[ad_1]

Meituan Dianping, fourth startup in the world, was the subject of an initial public offering in Hong Kong and revealed the magnitude of its losses for the first time.

Although the company did not disclose the amount it planned to raise from the sale of shares, it disclosed a net loss of 19 billion yuan (US $ 2.9 billion). Last year on a turnover of 33.9 billion yuan, according to initial deposit. After adjustment for compensation based on shares and other items, the loss for the year was 2.9 billion yuan.

Meituan joins the smartphone maker Xiaomi Corp. targeting an IPO in Hong Kong after the former British colony revised the regulations to attract the major technology registrations that it has lost in the past. Food delivery and restaurant notice service was would have targeted a $ 6 billion fundraiser at a value of about $ 60 billion, rivaling that of Xiaomi. goal of $ 6.1 billion in what would be the world's largest stock market IPO in two years. Xiaomi is also unprofitable and lost more than $ 1 billion in the first three months of 2018 alone.

Meituan debut is another signal of China's emerging technology could – a flash point for Tensions with the United States A promising generation like Meituan and Didi Chuxing, the ride-ride giant, are emerging to build a long-standing Internet industry dominated by the social media giant Tencent Holdings Ltd., e-commerce player Alibaba Group Holding Ltd. and search engine operator Baidu Inc. Bloomberg News reported his rankings and results on Friday.

Meituan has recently been valued at $ 30 billion, making it the fourth largest company in the world according to CB Insights. The co-sponsors of the IPO are Goldman Sachs Group Inc., Morgan Stanley and Bank of America Merrill Lynch. China Renaissance is the only financial advisor, according to the filing.

Read more: Tencent Backed Super-App emerges to compete with its own WeChat

CEO Wang Xing founded Meituan.com in 2010 as a group-buying site similar to Groupon Inc. before a merger in 2015 with Dianping, which has provided reviews of restaurants and other local businesses.

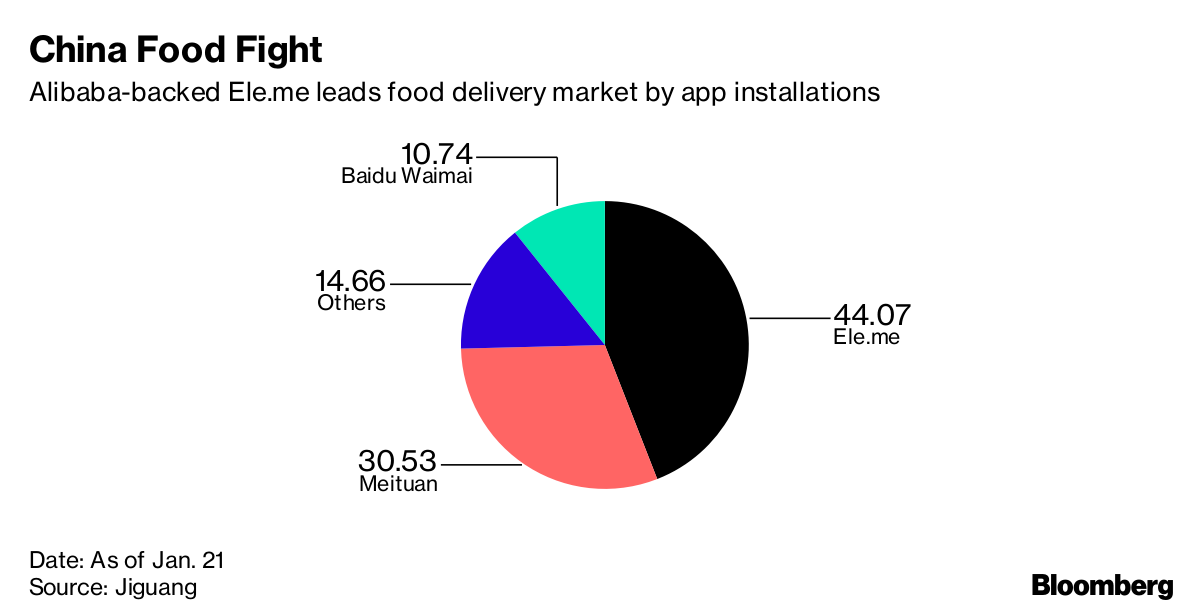

Food fight in China

Alibaba Supported Ele.me Leads Food Delivery Market Through Application Facilities

Source: Jiguang

An IPO would give Meituan additional capital to compete and grow. The company is, however, facing formidable rivals in key companies. He competes with entities supported by Alibaba in food delivery, with Didi Chuxing in the race, and even with his own support Tencent in payments. He also extended in bike sharing with a deal for Mobike.

Meituan is also considered a prime candidate to eventually sell Chinese depositary shares, a government program aimed at giving more opportunities to domestic investors and stemming a exodus to markets overseas. Its other existing funders include Booking Holdings Inc., Sequoia Capital, Investment Board of the Canada Pension Plan, Trustbridge Partners, Tiger Global Management, Coatue Management and Sovereign Funds of Singapore GIC.

Source link