[ad_1]

(Source: Herb)

We are looking at several different ways to invest in the marijuana boom – recreational, medical and other activities that could be winning, decriminalization and wider acceptance of the plant and its derivatives becoming more acceptable on the cultural plan. Perhaps not at the level of acceptance of Tesla's CEOs, but it is becoming increasingly common in the United States and Canada. See my Tesla articles (NASDAQ: TSLA) here and here.

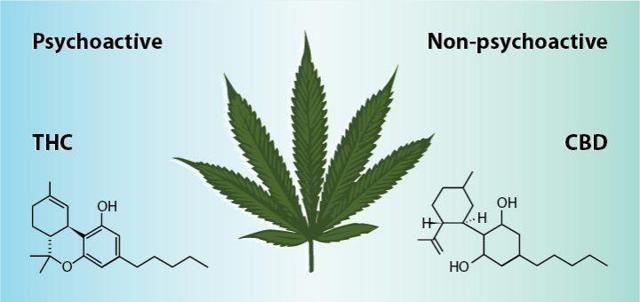

A closer look at cannabidiol

To break down what marijuana is, let's look at its components. Cannabidiol and tetrahydrocannabinol – THC – are the two main ingredients of the cannabis plant. CBD and THC both belong to a unique class of compounds known as cannabinoids. A smoker whose intention is to become high generally prefers (depending on the type of person desired) high levels of THC. However, CBD is mainly used in the medical field. The main differences between CBD and THC are discussed below.

THC is the psychoactive ingredient of marijuana. The CBD does not put you high. THC can cause anxiety or paranoia – especially in some of the most unique strains in South Africa. CBD seems to have the opposite effect. Studies show that CBD works to counter anxiety caused by the ingestion of THC. If one becomes "too high" when trying a new strain of weed, the CBD could have antipsychotic properties.

It is believed that THC is responsible for most of the inducing effects of marijuana sleep. On the other hand, studies suggest that CBD acts to promote waking, making CBD a poor choice as a sleep medication. The opposite effects of CBD and THC on sleep may explain why some strains of cannabis cause drowsiness in users, while others are known to boost energy. Finally, although the laws on marijuana and THC are fairly clear (but inconsistent), the legal status of the CBD is less clear. In the United States, the CBD is technically illegal because it is classified as Schedule I drug under US federal law.

Recent news

Almost daily, there are headlines on pot stocks. Inventories exploded and collapsed at regular intervals. Many of these stocks are traded only in Canada, but there are now some of these trades via American Depository Receipts (ADRs) in the United States. Although many ADRs are new, the volatility of this market is not.

(Source: Zacks)

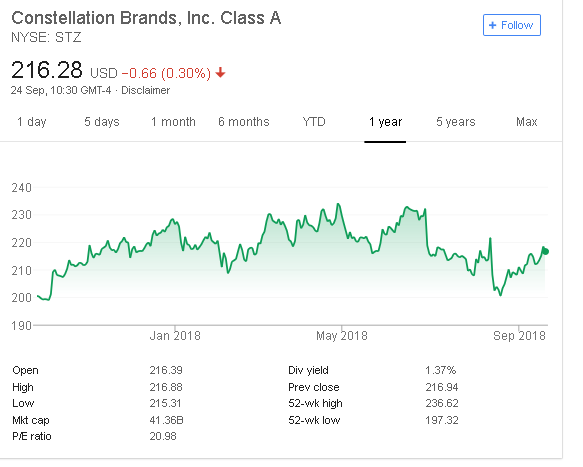

What's different this time is that Fortune 500 companies are getting involved in this sector – names like Coca-Cola (NYSE: KO), Constellation Brands (NYSE: STZ) and Scotts Miracle-Gro (NYSE: SMG). These are discussed in more detail below.

Of course, you have players like Tilray Inc. (NASDAQ: TLRY), which went public in July and has recently reached $ 300 to close at $ 112. Bubbles, bubbles everywhere.

(Source: Google)

TRLY is a difficult stock to invest for me. It is too expensive to own directly at these prices. Buying or selling options, including LEAPS, have too expensive premiums, large margins of purchase / demand and are little traded. For me, I'm comfortable not owning this stock right now.

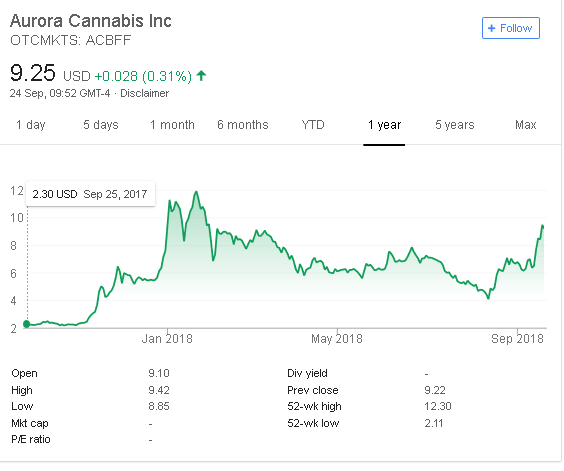

Vancouver-based cannabis producer Aurora Cannabis (OTCQX: ACBFF) gained more than 20% after Bloomberg announced that Coca-Cola was in talks with Aurora to develop weed-infused drinks. in marijuana that treats pain but does not improve users.

(Source: Google)

Coca-Cola published this statement:

"With many others in the beverage industry, we are closely watching the growth of non-psychoactive CBD as an ingredient in functional wellness beverages around the world." The space is changing rapidly. No decision has been taken yet. "

It is important to note that while Aurora shares rose 20% on the news, the stock price of KO has barely budged. If a new partnership would be beneficial for Aurora's sales and profits, it would probably not have a significant impact on KO sales.

(Source: Google)

It pays to pay close attention to this market where "new" stocks lead to a high level of low-trading stocks. Although you are on the safe side, too often you will be wrong and you will lose your shirt.

Other games infused with drinks

Canada, the last country to legalize marijuana for recreational purposes, is the second country to allow full legalization effective October 17, 2018. Many beverage producers are preparing to increase their market share in Canada. Cannabis-based beverages are gaining popularity as consumers turn to the medicinal value of marijuana. Many consider smoking to be unhealthy, but consider it a good idea to infuse some of their drinks, making the marijuana market an ideal choice for beer and soda companies.

Constellation Brands recently invested $ 5 billion in the largest marijuana company in Canada, Canopy Growth Corp. (NYSE: CGC), for $ 5 billion.

(Source: Google)

In addition, Molson Coors (NYSE: TAP) has a joint venture with Hydropothecary Corp. (OTCPK: HYYDF), which will sell non-alcoholic cannabis-infused soft drink beverages to Canada after legalization. In addition, Heineken (OTCQX: HEINY) offers a soda water infused with cannabis named "Hi-Fi Hops" via a sales unit with the artisanal brewer Lagunitas.

(Source: Lagunitas website)

(Source: Google)

Other ways to participate in the growth of marijuana

If owning pot stocks is outright a gamble and does not fit your risk tolerance, and if you do not want to invest in the colorless drink market, you might want to consider stocks in Scotts Miracle-Gro. They are a leader in the hydroponics industry – hydroponics is a method of growing soilless plants using mineral nutrient solutions in an aqueous solvent. Producers depend on hydroponics to produce high quality cannabis.

(Source: Google)

To be sure, SMG has not participated with the rest of the market in its recent upward movements. The company clearly has problems to solve even in its potted space. Hawthorne Gardening is the Scotts subsidiary. Hawthorne will not meet Scotts' internal growth targets for the foreseeable future. Jim Hagedorn, CEO of Scotts Miracle-Gro, recently seemed very disappointed with Hawthorne's progress in achieving its organic growth objectives. In April, Scotts set a target of $ 120 million in segment revenues for Hawthorne by 2020; However, he no longer expects Hawthorne to achieve this goal.

Buyer beware again – I would not buy SMG just for the small business business.

GW Pharmaceuticals (GWPH)

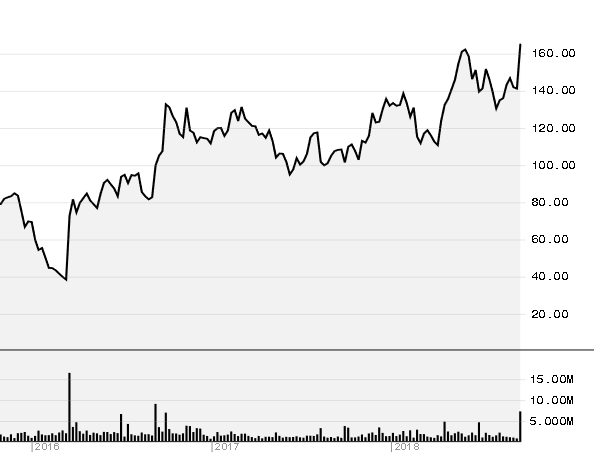

In May 2017, I recommended taking a long position in GW Pharmaceuticals and its exciting new medical breakthrough, Epidiolex. Since then, the stock has increased by more than 60%. The reason for this is that the US Drug Administration and Drug Control (DEA) is considering upgrading Epidiolex, GWPH's flagship cannabinoid drug.

At that time, I mentioned that it might be worth it to take more time to invest in the business. Epidiolex is described as "a liquid formulation of cannabidiol of pure plant origin", CBD, being developed for the treatment of a number of rare disorders of epilepsy. childhood.

GWPH claims to have "developed the world's first prescription drug derived from the cannabis plant for the treatment of spasticity due to multiple sclerosis, Sativex, now approved in more than 29 countries outside the United States. for the treatment of multiple sclerosis. " It is also mentioned that more than 1,500 patients were exposed to Epidiolex treatment and that 97% of patients who completed the phase 3 trials were prolonged.

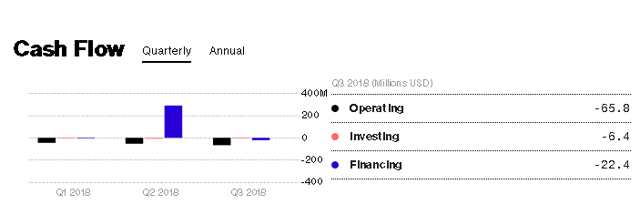

(Source: Bloomberg)

I decided to cash GWPH – like many stocks, I think the stock price has far exceeded the real value of the company. My main concerns are ongoing losses and lack of liquidity; However, it is not unusual for companies in their phases of research, development, testing and approval to get rid of losses.

(Source: Bloomberg)

In summary, how to invest in the pot market?

All that has been discussed above is high risk, small deals, high premiums or being so important to companies that most jar sales are not likely to reduce the profits of many people. of these big companies. However, you can have a little basket of these stocks to see how things are going. Do not bet the farm or invest with the money you will need in the short and medium term.

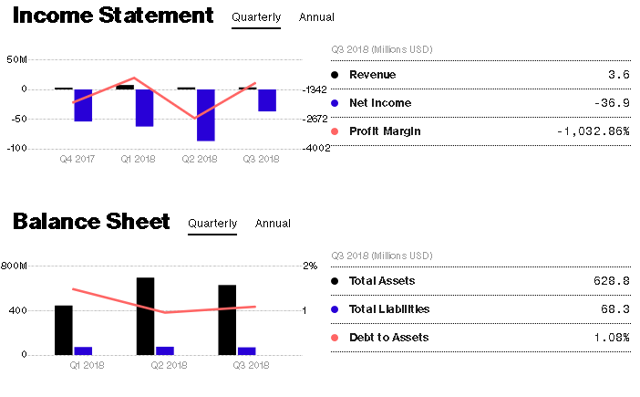

The only semi-logical game (if there is one) in the space seems to me to spread the risks and allow professional managers to play in this developing field. So, I'm thinking of taking a position in ETFMG Alternative Harvest ETF (NYSEARCA: MJ).

From there, MJ is the first market-oriented ETF to trade in the United States. The fund tracks an index of global equities that practice the legal cultivation, production, marketing or distribution of cannabis for medical or non-medical purposes. MJ also owns shares in companies that market or produce tobacco or tobacco products, fertilizers, plant foods, pesticides or cannabis or tobacco growing equipment. In addition, the fund may hold pharmaceutical companies that produce, market or distribute drugs using cannabinoids. It can only hold companies that carry out legal activities and have all the necessary permits.

The amount of money poured into the ETF is staggering. Of course, with all this money coming in, MJ has to invest it somewhere. Thus, the stocks he buys continue to skyrocket.

(Source: Bloomberg)

The top 10 ETF titles are all names you should know now.

(Source: ETFMJ)

In conclusion, it is encouraging to see Fortune 500 companies begin to enter this space. If you want to play on the market, beware of news that is too good to be true and spread your risk.

Important announcement

I am pleased to announce that I will soon be launching my own Market Service Information Bulletin – Financial Freedom Insights. This new publication will provide detailed technical and fundamental analysis, retirement ideas and business ideas. Be sure to follow me for updates on service launch dates. Do not hesitate to send me a direct message to find out more.

Additional disclosure: Thank you for your time reading the article above. I read and write on a wide range of companies on a regular basis. If you want to stay informed with articles like these, click the "Follow" button at the top of this report and select "Receive email alerts".If you have additional ideas on the subject or have different points of view, please share them in the Comments section.

This article is intended to provide educational information to readers and in no way constitutes investment advice. Investing in government securities is speculative and carries risks, including potential capital loss. The reader of this article must determine whether the investments mentioned in this article are appropriate to their portfolio, their risk tolerance and accept responsibility for their decisions. Neither the information nor the opinions expressed in this article constitute a solicitation, an offer or a recommendation to buy, sell or dispose of an investment or to provide an investment advice or service. . A notice in this article may change at any time without notice.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that are not traded on a major US market. Please be aware of the risks associated with these stocks.

[ad_2]

Source link