. Here is an overview of upcoming releases:

Figure 4. Versions of the original content of Prime Video

Source: Amazon Prime Video

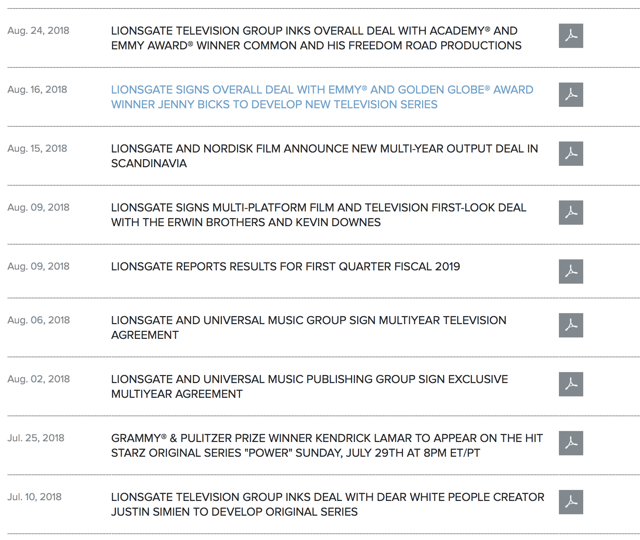

This is where the Lions Gate could be useful. Lions Gate is already engaged in a licensing partnership with Amazon, but a full buyout of the studio could become even more profitable for Amazon's content strategy. Not only does Lions Gate have a complete list of films in the coming year (Robin Hood, John Wick, Divergent), but he also announced a series of content agreements with award-winning producers and directors for new movies and television series:

Figure 5. Lionsgate Content Offers Announced in Press Releases

Source: Lionsgate Newsroom

For less than two years that Amazon has entered the world of streaming, its offering remains an asset to Prime subscribers, but is not really a jewel of the crown. The traditional game of Amazon when he embarked on new industries was to buy an existing leader, as he had done with Whole Foods and PillPack. Aside from Amazon Web Services, Amazon is not really known for creating businesses from scratch. Buying Lions Gate would be a logical extension of Amazon's imperial Hollywood ambitions.

Keys to take away

Even if Amazon does not end up becoming the Lions Gate contender, there will surely be other content-hungry companies scenting around you. Lions Gate offers both a rich library of existing content, a comprehensive portfolio of content under development, high operating profits and years of experience in Hollywood. Even in the absence of a merger and acquisition scenario, Lions Gate is sufficiently undervalued with a prospective EBITDA of 12.4 times to earn a clean investment. Stay long on this fantastic name.

Disclosure: I am / we have long been LGF.B.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link