[ad_1]

The semiconductor industry was shaken Thursday by negative analyst analysts on Micron (MU), sending the stock down 11% before recovering slightly.

Source: thestreet.com

Baird removed Micron from its list of convictions and lowered the price target to $ 75, the stock currently trading at $ 45. This alone implies an advantage of more than 60%. The concern raised was the continuing uncertainty over the price of DRAMs and the overabundance of NAND.

On top of that, KLA-Tencor (KLAC) presented Citi 2018 Global Technology Conference a bit more cautious during the December quarter, optimizing its mid-digit single-digit growth forecast.

Micron also attended the conference, commenting that "NAND prices decreased in the third quarter."

Seeing a good plunge of 10% always raises my eyebrows, wondering if this collapse is a sign that society is performing poor performance or an overreaction induced by short-term thinking. Personally, I trust him and so added to my position.

Although it seems certain that the memory market has at least temporarily peaked with excess supply leading to a drop in DRAM prices, the current ultra-low valuation of the security could already take this into account.

According to Morgan Stanley, "the Q4 outlook for DRAM servers is worse than expected, as well as prospects for the rest of the memory in the 3rd quarter." It is amazing to see the great diversity and divergence of analysts on Micron's earnings estimates. While for the fourth quarter, the range is less than $ 0.2, it can reach $ 1.38 in Q2 / 2019.

Source: Seeking Alpha – Micron Consensus Estimates

Given the current purchase price of $ 45, this means that it is currently trading at a futures earnings multiple of between 3 and 5 times its earnings if we annualize the 2019 / Q2 quarterly estimates. As analysts predict a decline in earnings for the following quarters, the actual annualized range is rather between 4 and 8 times the profits.

Given that analysts are completely torn between rising profits and the collapse of profits, I can not emphasize this too much. In fact, since it is almost impossible to predict the pricing of memory chips, why should investors place a high value on this? In the short term, supply could certainly exceed demand, but in the long run, large memory producers have no interest in overtaking the market. Demand for DRAM will continue to increase in the future as global trends in IoT, AI, autonomous driving, virtual reality and augmented reality will fuel demand.

I am a long term investor and, although a possible slowdown seems inevitable, the scale, timing and duration are hard to predict. Analysts are busy pumping and throwing away the stock, and while this creates a high volatility in my portfolio, I tend to focus on the big picture and know when it takes 12 months or three years to reach new heights. no one either. There is no real value in proposing precise price targets for an action with such a distribution of profits. Pretending precision where it does not exist makes precision absurd.

In addition to this, the company is about to launch its record $ 10 billion stock purchase program, in addition to plans to return at least 50% of free cash flow at the beginning of the year. Fiscal Year 2019. With Micron's $ 51.7 billion market capitalization after today's 10% liquidation, this represents a buyback of nearly 20% of its entire inventory. Of course, this will not happen in an instant but will extend over a year, but it should still provide downward support. Micron will begin redemptions in fiscal year 2019, and if today's lowest valuations remain or fall further, I am confident that this will result in a punch with the release of their results.

With such magnitude, the buyout will be very powerful and will save the profits. Interestingly, although analysts predict a massive price drop, neither the price targets nor the earnings per share estimates for the next earnings report would have fallen significantly. This is a strange action with very different future earnings forecasts and price targets involving more than 100% upside while analysts predict a drop in DRAM prices.

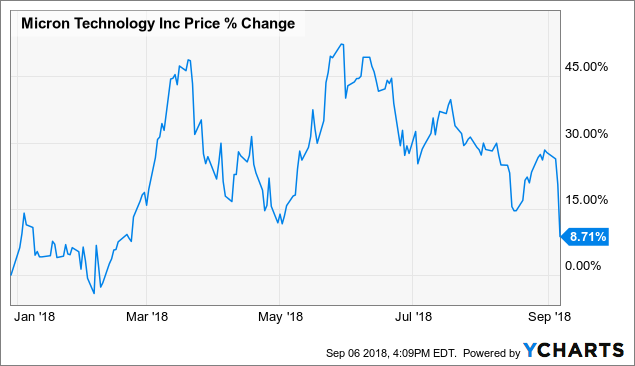

I took this opportunity and bought more MUs in the $ 40. If it falls in the $ 30, I will buy even more. I will never catch the background express, but I can catch it by accident while I'm averaging it. Micron's 2018 stock chart looks extremely erratic, with analysts raising price targets in the first half and sending the stock close to $ 65 or a gain of nearly 50% before price concerns quickly wipe out most stocks. earnings.

MU data by YCharts

Micron is not the "bargain" to which it only looks on the basis of multiple earnings, but given its current prices, it's hard to say it's too expensive, suggest another contraction of 50% or more. You may be optimistic or pessimistic in the short term, but in the long run, short-term price problems and analysts' estimates mean absolutely nothing.

Disclosure: I am / we are long MU

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional disclosure: I do not offer financial advice but only my personal opinion. Investors can take into account other aspects and their own due diligence before making a decision.

[ad_2]

Source link